Current Report Filing (8-k)

December 01 2017 - 5:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 29, 2017

|

LINCOLN EDUCATIONAL SERVICES CORPORATION

|

|

(Exact Name of Registrant as Specified in Charter)

|

|

New Jersey

|

|

000-51371

|

|

57-1150621

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

200 Executive Drive, Suite 340, West Orange, New Jersey 07052

|

|

(Address of Principal Executive Offices) (Zip Code)

|

Registrant’s telephone number, including area code: (973) 736-9340

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 29, 2017, Lincoln Educational Services Corporation (the “Company”) and its wholly-owned subsidiaries (collectively with the Company, the “Borrowers”) entered into a first amendment (the “First Amendment”) of the Credit Agreement dated as of March 31, 2017 (the “Credit Agreement”) among the Borrowers and its lender, Sterling National Bank (the “Bank”). As previously reported, pursuant to the Credit Agreement, the Borrowers obtained a revolving credit facility in the aggregate principal amount of up to $55 million, consisting of (i) a $30 million loan facility (“Facility 1”), comprised of a $25 million revolving loan designated as “Tranche A” and a $5 million non-revolving loan designated as “Tranche B” and (ii) a $25 million revolving loan facility which includes a sublimit amount for letters of credit of $10 million (“Facility 2”). Prior to the effectiveness of the First Amendment, the Borrowers repaid the $5 million non-revolving loan provided under Tranche B of Facility 1, resulting in a permanent reduction in the availability under Facility 1 to $25 million.

The First Amendment provides the Borrowers with an additional $15 million revolving credit facility (“Facility 3”), resulting in an increase in the aggregate availability under the Credit Agreement to $65 million.

Pursuant to the First Amendment, all draws under Facility 3 must be secured by cash collateral in an amount equal to 100% of the aggregate revolving loans outstanding through draws from Facility 1 or other available cash of the Company. Revolving loans under Facility 3 will bear interest at a rate per annum equal to the greater of (i) the Bank’s prime rate and (ii) 3.50%.

In connection with the effectiveness of the First Amendment, the Borrowers paid the Bank a Facility 3 origination fee in the amount of $75,000.

The foregoing description of the First Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the First Amendment filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The disclosure contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

Exhibit

|

Description

|

|

|

|

|

First Amendment to Credit Agreement dated as of November 29, 2017 among Lincoln Educational Services Corporation and its subsidiaries and Sterling National Bank

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 1, 2017

|

|

LINCOLN EDUCATIONAL SERVICES CORPORATION

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brian K. Meyers

|

|

|

|

Name:

|

Brian K. Meyers

|

|

|

|

Title:

|

Executive Vice President, Chief Financial Officer and Treasurer

|

|

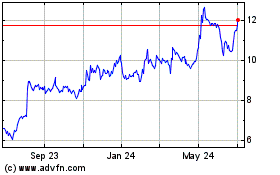

Lincoln Educational Serv... (NASDAQ:LINC)

Historical Stock Chart

From Mar 2024 to Apr 2024

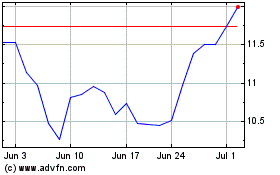

Lincoln Educational Serv... (NASDAQ:LINC)

Historical Stock Chart

From Apr 2023 to Apr 2024