UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2017.

Commission File Number 33-65728

CHEMICAL

AND MINING COMPANY OF CHILE INC.

(Translation of registrant’s

name into English)

El Trovador 4285, Santiago,

Chile (562) 2425-2000

(Address of principal executive

office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

|

SQM

Los Militares 4290 Piso

6,

Las Condes, Santiago, Chile

Tel: (56 2) 2425 2485

Fax: (56 2) 2425 2493

www.sqm.com

|

|

Santiago, Chile. November 22, 2017.-

Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM) reported today

earnings

for the nine months ended September 30, 2017

of US$317.2 million (US$1.21 per ADR), an increase from US$197.4 million (US$0.75

per ADR) for the nine months ended September 30, 2016.

Gross profit

(3)

reached US$546.4 million (34.5% of revenues)

for the nine months ended September 30, 2017, higher than US$406.2 million (29.3% of revenues) recorded for the nine months ended

September 30, 2016.

Revenues

totaled US$1,582.5 million for the nine months ended September 30, 2017, representing an increase

of 14.2% compared to US$1,385.5 million reported for the nine months ended September 30, 2016.

The Company also announced earnings for

the third quarter of 2017,

reporting net income

of US$112.9 million (US$0.43 per ADR) compared to US$55.8 million (US$0.21

per ADR) for the third quarter of 2016.

Gross profit

for the third quarter of 2017 reached US$188.5 million, higher than

the US$145.7 million recorded for the third quarter of 2016.

Revenues

totaled US$558.7 million, an increase of approximately

10.8% compared to the third quarter of 2016, when revenues amounted to US$504.0 million.

SQM’s Chief Executive Officer, Patricio

de Solminihac, stated: “The results we published for the first nine months of 2017 are a result of our strong position in

all of the markets in which we are present. In the specialty plant nutrient business line strong sales volumes were due to strong

demand growth along with decreased supply from our competition. Our operations team has been able to increase production in an

efficient way, allowing us to increase our volumes while maintaining the supply and demand equilibrium in the market. Our sales

volumes increased almost 9% during the first nine months of this year compared to the same period last year. In the potassium chloride

market, our sales volumes surpassed 1.0 million MT during the first nine months of the year. Sales volumes for 2017 could surpass

1.3 million MT, a decrease compared to last year, but higher than our previous expectations.”

“In the lithium market, we continue

to see strong demand growth and we saw prices continue to increase during the third quarter, surpassing US$13,000/ton, thus increasing

another 8% compared to the second quarter. We believe this pricing trend should continue for the remainder of this year, and through

the beginning of 2018. We continue to move forward with our new lithium projects. Our projects in Chile remain on time, and we

expect to complete our lithium hydroxide and lithium carbonate expansions by the middle of 2018. In Argentina, we are investing

in the first stage of the 25,000 MT expected to be online in 2019, and in Australia we finalized the documentation required to

move forward with the joint venture with Kidman Resources.”

“In the iodine market, we have

been working over the past several years to increase our sales volumes in line with our corporate strategy and operational

plan. Market share has returned to levels greater than 30%, and we believe sales volumes will surpass 12,500 MT this year. Given

these increase sales volumes, we are increasing our iodine production capacity to reach just over 14,000 MT as we want to ensure

the supply is available to meet the demand of the future. With prices slightly higher than prices seen during the second quarter,

we are optimistic about our future in the iodine market.”

Segment Analysis

Specialty Plant Nutrition (SPN)

Revenues from our Specialty Plant Nutrition

business line for the nine months ended September 30, 2017 totaled US$511.4 million, higher than the US$487.1 million reported

for the nine months ended September 30, 2016.

Third quarter 2017 revenues reached US$185.6

million, higher than the US$154.9 million reported in the third quarter of 2016.

