- Third quarter comparable sales

decreased by 1%

- Third quarter diluted earnings per

share (EPS) of $0.08

- Hurricane activity negatively

impacted third quarter net sales and EPS by approximately 1% and

$0.02, respectively

- E-commerce sales increased 23%,

accounting for 24% of net sales

- Initial success from omni-channel

initiatives, with continued rollout planned for 2018

- Remain on track to deliver $20

million in cost savings in 2017

- Strong balance sheet maintained with

$198 million in cash, an improved inventory position, and no

debt

- Narrows full year 2017 guidance for

adjusted diluted EPS to $0.43 to $0.47

Express, Inc. (NYSE:EXPR), a specialty retail apparel company,

announced its financial results for the third quarter of 2017.

These results, which cover the thirteen weeks ended

October 28, 2017, are compared to the thirteen weeks ended

October 29, 2016.

David Kornberg, the Company’s president and chief executive

officer, stated: “We are pleased with the progress we are making

towards returning our business to growth. Our key initiatives

continue to gain traction and contribute incrementally, which is

driving improved trends in our results. Comparable sales were at

the top end of our guidance, as were earnings excluding the

hurricane impact. E-commerce sales growth remained strong,

increasing 23% over last year, and store comps showed further

sequential improvement.”

Mr. Kornberg continued, "We enter the important holiday season

with positive momentum and are confident that our assortment and

fashion are resonating well with our customers based on the

continued strength in our e-commerce business and improving store

performance. We are seeing success from our recently expanded

omni-channel capabilities and expect enrollment growth in our NEXT

loyalty program to drive increased customer engagement in the

fourth quarter and into 2018. Our team is managing costs

effectively and delivering on our savings targets. Our balance

sheet remains strong with $198 million in cash and no debt, our

inventories are well-positioned, and we expect to generate solid

cash flow. We are committed to driving shareholder value and are

pleased to announce a new $150 million share repurchase program. We

continue to remain confident in our strategy and ability to

successfully transform our business to navigate a rapidly changing

environment.”

Third Quarter 2017 Operating Results:

- Net sales decreased 1% to $498.7

million from $506.1 million in the third quarter of 2016.

- Comparable sales (including e-commerce

sales) decreased 1%, compared to an 8% decrease in the third

quarter of 2016.

- E-commerce sales increased 23% year

over year to $118.2 million.

- Merchandise margin improved by 30 basis

points, driven by sourcing-related cost savings, partially offset

by the highly promotional environment. Buying and occupancy as a

percentage of net sales rose by 50 basis points. In combination,

this resulted in a 20 basis point decline in gross margin,

representing 29.8% of net sales compared to 30.0% in last year’s

third quarter.

- Selling, general, and administrative

(SG&A) expenses were $137.7 million versus $136.6 million in

last year's third quarter. As a percentage of net sales, SG&A

expenses increased by 60 basis points year over year to 27.6%.

- Restructuring costs of $0.3 million in

the third quarter of 2017 represent costs incurred related to the

Company's exit from Canada.

- Operating income was $11.2 million.

This compares to operating income of $15.1 million in the third

quarter of 2016.

- Income tax expense was $4.3 million, at

an effective tax rate of 40.8%, compared to income tax expense of

$2.8 million, at an effective tax rate of 19.6% in last year's

third quarter. The effective tax rate for the third quarter of 2016

included a net tax benefit of approximately $2.9 million

attributable to certain discrete items.

- Net income was $6.3 million, or $0.08

per diluted share. This compares to net income of $11.6 million, or

$0.15 per diluted share, in the third quarter of 2016. Net income

in the third quarter of 2016 includes a net $0.04 per

diluted share benefit related to the aforementioned income tax

items.

- Real estate activity for the third

quarter of 2017 is presented in Schedule 5.

Third Quarter 2017 Balance Sheet Highlights:

- Cash and cash equivalents totaled

$198.3 million versus $101.9 million at the end of the third

quarter of 2016.

