- Namodenoson:

- Commences enrollment in Phase II

NAFLD/NASH trial

- Completes enrollment in Phase II

liver cancer trial

- Receives milestones payment from

Korean distributor

- Piclidenoson:

- Commences enrollment in Phase III

rheumatoid arthritis trial as a replacement for standard of care

MTX

Can-Fite BioPharma Ltd. (NYSE MKT:CANF) (TASE:CFBI), a

biotechnology company advancing a pipeline of proprietary small

molecule drugs that address cancer, liver and inflammatory

diseases, today reported financial results for the nine months

ended September 30, 2017 and provided clinical and corporate

updates.

Clinical Development Program and Corporate Highlights

Include:

Namodenoson (CF102): Advances Phase II

Trials and Receives Milestone Payment

- First Patient Enrolled in Phase II

Trial for Treatment of NAFLD/NASH

Patient enrollment has commenced in Can-Fite’s Phase II trial of

Namodenoson in the treatment of non-alcoholic fatty liver disease

(NAFLD) and non-alcoholic steatohepatitis (NASH). The 12-week trial

is enrolling approximately 60 patients and is estimated to cost

less than $1 million. There is currently no U.S. FDA approved drug

for the indication of NASH, which is an addressable pharmaceutical

market estimated to reach $35-40 billion by 2025.

- Milestone Payment Received for

Distribution of Namodenoson in Korea for the Treatment of Liver

Cancer

During the third quarter of 2017, Can-Fite received a milestone

payment of $500,000 from Chong Kun Dang Pharmaceuticals (CKD),

which licensed the exclusive right to distribute Namodenoson for

the treatment of liver cancer in Korea upon receipt of regulatory

approvals. The payment is part of a deal worth up to $3,000,000 in

upfront and milestone payments plus 23% royalties.

- Patient Enrollment Completed in

Phase II Liver Cancer Trial of Namodenoson

Can-Fite completed enrollment during the third quarter of 2017

and randomized all 78 patients in its global Phase II study of

Namodenoson in the treatment of hepatocellular carcinoma (HCC), the

most common form of liver cancer. Patients with advanced HCC, Child

Pugh B, were enrolled in the U.S., Europe and Israel. The primary

endpoint of the Phase II study is overall survival. Can-Fite is

following the survival data closely and plans to perform the

survival analysis at the earliest possible opportunity. The HCC

market is expected to generate $1.4 billion in sales in 2019.

- Data Presented on Namodenoson at

NASH Summit Europe and The Liver Meeting®

Dr. Pnina Fishman, Can-Fite’s CEO, joined global thought-leaders

in the treatment of NASH at the NASH Summit Europe in October, in

Frankfurt, Germany, where she delivered a presentation titled, “The

Anti-Fibrogenic and Liver Protective Effects of Namodenoson

(CF102): From Preclinical to Human Studies.”

Can-Fite also presented two scientific posters at the American

Association for the Study of Liver Diseases (AASLD) annual

conference, The Liver Meeting® in Washington, D.C. in October. The

posters were titled “Namodenoson (CF102) Prevents Liver Fibrosis in

the CCL4 Model” and “The Anti-Fibrogenic and Liver Protective

Effects of Namodenoson (CF102) in a Non-Alcoholic Steatohepatitis

model.”

Piclidenoson (CF101): Commences Patient

Enrollment and Dosing in ACRobat Phase III Trial in Rheumatoid

Arthritis

Patient enrollment and dosing has commenced in Can-Fite’s Phase

III ACRobat trial that is evaluating Piclidenoson as a first line

treatment and replacement for the current standard of care,

Methotrexate (MTX), the most widely used drug for rheumatoid

arthritis. The trial is enrolling approximately 500 patients in

Europe, Canada and Israel. The estimated cost of the entire 24-week

Phase III study is approximately $5 million. An estimated 90% of

rheumatoid arthritis patients receive MTX at some point in their

disease. However, studies show that up to 50% of patients stop

taking MTX due to reasons including drug intolerance, minor and

major side effects, and lack of efficacy, creating a significant

need for a new, safe and effective treatment option in the

rheumatoid arthritis treatment market which is forecast to reach

$34.6 billion by 2020.

