UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or

15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 26, 2017

Civeo Corporation

(Exact name of registrant as specified in its charter)

|

British Columbia

,

Canada

|

1-36246

|

98-1253716

|

|

(State or Other Jurisdiction of

|

(Commission File Number)

|

(I.R.S. Employer

|

|

Incorporation)

|

|

Identification No.)

|

Three Allen Center,

333 Clay Street, Suite 4980

,

Houston, Texas 77002

(Address of Principal Executive Offices) (Zip Code)

Registrant

’s Telephone Number, Including Area Code: (

713

)

510

-

2400

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☒

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item

1

.01.

Entry into a Material Definitive Agreement

.

Purchase

Agreement

On

November 26, 2017, Civeo Corporation (“Civeo”) entered into a Share Purchase Agreement (the “Purchase Agreement”) by and among Civeo, Noralta Lodge Ltd. (“Noralta”), Torgerson Family Trust (“Torgerson Trust”), 2073357 Alberta Ltd., 2073358 Alberta Ltd., 1818939 Alberta Ltd., 2040618 Alberta Ltd., 2040624 Alberta Ltd., 989677 Alberta Ltd. (“989677”) and Lance Torgerson. Under the terms and subject to the conditions set forth in the Purchase Agreement, at closing, Civeo will acquire, directly or indirectly, all of the issued and outstanding shares of Noralta. The consideration for the acquisition payable at closing will be in an amount equal to (i) C$209,500,000 in cash, subject to customary adjustments for working capital, debt, cash and transaction expenses, of which C$28,500,000 will be held in escrow by Alliance Trust Company (the “Escrow Agent”) to support the sellers’ indemnification obligations under the Purchase Agreement, (ii) 32,790,868 common shares of Civeo, no par value (the “Common Shares”), of which 13,491,100 shares will be held in escrow by the Escrow Agent and released in three equal installments from escrow upon the satisfaction of certain conditions related to customer contracts remaining in place in June 2021, June 2022 and June 2023, and (iii) 9,679 shares of Class A Series 1 Preferred Shares of Civeo (the “Preferred Shares”) with an initial liquidation preference of US$96,790,000.

Consummation of the transaction

s contemplated by the Purchase Agreement is subject to various closing conditions, including but not limited to: (i) receipt of Canadian regulatory approvals and other regulatory and third party consents and approvals; (ii) the absence of any injunction or order prohibiting or restricting the consummation of the transactions contemplated by the Purchase Agreement; and (iii) the receipt of approval by Civeo’s shareholders of the issuance of the Common Shares and Preferred Shares by Civeo. The Purchase Agreement may be terminated by either party if such conditions are not satisfied by April 30, 2018.

The Purchase Agreement contains customary representations, warranties and covenants by each party. The covenants relate to, among other things, the conduct by

Noralta during the period between the signing of the Purchase Agreement and the closing and the parties’ efforts to obtain regulatory approvals in connection with the Purchase Agreement. In addition, in connection with the closing of the transactions contemplated by the Purchase Agreement, Civeo will obtain a representation and warranty insurance policy that will provide coverage for certain representations and warranties of the sellers contained in the Purchase Agreement, subject to a retention amount, exclusions, policy limits and certain other terms and conditions.

In addition, at the closing of the Purchase Agreement,

Civeo will enter into a Registration Rights, Lock-Up and Standstill Agreement (the “Registration Rights Agreement”) with Torgerson Trust and 989677. Pursuant to the terms and conditions of the Registration Rights Agreement, for a period of 18 months following the closing, Torgerson Trust and 989677 will agree not to transfer any of their Common Shares without the prior written consent of Civeo, with certain limited exceptions for permitted transfers. Following such 18-month period, Torgerson Trust and 989677 will be permitted to transfer Common Shares under Rule 144 or an effective registration statement under the U.S. Securities Act of 1933, as amended (the “Securities Act”), subject to a limitation restricting transfers of more than 10% of the Common Shares (including Common Shares received upon conversion of the Preferred Shares) received by Torgerson Trust and 989677 during any 90-day period. The Registration Rights Agreement also provides that, as soon as practicable following the date that is 18 months after the date of the Registration Rights Agreement, but in no event more than 30 days thereafter, Civeo will use its commercially reasonable efforts to prepare and file a shelf registration statement under the Securities Act covering the public offering of the registrable securities held by Torgerson Trust and 989677 and cause such shelf registration statement to become effective within 150 days after filing. In addition, Torgerson Trust and 989677 will have customary “piggy-back” rights with respect to public offerings of Common Shares by Civeo. In the event the shelf registration statement does not become effective within the time period specified in the Registration Rights Agreement, the dividend rate of the Preferred Shares will be increased by (i) 0.25% per annum commencing on the first succeeding dividend date after such registration default and (ii) 0.25% per annum on each subsequent dividend date until such time as a shelf registration statement becomes effective (up to a maximum increase of 1.00% per annum). Finally, Torgerson Trust and 989677 each agreed to be subject to customary standstill restrictions, including a restriction on additional purchases of Common Shares, and a restriction on voting Common Shares that limits the voting by such holders of Common Shares (including Common Shares held in escrow) in excess of 15% of the voting power of the outstanding Common Shares, which will be voted consistently with all other shareholders. The transfer, standstill and voting restrictions terminate at such time as the shares beneficially owned by Torgerson Trust and 989677 no longer constitute at least 5% of Civeo’s Common Shares then outstanding (calculated assuming conversion of all of the outstanding Preferred Shares) or upon a bankruptcy or change of control of Civeo.