- Capital expenditures totaled $42.2

million for the thirty-nine weeks ended October 28, 2017, compared

to $80.9 million for the thirty-nine weeks ended October 29,

2016.

- Inventory was $342.7 million compared

to $341.9 million at the end of the prior year’s third

quarter.

2017 Guidance:

The Company notes that 2017 is a fifty-three week period as

compared to a fifty-two week period in 2016. The fifty-third week

is in the fourth quarter and is expected to represent approximately

$0.04 in diluted EPS. The table below compares the Company's

projected results for the fourteen week period ended February 3,

2018 to the actual results for the thirteen week period ended

January 28, 2017.

Fourth Quarter 2017 Guidance

Fourth Quarter 2016 Actual Results Comparable Sales Positive

low single digits -13% Effective Tax Rate Approximately 40% 40.5%

Interest Expense, Net $0.3 million $0.6 million Net Income $32 to

$35 million $22.8 million Diluted EPS $0.40 to $0.44 $0.29 Weighted

Average Diluted Shares Outstanding 79.3 million 78.7 million

The table below compares the Company's projected results for the

fifty-three week period ended February 3, 2018 to the actual

results for the fifty-two week period ended January 28, 2017.

Full Year 2017 Guidance

Full Year 2016 Actual Results

Comparable Sales Negative low single digits -9% Effective Tax Rate

Approximately 40% 36.6% Interest Expense, Net $2.5 million $13.5

million(3) Net Income $22 to $25 million(1) $57.4 million(3)

Adjusted Net Income $34 to $37 million(2) $64.3 million(2) Diluted

EPS $0.28 to $0.32(1) $0.73(3) Adjusted Diluted EPS $0.43 to

$0.47(2) $0.81(2) Weighted Average Diluted Shares Outstanding 79.0

million 79.0 million Capital Expenditures $58 to $63 million $98.7

million (1) Includes $24.2

million, or $11.7 million net of tax and $0.15 per diluted share,

related to the exit of Canada. (2) Adjusted net income and

adjusted diluted EPS are non-GAAP financial measures. Refer to

Schedule 4 for a reconciliation of GAAP to Non-GAAP financial

measures. (3) Includes approximately $11.4 million, or $6.9

million net of tax and $0.08 per diluted share, of non-core items

related to an amendment to the Times Square Flagship store lease.

This guidance does not take into account any additional non-core

items that may occur.

See Schedule 5 for a discussion of projected real estate

activity.

Share Repurchase Program:

The Company also announced today that its Board of Directors has

approved a new $150 million share repurchase program. The

repurchase program authorizes the Company to repurchase shares of

its outstanding common stock using the Company’s available

cash.

The Company may repurchase shares on the open market, including

through Rule 10b5-1 plans, in privately negotiated transactions,

through block purchases, or otherwise in compliance with applicable

laws, including Rule 10b-18 of the Securities Exchange Act of 1934,

as amended. The timing and amount of stock repurchases will depend

on a variety of factors, including business and market conditions

as well as corporate and regulatory considerations. The share

repurchase program may be suspended, modified, or discontinued at

any time and the Company has no obligation to repurchase any amount

of its common stock under the program.

Conference Call Information:

A conference call to discuss third quarter 2017 results is

scheduled for November 30, 2017 at 9:00 a.m. Eastern Time (ET).

Investors and analysts interested in participating in the call are

invited to dial (877) 705-6003 approximately ten minutes prior to

the start of the call. The conference call will also be webcast

live at: http://www.express.com/investor and remain

available for 90 days. A telephone replay of this call will be

available at 12:00 p.m. ET on November 30, 2017 until 11:59 p.m. ET

on December 7, 2017 and can be accessed by dialing (844) 512-2921

and entering replay pin number 13672476.

