Current Report Filing (8-k)

November 29 2017 - 3:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

_____________________

Date of Report

(Date of earliest event reported)

November 22, 2017

TIDEWATER INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

(State of incorporation)

|

1-6311

(Commission File Number)

|

72-0487776

(IRS Employer Identification No.)

|

|

|

|

|

601 Poydras Street, Suite 1500

New Orleans, Louisiana

(Address of principal executive offices)

|

70130

(Zip Code)

|

(504) 568-1010

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 8.01

Other Events.

Tidewater Inc. (the "Company") has previously reported that it was in a dispute with a U.S. shipyard over the construction of two 5,400 deadweight ton (DWT) deepwater platform supply vessels (PSVs). During the quarter ended March 31, 2017, the Company rejected the delivery of the first PSV under construction and withheld the final contractual milestone payment. In March 2017, the shipyard filed a notice of arbitration alleging that the Company was (a) in breach of contract because of its rejection of the first PSV and (b) in anticipatory breach of contract based on the shipyard's expectation that the Company would reject delivery of the second PSV under construction. Further details of that dispute have been disclosed by the Company in prior filings. The Company has also disclosed that subsequent to September 30, 2017, the parties had engaged in settlement negotiations to resolve all outstanding disputes related to both vessels.

The Company and the shipyard entered into a settlement agreement effective November 22, 2017 to resolve all outstanding disputes associated with these vessels. With respect to the first PSV, the Company will receive a credit of $233,000 against the contract price due to actual deadweight being under the deadweight guaranties. The Company agreed to reimburse the shipyard for certain expenses in the aggregate amount of $65,000 and for costs associated with re-starting and testing equipment. Delivery of the first PSV occurred on November 22, 2017. The final installment for the first PSV is $4.3 million (after deduction of the contracted deadweight credit). With respect to the second PSV, the Company will receive a credit for liquidated damages due to any inability of the vessel to attain contracted deadweight guarantee when testing is performed at a later date. The Company agreed to reimburse the shipyard for certain costs and expenses of third party vendors to complete construction. That reimbursement obligation is expected to be in the aggregate amount of $655,000. The second PSV is expected to be delivered on or before June 2018. The remaining installment payment for the second PSV, in aggregate, is $4.9 million. As part of the overall settlement, the shipyard provided the Company with a $250,000 drydock credit for any future drydocking services to be provided by the shipyard to the Company.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TIDEWATER INC.

By:

/s/ Bruce D. Lundstrom

Bruce D. Lundstrom

Executive Vice President, General Counsel and Secretary

Date: November 29, 2017

3

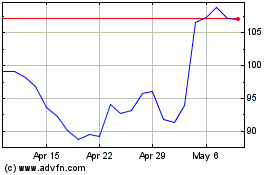

Tidewater (NYSE:TDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

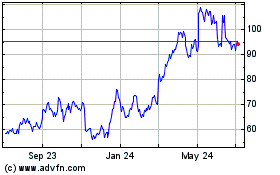

Tidewater (NYSE:TDW)

Historical Stock Chart

From Apr 2023 to Apr 2024