Can-Fite is also advancing Piclidenoson towards a Phase III

trial in the treatment of psoriasis which is expected to commence

in 2018. The upcoming trial will investigate the efficacy and

safety of Piclidenoson compared to placebo as its primary endpoint

and as compared to apremilast (Otezla®) as its secondary endpoint

in approximately 400 patients with moderate-to-severe plaque

psoriasis. The psoriasis market is forecast to be $8.9 billion in

2018 and Otezla® sales are estimated to be $2.35 billion by

2020.

Expands Intellectual

Property

Can-Fite was issued a new patent from the Korean Intellectual

Property Office for Piclidenoson titled, “Pharmaceutical

Composition Comprising A3 Adenosine Receptor Agonist

(IB-MECA/CF-101) For Treatment of Psoriasis.”

A new patent application was filed by Can-Fite to protect the

use of its drugs and other ligands which target the A3 adenosine

receptor (A3AR) in the treatment of cytokine release syndrome

(CRS), a potentially life-threatening complication of CAR-T cell

therapy. CAR-T is viewed by the medical community as a very

promising cancer immunotherapy, however, CRS, which is caused by an

overactive immune response to the treatment, has been identified as

a potentially severe and life-threatening side effect of CAR-T. Can

Fite’s platform technology selectively targets A3AR, which plays a

central role in mediating the mechanism of inflammation in CRS, and

as such, Can-Fite believes that A3AR targeting may serve as an

important treatment option for patients in reducing the risk of CRS

without limiting the utility of the underlying cancer

immunotherapy.

Can-Fite’s Former Subsidiary OphthaliX

Successfully Completes Merger with Wize Pharma

Can-Fite’s former majority-owned subsidiary, OphthaliX Inc.

(since renamed Wize Pharma, Inc.) recently completed a merger with

Wize Pharma Ltd. As a result of the merger, Can-Fite’s ownership of

OphthaliX, immediately post-merger, became approximately 8% of the

outstanding shares of common stock. In addition, immediately prior

to the merger, OphthaliX sold on an “as is” basis to Can-Fite all

the ordinary shares of Eyefite Ltd., a former wholly owned

subsidiary of OphthaliX, in exchange for the irrevocable

cancellation and waiver of all indebtedness owed by OphthaliX and

Eyefite to Can-Fite, including approximately $5 million of deferred

payments and, as part of the purchase of Eyefite, Can-Fite also

assumed certain accrued milestone payments in the amount of

$175,000 under a license agreement previously entered into with the

U.S. National Institutes of Health (NIH). In addition, as a result

of the merger, an exclusive license of Piclidenoson (CF101) for the

treatment of ophthalmic diseases previously granted by Can-Fite to

OphthaliX and a related services agreement was terminated.

“We are pleased to be on target with commencing patient

enrollment in our Phase III rheumatoid arthritis and Phase II in

NAFLD/NASH studies. Namodenoson is gaining increasing recognition

in the medical community, as evidenced by our recent scientific

presentations, for its liver protective properties in both NASH and

liver cancer. In 2018, we look forward to initiating our Phase III

study of Piclidenoson in psoriasis, as well as potentially

announcing top line data on our Phase II liver cancer study of

Namodenoson,” Dr. Fishman stated.

Financial Results

Revenues for the nine months ended September 30, 2017 were NIS

2.61 million (U.S. $0.74 million) compared to NIS 0.64 million

(U.S. $0.18 million) in the first nine months of 2016. The increase

in revenue was mainly due to payment received of NIS 1.8 million

(U.S. $0.5 million) in August 2017 under the distribution agreement

with CKD.

Research and development expenses for the nine months ended

September 30, 2017 were NIS 12.7 million (U.S. $3.6 million)

compared with NIS 15.45 million (U.S. $4.38 million) for the same

period in 2016. Research and development expenses for the nine

months ended September 30, 2017 comprised primarily of expenses

associated with the Phase II study for Namodenoson as well as

expenses for ongoing studies of Piclidenoson. The decrease is

primarily due to a reduction in preclinical studies of CF602

conducted during the nine months ended September 30, 2017.

General and administrative expenses were NIS 7.48 million (U.S.

$2.12 million) for the nine months ended September 30, 2017,

compared to NIS 7.88 million (U.S. $2.23 million) for the same

period in 2016. The decrease in general and administrative expenses

was mainly due to a decrease in investor relations expenses.

Financial income, net for the nine months ended September 30,

2017 aggregated NIS 3.91 million (U.S. $1.11 million) compared to

financial income, net of NIS 3.12 million (U.S. $0.88 million) for

the same period in 2016. The increase in financial income, net in

the nine months ended September 30, 2017 was mainly from a larger

decrease in the fair value of warrants that are accounted for as

financial liability as compared to the same period in 2016, offset

by exchange rate differences as compared to the same period in 2016

and from issuance expenses.