About Express, Inc.:

Express is a specialty retailer of women's and men's apparel and

accessories, targeting the 20 to 30-year-old customer. Express has

more than 35 years of experience offering a distinct combination of

fashion and quality for multiple lifestyle occasions at an

attractive value addressing fashion needs across work, casual,

jeanswear, and going-out occasions. The Company currently operates

more than 600 retail and factory outlet stores, located primarily

in high-traffic shopping malls, lifestyle centers, and street

locations across the United States and Puerto Rico. Express

merchandise is also available at franchise locations and online in

Latin America. Express also markets and sells its products through

its e-commerce website, www.express.com, as well as on its mobile app.

Forward-Looking Statements:

Certain statements are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

any statement that does not directly relate to any historical or

current fact and include, but are not limited to, (1) guidance and

expectations for the fourth quarter and full year 2017, including

statements regarding expected comparable sales, effective tax

rates, interest expense, net income, adjusted net income, diluted

earnings per share, adjusted diluted earnings per share, and

capital expenditures, (2) statements regarding expected store

openings, store closures, store conversions, and gross square

footage, (3) statements regarding the Company's strategy, plans,

and initiatives, including, but not limited to, results expected

from such strategy, plans, and initiatives, (4) statements

regarding inventory and expectations for the holiday season, (5)

expectations for the NEXT loyalty program, (6) expectations

regarding cash flow, and (7) statements regarding the Company's

intention to repurchase shares of its common stock and the funding

for such purchases. Forward-looking statements are based on our

current expectations and assumptions, which may not prove to be

accurate. These statements are not guarantees and are subject to

risks, uncertainties, and changes in circumstances that are

difficult to predict, and significant contingencies, many of which

are beyond the Company's control. Many factors could cause actual

results to differ materially and adversely from these

forward-looking statements. Among these factors are (1) changes in

consumer spending and general economic conditions; (2) our ability

to identify and respond to new and changing fashion trends,

customer preferences, and other related factors; (3) fluctuations

in our sales, results of operations, and cash levels on a seasonal

basis and due to a variety of other factors, including our product

offerings relative to customer demand, the mix of merchandise we

sell, promotions, and inventory levels; (4) competition from other

retailers; (5) customer traffic at malls, shopping centers, and at

our stores and online; (6) our dependence on a strong brand image;

(7) our ability to develop and maintain a relevant and reliable

omni-channel experience for our customers; (8) the failure or

breach of information systems upon which we rely; (9) our ability

to protect customer data from fraud and theft; (10) our dependence

upon third parties to manufacture all of our merchandise; (11)

changes in the cost of raw materials, labor, and freight; (12)

supply chain or other business disruption; (13) our dependence upon

key executive management; (14) our ability to achieve our strategic

objectives, including improving profitability through a balanced

approach to growth, increasing brand awareness and elevating our

customer experience, transforming and leveraging information

technology systems, and investing in the growth and development of

our people; (15) our substantial lease obligations; (16) our

reliance on third parties to provide us with certain key services

for our business; (17) claims made against us resulting in

litigation or changes in laws and regulations applicable to our

business; (18) our inability to protect our trademarks or other

intellectual property rights which may preclude the use of our

trademarks or other intellectual property around the world; (19)

restrictions imposed on us under the terms of our asset-based loan

facility, including restrictions on the ability to effect share

repurchases; (20) impairment charges on long-lived assets; and (21)

changes in tax requirements, results of tax audits, and other

factors that may cause fluctuations in our effective tax rate.

Additional information concerning these and other factors can be

found in Express, Inc.'s filings with the Securities and Exchange

Commission. We undertake no obligation to publicly update or revise

any forward-looking statement as a result of new information,

future events, or otherwise, except as required by law.