Specialty Plant Nutrition Sales Volumes

and Revenues:

|

|

|

|

|

9M2017

|

|

|

9M2016

|

|

|

2017/2016

|

|

|

Specialty Plant Nutrition Total Volumes

|

|

Th. MT

|

|

|

712.0

|

|

|

|

650.9

|

|

|

|

61.2

|

|

|

|

9

|

%

|

|

Sodium Nitrate

|

|

Th. MT

|

|

|

18.6

|

|

|

|

15.2

|

|

|

|

3.4

|

|

|

|

23

|

%

|

|

Potassium Nitrate and Sodium Potassium Nitrate

|

|

Th. MT

|

|

|

448.7

|

|

|

|

378.1

|

|

|

|

70.5

|

|

|

|

19

|

%

|

|

Specialty Blends

|

|

Th. MT

|

|

|

152.2

|

|

|

|

164.2

|

|

|

|

-12.0

|

|

|

|

-7

|

%

|

|

Other specialty plant nutrients (*)

|

|

Th. MT

|

|

|

92.6

|

|

|

|

93.4

|

|

|

|

-0.8

|

|

|

|

-1

|

%

|

|

Specialty Plant Nutrition Revenues

|

|

MUS$

|

|

|

511.4

|

|

|

|

487.1

|

|

|

|

24.3

|

|

|

|

5

|

%

|

|

*Includes trading of other specialty fertilizers.

|

|

|

|

|

|

|

|

|

|

|

3Q2017

|

|

|

3Q2016

|

|

|

2017/2016

|

|

|

Specialty Plant Nutrition Total Volumes

|

|

Th. MT

|

|

|

263.6

|

|

|

|

222.7

|

|

|

|

40.9

|

|

|

|

18

|

%

|

|

Sodium Nitrate

|

|

Th. MT

|

|

|

3.6

|

|

|

|

7.0

|

|

|

|

-3.4

|

|

|

|

-49

|

%

|

|

Potassium Nitrate and Sodium Potassium Nitrate

|

|

Th. MT

|

|

|

157.4

|

|

|

|

114.8

|

|

|

|

42.6

|

|

|

|

37

|

%

|

|

Specialty Blends

|

|

Th. MT

|

|

|

72.7

|

|

|

|

73.6

|

|

|

|

-1.0

|

|

|

|

-1

|

%

|

|

Other specialty plant nutrients (*)

|

|

Th. MT

|

|

|

30.0

|

|

|

|

27.3

|

|

|

|

2.7

|

|

|

|

10

|

%

|

|

Specialty Plant Nutrition Revenues

|

|

MUS$

|

|

|

185.6

|

|

|

|

154.9

|

|

|

|

30.8

|

|

|

|

20

|

%

|

*Includes trading of other specialty fertilizers.

Sales volumes during the nine months ended

September 30, 2017 increased 9.4% when compared to the same period last year, following the same trend we saw during the first

half of the year. Our average price declined approximately 4.0% when comparing the first nine months of 2017 to the same period

last year. As previously announced, we are committed to maintaining prices of potassium nitrate during the fourth quarter of this

year. We have the capacity to supply market growth, and will continue to ensure market needs are met as we increase our nitrates

capacity. This project remains on track, with completion date in the second half of 2018.

SPN

gross profit

(4)

accounted

for approximately 17% of SQM’s consolidated gross profit for the nine months ended September 30, 2017.

Iodine and Derivatives

Revenues from sales of iodine and derivatives

during the nine months ended September 30, 2017 totaled US$191.3 million, an increase of 9.3% compared to US$175.1 million reported

for the nine months ended September 30, 2016.

Iodine and derivatives revenues for the

third quarter of 2017 amounted to US$62.3 million, an increase of 10.2% compared to US$56.5 million recorded during the third quarter

of 2016.

