Evogene Ltd. (NASDAQ:EVGN) (TASE:EVGN), a leading biotechnology

company developing novel products for life science markets through

the use of a unique computational predictive biology platform,

announced today its financial results for the third quarter ending

September 30, 2017.

Ofer Haviv, Evogene's President and CEO,

stated: “This is an exciting time for Evogene, as we

rapidly advance the evolution of our company from a plant genomics

company to a company addressing a wide variety of biological

challenges and the development of novel products in and outside the

Ag world. This evolution, with a revised and expanded market focus

and new corporate structure, of which we recently announced, is

possible only due to the competitive advantages provided to us by

our broadly applicable predictive discovery and product

optimization platform."

"Under our new corporate structure, Evogene’s

core agricultural activities that had been previously divided into

two Crop Enhancement and Crop Protection units, are now part of

three product-oriented divisions: Ag-Biologicals, Ag-Seeds, and

Ag-Chemicals. Each division, managed by a General Manager, has its

own business development and R&D staff. All three are pursuing

an expanded market focus, including new product programs with a

clear path to commercialization."

“Additionally, Evogene has two subsidiaries –

Evofuel, which focuses on the development of castor seed varieties

and Biomica, our new subsidiary in the area of human microbiome,

which we recently announced. Biomica aims to discover and develop

human microbiome-based therapeutics and represents Evogene’s first

initiative to pursue activities outside the ag-world. The

subsidiary was co-founded, and is being led scientifically, by

Prof. Yehdua Ringel, a global authority on Gastroenterology and

will be funded by Evogene, for a period of up to two years, to

achieve its first key milestone."

“In order to guide the revision and expansion of

our market focus, within each operating entity we have established

criteria for the selection of specific product programs. These

include the opportunity for a more advanced, downstream, product

offering and a clear path to commercialization, in addition to the

absolute requirement that our unique technology platform is

anticipated to provide a substantial competitive advantage in the

product’s development."

Activity Highlights in Q3

2017:

Ag-Biologicals Division:

- In our collaboration with DuPont-Pioneer, for bio-stimulant

corn seed treatment, we are in the nomination process of Evogene

discovered microbial candidates for entry next year into

DuPont-Pioneer’s corn field trials in the US.

- Initiation of product development for two bio-pesticide product

offerings: (I) leveraging Evogene validated microbes with positive

results generated in our Ag Seeds insect control and fungi

resistance programs in corn & soy; (II) utilizing our proven

computational predictive biology platform, to discover new microbes

for additional pests in high-value specialty crops.

Ag-Seeds Division:

- Phase advancement in our insect control seed traits product

program: (I) in our Coleopteran control product program, targeting

Western Corn Rootworm in Corn, we have a second gene to advance to

Phase I, (II) in our Lepidopteran control product program,

targeting Fall Army Worm in Corn and Soy, we have a first gene to

advance to Phase I.

- As recently announced, Evogene and Rahan Meristem are

leveraging the collaboration’s positive results in banana traits,

addressing Black Sigatoka fungi disease, to develop a potentially

safer and healthier banana utilizing revolutionary genome editing

technology, with the goal of the end-product to be classified as

non-GMO.

Ag-Chemicals Division:

- Initiation of Insecticides product program, focusing on two

product offerings: (I) novel insecticides with a new site-of-action

and (II) optimization of an existing insecticide. Both product

offerings focus on key nerve & muscle targets – the farmers’

insecticide-of-choice. Several targets have already been identified

to undergo analysis by our computational platform.

Evofuel – subsidiary, focused on the development

and commercialization of castor seeds:

- A breakthrough in terms of mechanical harvesting capabilities,

which has been a major bottleneck in the commercialization of

castor seeds.

- In the upcoming year, our castor seed varieties are expected to

undergo field trials with potential customers in four different

countries in Central and South America.

Biomica - subsidiary, for the discovery and

development of human microbiome-based therapeutics:

- Initiation of work: Biomica has already tailored and enhanced

Evogene's computational predictive biology platform to create a

dedicated infrastructure for the discovery of live bacterial drug

candidates. In addition, it has begun establishing the relevant

databases for its needs.

Ofer Haviv concluded: “Looking

forward, we believe that the upcoming months will clearly

demonstrate how our revised market focus takes form in all activity

areas, creating true value for our evolving company.”