Schedule 1

Express, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

October 28, 2017 January 28, 2017 October

29, 2016 ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 198,294 $ 207,373 $ 101,855 Receivables, net 16,023

15,787 16,274 Inventories 342,696 241,424 341,936 Prepaid minimum

rent 30,831 31,626 31,434 Other 29,366 17,923 21,786

Total current assets 617,210 514,133 513,285 PROPERTY

AND EQUIPMENT 1,039,197 1,029,176 1,017,259 Less: accumulated

depreciation (617,958 ) (577,890 ) (550,725 ) Property and

equipment, net 421,239 451,286 466,534 TRADENAME/DOMAIN

NAMES/TRADEMARKS 197,618 197,618 197,618 DEFERRED TAX ASSETS 7,749

7,926 21,612 OTHER ASSETS 13,161 14,226 12,696

Total assets $ 1,256,977 $ 1,185,189 $ 1,211,745

LIABILITIES AND STOCKHOLDERS’ EQUITY CURRENT

LIABILITIES: Accounts payable $ 229,339 $ 172,668 $ 222,818

Deferred revenue 21,579 29,428 25,322 Accrued expenses 117,775

80,301 166,953 Total current liabilities

368,693 282,397 415,093 DEFERRED LEASE CREDITS 140,350

146,328 145,507 OTHER LONG-TERM LIABILITIES 108,970 120,777

40,451 Total liabilities 618,013 549,502 601,051

COMMITMENTS AND CONTINGENCIES Total stockholders’

equity 638,964 635,687 610,694 Total

liabilities and stockholders’ equity $ 1,256,977 $ 1,185,189

$ 1,211,745

Schedule 2

Express, Inc.

Consolidated Statements of

Income

(In thousands, except per share

amounts)

(Unaudited)

Thirteen Weeks Ended Thirty-Nine Weeks Ended

October 28, 2017 October 29, 2016

October 28, 2017 October 29, 2016 NET

SALES $ 498,651 $ 506,090 $ 1,444,216 $ 1,513,766 COST OF GOODS

SOLD, BUYING AND OCCUPANCY COSTS 349,850 354,373

1,036,947 1,043,382 Gross profit 148,801 151,717

407,269 470,384 OPERATING EXPENSES: Selling, general, and

administrative expenses 137,721 136,633 399,529 405,547

Restructuring costs 258 — 22,869 Other operating (income) expense,

net (341 ) (17 ) (664 ) 28 Total operating expenses 137,638

136,616 421,734 405,575 OPERATING INCOME/(LOSS) 11,163

15,101 (14,465 ) 64,809 INTEREST EXPENSE, NET 577 567 2,070

12,845 OTHER EXPENSE (INCOME), NET — 90 (537 ) (404 )

INCOME/(LOSS) BEFORE INCOME TAXES 10,586 14,444 (15,998 ) 52,368

INCOME TAX EXPENSE/(BENEFIT) 4,316 2,827 (5,935 )

17,725 NET INCOME/(LOSS) $ 6,270 $ 11,617 $

(10,063 ) $ 34,643 EARNINGS PER SHARE: Basic $ 0.08 $

0.15 $ (0.13 ) $ 0.44 Diluted $ 0.08 $ 0.15 $ (0.13 ) $ 0.44

WEIGHTED AVERAGE SHARES OUTSTANDING: Basic 78,805 78,401 78,679

78,754 Diluted 78,890 78,595 78,679 79,151

Schedule 3

Express, Inc.

Consolidated Statements of Cash

Flows

(In thousands)

(Unaudited)