Can-Fite's net loss for the nine months ended September 30, 2017

was NIS 13.75 million (U.S. $3.90 million) compared with a net loss

of NIS 19.56 million (U.S. $5.54 million) for the same period in

2016. The decrease in net loss for the nine months ended September

30, 2017 was primarily attributable to a decrease in research and

development expenses.

As of September 30, 2017, Can-Fite had cash and cash equivalents

of NIS 18.02 million (U.S. $5.11 million) as compared to NIS 31.2

million (U.S. $8.84 million) at December 31, 2016. The decrease in

cash during the nine months ended September 30, 2017 is due to use

of cash to fund operating expenses.

For the convenience of the reader, the reported NIS amounts have

been translated into U.S. dollars, at the representative rate of

exchange on September 30, 2017 (U.S. $1 = NIS 3.529).

The Company's consolidated financial results for the nine months

ended September 30, 2017 are presented in accordance with

International Financial Reporting Standards.

About Can-Fite BioPharma Ltd.

Can-Fite BioPharma Ltd. (NYSE American:CANF) (TASE:CFBI) is an

advanced clinical stage drug development Company with a platform

technology that is designed to address multi-billion dollar markets

in the treatment of cancer, inflammatory disease and sexual

dysfunction. The Company's lead drug candidate, Piclidenoson, is

currently in a Phase III trial for rheumatoid arthritis and is

expected to enter a Phase III trial for psoriasis in early 2018.

Can-Fite's liver cancer drug, Namodenoson, is in Phase II trials

for hepatocellular carcinoma (HCC), the most common form of liver

cancer, and for the treatment of non-alcoholic steatohepatitis

(NASH). Namodenoson has been granted Orphan Drug Designation in the

U.S. and Europe and Fast Track Designation as a second line

treatment for HCC by the U.S. Food and Drug Administration.

Namodenoson has also shown proof of concept to potentially treat

other cancers including colon, prostate, and melanoma. CF602, the

Company's third drug candidate, has shown efficacy in the treatment

of erectile dysfunction in preclinical studies and the Company is

investigating additional compounds, targeting A3AR, for the

treatment of sexual dysfunction. These drugs have an excellent

safety profile with experience in over 1,000 patients in clinical

studies to date. For more information please visit:

www.can-fite.com.

Forward-Looking Statements

This press release may contain forward-looking statements, about

Can-Fite's expectations, beliefs or intentions regarding, among

other things, market risks and uncertainties, its product

development efforts, business, financial condition, results of

operations, strategies or prospects. In addition, from time to

time, Can-Fite or its representatives have made or may make

forward-looking statements, orally or in writing. Forward-looking

statements can be identified by the use of forward-looking words

such as "believe," "expect," "intend," "plan," "may," "should" or

"anticipate" or their negatives or other variations of these words

or other comparable words or by the fact that these statements do

not relate strictly to historical or current matters. These

forward-looking statements may be included in, but are not limited

to, various filings made by Can-Fite with the U.S. Securities and

Exchange Commission, press releases or oral statements made by or

with the approval of one of Can-Fite's authorized executive

officers. Forward-looking statements relate to anticipated or

expected events, activities, trends or results as of the date they

are made. Because forward-looking statements relate to matters that

have not yet occurred, these statements are inherently subject to

risks and uncertainties that could cause Can-Fite's actual results

to differ materially from any future results expressed or implied

by the forward-looking statements. Many factors could cause

Can-Fite's actual activities or results to differ materially from

the activities and results anticipated in such forward-looking

statements. Factors that could cause our actual results to differ

materially from those expressed or implied in such forward-looking

statements include, but are not limited to: the initiation, timing,

progress and results of our preclinical studies, clinical trials

and other product candidate development efforts; our ability to

advance our product candidates into clinical trials or to

successfully complete our preclinical studies or clinical trials;

our receipt of regulatory approvals for our product candidates, and

the timing of other regulatory filings and approvals; the clinical

development, commercialization and market acceptance of our product

candidates; our ability to establish and maintain corporate

collaborations; the implementation of our business model and

strategic plans for our business and product candidates; the scope

of protection we are able to establish and maintain for

intellectual property rights covering our product candidates and

our ability to operate our business without infringing the

intellectual property rights of others; estimates of our expenses,

future revenues, capital requirements and our needs for additional

financing; competitive companies, technologies and our industry;

statements as to the impact of the political and security situation

in Israel on our business; and risks and other risk factors

detailed in Can-Fite's filings with the SEC and in its periodic

filings with the TASE. In addition, Can-Fite operates in an

industry sector where securities values are highly volatile and may

be influenced by economic and other factors beyond its control.

