REX American Resources Corporation (NYSE American: REX) (“REX”

or “the Company”) today reported financial results for its fiscal

2017 third quarter (“Q3 ‘17”) ended October 31, 2017.

REX American Resources’ Q3 ‘17 results principally reflect its

interests in six ethanol production facilities and its refined coal

operation. One Earth Energy, LLC (“One Earth”) and NuGen Energy,

LLC (“NuGen”) are consolidated, while those of its four remaining

plants are reported as equity in income of unconsolidated ethanol

affiliates. REX’s financial results for the fiscal 2017 third

quarter also reflect the refined coal entity acquired by the

Company on August 10, 2017. REX expects revenues from the sale of

refined coal produced at the facility will be subsidized by federal

production tax credits, subject to meeting qualified emissions

reductions as governed by Section 45 of the Internal Revenue Code.

Beginning in the third quarter of fiscal 2017, the Company will

report results for its two business segments, ethanol and

by-products and refined coal.

REX’s Q3 ‘17 net sales and revenue increased 4.2% to $121.2

million, compared with $116.3 million in Q3 ‘16, primarily

attributable to higher revenues from the Company’s ethanol and

by-products segment. Ethanol sales increased 6.2% primarily due to

a 5.7% increase in gallons of ethanol sold, which was partially

offset by 14.6% reduction in dried distillers grains sales

primarily due to an 11.4% decline in pricing.

Gross profit decreased to $18.3 million from $20.2 million

related to the Company’s ethanol and by-products operations during

the third quarter. Additionally, the Company reported a $3.4

million gross loss from the Company’s refined coal operations.

While gross profit was negatively impacted, the Company recognized

benefits related to its refined coal operations in the form of a

lower effective tax rate. Equity in income of unconsolidated

ethanol affiliates in Q3 ‘17 decreased to $1.1 million, from $1.8

million in Q3 ‘16. As a result of these factors, income before

income taxes and non-controlling interests in Q3 ‘17 decreased to

$9.3 million from $17.2 million in Q3 ‘16. Primarily reflecting the

company’s recent investment in refined coal operations, REX

recorded a $5.7 million income tax benefit in Q3 ‘17, versus a

provision for income taxes of $5.7 million in Q3 ‘16.

Net income attributable to REX common shareholders in Q3 ‘17

rose to $13.2 million or $2.00 per basic and diluted share compared

to $8.9 million or $1.36 per share in Q3 ‘16. Net income

attributable to non-controlling interests in Q3 ‘17 was $1.8

million, compared with $2.5 million in Q3 ‘16. Per share results in

Q3 ‘17 and Q3 ‘16 are based on 6,597,000 and 6,590,000 diluted

weighted average shares outstanding, respectively.

Segment Income Statement Data:

Three Months

Ended

Nine Months

Ended

($ in thousands)

October 31, October 31, 2017

2016 2017 2016 Net

sales and revenue: Ethanol & By-Products (1) $

120,971 $ 116,283 $ 342,858 $ 332,212 Refined coal (2) (3)

193 - 193

- Total net sales and revenues

$ 121,164 $

116,283 $ 343,051

$ 332,212 Gross profit

(loss): Ethanol & By-Products (1) $ 18,257 $ 20,162 $

41,527 $ 45,868 Refined coal (2)

(3,390)

- (3,390) -

Total gross profit $ 14,867

$ 20,162 $

38,137 $ 45,868

Income (loss) before income taxes: Ethanol & By-Products

(1) $ 15,554 $ 17,682 $ 31,807 $ 37,294 Refined coal (2) (5,684) -

(5,684) - Corporate and other

(611)

(468) (2,389)

(1,554) Total income (loss) before income taxes

$ 9,259 $

17,214 $ 23,734

$ 35,740

Benefit (provision) for income

taxes:

Ethanol & By-Products $ (4,379) $ (5,917) $ (9,712) $ (12,331)

Refined coal (4) 9,918 - 9,918 - Corporate and other

196 177 837

560 Total benefit (provision) before income

taxes

$ 5,735 $

(5,740) $ 1,043

$ (11,771)

Segment profit (loss):

Ethanol & By-Products $ 9,058 $ 9,209 $ 17,665 $ 20,901 Refined

coal 4,520 - 4,520 - Corporate and other

(410)

(271) (1,532)

(949) Net income attributable to REX common

shareholders

$ 13,168 $

8,938 $ 20,653

$ 19,952 (1) Includes

results attributable to non-controlling interests of approximately

25% for One Earth and approximately 1% for NuGen. (2) Includes

results attributable to non-controlling interests of approximately

5%. (3) Refined coal sales are reported net of the cost of coal.

(4) We record our tax provision/benefit based on an estimated

annual rate adjusted for items recorded discretely. This estimate

was significantly reduced beginning in the third quarter of the

current year, as we began operating our recently acquired refined

coal facility. This resulted in a disproportionate tax benefit

recognized in the third quarter of fiscal year 2017 as the

cumulative effect of the reduced annual rate was recorded in the

third quarter of fiscal year 2017.