Thirty-Nine Weeks Ended October 28, 2017

October 29, 2016 CASH FLOWS FROM OPERATING

ACTIVITIES: Net (loss)/income $ (10,063 ) $ 34,643 Adjustments to

reconcile net (loss)/income to net cash provided by operating

activities: Depreciation and amortization 67,852 58,960 Loss on

disposal of property and equipment 1,323 907 Impairment charge

5,479 829 Amortization of lease financing obligation discount —

11,354 Loss on deconsolidation of Canada 10,672 — Share-based

compensation 11,110 10,783 Deferred taxes 1,210 (385 ) Landlord

allowance amortization (9,779 ) (8,345 ) Other non-cash adjustments

(500 ) — Changes in operating assets and liabilities: Receivables,

net (660 ) 5,883 Inventories (105,379 ) (86,468 ) Accounts payable,

deferred revenue, and accrued expenses 61,797 28,749 Other assets

and liabilities 14,612 2,954 Net cash provided by

operating activities 47,674 59,864 CASH FLOWS FROM INVESTING

ACTIVITIES: Capital expenditures (42,207 ) (80,900 ) Decrease in

cash and cash equivalents resulting from deconsolidation of Canada

(9,232 ) — Purchase of intangible assets — (21 ) Investment in

equity interests — (10,133 ) Net cash used in investing

activities (51,439 ) (91,054 ) CASH FLOWS FROM FINANCING

ACTIVITIES: Payments on lease financing obligations (1,262 ) (1,186

) Repayments of financing arrangements (2,040 ) — Proceeds from

exercise of stock options — 2,735 Repurchase of common stock under

share repurchase program — (51,538 ) Repurchase of common stock for

tax withholding obligations (1,574 ) (4,498 ) Net cash used in

financing activities (4,876 ) (54,487 ) EFFECT OF EXCHANGE

RATE ON CASH (438 ) 629 NET DECREASE IN CASH AND CASH

EQUIVALENTS (9,079 ) (85,048 ) CASH AND CASH EQUIVALENTS, Beginning

of period 207,373 186,903 CASH AND CASH EQUIVALENTS,

End of period $ 198,294 $ 101,855

Schedule 4

Supplemental Information - Consolidated

Statements of IncomeReconciliation of GAAP to Non-GAAP

Financial Measures(Unaudited)

The Company supplements the reporting of its financial

information determined under United States generally accepted

accounting principles (GAAP) with certain non-GAAP financial

measures: adjusted operating income, adjusted net income, and

adjusted diluted earnings per share. The Company believes that

these non-GAAP measures provide additional useful information to

assist stockholders in understanding its financial results and

assessing its prospects for future performance. Management believes

adjusted operating income, adjusted net income, and adjusted

diluted earnings per share are important indicators of the

Company's business performance because they exclude items that may

not be indicative of, or are unrelated to, the Company's underlying

operating results, and provide a better baseline for analyzing

trends in the business. In addition, adjusted operating income is

used as a performance measure in the Company's seasonal cash

incentive compensation program and adjusted diluted earnings per

share is used as a performance measure in the Company's executive

compensation program for purposes of determining the number of

equity awards that are ultimately earned. Because non-GAAP

financial measures are not standardized, it may not be possible to

compare these financial measures with other companies' non-GAAP

financial measures having the same or similar names. These adjusted

financial measures should not be considered in isolation or as a

substitute for reported operating income, reported net income, or

reported diluted earnings per share. These non-GAAP financial

measures reflect an additional way of viewing the Company's

operations that, when viewed with the GAAP results and the below

reconciliations to the corresponding GAAP financial measures,

provide a more complete understanding of the Company's business.

Management strongly encourages investors and stockholders to review

the Company's financial statements and publicly-filed reports in

their entirety and not to rely on any single financial measure.

Supplemental Information - Consolidated

Statements of Income

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Unaudited)

Thirteen Weeks Ended October 28, 2017 (in

thousands, except per share amounts) Operating Income

Net Income Diluted Earnings

per Share

Weighted Average Diluted Shares

Outstanding

Reported GAAP Measure $ 11,163 $ 6,270 $ 0.08 78,890 Impact of

Canadian Exit (a) 258 258 — Income Tax Benefit - Canadian Exit —

(98 ) — Adjusted Non-GAAP Measure $ 11,421 $

6,430 $ 0.08 (a)

Consists of $0.3 million in restructuring costs related to the

Canadian exit.

