Disney Re-Engages in Talks to Buy 21st Century Fox Assets--2nd Update

December 02 2017 - 2:23PM

Dow Jones News

By Dana Mattioli and Amol Sharma

Walt Disney Co. has re-engaged in discussions with 21st Century

Fox to purchase some of the media giant's assets, and Comcast Corp.

remains in the mix, with deal talks gaining momentum, according to

people familiar with the situation.

The talks center on the Twentieth Century Fox movie and TV

studio, international assets such as Fox's 39% holding in U.K.

satellite TV provider Sky PLC and India's Star TV, along with some

U.S. cable networks. Fox News, the Fox broadcast network and sports

network FS1 aren't expected to be sold in any transaction, the

people said.

Rupert Murdoch and his family, who hold 39% of 21st Century

Fox's voting shares, expect to make a decision by year's end on

whether to pursue a transaction, the people said.

Disney first reached out to 21st Century Fox about a possible

deal several weeks ago, but the talks cooled after the two sides

couldn't agree on price, among other issues, people familiar with

the matter have said.

Once news of those initial talks surfaced, other potential

acquirers began emerging. Comcast, Sony Corp.'s entertainment unit,

and Verizon Communications Inc., are among firms that have

expressed various levels of interest, the people familiar with the

situation say. The extent of discussions with Sony and Verizon is

unclear. A top Verizon executive last week played down the need for

the company to do a big content acquisition.

Disney and Comcast are in active talks with 21st Century Fox. It

is possible the talks could fall through and a deal won't be

reached.

21st Century Fox and Wall Street Journal-parent News Corp share

common ownership.

The assets in play would give a buyer exposure to growth in

international markets as the U.S. pay-TV industry reaches

maturity.

With the Twentieth Century Fox studio, they would also get a

premier Hollywood content factory and strengthen their position as

media consumption shifts to digital platforms.

Also on the table in some of the discussions is Fox's 30% stake

in streaming service Hulu. Disney and Comcast each also own 30% of

the company, so they could consolidate control by buying out Fox's

stake. Fox's regional sports networks could also be sold off, the

people familiar with the situation say.

The Fox deal talks are happening as another big media deal,

AT&T Inc.'s proposed takeover of Time Warner Inc., is headed

for court. The Justice Department has sued to block the

transaction, arguing it will reduce competition and harm consumers.

Some industry observers thought that any major media deal-making

would be on hold as companies wait to see the result of that

litigation.

A sale would mark a significant turn for 21st Century Fox, which

has long been viewed as a potential buyer in the media industry,

not a seller. Media companies across the board are considering new

business models and strategic options as they confront a rapidly

changing landscape, with consumers cutting the cable TV cord, big

programming distributors flexing their muscles, and advertising

revenue growth uncertain.

The remaining elements of Mr. Murdoch's entertainment empire

would be much smaller if an asset sale is completed.

But the entity would likely include some engines of growth. In

the September quarter, results at 21st Century Fox were driven by

the cable network group including Fox News and sports network FS1,

which posted a 9% increase in operating income before depreciation

and amortization. Revenue from monthly pay TV subscription fees

continues to grow, in part because of higher prices.

Meanwhile, operating profit at Twentieth Century Fox fell 18%

from a year earlier, as last year's results were boosted by

licensing deals.

Overall, Fox's profit in the September period rose 4% to $855

million. Revenue rose 7.6% to $7 billion.

Write to Dana Mattioli at dana.mattioli@wsj.com and Amol Sharma

at amol.sharma@wsj.com

(END) Dow Jones Newswires

December 02, 2017 14:08 ET (19:08 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

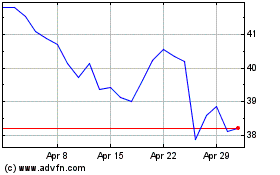

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024