REX American Resources’ Chief Executive Officer, Zafar Rizvi,

commented, “REX delivered healthy third quarter results, including

net income attributable to REX shareholders of over $13.2 million,

or $2.00 per share, marking a 47% year-over-year increase. We are

pleased to report an increase in sales based upon a 5.7% increase

in our consolidated gallons of ethanol sold, offset by lower

distillers grains pricing. As expected, our recent investment in

refined coal operations enabled us to recognize income tax benefits

and was significantly accretive to our earnings per share.”

Balance Sheet and Capital AllocationAt October 31, 2017,

REX had cash and cash equivalents of $190.5 million, $63.5 million

of which was at the parent company and $127.0 million of which was

at its consolidated ethanol production facilities. This compares

with cash and cash equivalents of $188.6 million at January 31,

2017, $79.5 million of which was at the parent company and $109.1

million of which was at its consolidated ethanol production

facilities.

The following table summarizes select

data related to the Company’s consolidated ethanol

interests:

Three Months

Ended October 31,

Nine Months

Ended October 31,

2017 2016 2017

2016 Average selling price per gallon of ethanol

$ 1.45 $ 1.44 $ 1.45 $ 1.42

Average selling price per ton of dried distillers grains

$ 108.34 $ 122.34 $ 101.44 $ 127.27

Average selling price per pound of non-food grade corn oil

$ 0.30 $ 0.29 $ 0.29 $ 0.27 Average

selling price per ton of modified distillers grains $

41.64 $ 45.17 $ 41.53 $ 54.49 Average cost per

bushel of grain $ 3.35 $ 3.30 $ 3.39

$ 3.51 Average cost of natural gas (per mmbtu)

$ 3.22 $ 3.31 $ 3.41 $ 3.08

Supplemental Data Related to REX’s

Ethanol & By-Products Interests:

REX American Resources

CorporationEthanol Ownership Interests/Effective Annual

Gallons Shipped as of October 31, 2017(gallons in

millions)

Entity

TrailingTwelveMonthsGallonsShipped

CurrentREXOwnershipInterest

REX’s CurrentEffective

Ownershipof Trailing TwelveMonth

GallonsShipped

One Earth Energy, LLC(Gibson City,

IL)

123.6 75.0% 92 .7

NuGen Energy, LLC(Marion, SD)

131.9 99.5% 131 .2

Big River Resources West Burlington,

LLC(West Burlington, IA)

106.8 10.3% 11 .0

Big River Resources Galva,

LLC(Galva, IL)

124.6 10.3% 12 .8

Big River United Energy,

LLC(Dyersville, IA)

129.4 5.7% 7 .4

Big River Resources Boyceville,

LLC(Boyceville, WI)

57.1 10.3% 5 .9

Total

673.4 n/a 261 .0

Third Quarter Conference CallREX will host a conference

call at 11:00 a.m. ET today. Senior management will discuss the

financial results and host a question and answer session. The dial

in number for the audio conference call is (212) 231-2935 (domestic

and international callers).

Participants can also listen to a live webcast of the call on

the Company’s website, www.rexamerican.com/Corp/Page4.aspx. A

webcast replay will be available for 30 days following the live

event at www.rexamerican.com/Corp/Page4.aspx.

About REX American Resources CorporationREX American

Resources has interests in six ethanol production facilities, which

in aggregate shipped approximately 673 million gallons of ethanol

over the twelve month period ended October 31, 2017. REX’s

effective ownership of the trailing twelve month gallons shipped

(for the twelve months ended October 31, 2017) by the ethanol

production facilities in which it has ownership interests was

approximately 261 million gallons. In addition, the Company

acquired a refined coal operation on August 10, 2017. Further

information about REX is available at www.rexamerican.com.

This news announcement contains or may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements can be identified by use of

forward-looking terminology such as “may,” “expect,” “believe,”

“estimate,” “anticipate” or “continue” or the negative thereof or

other variations thereon or comparable terminology. Readers are

cautioned that there are risks and uncertainties that could cause

actual events or results to differ materially from those referred

to in such forward-looking statements. These risks and

uncertainties include the risk factors set forth from time to time

in the Company’s filings with the Securities and Exchange

Commission and include among other things: the impact of

legislative changes, the price volatility and availability of corn,

dried and modified distillers grains, ethanol, corn oil, gasoline

and natural gas, ethanol plants operating efficiently and according

to forecasts and projections, changes in the international,

national or regional economies, weather, results of income tax

audits, changes in income tax laws or regulations and the effects

of terrorism or acts of war. The Company does not intend to update

publicly any forward-looking statements except as required by

law.