Thirty-Nine Weeks Ended

October 28, 2017 (in thousands, except per share

amounts) Operating Income/(Loss) Net

Income/(Loss) Diluted Earnings per Share

Weighted Average Diluted Shares

Outstanding

Reported GAAP Measure $ (14,465 ) $ (10,063 ) $ (0.13 )

78,679 Impact of Canadian Exit (a) $ 24,151 $ 24,151 0.31 Income

Tax Benefit - Canadian Exit $ — $ (12,469 ) (0.16 ) Adjusted

Non-GAAP Measure $ 9,686 $ 1,619 $ 0.02 78,851

(b) (a) Includes $22.9 million

in restructuring costs and an additional $1.3 million in inventory

adjustments related to the Canadian exit. (b) Weighted

average diluted shares outstanding for purposes of calculating

adjusted diluted earnings per share includes the dilutive effect of

share-based awards as determined under the treasury stock method.

Supplemental Information - Consolidated

Statements of Income

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Unaudited)

Thirty-Nine Weeks Ended October 29, 2016 (in

thousands, except per share amounts) Net Income

Diluted Earnings per Share Weighted

Average Diluted Shares Outstanding Reported GAAP Measure $

34,643 $ 0.44 79,151 Interest Expense (a) 11,354 0.14 Income Tax

Benefit (b) (4,428 ) (0.06 ) Adjusted Non-GAAP Measure $ 41,569

$ 0.53 (a)

Represents non-core items related to the amendment of the Times

Square Flagship store lease. (b) Represents the tax impact

of the interest expense adjustment at our statutory rate of

approximately 39% for the thirty-nine weeks ended October 29, 2016.

Fifty-Three Weeks Ended February 3,

2018 (in thousands, except per share amounts)

Projected Net Income Projected Diluted

Earnings per Share Projected Weighted Average

Diluted Shares Outstanding Projected GAAP Measure* $ 23,800 $

0.30 78,967 Projected Impact of Canadian Exit 24,200 0.31 Projected

Income Tax Benefit - Canadian Exit (12,500 ) (0.16 ) Projected

Adjusted Non-GAAP Measure* $ 35,500 $ 0.45

* Represents mid-point of guidance range.

This guidance does not take into account any additional non-core

items that may occur.

Fifty-Two Weeks Ended January 28, 2017 (in

thousands, except per share amounts) Net Income

Diluted Earnings per Share Weighted

Average Diluted Shares Outstanding GAAP Measure $ 57,417 $ 0.73

79,049 Interest Expense (a) 11,354 0.14 Income Tax Benefit (b)

(4,428 ) (0.06 ) Adjusted Non-GAAP Measure $ 64,343 $ 0.81

(a) Represents non-core

items related to the amendment of the Times Square Flagship store

lease. (b) Represents the tax impact of the interest expense

adjustment at our statutory rate of approximately 39% for the

fifty-two weeks ended January 28, 2017.

Schedule 5

Express, Inc.

Real Estate Activity

(Unaudited)

Third Quarter 2017 - Actual

October 28, 2017 - Actual Company-Operated Stores

Opened Closed

Conversion Store Count Gross

Square Footage United States - Retail Stores —

(2) (2) 499 United States - Outlet Stores 7 — 2 141

Canada — — — —

Total 7 (2) — 640 5.5 million

Fourth Quarter 2017 -

Projected February 3, 2018 -

Projected Company-Operated Stores

Opened Closed

Conversion Store Count Gross Square

Footage United States - Retail Stores — (5) (3) 491 United

States - Outlet Stores 1 — 3 145 Canada — —

— — Total 1 (5) — 636 5.4 million

Full Year 2017 - Projected

February 3, 2018 - Projected Company-Operated Stores

Opened Closed

Conversion Store Count Gross

Square Footage United States - Retail Stores — (20) (24) 491

United States - Outlet Stores 17 — 24 145 Canada —

(17) — — Total 17 (37) — 636 5.4

million

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171130005222/en/

Express, Inc.Mark Rupe, 614-474-4465Vice President, Investor

Relations

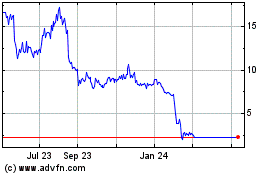

Express (NYSE:EXPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Express (NYSE:EXPR)

Historical Stock Chart

From Apr 2023 to Apr 2024