Financial results for the period ending

September 30, 2017

Cash Position: As of

September 30, 2017, the Company had $75.9 million in cash,

short-term bank deposits and marketable securities, representing a

net cash usage of $3.8 million for the third quarter and $12.3

million for the nine months ending September 30, 2017. Evogene

continues to expect that its net cash usage for full-year 2017 will

be in the range of $16 to $18 million.

Assuming the currently expected course of business

and no new revenue sources from existing or new collaborations, in

2018 Evogene expects net cash usage of $14 to $16 million.

Revenues primarily consist

of research and development payments, reflecting R&D cost

reimbursement under certain of our collaboration agreements. The

majority of these agreements also provide for development milestone

payments and royalties or other forms of revenue sharing from

successfully developed products.

Revenues for the first nine months of 2017 were

$2.6 million in comparison to $5.4 million, in the comparable

period in 2016. Revenues for the third quarter of 2017 were $0.7

million, in comparison to revenues of $1.5 million for the third

quarter in 2016. The decline in revenues reflects the net decrease

in research and development cost reimbursement, in accordance with

the work plans under Evogene's various collaboration agreements.

This decline is mainly due to the advancement of our collaboration

agreement with Monsanto, from gene discovery to pre-development

efforts, resulting in reduction of activity scope. Looking forward,

we expect this revenue trend to continue.

During the first nine months of 2017 we saw a

negative impact on our expenses due to the depreciation of the USD

in comparison to the Israeli Shekel. Our expenses, mostly salaries,

are denominated in Israeli Shekels while our reporting currency is

USD.

Cost of revenues mainly consist

of collaboration related R&D expenses. Cost of revenues for the

first nine months of 2017 were $2.2 million in comparison to $4.5

million in the first nine months of 2016. Cost of revenues for the

third quarter of 2017 were $0.5 million, in comparison to $1.4

million in the third quarter of 2016. The decrease related

primarily to the decrease in revenues from R&D cost

reimbursement for such periods.

R&D expenses for the first

nine months of 2017 were $12.3 million in comparison to $11.7

million in the first nine months of 2016. R&D expenses for the

third quarter of 2017 were $4.3 million in comparison to $3.9

million in the third quarter in 2016. The increase in R&D

expenses was mainly due to an expansion of investments in internal

product programs and due to exchange rate fluctuations, as

mentioned above.

Operating loss for the first

nine months of 2017 was $15.9 million, in comparison to an

operating loss of $14.9 million for the first nine months of 2016.

Operating loss for the third quarter of 2017 was $5.5 million in

comparison to $5.2 million in the third quarter in 2016. The

increase in operating loss was mainly due to the decrease in

revenues and an increase in R&D expenses.

The net financing income for the first nine

months of 2017 was $1.3 million in comparison to $2.0 million in

the corresponding period. This decrease is due to relatively high

capital gains derived mainly from the company's marketable

securities in the first half of 2016.

The net financing income for the third quarter

of 2017 was $0.5 million in comparison to $0.1 million in the

comparable quarter in 2016.

Net loss for the first nine

months of 2017 was $14.6 million in comparison to $12.9 million in

the first nine months of 2016. The increase in the net loss was

primarily due to the decrease in revenues, an increase in R&D

expenses and the decrease in net financing income.

Net loss for the third quarter of 2017 was $5.0

million compared to the net loss of $5.1 million in the comparable

quarter in 2016.

Conference Call & Webcast

Details:

Evogene management will host a conference call

to discuss the results at 09:00 AM Eastern time, 16:00 Israel time.

To access the conference call, please dial 1-888-281-1167 toll free

from the United States, or +972-3-918-0685 internationally. Access

to the call will also be available via live webcast through the

Company’s website at www.evogene.com.

A replay of the conference call will be

available approximately three hours following the completion of the

call. To access the replay, please dial 1-888-326-9310 toll free

from the United States, or +972-3-925-5927 internationally. The

replay will be accessible through November 24, 2017, and an archive

of the webcast will be available on the Company’s website through

December 4, 2017.

About Evogene Ltd.:Evogene

(NASDAQ:EVGN) (TASE:EVGN) is a leading biotechnology company

developing novel products for life science markets through the use

of a unique computational predictive biology platform. The Company

operates in three key target markets: improved seed traits

(addressing yield increase, tolerance to environmental stresses and

resistance to insects and diseases); innovative ag-chemicals

(developing novel herbicide solutions for weed control); and

ag-biologicals (developing microbiome based ag-products). Evogene

has collaborations with world-leading seed and ag-chemical

companies. For more information, please visit www.evogene.com or

contact the Company at info@evogene.com.

