UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

|

[ ]

|

Preliminary

Information Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

[X]

|

Definitive

Information Statement

|

TRISTAR

WELLNESS SOLUTIONS, INC.

(Name

of Registrant as Specified in its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

(1)

|

Title

of each class of securities to which transaction applies: n/a

|

|

(2)

|

Aggregate

number of securities to which transaction applies: n/a

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined): n/a.

|

|

(4)

|

Proposed

maximum aggregate value of transaction: n/a

|

|

(5)

|

Total

fee paid: -0-

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

(1)

|

Amount

Previously Paid:

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

(3)

|

Filing

Party:

|

|

(4)

|

Date

filed:

|

TRISTAR

WELLNESS SOLUTIONS, INC.

7047

E. Greenway Parkway, Suite 250

Scottsdale,

Arizona 85254

NOTICE

OF ACTION TAKEN BY WRITTEN CONSENT OF OUR MAJORITY STOCKHOLDERS

To

Our Stockholders:

We

are writing to advise you that three shareholders, owning various classes of voting capital stock of Tristar Wellness Solutions,

Inc.(the “Company”), with voting power of approximately 63% of the total voting power of all classes of issued and

outstanding voting capital stock of the Company (the “Majority Shareholders”) have approved by written consent, dated

November 29, 2017, the election of two directors to the Company’s Board of Directors.

PLEASE

NOTE THAT THE NUMBER OF VOTES RECEIVED FROM THE THREE SHAREHOLDERS IS SUFFICIENT TO SATISFY THE SHAREHOLDER VOTE REQUIREMENT FOR

THESE ACTIONS UNDER NEVADA LAW AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THE ACTIONS.

No

action is required by you. The accompanying information statement is furnished only to inform shareholders of the actions taken

by written consent described above before they take effect in accordance with Rule 14c-2, promulgated under the Securities of

1934, as amended. This information statement is first being mailed or furnished to you on or about November 30, 2017 and we anticipate

the effective date of the Written Consent to be on or about December 20, 2017.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

accompanying information statement is for information purposes only and explains the actions taken by Written Consent of the Majority

Shareholders. Please read the accompanying information statement carefully.

November

30, 2017

|

|

By

Direction of and on behalf of the Majority Shareholders

|

|

|

|

|

|

|

By:

|

/s/

Robert Ramsey

|

|

|

|

Robert

Ramsey

|

|

|

|

Agent

for Majority Shareholders &

|

|

|

|

Proposed

Director

|

TRISTAR

WELLNESS SOLUTIONS, INC.

7047

E. Greenway Parkway, Suite 250

Scottsdale,

Arizona 85254

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES OF 1934 AND

REGULATION

14C THEREUNDER

FOR

NOTICE OF ACTION TAKEN BY MAJORITY OF SHAREHOLDERS

ON

WRITTEN CONSENT

Written

notice of the filing of this 14C Information Statement is being sent by first class mail to all record and beneficial owners of

the voting common stock and other classes of the voting capital stock of Tristar Wellness Solutions, Inc., a Nevada corporation,

which we refer to herein as “Tristar,” or the “Company.” The mailing date of the notice is on or about

December 1, 2017. The written notice will inform the Company’s shareholders of the filing of this Definitive 14C Information

Statement with the U.S. Securities and Exchange Commission (the “SEC”) and the right of the shareholders to receive

upon request and without charge a complete written copy of the Information Statement and its exhibits. The Information Statement

has been filed with the SEC and is being furnished, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), to notify our shareholders of actions being taken by the Company pursuant to Written Consent

by the Company’s stockholders holding a majority of the voting power in lieu of a meeting of stockholders.

Shareholders

constituting in the aggregate a majority of the voting power of issued and outstanding voting capital shares of the Company (the

“Majority Shareholders”), have elected two directors to serve until the Company’s next annual meeting of shareholders

or until their resignations are duly tendered and accepted.