Can-Fite does not undertake any obligation to publicly update these

forward-looking statements, whether as a result of new information,

future events or otherwise.

INTERIM CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

In thousands (except for share and per

share data)

Conveniencetranslationinto U.S.

dollars

September 30, September 30,

December 31, 2017 2017 2016

Unaudited Audited USD NIS ASSETS

CURRENT ASSETS: Cash and cash equivalents 5,106

18,018 31,203 Other receivable and prepaid expenses 3,609 12,737

7,664

Total current

assets

8,715 30,755 38,867 NON-CURRENT ASSETS: Lease

deposits 8 28 37 Property, plant and equipment, net 47 168 205

Total long-term

assets

55 196 242

Total

assets

8,770 30,951 39,109

INTERIM CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

In thousands (except for share and per

share data)

Conveniencetranslationinto U.S.

dollars

September 30, September 30, December

31, 2017 2017 2016

Unaudited Audited USD NIS

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES:

Trade payables 416 1,470 4,804 Deferred revenues 302 1,066

1,237 Other accounts payable 662 2,337 3,588

Total current

liabilities

1,380 4,873 9,629 NON-CURRENT

LIABILITIES: Warrants exercisable into shares 2,820 9,951

10,068 Deferred revenues 1,100 3,882 4,510

Total long-term

liabilities

3,920 13,833 14,578 CONTINGENT

LIABILITIES AND COMMITMENTS EQUITY ATTRIBUTABLE TO EQUITY

HOLDERS OF THE COMPANY: Share capital 2,349 8,289 7,039

Share premium 96,787 341,561 332,873 Capital reserve from

share-based payment transactions 6,141 21,670 20,438 Warrants

exercisable into shares (series 10-12) 2,545 8,983 8,983 Treasury

shares, at cost (1,028 ) (3,628 ) (3,628 ) Accumulated other

comprehensive loss (267 ) (943 ) (883 ) Accumulated deficit

(103,060 ) (363,699 ) (349,953 )

Total equity

attributable to equity holders of the Company

3,467 12,233 14,869 Non-controlling

interests 3 12 33

Total

equity

3,470 12,245 14,902

Total liabilities

and equity

8,770 30,951 39,109

INTERIM CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS

In thousands (except for share and per

share data)

Conveniencetranslationinto U.S.

dollars

Nine months ended September 30, 2017

2017 2016

Unaudited USD NIS NIS Revenues

740 2,611 643 Research and development

expenses 3,598 12,699 15,449 General and administrative expenses

2,120 7,481 7,878 Operating loss 4,978

17,569 22,684 Finance expenses 1,000

3,529 1,411 Finance income (2,107 ) (7,434 ) (4,535 ) Loss

before taxes on income 3,871 13,664 19,560 Taxes on income 26

90 - Net loss 3,897 13,754

19,560 Other comprehensive loss (income):

Total components that will be or that have

been reclassified to profit or loss:

Adjustments arising from translating financial statements of

foreign operations 21 73 (10 ) Total

comprehensive loss 3,918 13,827 19,550

Net loss attributable to: Equity holders of the Company 3,895

13,746 19,294 Non-controlling interests 2 8 266

3,897 13,754 19,560 Total

comprehensive loss attributable to: Equity holders of the Company

3,912 13,806 19,286 Non-controlling interests 6 21

264 3,918 13,827 19,550

Net loss per share attributable to equity holders of the Company :

Basic and diluted net loss per share 0.12 0.42 0.70

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171127005205/en/

Can-Fite BioPharmaMotti Farbstein,

+972-3-9241114info@canfite.com

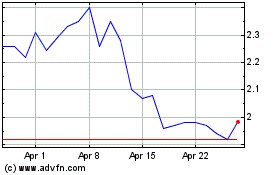

Can Fite BioPharma (AMEX:CANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Can Fite BioPharma (AMEX:CANF)

Historical Stock Chart

From Apr 2023 to Apr 2024