FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of November, 2017

Commission File Number: 001-37723

Enel Chile S.A.

(Translation of Registrant’s Name into English)

Santa Rosa 76

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [X]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [X]

Indicate by check mark whether by furnishing the information

ontained in this Form, the Registrant is also thereby furnishing the

information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes [ ] No [X]

If °;Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

No Offer or Solicitation

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to a proposed tender offer by Enel Chile S.A. (“Enel Chile”) for all of the outstanding shares of common stock, no par value, of Enel Generación Chile S.A. (“Enel Generación”), including the form of American Depositary Shares, that are not currently owned by Enel Chile. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Important Information For Investors and Security Holders

The tender offer described herein has not yet commenced

.

If the tender offer is commenced, tender offer materials will be made available and filed with the U.S. Securities and Exchange Commission (the “SEC”) in accordance with applicable U.S. federal securities laws and SEC rules.

In connection with the proposed tender offer, Enel Chile has filed with the SEC a registration statement on Form F-4 (Registration No. 333-221156) containing a preliminary prospectus of Enel Chile regarding the proposed tender offer. The information contained in the preliminary prospectus is not complete and may be changed and the registration statement has not been declared effective by the SEC. Each of Enel Chile and Enel Generación may file with the SEC other documents in connection with the proposed tender offer.

This communication is not a substitute for the definitive prospectus that Enel Chile will file with the SEC, which will contain important information, including detailed risk factors. The definitive prospectus (when available) and related tender offer materials (when available) will be sent to shareholders and holders of American Depositary Receipts (ADRs) of Enel Generación.

INVESTORS AND SECURITY HOLDERS OF Enel Generación ARE URGED TO READ THE DEFINITIVE PROSPECTUS AND OTHER

tender offer materials

THAT ARE FILED OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

, including the full details of the tender offer

.

Investors and security holders will be able to obtain free copies of the

tender offer materials

and other documents filed with the SEC by Enel Chile and Enel Generación on the SEC’s website at www.sec.gov. Copies of the

tender offer materials

and the other documents filed with the SEC by Enel Chile will also be available free of charge on the Enel Chile Investor Relations website at www.enelchile.cl or by contacting Enel Chile S.A. at Santa Rosa 76, Piso 15, Santiago, Chile, Attention: Investor Relations or by phone at +56 2 2353 4400 or by E-mail at ir.enelchile@enel.com. Copies of the

tender offer materials

and the other documents filed with the SEC by Enel Generación will be available free of charge on the Enel Generación Investor Relations website at www.enelgeneracion.cl or by contacting Enel Generación S.A. at Santa Rosa 76, Piso 15, Santiago, Chile, Attention: Investor Relations or by phone at +56 2 2630 9000 or by E-mail at

ir.enelgeneracionchile@enel.com

.

SIGNIFICANT EVENT

Enel Chile S.A.

Securities Registration Record N° 1139

Santiago, November 17, 2017

Ger. Gen. N° 039/2017

Mr. Carlos Pavez T

Superintendent of Securities and Insurance

Superintendence of Securities and Insurance

Av. Libertador General Bernardo O’Higgins N°1449

Santiago, Chile

Ref.: SIGNIFICAN EVENT

Dear Sir,

In accordance with articles 9 and 10 paragraph 2, under the Securities Market Law N° 18,045, and as established under General Norm N°30 of the Superintendence of Securities and Insurance, I hereby inform, duly authorized on behalf of Enel Chile S.A (“Enel Chile” or the “Company”)., that the Company has received a letter dated today, informing on the favorable decision adopted by the Board of Directors’ of Enel Green Power Latam S.A. regarding the implementation of Enel Chile’s corporate reorganization operation disclosed through a significant event dated August 25, 2017. Such letter is included in this significant event.

Sincerely,

Raffaele Grandi

Chief Finance Officer

Enel Chile S.A.

c.c.: Fiscalía Nacional Económica (National Economics Affairs Investigations Bureau)

Banco Central de Chile (Central Bank of Chile)

Bolsa de Comercio de Santiago (Santiago Stock Exchange)

Bolsa Electrónica de Chile (Chile Electronic Stock Exchange)

Bolsa de Corredores de Valparaíso (Valparaíso Stock Exchange)

Banco Santander - Representantes Tenedores de Bonos (Bondholders Representative)

Depósito Central de Valores (Central Securities Depositary)

Comisión Clasificadora de Riesgos (Risk Rating Commission)

ENEL GREEN POWER LATIN AMERICA S.A.

Santiago, November 17, 2017

Herman Chadwick

Chairman of the Board of Directors

Enel Chile S.A.

76 Santa Rosa Ave. 17 Floor

Santiago

Ref: Reorganization – Merger with and into Enel Chile S.A.

Dear Mr. Chadwick,

We hereby refer to the significant event disclosed by Enel Chile S.A. (“

Enel Chile

”) dated November 14, 2017

(“Enel Chile Significant Event

”), by means of which Enel Chile’s Board of Directors, with the unanimous consent of its members, issued a collective pronouncement in favor of the corporate reorganization (the “

Reorganization

”), a related party transaction that involves the following: (i) the merger by incorporation of Enel Green Power Latin America S.A (“

EGPL

”) by Enel Chile that will result in the dissolution of EGPL, being absorbed by Enel Chile, acquiring all assets, liabilities and equity of EGPL and succeeding it in all its rights and responsibilities; (ii) a public tender offer by Enel Chile for up to 100% of the shares and the American Depository Shares (“

ADS

”) issued by Enel Generación Chile S.A. (“

Enel Generación”)

held by the minority shareholders of the latter (the “

TO

”). This tender offer will be subject to a series of conditions, including the condition mentioned in the Enel Chile Significant Event regarding the capital increase of Enel Chile that is to be partially paid for with a portion of the price payment of the TO; (iii) a capital increase of Enel Chile required to issue sufficient shares and ADS to be delivered to the Enel Generación shareholders that decide to sell their shares or ADS in the Enel Generación TO and to issue sufficient shares to deliver to EGPL shareholders in the Merger with Enel Chile (the ”

Enel Chile Capital Increase

”); and (iv) an amendment to the Enel Generación bylaws (the “

Amendment to Enel Generación Bylaws

”) to eliminate the dispositions of Decree Law N

o

3,500/1980 related to shareholder concentration. This amendment is established as a condition precedent to the success of the TO.