Holders of the Preferred Shares will be entitled to receive a 2% annual dividend

, paid quarterly in cash or, at Civeo’s option, by increasing the Preferred Shares’ liquidation preference. The Preferred Shares are convertible into Common Shares at a conversion price of US$3.30 per Preferred Share (the “Conversion Price”). Civeo has the right to elect to convert the Preferred Shares into Common Shares if the 15-day volume weighted average price of the Common Shares is equal to or exceeds the Conversion Price. Holders of the Preferred Shares will have the right to convert the Preferred Shares into Common Shares at any time after two years from the date of issuance, and the Preferred Shares mandatorily convert after five years from the date of issuance. The Preferred Shares also convert automatically into Common Shares upon a change of control of Civeo. Civeo may redeem any or all of the Preferred Shares for cash at the liquidation preference, plus accrued and unpaid dividends. The Preferred Shares do not have voting rights, except as statutorily required.

The foregoing description

s of the Purchase Agreement, the Registration Rights Agreement and the Preferred Shares do not purport to be complete and are qualified in their entirety by reference to a copy of the Purchase Agreement, which is attached as Exhibit 10.1 hereto, and the Preferred Shares Terms and the Registration Rights Agreement, which are attached as Exhibit “3” and Exhibit “4”, respectively, to the Purchase Agreement.

Item 3.02.

Unregistered Sales of Equity Securities.

The Company anticipates that,

pursuant the terms and conditions described in the Purchase Agreement, the issuance of Common Shares and Preferred Shares upon the closing of the Purchase Agreement will be exempt from the registration requirements under the Securities Act pursuant to Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated under the Securities Act. In connection with the Purchase Agreement, the recipients of the securities represented to Civeo that they are each an “accredited investor” as defined in each of Rule 501(a) of Regulation D promulgated under the Securities Act and Section 1.1 of National Instrument 45-106 –

Prospectus Exemptions

and that the securities were not purchased as a result of “general solicitation” or “general advertising” (as such terms are used in Rule 502 of Regulation D promulgated under the Securities Act). The information provided in Item 1.01 is incorporated into this Item 3.02 by reference.

Item 7.01.

Regulation FD Disclosure.

On

November 27, 2017, Civeo issued a press release announcing its entry into the Purchase Agreement. A copy of the press release is furnished as Exhibit 99.1 to this current report and is incorporated herein by reference. The information furnished in Item 7.01 is not deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section, and is not deemed incorporated by reference in any filing under the Securities Act .

Item

8

.01.

Other Events

.

On

November 27, 2017, Civeo (i) made a presentation to investors, (ii) sent an email to its employees and (iii) posted an FAQ for its employees, in each case, in connection with the transactions contemplated by the Purchase Agreement. Copies of each of the foregoing are furnished as Exhibits 99.2, 99.3 and 99.4, respectively, hereto and are incorporated herein by reference.

In addition, Civeo hosted a town hall meeting with its employees on November 27, 2017.

The transcript of the meeting is furnished as Exhibit 99.5 hereto and incorporated herein by reference.

Cautionary Statement Regarding Forward-Looking Statements

Statements included in this Current Report on Form 8-K regarding the proposed transaction and other attributes of Civeo following the completion of the transaction, and other statements that are not historical facts, are forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act). Forward-looking statements include words or phrases such as “anticipate,” “believe,” “contemplate,” “estimate,” “expect,” “intend,” “plan,” “project,” “could,” “may,” “might,” “should,” “will” and words and phrases of similar import. The forward-looking statements included herein are based on current expectations and entail various risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these forward-looking statements.

With respect to forward-looking statements regarding estimated annu

al revenues under two Noralta contracts, such statements are subject to the risks of early termination of the contracts, failure to extend the contracts beyond their primary term, a decrease in demand under the contracts below Civeo’s expectations and other risks described below. One of such contracts extends through May 2019, with customer extension options through May 2022, and the second contract has a primary term through 2027, with early termination by the customer permitted starting in 2021.