NO

VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS IS SOLICITED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR

A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

Majority Shareholders, holding an aggregate voting power equivalent of 109,576,177 votes out of a total of 173,063,390 votes or

representing approximately 63 percent (63%) of the Company’s total number of votes with respect to the Company’s various

classes of issued and outstanding voting shares of capital stock, based on the most recently available public information and

confirmed by the Company’s stock transfer agent, ClearTrust LLC, deem it necessary and appropriate and in the best interests

of the Company and its shareholders to undertake the election of Directors. Pursuant to the Written Consent, dated November 29,

2017, the Majority Shareholders have elected Robert Ramsey and Harry Pond to serve as Directors.

We

are not aware of any substantial interest, direct or indirect, by security holders or otherwise, that is in opposition to matters

of action being taken. In addition, pursuant to the laws of Nevada, the actions to be taken by majority Written Consent in lieu

of a special stockholder meeting do not create appraisal or dissenters’ rights.

Under

Section 14(c) of the Exchange Act, actions taken by written consent without a meeting of stockholders cannot become effective

until 20 days after the mailing date of this definitive information statement, or as soon thereafter as is practicable. We are

not seeking written consent from any stockholders other than as set forth above and our other stockholders will not be given an

opportunity to vote with respect to the actions taken. All necessary corporate approvals have been obtained, and this information

statement is furnished solely for the purpose of advising stockholders of the actions taken by written consent and giving stockholders

advance notice of the actions taken.

It

is the intent of the Majority Shareholders that following the effectiveness of the election of the two Directors, the newly elected

Board of Directors will hold its first Board of Directors meeting and appoint officers of the Company.

FORWARD-LOOKING

INFORMATION

This

information statement and other reports that the Company file with the SEC contain certain forward-looking statements relating

to future events performance. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will” “should,” “expect,” “intend,” “plan,” anticipate,” “believe,”

“estimate,” “predict,” “potential,” “continue,” or similar terms, variations of

such terms or the negative of such terms. These statements are only predictions and involve known and unknown risks, uncertainties

and other factors, including those risks discussed elsewhere herein. Although forward-looking statements, and any assumptions

upon which they are based, are made in good faith and reflect the Company’s current judgment, actual results could differ

materially from those anticipated in such statements.

Except

as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of

the forward-looking statements to conform these statements to actual results.

OUTSTANDING

VOTING SECURITIES AND CONSENTING STOCKHOLDERS

As

of the date of the execution of the Written Consent by the Majority Stockholders on November 29, 2017, the Company had issued

and outstanding shares of voting capital stock with voting power equivalent to 173,063,390 votes in total. Because the actions

were approved by stockholders that own voting capital stock representing a majority of the voting power of all classes of issued

and outstanding voting shares of capital stock, no proxies are being solicited with this information statement.

Nevada

corporate law provides in substance that unless a company’s articles of incorporation provide otherwise, stockholders may

take action without a meeting of stockholders and without prior notice if a consent or consents in writing, setting forth the

action so taken, is signed by stockholders having not less than the minimum number of votes that would be necessary to take such

action at a meeting at which all shares entitled to vote thereon were present.

The

three consenting stockholders are the owners of shares of voting capital stock representing 109,576,177 votes, which represents

approximately 63% of the total number of issued and outstanding voting shares. The consenting Majority Shareholders voted in favor

of the actions described in the Written Consent pursuant to written consents dated November 29, 2017. No consideration was paid

for the consents. Those consenting stockholders are set forth below.

|

Name

|

|

Number

of Votes

1

|

|

|

Percent

2

|

|

|

Allied

Technology Solutions LLC

|

|

|

6,000,000

|

|

|

|

3.47

|

%

|

|

Rockland

Group LLC

|

|

|

78,576,177

|

|

|

|

45.40

|

%

|

|

Rivercoach

Partners LP

|

|

|

25,000,000

|

|

|

|

14.45

|

%

|

|

Total

|

|

|

109,576,177

|

|

|

|

|

|

|

|

(1)

|

Based

upon the voting power of all shares of voting capital stock of the Company issued and outstanding as of November 29, 2017.

|

|

|

(2)

|

Percentages

have been rounded to second decimal place.