Forward Looking Statements:This

press release contains "forward-looking statements" relating to

future events. These statements may be identified by words such as

"may", "could", “expects”, "intends", “anticipates”, “plans”,

“believes”, “scheduled”, “estimates” or words of similar meaning.

Such statements are based on current expectations, estimates,

projections and assumptions, describe opinions about future events,

involve certain risks and uncertainties which are difficult to

predict and are not guarantees of future performance. Therefore,

actual future results, performance or achievements of Evogene may

differ materially from what is expressed or implied by such

forward-looking statements due to a variety of factors, many of

which beyond Evogene's control, including, without limitation,

those risk factors contained in Evogene’s reports filed with the

appropriate securities authority. Evogene disclaims any obligation

or commitment to update these forward-looking statements to reflect

future events or developments or changes in expectations,

estimates, projections and assumptions.

Contact:Nir Zalik IR/PR ManagerE:

IR@evogene.comT: (+972)-8-931-1963

|

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

|

|

|

|

|

U.S. dollars in thousands (except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

As of December

31, 2016 |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

Unaudited |

|

Audited |

| CURRENT

ASSETS: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

2,457 |

|

|

$ |

5,439 |

|

|

$ |

3,236 |

|

|

Restricted cash |

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

Marketable securities |

|

|

63,882 |

|

|

|

72,520 |

|

|

|

71,738 |

|

|

Short-term bank deposits |

|

|

9,517 |

|

|

|

15,058 |

|

|

|

13,137 |

|

| Trade

receivables |

|

|

968 |

|

|

|

100 |

|

|

|

169 |

|

| Other

receivables |

|

|

971 |

|

|

|

1,778 |

|

|

|

1,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

77,842 |

|

|

|

94,942 |

|

|

|

89,490 |

|

|

LONG-TERM ASSETS: |

|

|

|

|

|

|

| Long-term

deposits |

|

|

15 |

|

|

|

14 |

|

|

|

13 |

|

| Property,

plant and equipment, net |

|

|

5,248 |

|

|

|

6,829 |

|

|

|

6,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5,263 |

|

|

|

6,843 |

|

|

|

6,496 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

83,105 |

|

|

$ |

101,785 |

|

|

$ |

95,986 |

|

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

| Trade

payables |

|

$ |

898 |

|

|

$ |

1,071 |

|

|

$ |

1,330 |

|

| Other

payables |

|

|

2,676 |

|

|

|

2,695 |

|

|

|

2,803 |

|

|

Liabilities in respect of government grants |

|

|

81 |

|

|

|

680 |

|

|

|

125 |

|

| Deferred

revenues and other advances |

|

|

1,006 |

|

|

|

1,126 |

|

|

|

967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4,661 |

|

|

|

5,572 |

|

|

|

5,225 |

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

Liabilities in respect of government grants |

|

|

3,303 |

|

|

|

2,747 |

|

|

|

3,303 |

|

| Deferred

revenues and other advances |

|

|

104 |

|

|

|

154 |

|

|

|

138 |

|

| Severance

pay liability, net |

|

|

32 |

|

|

|

30 |

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,439 |

|

|

|

2,931 |

|

|

|

3,472 |

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

| Ordinary

shares of NIS 0.02 par value: |

|

|

|

|

|

|

|

Authorized - 150,000,000 ordinary shares; Issued and outstanding –

25,749,969, 25,459,809 and 25,480,809 shares at September 30, 2017

and 2016 and December 31, 2016, respectively |

|

|

142 |

|

|

|

140 |

|

|

|

141 |

|

| Share

premium and other capital reserve |

|

|

185,671 |

|

|

|

182,693 |

|

|

|

183,342 |

|

|

Accumulated deficit |

|

|

(110,808 |

) |

|

|

(89,551 |

) |

|

|

(96,194 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

75,005 |

|

|

|

93,282 |

|

|

|

87,289 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

83,105 |

|

|

$ |

101,785 |

|

|

$ |

95,986 |

|

| CONSOLIDATED STATEMENTS OF PROFIT OR

LOSS |

| U.S. dollars in thousands (except share and

per share data) |

|

|

|

|

|

|

|

|

|

|

|

Nine months endedSeptember

30, |

|

Three months endedSeptember

30, |

|

Year ended December 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2016 |

|

|

|

|

Unaudited |

|

Audited |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

2,647 |

|

|

$ |

5,360 |

|

|

$ |

748 |

|

|

$ |

1,536 |

|

|

$ |

6,540 |

|

| Cost

of revenues |

|

|

2,211 |

|

|

|

4,508 |

|

|

|

546 |

|

|

|

1,418 |

|

|

|

5,639 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

436 |

|

|

|

852 |

|

|

|

202 |

|

|

|

118 |

|

|

|

901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net |

|

|

12,319 |

|

|

|

11,670 |

|

|

|

4,301 |

|

|

|

3,905 |

|

|

|

16,405 |

|

|

Business development |

|

|

1,264 |

|

|

|

1,225 |

|

|

|

443 |

|

|

|

435 |

|

|

|

1,696 |

|

|

General and administrative |

|

|

2,781 |

|

|

|

2,894 |

|

|

|

960 |

|

|

|

950 |

|

|

|

3,889 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

operating expenses |

|

|

16,364 |

|

|

|

15,789 |

|

|

|

5,704 |

|

|

|

5,290 |

|

|

|

21,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(15,928 |

) |

|

|

(14,937 |

) |

|

|

(5,502 |

) |

|

|

(5,172 |

) |

|

|

(21,089 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing income |

|

|

1,769 |

|

|

|

2,286 |

|

|

|

563 |

|

|

|

191 |

|

|

|

2,424 |

|

|

Financing expenses |

|

|

(444 |

) |

|

|

(277 |

) |

|

|

(85 |

) |

|

|

(112 |

) |

|

|

(891 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss

before taxes on income |

|

|

(14,603 |

) |

|

|

(12,928 |

) |

|

|

(5,024 |

) |

|

|

(5,093 |

) |

|

|

(19,556 |

) |

| Taxes

on income |

|

|

11 |

|

|

|

21 |

|

|

|

- |

|

|

|

21 |

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(14,614 |

) |

|

$ |

(12,949 |

) |

|

$ |

(5,024 |

) |

|

$ |

(5,114 |

) |

|

$ |

(19,592 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

and diluted net loss per share |

|

$ |

(0.57 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.77 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF CHANGES IN

