Current Report Filing (8-k)

November 28 2017 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2017

BioMarin Pharmaceutical Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-26727

|

|

68-0397820

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

770 Lindaro Street, San Rafael, CA

|

|

94901

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (415)

506-6700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry Into a Material Definitive Agreement.

|

On November 21, 2017 BioMarin Pharmaceutical Inc., a

Delaware corporation (BioMarin), and BioMarin Commercial Ltd., a private limited liability company registered in Ireland and wholly owned subsidiary of BioMarin (together with BioMarin, the Company), entered into a definitive agreement (the Asset

Purchase Agreement) to sell a Rare Pediatric Disease Priority Review Voucher (PRV) for a lump sum payment of $125,000,000. The Company received the PRV under a U.S. Food and Drug Administration (FDA) program intended to encourage the development of

treatments for rare pediatric diseases. The Company was awarded the PRV in April 2017 when it received approval from the FDA of Brineura

®

for the treatment of late infantile neuronal ceroid

lipofuscinosis type 2.

The transactions contemplated by the Asset Purchase Agreement remains subject to customary closing conditions, including the

expiration or termination of the required waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The Agreement contains customary representations, warranties and covenants.

The foregoing description of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text

of the Asset Purchase Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2017.

|

Item 7.01

|

Regulation FD Disclosure.

|

On November 27, 2017, the Company issued a press release pursuant to

which it announced that it had entered into the Asset Purchase Agreement. A copy of the press release is furnished as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits.

|

Forward-Looking Statements

This Current Report on

Form 8-K

contains forward-looking statements, including, but not limited to, statements

about the closing of the transactions contemplated by the Asset Purchase Agreement and the Company’s receipt of the payment for the PRV. These forward-looking statements are predictions and involve risks and uncertainties. Actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, but are not limited to, risks and uncertainties related to anti-trust review of the

Asset Purchase Agreement and those factors detailed in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the factors contained under the caption “Risk Factors” and elsewhere in the

Company’s Securities and Exchange Commission (SEC) filings and reports (Commission File No. 000-26727), including the Quarterly Report on

Form 10-Q

for the quarter ended September 30, 2017

filed with the SEC on October 31, 2017, and future filings and reports by the Company. The Company undertakes no duty or obligation to update any forward-looking statements contained in this Current Report on

Form 8-K

as a result of new information, future events or changes in its expectations.

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: November 28, 2017

|

|

|

|

BIOMARIN PHARMACEUTICAL INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ G. Eric Davis

|

|

|

|

|

|

|

|

G. Eric Davis

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel

|

- 3 -

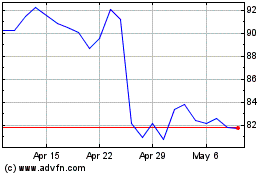

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

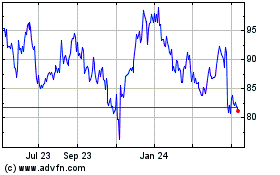

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024