Iodine and Derivative Sales Volumes

and Revenues:

|

|

|

|

|

9M2017

|

|

|

9M2016

|

|

|

2017/2016

|

|

|

Iodine and Derivatives

|

|

Th. MT

|

|

|

9.7

|

|

|

|

7.5

|

|

|

|

2.2

|

|

|

|

30

|

%

|

|

Iodine and Derivatives Revenues

|

|

MUS$

|

|

|

191.3

|

|

|

|

175.1

|

|

|

|

16.2

|

|

|

|

9

|

%

|

|

|

|

|

|

3Q2017

|

|

|

3Q2016

|

|

|

2017/2016

|

|

|

Iodine and Derivatives

|

|

Th. MT

|

|

|

3.1

|

|

|

|

2.6

|

|

|

|

0.5

|

|

|

|

21

|

%

|

|

Iodine and Derivatives Revenues

|

|

MUS$

|

|

|

62.3

|

|

|

|

56.5

|

|

|

|

5.8

|

|

|

|

10

|

%

|

Iodine revenues during the third quarter

2017 were higher than revenue seen during the same period last year related to higher sales volumes. Sales volumes during the nine

months ended September 30, 2017 increased almost 30% when compared to the same period last year, bringing our market share in this

market to well over 30%.

Average prices during the third quarter

reached US$20/kg, also increasing compared to the second quarter. This is in line with our expectations that prices reached

a bottom during the first half of the year, and have been slowly increasing in recent months.

Demand in the iodine market is expected

to grow about 3% during 2017, led by the x-ray contrast media and the pharmaceutical industry.

Gross profit

for the Iodine and

Derivatives segment accounted for approximately 7% of SQM’s consolidated gross profit for the nine months ended September

30, 2017.

Lithium and Derivatives

Revenues for lithium and derivatives totaled

US$465.2 million during the nine months ended September 30, 2017, an increase of 37.7% compared to US$337.9 million recorded for

the nine months ended September 30, 2016.

Revenues for lithium and derivatives during

the third quarter of 2017 increased 15.6% compared to the third quarter of 2016. Total revenues amounted to US$167.8 million during

the third quarter of 2017, compared to US$145.1 million in the third quarter of 2016.

Lithium and Derivatives Sales Volumes and Revenues:

|

|

|

|

|

9M2017

|

|

|

9M2016

|

|

|

2017/2016

|

|

|

Lithium and Derivatives

|

|

Th. MT

|

|

|

36.5

|

|

|

|

35.2

|

|

|

|

1.3

|

|

|

|

4

|

%

|

|

Lithium and Derivatives Revenues

|

|

MUS$

|

|

|

465.2

|

|

|

|

337.9

|

|

|

|

127.3

|

|

|

|

38

|

%

|

|

|

|

|

|

3Q2017

|

|

|

3Q2016

|

|

|

2017/2016

|

|

|

Lithium and Derivatives

|

|

Th. MT

|

|

|

12.7

|

|

|

|

12.1

|

|

|

|

0.5

|

|

|

|

4

|

%

|

|

Lithium and Derivatives Revenues

|

|

MUS$

|

|

|

167.8

|

|

|

|

145.1

|

|

|

|

22.7

|

|

|

|

16

|

%

|

Lithium demand growth continues to be strong

and should surpass 14% this year. The average prices during the second half of 2017 should be higher than prices reported during

the first half of the year.

Sales volumes were higher during the third

quarter 2017 when compared to the previous quarters of 2017. We believe that sales volumes for the year will be similar to sales

volumes seen during 2016.

Gross profit

for the Lithium and

Derivatives segment accounted for approximately 61% of SQM’s consolidated gross profit for the nine months ended September

30, 2017.

Potassium: Potassium Chloride &

Potassium Sulfate (MOP & SOP)

Potassium chloride and potassium sulfate

revenues for the nine months ended September 30, 2017 totaled US$301.0 million, similar to revenues reported during the nine months

ended September 30, 2016, which totaled US$296.1 million.

Potassium chloride and potassium sulfate

revenues remained flat in the third quarter of 2017, reaching US$113.0 million, compared to US$114.4 million for the third quarter

of 2016.