SHAREHOLDERS’ EQUITY |

| U.S. dollars in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital |

|

Share premium and other capital

reserve |

|

Accumulated deficit |

|

Total |

|

|

|

|

|

Unaudited |

|

|

|

Balance as of January 1, 2017 (audited) |

|

$ |

141 |

|

$ |

183,342 |

|

$ |

(96,194 |

) |

|

$ |

87,289 |

|

| Net

loss |

|

|

- |

|

|

- |

|

(14,614 |

) |

|

(14,614 |

) |

|

Exercise of options |

|

|

1 |

|

|

681 |

|

- |

|

|

682 |

|

|

Share-based compensation |

|

|

- |

|

|

1,648 |

|

- |

|

|

1,648 |

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2017 |

|

$ |

142 |

|

$ |

185,671 |

$ |

(110,808 |

) |

$ |

75,005 |

|

|

|

|

Share capital |

|

Share premium and other capital

reserve |

|

Accumulated deficit |

|

Total |

|

|

|

|

|

Unaudited |

|

|

|

Balance as of January 1, 2016 (audited) |

|

$ |

140 |

|

$ |

180,214 |

|

$ |

(76,602 |

) |

|

$ |

103,752 |

|

| Net

loss |

|

|

- |

|

|

- |

|

(12,949 |

) |

|

(12,949 |

) |

|

Exercise of options |

|

*) - |

|

|

143 |

|

- |

|

|

143 |

|

|

Share-based compensation |

|

|

- |

|

|

2,336 |

|

- |

|

|

2,336 |

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2016 |

|

$ |

140 |

|

$ |

182,693 |

$ |

(89,551 |

) |

$ |

93,282 |

|

*) Represents an amount lower than $1

|

|

|

Share capital |

|

Share premium and other capital

reserve |

|

Accumulated deficit |

|

Total |

|

|

|

|

|

Unaudited |

|

|

|

Balance as of July 1, 2017 |

|

$ |

142 |

|

$ |

184,977 |

|

$ |

(105,784 |

) |

|

$ |

79,335 |

|

| Net

loss |

|

|

- |

|

|

- |

|

(5,024 |

) |

|

(5,024 |

) |

|

Exercise of options |

|

*) - |

|

|

12 |

|

- |

|

|

12 |

|

|

Share-based compensation |

|

|

- |

|

|

682 |

|

- |

|

|

682 |

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2017 |

|

$ |

142 |

|

$ |

185,671 |

$ |

(110,808 |

) |

$ |

75,005 |

|

*) Represents an amount lower than $1

| CONSOLIDATED STATEMENTS OF CHANGES IN

SHAREHOLDERS’ EQUITY |

| U.S. dollars in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital |

|

Share premium and other capital

reserve |

|

Accumulated deficit |

|

Total |

|

|

|

|

|

Unaudited |

|

|

|

Balance as of July 1, 2016 |

|

$ |

140 |

|

$ |

181,985 |

|

$ |

(84,437 |

) |

|

$ |

97,688 |

|

| Net

loss |

|

|

- |

|

|

- |

|

(5,114 |

) |

|

(5,114 |

) |

|

Exercise of options |

|

*) - |

|

|

29 |

|

- |

|

|

29 |

|

|

Share-based compensation |

|

|

- |

|

|

679 |

|

- |

|

|

679 |

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2016 |

|

$ |

140 |

|

$ |

182,693 |

$ |

(89,551 |

) |

$ |

93,282 |

|

*) Represents an amount lower than $1

|

|

|

Share capital |

|

Share premium and other capital

reserve |

|

Accumulated deficit |

|

Total |

|

|

|

|

|

Audited |

|

|

|

Balance as of January 1, 2016 |

|

$ |

140 |

|

$ |

180,214 |

|

$ |

(76,602 |

) |

|

$ |

103,752 |

|

| Net

loss |

|

|

