UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2017

Commission File Number: 001-31995

MEDICURE

INC.

(Translation of registrant's name into English)

2-1250 Waverley Street

Winnipeg, MB Canada R3T 6C6

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F o

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 8a72____.

EXHIBIT

LIST

| Exhibit |

Title |

| |

|

| 99.1 |

News Release Dated November 21, 2017 - Medicure

Reports Financial Results for Quarter Ended September 30, 2017 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Medicure Inc. |

| |

(Registrant) |

| |

|

| |

|

|

| Date: November 21, 2017 |

By: |

/s/ Dr. Albert D. Friesen |

| |

Dr. Albert D. Friesen |

| |

Title: President & CEO |

Exhibit 99.1

Medicure Reports Financial Results for Quarter Ended

September 30, 2017

WINNIPEG, Nov. 21, 2017 /CNW/ - Medicure Inc. ("Medicure"

or the "Company") (TSXV:MPH, OTC:MCUJF), a pharmaceutical company, today reported its results from operations

for the quarter ended September 30, 2017.

Quarter Ended September 30, 2017 Highlights:

| · | Recorded net revenue from the sale of AGGRASTAT of

$7.0 million during the quarter ended September 30, 2017 compared to $8.2 million for the quarter ended September 30, 2016; |

| · | Adjusted earnings before interest, taxes, depreciation

and amortization (EBITDA)1 for the quarter ended September 30, 2017 was $1.8 million compared to adjusted EBITDA of

$2.9 million for the quarter ended September 30, 2016; and |

| · | Net loss for the quarter ended September 30, 2017

was $4.3 million, compared to net income of $2.0 million for the quarter ended September 30, 2016. The net loss for the quarter

was due to Apicore's net loss for the quarter of $5.5 million. Medicure had net income for the quarter ended September 30, 2017

of $1.2 million if not including Apicore. |

Financial Results

Net revenues from AGGRASTAT for the quarter ended September

30, 2017 were $7.0 million compared to $8.2 million for the quarter ended September 30, 2016.

Net revenues for the nine months ended September 30, 2017

were $22.1 million compared to $22.0 million for the nine months ended September 30, 2016.

The Company continues to experience an increase in patient

market share held by the product and an increase in the number of new hospital customers using AGGRASTAT leading to the highest

hospital demand for AGGRASTAT in the Company's history. The increase in our customer base has not led to a corresponding increase

in revenue for the quarter as increased competition from generic versions of AGGRASTAT's main competitor has led to higher hospital

discounts for our customers. Additionally, a significantly lower US dollar exchange rate during the third quarter of 2017

was also responsible for the lower Canadian dollar net revenues as compared to the corresponding quarter in the previous fiscal

year.

The Company's commercial team continues to work on expanding

the customer base for AGGRASTAT and the Company remains confident in its ability to grow the brand. At the same time,

diversification of revenues remains a priority for the Company.

Adjusted EBITDA for the quarter ended September 30, 2017 was

$1.8 million compared to $2.9 million for the quarter ended September 30, 2016. The decrease in adjusted EBITDA for the quarter

is the result of the lower revenues experienced during the quarter ended September 30, 2017, which were due primarily to lower

prices for Aggrastat and a higher Canadian dollar. Adjusted EBITDA for the nine months ended September 30, 2017 was $5.2 million

compared to $7.3 million for the nine months ended September 30, 2016, after adjusting for $1.3 million of share-based compensation

(a non-cash expense item) and $346,000 relating to on-going costs pertaining to the one-time sNDA filing. The decrease in

adjusted EBITDA for the nine months ended September 30, 2017 was a result of higher selling, general and administration costs,

after adjusting for stock-based compensation, relating to the growth of the commercial organization and higher research and development

costs associated with the Company's ANDA development projects.

Net loss for the quarter ended September 30, 2017 was $4.3

million or $0.28 per share which includes a $5.5 million loss from the Apicore business, which is included as discontinued operations

in the financial statements for the quarter ended September 30, 2017. This compares to net income of $2.0 million or $0.13 per

share for the quarter ended September 30, 2016.

The Company experienced a net loss for the nine months ended

September 30, 2017 of $8.0 million which includes a $10.2 million loss from the Apicore business compared to net income of $3.2

million for the nine months ended September 30, 2016. The loss for the current period is primarily related to losses in the

Apicore business for the period, which has been classified as discontinued operations in the 2017 results, as well as significantly

higher finance expense relating to the loan obtained in November 2016 to acquire Apicore. Subsequent to September 30, 2017,

the Apicore business was divested and the loan was repaid in full.