Potassium Chloride & Potassium Sulfate Sales Volumes

and Revenues:

|

|

|

|

|

9

M2017

|

|

|

9M2016

|

|

|

2017/2016

|

|

|

Potassium Chloride and Potassium Sulfate

|

|

Th. MT

|

|

|

1.082.3

|

|

|

|

1.124.1

|

|

|

|

-41.7

|

|

|

|

-4

|

%

|

|

Potassium Chloride and Potassium Sulfate Revenues

|

|

MUS$

|

|

|

301.0

|

|

|

|

296.1

|

|

|

|

4.9

|

|

|

|

2

|

%

|

|

|

|

|

|

3Q2017

|

|

|

3Q2016

|

|

|

2017/2016

|

|

|

Potassium Chloride and Potassium Sulfate

|

|

Th. MT

|

|

|

406.1

|

|

|

|

463.7

|

|

|

|

-57.7

|

|

|

|

-12

|

%

|

|

Potassium Chloride and Potassium Sulfate Revenues

|

|

MUS$

|

|

|

113.0

|

|

|

|

114.4

|

|

|

|

-1.4

|

|

|

|

-1

|

%

|

In line with our previous statement, sales

volumes decreased 3.7% in the nine months ended September 30, 2017 compared to the same period of 2016. Sales volumes seen in the

third quarter 2017 decreased 12.4% compared to the third quarter 2016, as our continuous focus on lithium production results in

reduced potassium chloride production in 2017.

We saw average prices in the potassium

chloride and potassium sulfate business line show a growth of approximately 5.6% during the nine months ended September 30, 2017

when compared to the same period of 2016, reaching US$278/MT, similar to the average prices seen in the second quarter 2017.

Gross profit

for Potassium Chloride

and Potassium Sulfate accounted for approximately 9% of SQM’s consolidated gross profit for the nine months ended September

30, 2017.

Industrial Chemicals

Industrial chemicals revenues for the nine

months ended September 30, 2017 reached US$80.9 million, 87.0% higher than US$43.3 million recorded for the nine months ended September

30, 2016.

Revenues for the third quarter of 2017

totaled US$14.6 million, an increase of 14.1% compared to the revenue figures for third quarter of 2016 of US$12.8 million.

Industrial Chemicals Sales Volumes and

Revenues:

|

|

|

|

|

9M2017

|

|

|

9M2016

|

|

|

2017/2016

|

|

|

Industrial Nitrates

|

|

Th. MT

|

|

|

103.2

|

|

|

|

53.6

|

|

|

|

49.7

|

|

|

|

93

|

%

|

|

Industrial Chemicals Revenues

|

|

MUS$

|

|

|

80.9

|

|

|

|

43.3

|

|

|

|

37.7

|

|

|

|

87

|

%

|

|

|

|

|

|

3Q2017

|

|

|

3Q2016

|

|

|

2017/2016

|

|

|

Industrial Nitrates

|

|

Th. MT

|

|

|

19.2

|

|

|

|

16.3

|

|

|

|

3.0

|

|

|

|

18

|

%

|

|

Industrial Chemicals Revenues

|

|

MUS$

|

|

|

14.6

|

|

|

|

12.8

|

|

|

|

1.8

|

|

|

|

14

|

%

|

Revenues in the industrial chemicals business

line increased as a result of higher sales volumes of solar salts

(5)

seen in the first quarter of 2017, which reached

45,000 MT. We expect solar salts sales volumes to be strong during the fourth quarter, surpassing 90,000 MT for the year. Average

prices during the nine months ended September 30, 2017 decreased 2.9% compared to the nine months ended September 30, 2016.

Gross profit

for the Industrial

Chemicals segment accounted for approximately 5% of SQM’s consolidated gross profit for the nine months ended September 30,

2017.

Other Commodity Fertilizers & Other

Income

Revenues from sales of other commodity

fertilizers and other income reached US$32.7 million in the nine months ended September 30, 2017, lower than the US$46.1 million

for the nine months ended September 30, 2016.