|

SECURITIES

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As

of the date of filing of this Information Statement, there are no officers or directors of the Company. Mr. Robert Ramsey, one

of the two individuals elected by Written Consent of the Majority Shareholders, does not beneficially own any of the Company’s

common stock or other voting capital stock. Mr. Harry Pond is the Managing Member of Rockland Group LLC and due to his control

position would be deemed to beneficially own or control the Company’s voting capital stock having voting power equivalent

to 78,576,177 votes or 45.40% of the total voting power of the Company’s capital stock. To the best knowledge of the Majority

Shareholders, as of November 29, 2017, only four shareholders are beneficial owners of in excess of 5% of the voting power of

the Company’s capital stock. The beneficial ownership and percentage of voting power of these shareholders as of November

29, 2017 are set forth in the table below:

|

Name

|

|

Number

of Votes

1

|

|

|

Percent

2

|

|

|

Rockland

Group LLC

3

|

|

|

78,576,177

|

|

|

|

45.40

|

%

|

|

Rivercoach

Partners LP

|

|

|

25,000,000

|

|

|

|

14.45

|

%

|

|

Northstar Consumer Products,

LLC

|

|

|

25,000,000

|

|

|

|

14.45

|

%

|

|

M&K

|

|

|

25,000,000

|

|

|

|

14.45

|

%

|

|

|

(1)

|

Based

upon the voting power of all shares of voting capital stock of the Company issued and outstanding as of November 29, 2017.

|

|

|

(2)

|

Percentages

have been rounded to second decimal place.

|

|

|

(3)

|

Mr.

Harry Pond is deemed to be the beneficial owner of these shares of Company capital stock by virtue of his position as Managing

Member of Rockland Group LLC.

|

WHERE

YOU CAN FIND MORE INFORMATION

The

Definitive 14C Information Statement is being filed with the SEC on Edgar on or about December 1, 2017. You can inspect and copy

the Information Statement and the Exhibits at the public reference facilities of the SEC’s Washington, D.C. office, 100

F Street, NE, Washington, D.C. 20549 and on its Internet site at http://www.sec.gov . In addition, the Company will furnish a

written copy of this Definitive Information Statement and the exhibits thereto to any Company shareholder of record as of November

29, 2017 free of charge upon written request.

EFFECTIVE

DATE

Pursuant

to Rule 14c-2 under the Exchange Act, the above actions shall not be effective until a date at least twenty (20) days after the

date on which the definitive information statement has been mailed or made available to the stockholders. We anticipate that the

actions contemplated hereby will be effected on or about the close of business on or about December 20, 2017.

CONCLUSION

As

a matter of regulatory compliance, the Company, acting through its Majority Shareholders, is sending you this information statement

that describes the purpose and effect of the above actions. Your consent to the above action is not required and is not being

solicited in connection with this action. This information statement is intended to provide the Company’s stockholders information

required by the rules and regulations of the Securities Exchange Act of 1934.

THE

MAJORITY SHAREHOLDERS ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ATTACHED MATERIAL IS FOR

INFORMATIONAL PURPOSES ONLY.

EXHIBITS

Exhibit

1 –

Written Consent of Majority Shareholders of Tristar Wellness Solutions, Inc., dated November 29, 2017

|

Dated:

December 1, 2017

|

BY

DIRECTION OF AND ON BEHALF OF THE MAJORITY SHAREHOLDERS

|

|

|

|

|

|

|

By:

|

/s/

Robert Ramsey

|

|

|

|

Robert

Ramsey

|

|

|

|

Agent

for Majority Shareholders &

|

|

|

|

Proposed

Director

|

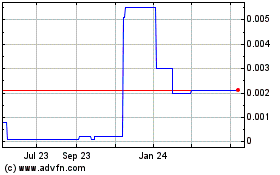

Tristar Wellness Solutions (CE) (USOTC:TWSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

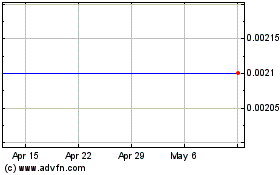

Tristar Wellness Solutions (CE) (USOTC:TWSI)

Historical Stock Chart

From Apr 2023 to Apr 2024