Current Report Filing (8-k)

November 28 2017 - 6:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 27, 2017

KILROY REALTY CORPORATION

KILROY REALTY, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland (Kilroy Realty

Corporation)

|

|

001-12675

(Kilroy Realty

Corporation)

|

|

95-4598246

(Kilroy Realty

Corporation)

|

|

Delaware (Kilroy Realty, L.P.)

|

|

000-54005

(Kilroy Realty, L.P.)

|

|

95-4612685

(Kilroy Realty, L.P.)

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

12200 W. Olympic Boulevard, Suite

200

Los Angeles,

California

|

|

90064

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(310) 481-8400

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

ITEM 1.01

|

ENTRY INTO A MATERIAL AGREEMENT

|

On November 27, 2017, Kilroy Realty, L.P. (the

“Operating Partnership”) and Kilroy Realty Corporation (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with J.P. Morgan Securities LLC (“J.P. Morgan”) and U.S. Bancorp

Investments, Inc. (“US Bancorp”), as representatives of the several underwriters (the “Underwriters”) listed on Schedule A attached thereto, relating to the public offering by the Operating Partnership of $425,000,000 aggregate

principal amount of the Operating Partnership’s 3.450% Senior Notes due 2024 (the “2024 Notes”).

Pursuant to the

Underwriting Agreement, the Company has agreed to sell to the several Underwriters, and the Underwriters have severally agreed to purchase, $425,000,000 aggregate principal amount of 2024 Notes. The 2024 Notes will be guaranteed by the Company. The

2024 Notes will pay interest semi-annually at a rate of 3.450% per annum on June 15 and December 15 each year and mature on December 15, 2024. The public offering price of the 2024 Notes was 99.870% of the principal amount, for a yield to maturity

of 3.471%. The offering is expected to close on December 11, 2017, subject to the satisfaction of customary closing conditions.

Net

proceeds from the offering will be approximately $421.0 million, after deducting underwriting discounts and our estimated expenses. The Company intends to use the net proceeds from the offering to redeem all $325.0 million aggregate principal

amount (plus the make-whole amount and accrued and unpaid interest) of the Operating Partnership’s 2018 Notes (defined below) and to use the remaining net proceeds for general corporate purposes, which may include funding development projects,

acquiring land and properties and repaying other outstanding indebtedness. Pending application of the net proceeds for those purposes, the Company may use the net proceeds from the offering to repay borrowings under the Operating Partnership’s

revolving credit facility and/or temporarily invest such net proceeds in marketable securities.

This Current Report on Form

8-K

shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor will there be any sale of these securities in any jurisdiction in which, or to any person to whom, such offer,

solicitation or sale would be unlawful.

The foregoing description of the Underwriting Agreement does not purport to be complete and is

qualified in its entirety by the full text of the Underwriting Agreement, which is being filed as Exhibit 1.1 to this Current Report on Form

8-K

and is incorporated herein by reference.

|

ITEM 7.01

|

REGULATION FD DISCLOSURE

|

On November 27, 2017, the Company issued a press release

announcing that the Operating Partnership has priced the underwritten public offering of the 2024 Notes. A copy of the press release is furnished as Exhibit 99.1 to this Current

Report on Form 8-K.

The information included in this Current Report on Form

8-K

under this Item 7.01 (including Exhibit 99.1 hereto) is being “furnished” and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of

1934, as amended, or otherwise subject to the liabilities of Section 18, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall

be expressly set forth by specific reference in such filing. The information included in this Current Report on Form

8-K

under this Item 7.01 (including Exhibit 99.1) will not be deemed an admission as to

the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

In addition, on November 27, 2017, the Company issued a press release

announcing that the Operating Partnership is redeeming all of the outstanding $325.0 million aggregate principal amount of the Operating Partnership’s 4.800% Senior Unsecured Notes due July 15, 2018 (CUSIP No. 49427RAH5) (the

“2018 Notes”) in full on December 27, 2017 (the “Redemption Date”). The redemption price will equal 100% of the principal amount of the 2018 Notes to be redeemed and a make-whole amount calculated in accordance with the indenture

governing the 2018 Notes plus accrued and unpaid interest thereon to the Redemption Date. A copy of the press release is filed as Exhibit 99.2 to this Current Report on Form

8-K

and is incorporated herein by

reference.

This Current Report on Form

8-K

shall not constitute a notice of redemption under the

optional redemption provisions of the indenture governing the 2018 Notes.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

(d) Exhibits.

|

|

|

|

|

|

|

|

1.1*

|

|

Underwriting Agreement, dated November 27, 2017, by and among Kilroy Realty, L.P., Kilroy Realty Corporation and J.P. Morgan Securities LLC and U.S. Bancorp Investments, Inc., as representatives of the several underwriters named on

Schedule A thereto.

|

|

|

|

|

99.1**

|

|

Press Release, dated November 27, 2017, issued by Kilroy Realty Corporation.

|

|

|

|

|

99.2*

|

|

Press Release, dated November 27, 2017, issued by Kilroy Realty Corporation.

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1*

|

|

Underwriting Agreement, dated November 27, 2017, by and among Kilroy Realty, L.P., Kilroy Realty Corporation and J.P. Morgan Securities LLC and U.S. Bancorp Investments, Inc., as representatives of the several

underwriters named on Schedule A thereto.

|

|

|

|

|

99.1**

|

|

Press Release, dated November 27, 2017, issued by Kilroy Realty Corporation.

|

|

|

|

|

99.2*

|

|

Press Release, dated November 27, 2017, issued by Kilroy Realty Corporation.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Kilroy Realty Corporation

|

|

|

|

|

|

|

Date: November 28, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Heidi R. Roth

|

|

|

|

|

|

|

|

Heidi R. Roth

Executive Vice President

and Chief Accounting Officer

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Kilroy Realty, L.P.

|

|

|

|

|

|

|

Date: November 28, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

Kilroy Realty Corporation,

Its general

partner

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Heidi R. Roth

|

|

|

|

|

|

|

|

Heidi R. Roth

Executive Vice President

and Chief Accounting Officer

|

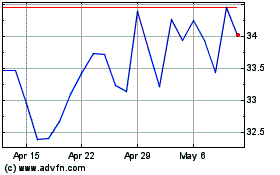

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

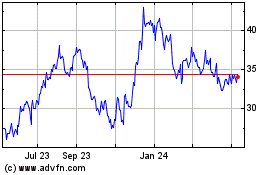

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Apr 2023 to Apr 2024