Financial Information

Capital Expenditures

Capex for 2017 is expected to reach approximately

US$170 million, and the majority of these expenses will be related to maintenance and investments in expansion projects in Chile,

and our projects in Argentina and Australia.

Administrative Expenses

Administrative expenses totaled US$72.6

million (4.6% of revenues) for the nine months ended September 30, 2017, compared to US$62.6 million (4.5% of revenues) recorded

during the nine months ended September 30, 2016.

Net Financial Expenses

Net financial expenses for the nine months

ended September 30, 2017 were US$29.0 million, compared to US$37.2 million recorded for the nine months ended September 30, 2016.

Income Tax Expense

Income tax expense reached US$123.4 million

for the nine months ended September 30, 2016, representing an effective tax rate of 28.0%, compared to an income tax expense of

US$81.1 million during the nine months ended September 30, 2016. The Chilean corporate tax rate was 25.5% during the 2017 period

and 24.0% during the 2016 period.

Other

The EBITDA margin was approximately 41%

for the nine months ended September 30, 2017. EBITDA margin for the nine months ended September 30, 2016 was approximately 38%.

The EBITDA margin for the third quarter of 2017 was approximately 40%.

Notes:

|

|

1)

|

Net income refers to the comprehensive income attributable to controlling interests.

|

|

|

2)

|

EBITDA = gross profit - administrative expenses + depreciation and amortization. EBITDA margin

= EBITDA/revenues.

|

|

|

3)

|

Gross profit corresponds to consolidated revenues less total costs, including depreciation and

amortization and excluding administrative expenses.

|

|

|

4)

|

A significant portion of SQM’s costs of goods sold are costs related to common productive

processes (mining. crushing. leaching. etc.) which are distributed among the different final products. To estimate gross profit

by business line in both periods covered by this report, the Company employed similar criteria on the allocation of common costs

to the different business areas. This gross profit distribution should be used only as a general and approximated reference of

the margins by business line.

|

|

|

5)

|

Solar salts are a mix of 60% sodium nitrate and 40% potassium nitrate used for thermal energy storage.

|

About SQM

SQM is an integrated producer and distributor

of lithium, iodine, specialty plant nutrients, potassium-related fertilizers and industrial chemicals. Its products are based on

the development of high quality natural resources that allow the Company to be a leader in costs, supported by a specialized international

network with sales in over 110 countries.

SQM´s business strategy is to be

a mining operator that selectively integrates the production and sales of products to industries essential for human development,

such as food, health and technology. The strategy is built on the following six principles:

|

|

•

|

strengthen internal processes to ensure access to key resources required for the sustainability

of the business;

|

|

|

•

|

extend lean operations (M1) to the entire organization to strengthen our cost position, increase

quality and ensure safety;

|

|

|

•

|

invest in the development of a specialty fertilizer market, including product differentiation,

sales channel management and price optimization;

|

|

|

•

|

recover the iodine market share, seek consolidation and vertical integration opportunities; invest

in the development of industrial nitrate applications;

|

|

|

•

|

search and invest in lithium and potassium assets outside of Chile to leverage our operational

capabilities, take advantage of the current lithium market appeal and ensure access to raw materials for our potassium nitrate

production; and

|

|

|

•

|

seek diversification opportunities in gold, copper and zinc projects in the region to leverage

our mining operating capabilities and provide business continuity to our exploration program.

|

The business strategy´s principles

are based on the following four concepts:

|

|

•

|

build an organization with strategic clarity, inspirational leaders, responsible personnel and

strong values;

|

|

|

•

|

develop a strategic planning process that responds to the needs of our customers and market trends,

while ensuring coordination between all segments of the business, including sales and operations;

|

|

|

•

|

develop a robust risk control and mitigation process to actively manage business risk; and

|

|

|

•

|

improve our stakeholder management to establish links with the community and communicate to Chile

and worldwide our contribution to industries essential for human development.

|

For further information, contact:

