Current Report Filing (8-k)

November 29 2017 - 10:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

Pursuant To Section

13 OR 15(d) Of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 28, 2017

INFRAX SYSTEMS, INC.

(Exact name of registrant as specified in charter)

|

Nevada

|

000-52488

|

20-2583185

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

Infrax Systems, Inc.

3637 Fourth Street North.

Suite 330

St. Petersburg, Florida

|

|

33704

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

727-498-8514

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

FORWARD LOOKING STATEMENTS

This Form 8-K and other reports filed by Registrant from time to

time with the Securities and Exchange Commission (collectively the "Filings") contain or may contain forward looking

statements and information that are based upon beliefs of, and information currently available to, Registrant's management as well

as estimates and assumptions made by Registrant's management. When used in the filings the words "anticipate", "believe",

"estimate", "expect", "future", "intend", "plan" or the negative of these terms

and similar expressions as they relate to Registrant or Registrant's management identify forward looking statements. Such statements

reflect the current view of Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other

factors relating to Registrant's industry, Registrant's operations and results of operations and any businesses that may be acquired

by Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect,

actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although Registrant believes that the expectations reflected in

the forward looking statements are reasonable, Registrant cannot guarantee future results, levels of activity, performance or achievements.

Except as required by applicable law, including the securities laws of the United States, Registrant does not intend to update

any of the forward-looking statements to conform these statements to actual results.

Explanatory Note

On November 7, 2017, Infrax Systems, Inc. (“IFXY”)

announced plans to create a new public holding company, Cryptocurrency Corp. (“Crypto”), by implementing a holding

company reorganization (the “Crypto Merger”). Following the Crypto Merger, Crypto, a Nevada corporation, became the

successor issuer to Infrax Systems, a Nevada corporation. This Current Report on Form 8k (the “Form 8k”) is being filed

for establishing Crypto as the successor issuer pursuant to NRS 92A.180, 92A.200, NRS 92A.230 and NRS 92A.250 of the

General Corporation Law of the State of Nevada and to disclose certain related matters. As a result of the Merger, Infrax became

a wholly owned subsidiary of Crypto.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Adoption of Agreement and Plan of Merger and Consummation of Holding

Company Reorganization

On November 7, 2017, Infrax implemented a holding company reorganization

pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of November 1, 2017, among Infrax,

Crypto and NUV SUB Inc., a Nevada corporation (“Merger Sub”), which resulted in Crypto owning all of the outstanding

capital stock of Infrax. Pursuant to the Crypto Merger, Merger Sub, a direct, wholly owned subsidiary of Crypto and an indirect,

wholly owned subsidiary of Infrax, merged with and into Infrax, with Infrax surviving as a direct, wholly owned subsidiary of Crypto.

Each share of each class of Infrax stock issued and outstanding immediately prior to the Crypto Merger automatically converted

into an equivalent corresponding share of Crypto stock, having the same designations, rights, powers and preferences and the qualifications,

limitations and restrictions as the corresponding share of Infrax stock being converted. Accordingly, upon consummation of the

Crypto Merger, Infrax’s stockholders immediately prior to the consummation of the Crypto Merger became stockholders of Crypto.

The stockholders of Infrax will not recognize gain or loss for U.S. federal income tax purposes upon the conversion of their shares

in the Crypto Merger.

The Crypto Merger was conducted pursuant to NRS 92A.180, 92A.200,

NRS 92A.230 and NRS 92A.250 of the General Corporation Law of the State of Nevada (the “MCED”), which provides

for the formation of a holding company without a vote of the stockholders of the constituent corporation. The conversion of stock

occurred automatically without an exchange of stock certificates. After the Crypto Merger, unless exchanged, stock certificates

that previously represented shares of a class of Infrax stock now represent the same number of shares of the corresponding class

of Crypto stock. Following the consummation of the Crypto Merger, Crypto Class A shares continue to trade on the OTC Market

on an uninterrupted basis under the symbol “IFXY” until the new symbol change is in effect by FINRA and respectively

with new CUSIP numbers (for Crypto Class A shares). Immediately after consummation of the Crypto Merger, Crypto will be, on

a consolidated basis, a cryptocurrency and blockchain investor and developer. As a result of the Crypto Merger, Crypto became the

successor issuer to Infrax and Infrax will become a subsidiary of Cryptocurrency Corp.

Cryptocurrency Corp., through its business units, invests in Crypto

assets, Provides Blockchain Technology Consulting, ICO Consulting Services, Tokenization of Asset Funds & IoT Related Intelligence

& Security Based on Blockchain.

Infrax Systems is intending to concentrate on IoT technology development

using blockchain (IOTA).

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

1.1

|

|

Agreement and Plan of Merger, dated November 1, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Infrax Systems, Inc.

/s/ Sam Talari

Sam Talari

Principal Executive Officer

Dated: November 28, 2017

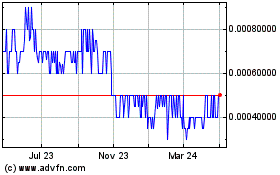

Infrax Systems (PK) (USOTC:IFXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

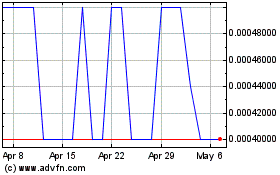

Infrax Systems (PK) (USOTC:IFXY)

Historical Stock Chart

From Apr 2023 to Apr 2024