- statements of operations follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Statements of

Operations

(in thousands, except per share

amounts)

Unaudited

Three Months

Ended

Nine Months

Ended

October 31, October 31,

2017

2016

2017

2016

Net sales and revenue $ 121,164 $ 116,283 $ 343,051 $ 332,212 Cost

of sales

106,297 96,121

304,914 286,344 Gross

profit 14,867 20,162 38,137 45,868 Selling, general and

administrative expenses (7,347) (5,082) (17,528) (14,315) Equity in

income of unconsolidated ethanol affiliates 1,094 1,838 1,931 3,257

(Loss) gain on sale of investment - - (13) 192 (Loss) gain on

disposal of property and equipment, net (100) 179 (87) 364 Interest

and other income

745 117

1,294 374 Income before

income taxes 9,259 17,214 23,734 35,740 Benefit (provision) for

income taxes

5,735 (5,740)

1,043 (11,771) Net income

14,994 11,474 24,777 23,969 Net income attributable to

non-controlling interests

(1,826)

(2,536) (4,124)

(4,017) Net income attributable to REX common

shareholders

$ 13,168 $

8,938 $ 20,653

$ 19,952 Weighted average shares

outstanding – basic and diluted

6,597

6,590 6,594

6,591 Basic and diluted net income per share

attributable to REX common shareholders

$

2.00

$

1.36

$

3.13

$

3.03

- balance sheet follows -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Balance Sheets

(in thousands) Unaudited

October 31,

January 31,

ASSETS:

2017

2017

CURRENT ASSETS: Cash and cash equivalents $ 190,460 $ 188,576

Restricted cash 230 130 Accounts receivable 9,801 11,901 Inventory

24,145 17,057 Refundable income taxes 977 1,070 Prepaid expenses

and other 6,828 6,959 Deferred taxes-net

-

824

Total current assets 232,441 226,517 Property and equipment-net

198,959 182,761 Other assets 7,190 6,913 Equity method investments

35,755 37,833 TOTAL ASSETS

$ 474,345 $

454,024 LIABILITIES AND EQUITY CURRENT

LIABILITIES: Accounts payable – trade $ 11,778 $ 9,171 Accrued

expenses and other current liabilities

11,223

13,348

Total current liabilities

23,001

22,519

LONG TERM LIABILITIES: Deferred taxes 34,629 41,135 Other long term

liabilities

3,343 2,096

Total long term liabilities

37,972

43,231

COMMITMENTS AND CONTINGENCIES EQUITY: REX shareholders’ equity:

Common stock, 45,000 shares authorized, 29,853 shares issued at par

299 299 Paid in capital 146,887 145,767 Retained earnings 528,860

508,207 Treasury stock, 23,287 and 23,292 shares

(313,650) (313,838) Total REX

shareholders’ equity 362,396 340,435 Non-controlling interests

50,976 47,839 Total equity

413,372

388,274

TOTAL LIABILITIES AND EQUITY

$ 474,345

$ 454,024

- statements of cash flows follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Statements of Cash

Flows

(in thousands) Unaudited

Nine Months Ended

October 31,

2017

2016

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 24,777 $ 23,969

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 15,695 14,567

Income from equity method investments (1,931) (3,257) Dividends

received from equity method investee 4,009 4,010 Loss (gain) on

disposal of property and equipment 87 (364) Loss (gain) on sale of

investment 13 (192) Deferred income tax (5,682) (1,019) Stock based

compensation expense 881 68 Changes in assets and liabilities:

Accounts receivable 2,023 (1,686) Inventories (7,039) (2,305) Other

assets (222) 2,758 Accounts payable-trade 2,195 1,653 Other

liabilities

(746) 3,157 Net

cash provided by operating activities

34,060

41,359 CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures (19,315) (11,836) Acquisition of business, net

of cash acquired (12,049) - Restricted cash (100) 8 Restricted

investments and deposits 150 460 Proceeds from sale of investment

64 2,275 Proceeds from sale of property and equipment 42 1,510

Other

19 17 Net cash used

in investing activities

(31,189)

(7,566) CASH FLOWS FROM FINANCING ACTIVITIES: Dividend

payments to and purchases of stock from non-controlling interests

holders (1,725) (2,096) Capital contributions from minority

investor 738 - Treasury stock acquired

-

(4,709) Net cash used in financing activities

(987) (6,805) NET INCREASE IN CASH

AND CASH EQUIVALENTS 1,884 26,988 CASH AND CASH

EQUIVALENTS-Beginning of period

188,576

135,765 CASH AND CASH EQUIVALENTS-End of period

$ 190,460 $

162,753 Non cash investing activities – Accrued

capital expenditures

$ 1,049

$ 1,183 Non cash financing activities –

Stock awards accrued

$ 768 $

- Non cash financing activities – Stock awards issued

$ 1,195 $ 1,095

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171129005234/en/

REX American Resources CorporationDouglas Bruggeman,

937-276-3931Chief Financial OfficerorJCIRJoseph Jaffoni, Norberto

Aja212-835-8500rex@jcir.com

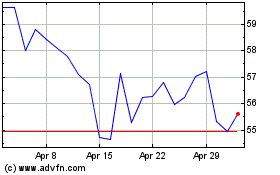

REX American Resources (NYSE:REX)

Historical Stock Chart

From Mar 2024 to Apr 2024

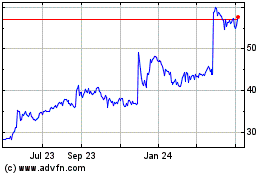

REX American Resources (NYSE:REX)

Historical Stock Chart

From Apr 2023 to Apr 2024