- |

|

|

- |

|

|

(19,592 |

) |

|

|

(19,592 |

) |

|

Exercise of options |

|

|

1 |

|

|

185 |

|

|

- |

|

|

|

186 |

|

|

Share-based compensation |

|

|

- |

|

|

2,943 |

|

|

- |

|

|

|

2,943 |

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2016 |

|

$ |

141 |

|

$ |

183,342 |

|

$ |

(96,194 |

) |

|

$ |

87,289 |

|

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| U.S. dollars in thousands |

| |

|

|

|

Nine months endedSeptember

30, |

|

Three months endedSeptember

30, |

|

Year ended December 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2016 |

|

|

|

|

Unaudited |

|

Audited |

| Cash

flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(14,614 |

) |

|

$ |

(12,949 |

) |

|

$ |

(5,024 |

) |

|

$ |

(5,114 |

) |

|

$ |

(19,592 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to the profit or loss items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

1,624 |

|

|

|

1,763 |

|

|

|

533 |

|

|

|

587 |

|

|

|

2,279 |

|

|

Share-based compensation |

|

|

1,648 |

|

|

|

2,336 |

|

|

|

682 |

|

|

|

679 |

|

|

|

2,943 |

|

| Net

financing income |

|

|

(1,579 |

) |

|

|

(2,168 |

) |

|

|

(490 |

) |

|

|

(151 |

) |

|

|

(1,688 |

) |

| Loss

from sale of property, plant and equipment |

|

|

- |

|

|

|

17 |

|

|

|

- |

|

|

|

- |

|

|

|

39 |

|

| Taxes

on income |

|

|

11 |

|

|

|

21 |

|

|

|

- |

|

|

|

21 |

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,704 |

|

|

|

1,969 |

|

|

|

725 |

|

|

|

1,136 |

|

|

|

3,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in asset and liability items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Decrease

(increase) in trade receivables |

|

|

(799 |

) |

|

|

2,575 |

|

|

|

95 |

|

|

|

(20 |

) |

|

|

2,506 |

|

| Decrease

(increase) in other receivables |

|

|

177 |

|

|

|

(667 |

) |

|

|

127 |

|

|

|

(190 |

) |

|

|

(100 |

) |

| Decrease

(increase) in long-term deposits |

|

|

(2 |

) |

|

|

8 |

|

|

|

(1 |

) |

|

|

2 |

|

|

|

9 |

|

| Decrease

in trade payables |

|

|

(381 |

) |

|

|

(359 |

) |

|

|

(62 |

) |

|

|

(118 |

) |

|

|

(215 |

) |

| Increase

(decrease) in other payables |

|

|

(122 |

) |

|

|

(415 |

) |

|

|

177 |

|

|

|

181 |

|

|

|

(303 |

) |

| Increase

in severance pay liability, net |

|

|

1 |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

5 |

|

| Increase

(decrease) in deferred revenues and other advances |

|

|

5 |

|

|

|

422 |

|

|

|

(1 |

) |

|

|

303 |

|

|

|

(81 |

) |

| Increase

in liabilities in respect of government grants |

|

|

- |

|

|

|

115 |

|

|

|

- |

|

|

|

- |

|

|

|

115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,121 |

) |

|

|

1,683 |

|

|

|

335 |

|

|

|

158 |

|

|

|

1,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash

received (paid) during the period for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest received |

