Current Report Filing (8-k)

November 22 2017 - 3:19PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report Pursuant

to

Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported):

November 22, 2017 (October 6, 2017)

AMERICAN

POWER GROUP CORPORATION

(Exact

name of Registrant as Specified in its Charter)

DELAWARE

(State

or Other Jurisdiction of Incorporation)

|

1-13776

|

|

71-0724248

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification Number)

|

2503

East Poplar Street

Algona,

Iowa 50511

(Address

of Principal Executive Offices, including Zip Code)

(781)

224-2411

(Registrant’s

Telephone Number, including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement

During

the period of October 6, 2017 and November 10, 2017, American Power Group, Inc. entered into unsecured promissory notes aggregating

$56,691.91 with Arrow, LLC, an entity associated with one of our Board of Directors and notes aggregating $56,691.91 with Associate

Private Equity, LLC, an entity associated with another member of our Board of Directors. The notes bear simple interest at the

rate of 10% per annum and will become due and payable on December 31, 2017 and may be prepaid at any time.

The

foregoing description of the note does not purport to be complete and is qualified in its entirety by reference to the complete

text of each such document, a copy of which is filed as an exhibit hereto and is incorporated herein by reference.

On

October 27, 2017, the holders of American Power Group Corporation’s Subordinated Contingent Convertible Promissory Notes

in the aggregate principal amount of $3,000,000 (the “Notes”) agreed to extend the maturity of the Notes from October

27, 2017 until December 31, 2017.

On

November 21, 2017, American Power Group, Inc. (“APG”), a wholly owned subsidiary of American Power Group Corporation,

and Iowa State Bank (the “Bank”), entered into a Change of Terms Agreement, pursuant to which the maturity of APG’s

$500,000 Revolving Line of Credit was extended from November 18, 2017 to December 18, 2017.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a

Registrant

See

the disclosures set forth in Item 1.01 above, which are incorporated herein by reference.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers

On

November 20, 2017, Charles McDermott resigned from the Board of Directors of the American Power Group Corporation (the “Company”).

Mr. McDermott’s resignation is not due to any disagreement known to the Company’s executive officers with respect

to any matter relating to the Company’s operations, policies or practices.

Item

9.01 Financial Statements and Exhibits

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

|

|

10.1

|

|

Amendment to Promissory Notes, dated as of October 26, 2017, among American Power Group Corporation and the holders of such Notes

|

|

|

10.2

|

|

Change in Terms Agreement, dated as of November 21, 2017, among American Power Group, Inc. and Iowa State Bank

|

|

|

10.3

|

|

Unsecured Promissory Note in the amount of $15,329.67, dated as of October 6, 2017, among American Power Group, Inc. and Arrow, LLC

|

|

|

10.4

|

|

Unsecured Promissory Note in the amount of $15,329.67, dated as of October 6, 2017, among American Power Group, Inc. and Associated Private Equity

|

|

|

10.5

|

|

Unsecured Promissory Note in the amount of $41,352.24, dated as of November 9, 2017, among American Power Group, Inc. and Arrow, LLC

|

|

|

10.6

|

|

Unsecured Promissory Note in the amount of $41,352.24, dated as of November 10, 2017, among American Power Group, Inc. and Associated Private Equity

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AMERICAN

POWER GROUP CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

Charles E. Coppa

|

|

|

|

Charles

E. Coppa

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

Date:

November 22, 2017

|

|

|

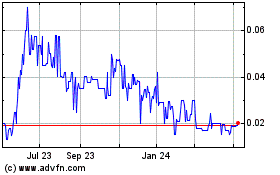

American Power (PK) (USOTC:APGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

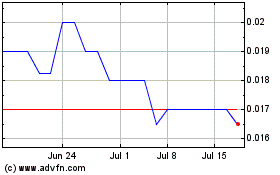

American Power (PK) (USOTC:APGI)

Historical Stock Chart

From Apr 2023 to Apr 2024