R

isks and uncertainties with respect to any forward-looking statement included herein also include, among other things, the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Civeo’s business and the price of its common shares, risks associated with the failure to satisfy the conditions to the consummation of the transaction, including the approval of Civeo’s issuance of shares by its shareholders and the receipt of certain governmental and regulatory approvals, risks associated with the ability of Civeo to successfully integrate Noralta’s operations, risks associated with the ability of Civeo to implement its plans, forecasts and other expectations with respect to Noralta’s business after the completion of the proposed transaction and to realize the anticipated synergies and cost savings in the time frame anticipated or at all, risks associated with the occurrence of any event, change or other circumstance that could give rise to the termination of the Purchase Agreement, risks associated with the effect of the announcement or pendency of the transaction on Civeo’s or Noralta’s business relationships, operating results and business generally, risks that the proposed transaction disrupts current plans and operations of Civeo or Noralta and potential difficulties in employee retention as a result of the transaction, risks related to diverting management’s attention from Civeo’s and Noralta’s ongoing business operations, risks associated with any legal proceedings that may be instituted related to the Purchase Agreement or the transactions contemplated thereby, risks associated with the general nature of the accommodations industry (including lower than expected room requirements), risks associated with the level of supply and demand for oil, coal, natural gas, iron ore and other minerals, including the level of activity and developments in the Canadian oil sands, the level of demand for coal and other natural resources from Australia, and fluctuations in the current and future prices of oil, coal, natural gas, iron ore and other minerals, risks associated with currency exchange rates, risks associated with Civeo’s redomiciliation to Canada, including, among other things, risks associated with changes in tax laws or their interpretations, risks associated with the development of new projects, including whether such projects will continue in the future, and other factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of Civeo’s annual report on Form 10-K for the year ended December 31, 2016, subsequent quarterly reports on Form 10-Q and other reports Civeo may file from time to time with the U.S. Securities and Exchange Commission. Each forward-looking statement contained in this report speaks only as of the date of this release. Except as required by law, Civeo expressly disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This communication does not constitute an offer to buy, or solicitation of an offer to sell, any securities of Civeo. This communication relates to a proposed transaction between Civeo and Noralta that will become the subject of a proxy statement to be filed with the U.S. Securities and Exchange Commission (the “SEC”) that will provide full details of the proposed transaction and the attendant benefits and risk. This communication is not a substitute for the proxy statement or any other document that Civeo may file with the SEC or send to its shareholders in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CIVEO, NORALTA AND THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC

’s website, www.sec.gov. In addition, copies of the proxy statement and other relevant documents (when they become available) may be obtained free of charge by accessing Civeo’s website at www.civeo.com by clicking on the “Investors” link, or upon written request to Civeo, 333 Clay Street, Suite 4980, Houston, Texas 77002, Attention: Investor Relations. Shareholders may also read and copy any reports, statements and other information filed by Civeo with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

Participants in the Solicitation

Civeo and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders in respect of the transaction under the rules of the SEC. Information regarding Civeo

’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2016 filed with the SEC on February 23, 2017, and in its definitive proxy statement filed with the SEC on April 10, 2017 in connection with its 2017 annual meeting of shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in Civeo’s proxy statement and other relevant materials to be filed with the SEC when they become available. Investors should read the proxy statement and other relevant documents carefully when they become available before making any voting or investment decisions.

Item 9.01. Financial Statements and Exhibits.

(d)

List of Exhibits

|

Exhibit No.

|

|

Description

|

|

10

.1*

|

|

Share Purchase

Agreement, dated November 26, 2017, by and among Civeo Corporation,

Noralta Lodge Ltd., Torgerson Family Trust, 2073357 Alberta Ltd., 2073358 Alberta Ltd., 1818939 Alberta Ltd., 2040618 Alberta Ltd., 2040624 Alberta Ltd., 989677 Alberta Ltd. and Lance Torgerson.

|

|

|

|

|

|

99.1

|

|

Press Release

dated November 27, 2017, issued by Civeo Corporation.

|

|

|

|

|

|

99.2

|

|

Investor Presentation dated November 27, 2017.

|

|

|

|

|

|

99.3

|

|

Email

to Civeo Employees dated November 27, 2017.

|

|

|

|

|

|

99.4

|

|

Civeo Employee FAQ dated November 27, 2017.

|

|

|

|

|

|

99.5

|

|

Transcript of Civeo town hall meeting with employees on November 27, 2017.

|

*

Certain schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule will be furnished to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CIVEO CORPORATION

|

|

|

|

|

|

|

|

|

By:

/s/

Frank C. Steininger

|

|

|

Name:

Frank C. Steininger

|

|

|

Title: Senior Vice President

, Chief Financial Officer

and Treasurer

|

DATED:

November 27

, 2017

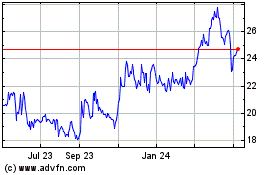

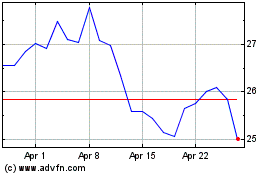

Civeo (NYSE:CVEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Civeo (NYSE:CVEO)

Historical Stock Chart

From Apr 2023 to Apr 2024