Gerardo Illanes

56-2-24252022 /

gerardo.illanes@sqm.com

Kelly O’Brien

56-2-24252074 /

kelly.obrien@sqm.com

Irina Axenova

56-2-24252280 /

irina.axenova@sqm.com

For media inquiries,

contact:

Carolina García Huidobro

/

carolina.g.huidobro@sqm.com

Alvaro Cifuentes /

alvaro.cifuentes@sqm.com

Tamara Rebolledo /

tamara.rebolledo@sqm.com

(Northern Region)

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as: “anticipate,” “plan,” “believe,”

“estimate,” “expect,” “strategy,” “should,” “will” and similar references

to future periods. Examples of forward-looking statements include, among others, statements we make concerning the Company’s

business outlook, future economic performance, anticipated profitability, revenues, expenses, or other financial items, anticipated

cost synergies and product or service line growth.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead, they are estimates that reflect the best judgment of SQM management

based on currently available information. Because forward-looking statements relate to the future, they involve a number of risks,

uncertainties and other factors that are outside of our control and could cause actual results to differ materially from those

stated in such statements. Therefore, you should not rely on any of these forward-looking statements. Readers are referred to the

documents filed by SQM with the United States Securities and Exchange Commission, specifically the most recent annual report on

Form 20-F, which identifies important risk factors that could cause actual results to differ from those contained in the forward-looking

statements. All forward-looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation

to update such statements, whether as a result of new information, future developments or otherwise.

Balance Sheet

|

(US$ Millions)

|

|

As of Sep. 30,

|

|

|

As of Dec. 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

2,349.5

|

|

|

|

2,331.9

|

|

|

Cash and cash equivalents

|

|

|

520.6

|

|

|

|

514.7

|

|

|

Other current financial assets

|

|

|

384.2

|

|

|

|

289.2

|

|

|

Accounts receivable (1)

|

|

|

440.1

|

|

|

|

451.0

|

|

|

Inventory

|

|

|

916.4

|

|

|

|

993.1

|

|

|

Others

|

|

|

88.2

|

|

|

|

84.0

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Non-current Assets

|

|

|

1,795.4

|

|

|

|

1,886.7

|

|

|

Other non-current financial assets

|

|

|

35.2

|

|

|

|

34.1

|

|

|

Investments in related companies

|

|

|

111.4

|

|

|

|

113.1

|

|

|

Property. plant and equipment

|

|

|

1,435.0

|

|

|

|

1,532.7

|

|

|

Other Non-current Assets

|

|

|

213.7

|

|

|

|

206.8

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

4,144.8

|

|

|

|

4,218.6

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

619.9

|

|

|

|

580.3

|

|

|

Short-term debt

|

|

|

133.6

|

|

|

|

179.1

|

|

|

Others

|

|

|

486.3

|

|

|

|

401.2

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Long-Term Liabilities

|

|

|

1,273.4

|

|

|

|

1,331.0

|

|

|

Long-term debt

|

|

|

1,021.2

|

|

|

|

1,093.4

|

|

|

Others

|

|

|

252.3

|

|

|

|

237.6

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity before Minority Interest

|

|

|

2,192.3

|

|

|

|

2,246.1

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority Interest

|

|

|

59.2

|

|

|

|

61.2

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders' Equity

|

|

|

2,251.5

|

|

|

|

2,307.3

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities & Shareholders' Equity

|

|

|

4,144.8

|

|

|

|

4,218.6

|

|

|

|

|

|

|

|

|

|

|

|

|

Liquidity (2)

|

|

|

3.8

|

|

|

|

4.0

|

|

|

|

(1)

|

Accounts

receivable + accounts receivable from related companies

|

|

|

(2)

|

Current

assets / current liabilities

|

Income Statement

|

(US$ Millions)

|

|

For the 3rd quarter

|

|

|

For the nine months ended Sep. 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2017

