Globus Maritime Limited Reports a Correction to the Financial Results for the Quarter and Six Month Period ended June 30, 20...

December 01 2017 - 4:10PM

Globus Maritime Limited ("Globus," the “Company," “we,” or “our”)

(NASDAQ:GLBS), a dry bulk shipping company, today reported a

correction to the comparative figures published on October 4, 2017

on its consolidated condensed statement of financial position for

the period ended June 30, 2017. Some of the figures in the December

31, 2016 column inadvertently showed figures for June 30, 2016.

The correct figures appear below. A consolidated

statement of changes in equity between December 31, 2016 and June

30, 2017 also appears below.

|

|

|

|

|

|

As of June 30, |

As of December 31, |

|

(Expressed in thousands of U.S. Dollars) |

2017 |

2016 |

|

|

(Unaudited) |

|

Consolidated condensed statement of financial

position: |

|

|

|

Vessels, net |

89,107 |

91,792 |

| Other

non-current assets |

51 |

55 |

|

Total non-current assets |

89,158 |

91,847 |

| Cash

and bank balances and bank deposits |

826 |

163 |

| Other

current assets |

1,848 |

1,986 |

|

Total current assets |

2,674 |

2,149 |

|

Total assets |

91,832 |

93,996 |

|

Total equity |

42,064 |

20,760 |

| Total

debt net of unamortized debt discount |

44,209 |

65,573 |

| Other

liabilities |

5,559 |

7,663 |

|

Total

liabilities |

49,768 |

73,236 |

|

Total equity and liabilities |

91,832 |

93,996 |

|

|

|

|

|

Consolidated statement of changes in equity: |

|

|

|

|

|

(Expressed in thousands of U.S. Dollars) |

Issued share |

Share |

(Accumulated |

Total |

|

|

Capital |

Premium |

Deficit) |

Equity |

|

As at December 31, 2016 |

10 |

110,004 |

(89,254) |

20,760 |

| Loss

for the period |

- |

- |

(3,725) |

(3,725) |

|

Issuance of common stock (1) |

100 |

24,900 |

- |

25,000 |

|

Issuance of common stock due to exercise of warrants (2) |

- |

11 |

- |

11 |

|

Share-based payments (to directors) |

1 |

17 |

- |

18 |

|

As at June

30,

2017 |

111 |

134,932 |

(92,979) |

42,064 |

|

|

|

|

|

|

(1) For more details see section titled

“Share and warrant purchase agreement” below.(2) Pursuant to

the “Share and warrant purchase agreement” described below,

warrants to buy 7,000 common shares were exercised in June

2017.

Share and warrant purchase

agreement As previously reported, the Company on February

8, 2017 entered into a Share and Warrant Purchase Agreement

pursuant to which it sold for $5 million an aggregate of 5 million

of its common shares, par value $0.004 per share and warrants to

purchase 25 million of its common shares at a price of $1.60 per

share to a number of investors in a private placement. These

securities were issued in transactions exempt from registration

under the Securities Act. On February 9, 2017, the Company entered

into a registration rights agreement with those purchasers

providing them with certain rights relating to registration under

the Securities Act of the Shares and the common shares underlying

the Warrants.

In connection with the closing of the February

2017 private placement, the Company also entered into two loan

amendment agreements with existing lenders.

One loan amendment agreement was entered into by

the Company with Firment Trading Limited (“Firment”), an affiliate

of the Company’s chairman, and the lender of the Firment Credit

Facility, which then had an outstanding principal amount of

$18,524. Firment released an amount equal to $16,885 (but left an

amount equal to $1,639 outstanding, which continued to accrue

interest under the Firment Credit Facility as though it were

principal) of the Firment Credit Facility and the Company issued to

Firment Shipping Inc., an affiliate of Firment, 16,885,000 common

shares and a warrant to purchase 6,230,580 common shares at a price

of $1.60 per share. Subsequent to the closing of the February 2017

private placement, Globus repaid the outstanding amount on the

Firment Credit Facility in its entirety. The Firment Credit

Facility expired on April 12, 2017.

The other loan amendment agreement was entered

into by the Company with Silaner Investments Limited (“Silaner”),

an affiliate of the Company’s chairman, and the lender of the

Silaner Credit Facility. Silaner released an amount equal to the

outstanding principal of $3,115 (but left an amount equal to $74

outstanding, which continued to accrue interest under the Silaner

Credit Facility as though it were principal) of the Silaner Credit

Facility and the Company issued to Firment Shipping Inc., an

affiliate of Silaner, 3,115,000 common shares and a warrant to

purchase 1,149,437 common shares at a price of $1.60 per share.

Subsequent to the closing of the February 2017 private placement,

Globus repaid the outstanding amount on the Silaner Credit Facility

in its entirety. The Silaner Credit Facility remains available to

the Company until January 12, 2018.

Each of the above mentioned warrants are

exercisable for 24 months after their respective issuance. Under

the terms of the warrants, all warrant holders (other than Firment

Shipping Inc., which has no such restriction in its warrants) may

not exercise their warrants to the extent such exercise would cause

such warrant holder, together with its affiliates and attribution

parties, to beneficially own a number of common shares which would

exceed 4.99% (which may be increased, but not to exceed 9.99%) of

the Company’s then outstanding common shares immediately following

such exercise, excluding for purposes of such determination common

shares issuable upon exercise of the warrants which have not been

exercised. This provision does not limit a warrant holder from

acquiring up to 4.99% of the Company’s common shares, selling all

of their common shares, and re-acquiring up to 4.99% of the

Company’s common shares.

About Globus Maritime

LimitedGlobus is an integrated dry bulk shipping company

that provides marine transportation services worldwide and

presently owns, operates and manages a fleet of five dry bulk

vessels that transport iron ore, coal, grain, steel products,

cement, alumina and other dry bulk cargoes internationally. Globus’

subsidiaries own and operate five vessels with a total carrying

capacity of 300,571 Dwt and a weighted average age of 9.6 years as

of September 30, 2017.

Safe Harbor StatementThis

communication contains “forward-looking statements” as defined

under U.S. federal securities laws. Forward-looking statements

provide the Company’s current expectations or forecasts of future

events. Forward-looking statements include statements about the

Company’s expectations, beliefs, plans, objectives, intentions,

assumptions and other statements that are not historical facts or

that are not present facts or conditions. Words or phrases such as

“anticipate,” “believe,” “continue,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. The Company’s actual results could

differ materially from those anticipated in forward-looking

statements for many reasons specifically as described in the

Company’s filings with the Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking

statements, which speak only as of the date of this communication.

Globus undertakes no obligation to publicly revise any

forward-looking statement to reflect circumstances or events after

the date of this communication or to reflect the occurrence of

unanticipated events. You should, however, review the factors and

risks Globus describes in the reports it will file from time to

time with the Securities and Exchange Commission after the date of

this communication.

For further information please

contact:

Globus Maritime LimitedAthanasios Feidakis,

CEO

+30 210 960 8300

a.g.feidakis@globusmaritime.gr

Capital Link – New York

Nicolas

Bornozis

+1 212 661 7566globus@capitallink.com

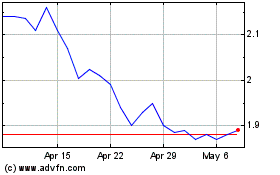

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024