The Enel Chile Significant Event states that the Reorganization involves all the actions or stages identified above, so that, they must all be approved for the Reorganization to be approved.

Consequently, the Board of Directors’ meeting held November 14, 2017, after analyzing the available information regarding the Reorganization, believes the Merger, within the context of the Reorganization, may be positive for EGPL shareholders because it consolidates the stake in the distribution business (through Enel Distribucion S.A, subsidiary of Enel Chile), the conventional generation business ( through Enel Generación) and the non-conventional generation business (through EGP Latam) into one sole company creating the leading company in the electricity industry; aligns the interests of the common controlling shareholder of these companies, Enel SpA, with the shareholders of Enel Chile; optimizes Enel Chile’s capital structure; and improves the liquidity of the stock. The exchange ratio proposed by Enel Chile is also considered adequate.

Due to the abovementioned, such board of directors’ meeting, with the unanimous consent of its members, agreed to summon an Extraordinary Shareholders Meeting of EGPL. to be held on December 20, 2017, in the main office of the company to pronounce on the following topics:

1) In accordance with the provisions of Article 44 of the Corporations Law N

o

18,046, approve the corporate reorganization (the “

Reorganization

”) as a related party transaction involving the following actions or stages: (i) the merger by incorporation of Enel Green Power Latin America S.A (“

Enel Green Power

”) by Enel Chile S.A. (“

Enel Chile

”)( the “

Merger

”) that will require a capital increase of Enel Chile to pay for the shares of Enel Green Power shareholders according to the exchange ratio to be determined for the Merger and that is subject to, among others, a successful PTO as mentioned hereafter; (ii) a public tender offer by Enel Chile for up to 100% of the shares and the American Depository Shares (“

ADS

”) issued by Enel Generación Chile S.A. (“

Enel Generación

”) held by the minority shareholders of the latter (the “PTO”) requiring as a condition, among others, that the number of shareholders that accept the PTO allow Enel Chile to reach an ownership share of Enel Generación above 75% and also that such shareholders and ADS holders accept to subscribe shares and ADS, respectively, of Enel Chile issued as part of the capital increase as described hereafter. Such Enel Chile shares and ADS will be paid for with a portion of the price Enel Generación Shareholders receive for selling their shares and ADS in the TO; (iii) a capital increase of Enel Chile (the”

Enel Chile Capital Increase

”) to issue sufficient shares and ADS to be delivered to the shareholders of Enel Generación that accept to sell their shares and ADS in the Enel Generación cash tender offer, capital increase that is subject to the success of the TO referred to in numeral (ii), and (iv) an amendment to the Enel Generación bylaws (the “

Amendment to Enel Generación Bylaws

”) to eliminate the limitations and restrictions established by the dispositions of Decree Law N

o

3,500/1980, particularly, that one shareholder may not hold more than 65% of the shares with voting rights of Enel Generación (the “

Amendment to Enel Generación Bylaws

”) that depends on the success of the TO mentioned in numeral (ii) above.

The Reorganization involves all the actions or stages identified above, so that, they must all be approved for the Reorganization to be approved.

2) In accordance with the provisions of Title IX of the Corporations Law and Title IX of the Corporations Rules, approve: (i) the proposed Merger by incorporation of Enel Green Power by Enel Chile, dissolving it without the need of a liquidation and succeeding it in all its rights and responsibilities;(ii) the exchange ratio of the Merger; (iii) the audited financial statements of Enel Chile and Enel Green Power as the companies involved in the merger; (iv) Enel Chile’s bylaws as the surviving entity of the merger; (v) the respective expert report; and (vi) the document entitled “General Terms of the Reorganization”.

Regarding Article 155 of the Corporations Law, the information referred to by Enel Chile’s Significant Event has been made available to its shareholders and also to the shareholders of EGPL on the website www.enelgreenpower.com/es/pais-chile.html.

3) Adopt all agreements that are necessary and conducive and/or convenient to legalize, materialize and give effect to the decisions adopted by the Shareholders’ Meeting.

The board of directors of EGPLhas agreed that the undersigned deliver this document to you and authorizes its disclosure to Enel Chile’s shareholders and the general public.

Sincerely,

James Lee Stancampiano

Chairman of the Board of Directors

Enel Green Power Latin America S.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

Enel Chile S.A.

|

|

|

|

|

|

By: /s/ Nicola Cotugno

|

|

|

--------------------------------------------------

|

|

|

|

|

|

Title: Chief Executive Officer

|

Date: November 24, 2017

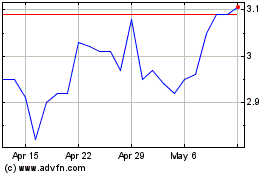

Enel Chile (NYSE:ENIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

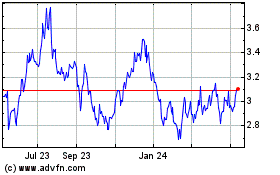

Enel Chile (NYSE:ENIC)

Historical Stock Chart

From Apr 2023 to Apr 2024