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

558.7

|

|

|

|

504.0

|

|

|

|

1,582.5

|

|

|

|

1,385.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty Plant Nutrition (1)

|

|

|

185.6

|

|

|

|

154.9

|

|

|

|

511.4

|

|

|

|

487.1

|

|

|

Iodine and Iodine Derivatives

|

|

|

62.3

|

|

|

|

56.5

|

|

|

|

191.3

|

|

|

|

175.1

|

|

|

Lithium and Lithium Derivatives

|

|

|

167.8

|

|

|

|

145.1

|

|

|

|

465.2

|

|

|

|

337.9

|

|

|

Industrial Chemicals

|

|

|

14.6

|

|

|

|

12.8

|

|

|

|

80.9

|

|

|

|

43.3

|

|

|

Potassium Chloride & Potassium Sulfate

|

|

|

113.0

|

|

|

|

114.4

|

|

|

|

301.0

|

|

|

|

296.1

|

|

|

Other Income

|

|

|

15.4

|

|

|

|

20.4

|

|

|

|

32.7

|

|

|

|

46.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Goods Sold

|

|

|

(311.3

|

)

|

|

|

(297.4

|

)

|

|

|

(856.6

|

)

|

|

|

(800.5

|

)

|

|

Depreciation and Amortization

|

|

|

(58.8

|

)

|

|

|

(60.9

|

)

|

|

|

(179.6

|

)

|

|

|

(178.8

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

|

188.5

|

|

|

|

145.7

|

|

|

|

546.4

|

|

|

|

406.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative Expenses

|

|

|

(26.5

|

)

|

|

|

(21.8

|

)

|

|

|

(72.6

|

)

|

|

|

(62.6

|

)

|

|

Financial Expenses

|

|

|

(12.3

|

)

|

|

|

(12.8

|

)

|

|

|

(37.8

|

)

|

|

|

(45.2

|

)

|

|

Financial Income

|

|

|

3.1

|

|

|

|

1.4

|

|

|

|

8.8

|

|

|

|

8.0

|

|

|

Exchange Difference

|

|

|

5.3

|

|

|

|

1.0

|

|

|

|

0.6

|

|

|

|

(0.6

|

)

|

|

Other

|

|

|

(4.4

|

)

|

|

|

(32.7

|

)

|

|

|

(5.1

|

)

|

|

|

(25.3

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Taxes

|

|

|

153.8

|

|

|

|

80.8

|

|

|

|

440.3

|

|

|

|

280.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax

|

|

|

(40.8

|

)

|

|

|

(23.8

|

)

|

|

|

(123.4

|

)

|

|

|

(81.1

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income before minority interest

|

|

|

113.0

|

|

|

|

57.0

|

|

|

|

316.9

|

|

|

|

199.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority Interest

|

|

|

(0.2

|

)

|

|

|

(1.2

|

)

|

|

|

0.3

|

|

|

|

(2.0

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

|

112.9

|

|

|

|

55.8

|

|

|

|

317.2

|

|

|

|

197.4

|

|

|

Net Income per Share (US$)

|

|

|

0.43

|

|

|

|

0.21

|

|

|

|

1.21

|

|

|

|

0.75

|

|

(1) Includes other specialty fertilizers

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CHEMICAL AND MINING COMPANY OF CHILE INC.

|

|

|

(Registrant)

|

|

|

|

|

Date: November 22, 2017

|

/s/ Ricardo Ramos

|

|

|

By: Ricardo Ramos

|

|

|

CFO & Vice-President of Development

|

Persons who are to respond to the collection

of information contained SEC 1815 (04-09) in this form are not required to respond unless the form displays currently valid OMB

control number.

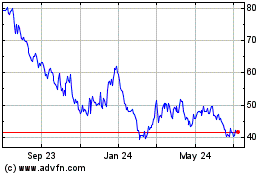

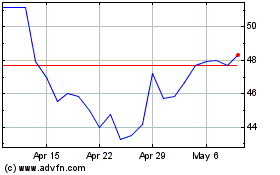

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Apr 2023 to Apr 2024