Van Leeuwenhoeck Institute Updates Immuron Research Coverage

November 22 2017 - 9:00AM

Immuron Limited (ASX:IMC) (the “Company”) wishes to advise

investors that Van Leeuwenhoeck Institute, a prominent European and

US-based Life Sciences Research and Analyst firm (“VLI”), has

published an updated Equity Analyst Research Report on the Company

and its R&D programs.

The report provides a full valuation of

Immuron’s Intellectually Property Assets including its current

pipeline of development programs. It also highlights the

high-growth market opportunity for two key diseases for which

Immuron seeks to develop treatments for, Non-Alcoholic

Steatohepatitis (NASH) and C. Difficile, referring to the former as

a “holy grail” and the latter as “underestimated potential.”

The final point within the Report’s Executive

Summary states:

“Based on our NPV valuation, we believe that

Immuron is substantially undervalued at the current share price of

AUD$0.18. We have increased our valuation calculation following a

rerating of both its programs in NASH and CDI. Especially in NASH,

the potential deal size has increased following recent activity in

the area. In our view, the Company’s current total value should be

AUD$270 million, or AUD$2.08 per share compared to our previous

calculation of AUD$197 million. This represents a substantial

upside from the current share price.”

Van Leeuwenhoeck Institute provides expert

independent un-biased equity research on the real value of

innovative life science biotechnology companies in Europe, North

America, Australia and emerging markets for institutional, and

professional investors throughout the US and Europe.

A copy of the Research Note as well as others can be viewed on

the Company website at:

http://www.immuron.com/investor-centre/analyst-reports/

|

COMPANY CONTACT:

Jerry KanellosChief Executive OfficerPh: +61 (0)3

9824 5254 jerrykanellos@immuron.com |

USA MEDIA CONTACT:

Kate Caruso-SharpeFischTank Marketing and PRUS Ph:

+ 1 646 699 1414kate@fischtankpr.com |

USA INVESTOR RELATIONS:

Jon CunninghamRedChip Companies, Inc.US Ph: +1

(407) 644 4256, (ext. 107)jon@redchip.com |

About Van Leeuwenhoeck Institute:

Van Leeuwenhoeck Institute (VLI) provides

institutional investors and other professional investors with

independent, un-biased research on the real value of innovative

Life Sciences companies. Many institutional and individual

investors will not invest in companies lacking independent

third-party research coverage, yet few investment banks cover this

sector because it requires dedicated expertise.

In spite of the lack of quality knowledge on an

industry-wide basis, there is increased demand for life

science-specific market research as investors are seeking

information about leading companies in the sector in order to make

well-informed investment decisions.

Immuron Limited has engaged VLI to

provide the Company with logistical support services in

support of potential European road shows.

For more information visit:

http://www.leeuwenhoeck.com/

ABOUT IMMURON:Immuron Ltd

(ASX:IMC) is a biopharmaceutical company focused on developing and

commercialising oral immunotherapeutics for the treatment of many

gut mediated diseases. Immuron has a unique and safe

technology platform that enables a shorter development therapeutic

cycle. The Company currently markets and sells Travelan® for

the prevention of travellers’ diarrhea whilst its lead product

candidate IMM-124E is in Phase 2 clinical trials for NASH and

ASH. These products together with the Company’s other

preclinical immunotherapy pipeline products targeting

immune-related diseases currently under development, will meet a

large unmet need in the market. For more information visit:

http://www.immuron.com

FORWARD-LOOKING STATEMENTS:

This press release may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

each as amended. Such statements include, but are not limited

to, any statements relating to our growth strategy and product

development programs and any other statements that are not

historical facts. Forward-looking statements are based on

management’s current expectations and are subject to risks and

uncertainties that could negatively affect our business, operating

results, financial condition and stock value. Factors that could

cause actual results to differ materially from those currently

anticipated include: risks relating to our growth strategy; our

ability to obtain, perform under and maintain financing and

strategic agreements and relationships; risks relating to the

results of research and development activities; risks relating to

the timing of starting and completing clinical trials;

uncertainties relating to preclinical and clinical testing; our

dependence on third-party suppliers; our ability to attract,

integrate and retain key personnel; the early stage of products

under development; our need for substantial additional funds;

government regulation; patent and intellectual property matters;

competition; as well as other risks described in our SEC filings.

We expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in our expectations or any

changes in events, conditions or circumstances on which any such

statement is based, except as required by

law.

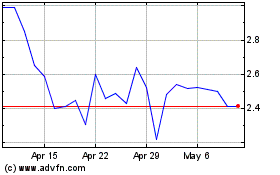

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

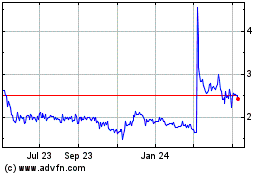

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024