|

|

1,682 |

|

|

|

1,838 |

|

|

|

561 |

|

|

|

684 |

|

|

|

2,360 |

|

| Taxes

paid |

|

|

(14 |

) |

|

|

(2 |

) |

|

|

(3 |

) |

|

|

(2 |

) |

|

|

(6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash

used in operating activities |

|

|

(12,363 |

) |

|

|

(7,461 |

) |

|

|

(3,406 |

) |

|

|

(3,138 |

) |

|

|

(11,693 |

) |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| U.S. dollars in thousands |

| |

|

|

|

Nine months endedSeptember

30, |

|

Three months endedSeptember

30, |

|

Year ended December 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2016 |

|

|

|

|

Unaudited |

|

Audited |

| Cash

flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

$ |

(442 |

) |

|

$ |

(711 |

) |

|

$ |

(157 |

) |

|

$ |

(237 |

) |

|

$ |

(808 |

) |

|

Proceeds from sale of marketable securities |

|

|

13,812 |

|

|

|

17,192 |

|

|

|

2,697 |

|

|

|

5,568 |

|

|

|

23,926 |

|

|

Purchase of marketable securities |

|

|

(6,208 |

) |

|

|

(17,576 |

) |

|

|

(881 |

) |

|

|

(3,826 |

) |

|

|

(24,561 |

) |

| Proceeds

from (investment in) bank deposits, net |

|

|

3,620 |

|

|

|

3,545 |

|

|

|

(1,500 |

) |

|

|

1,503 |

|

|

|

5,466 |

|

| Proceeds

from sale of property, plant and equipment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

cash provided by investing activities |

|

|

10,782 |

|

|

|

2,450 |

|

|

|

159 |

|

|

|

3,008 |

|

|

|

4,028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash

Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of options |

|

|

682 |

|

|

|

143 |

|

|

|

12 |

|

|

|

29 |

|

|

|

186 |

|

|

Proceeds from government grants |

|

|

266 |

|

|

|

404 |

|

|

|

- |

|

|

|

146 |

|

|

|

802 |

|

|

Repayment of government grants |

|

|

(208 |

) |

|

|

(333 |

) |

|

|

(64 |

) |

|

|

(134 |

) |

|

|

(333 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash

provided by (used in) financing activities |

|

|

740 |

|

|

|

214 |

|

|

|

(52 |

) |

|

|

41 |

|

|

|

655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange

rate differences - cash and cash equivalent balances |

|

|

62 |

|

|

|

15 |

|

|

|

(2 |

) |

|

|

(5 |

) |

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Decrease

in cash and cash equivalents |

|

|

(779 |

) |

|

|

(4,782 |

) |

|

|

(3,301 |

) |

|

|

(94 |

) |

|

|

(6,985 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents, beginning of the period |

|

|

3,236 |

|

|

|

10,221 |

|

|

|

5,758 |

|

|

|

5,533 |

|

|

|

10,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents, end of the period |

|

$ |

2,457 |

|

|

$ |

5,439 |

|

|

$ |

2,457 |

|

|

$ |

5,439 |

|

|

$ |

3,236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant non-cash transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of property, plant and equipment |

|

$ |

122 |

|

|

$ |

50 |

|

|

$ |

122 |

|

|

$ |

50 |

|

|

$ |

150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

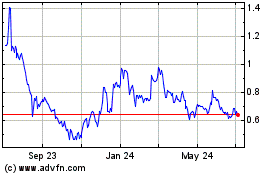

Evogene (NASDAQ:EVGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

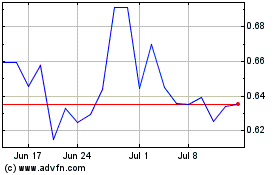

Evogene (NASDAQ:EVGN)

Historical Stock Chart

From Apr 2023 to Apr 2024