At September 30, 2017, the Company had unrestricted cash totaling

$2.1 million compared to $12.3 million as of December 31, 2016. The decrease in cash is due to the net loss, after adjusting for

non-cash items, higher interest payments made during the quarter relating to the debt obtained in November 2016 and the acquisition

of additional Class E common shares of Apicore during the period. Cash from operating activities of approximately $28.6 million

for the nine months ended September 30, 2017 resulted from up-front payments received by the Apicore business during the period.

All amounts referenced herein are in Canadian dollars unless

otherwise noted.

Company Highlights Subsequent to September 30, 2017

On October 3, 2017, the Company announced that it has sold

its interests in Apicore to an arm's length, pharmaceutical company. The Company acquired Apicore in a series of transactions occurring

between July 3, 2014 and July 12, 2017 and will receive net proceeds of approximately US$105 million.

On October 31, 2017, the Company announced that it has acquired

an exclusive license to sell and market PREXXARTAN® (valsartan) oral solution in the United States and its territories

from Carmel Biosciences, Inc. ("Carmel") for a seven-year term with extensions to the term available. The Company

intends to launch the product using its existing commercial sales force and infrastructure with a target commercial launch date

in the first half of 2018.

On November 17, 2017, the Company announced that it had repaid

in full its loans with the Manitoba Development Corporation ("MDC"), totaling $1.1 million and Crown Capital Fund IV,

LP, an investment fund managed by Crown Capital Partners Inc. ("Crown"), totaling $60.0 million.

Notes

(1) The Company defines EBITDA as "earnings

before interest, taxes, depreciation, amortization and other income or expense" and Adjusted EBITDA as "EBITDA adjusted

for non-cash and one-time items". The terms "EBITDA" and "Adjusted EBITDA", as it relates to the

quarters ended September 30, 2017 and 2016 results prepared using International Financial Reporting Standards ("IFRS"),

do not have any standardized meaning according to IFRS. It is therefore unlikely to be comparable to similar measures presented

by other companies.

Reminder for the Conference Call Tomorrow

Conference Call Info:

Topic: Medicure's Q3 Results

Call date: Wednesday, November 22, 2017

Time: 7:30 AM Central Time (8:30 AM Eastern Time)

Canada toll-free: 1 (888) 465-5079 Canada toll:

1 (416) 216-4169

United States toll-free: 1 (888) 545-0687

Passcode: 6477570#

Webcast: This conference call will be webcast live over

the internet and can be accessed from the Medicure investor relations page at the following link: http://www.medicure.com/investors.html

You may request international country-specific access information

by e-mailing the Company in advance. Management will accept and answer questions related to the financial results and operations

during the question-and-answer period at the end of the conference call. A recording of the call will be available following the

event at the Company's website.

About Medicure Inc.

Medicure is a pharmaceutical company focused on the development

and commercialization of therapeutics for the U.S. cardiovascular market. The primary focus of the Company is the marketing and

distribution of AGGRASTAT (tirofiban hydrochloride) in the United States, where it is sold through the Company's U.S. subsidiary,

Medicure Pharma, Inc. For more information on Medicure please visit www.medicure.com.

About AGGRASTAT

Indications and Usage

AGGRASTAT is indicated to reduce the rate of thrombotic cardiovascular events (combined endpoint of death, myocardial infarction,

or refractory ischemia/repeat cardiac procedure) in patients with non-ST elevation acute coronary syndrome (NSTE-ACS).

Dosage and Administration

Administer intravenously 25 mcg/kg within 5 minutes and then 0.15 mcg/kg/min for up to 18 hours. In patients with creatinine clearance

≤60 mL/min, give 25 mcg/kg within 5 minutes and then 0.075 mcg/kg/min.

Clinical Experience

In clinical studies with the HDB regimen, Aggrastat was administered in combination with aspirin, clopidogrel and heparin or bivalirudin

to over 8,000 patients for typically ≤24 hours.

Contraindications

Known hypersensitivity to any component of Aggrastat History of thrombocytopenia with prior exposure to Aggrastat Active internal

bleeding, or history of bleeding diathesis, major surgical procedure or severe physical trauma within previous month.

Warnings and Precautions

Aggrastat can cause serious bleeding. If bleeding cannot be controlled discontinue Aggrastat. Thrombocytopenia: Discontinue Aggrastat

and heparin.

Adverse Reactions

Bleeding is the most commonly reported adverse reaction.

For more information on AGGRASTAT, please refer to Full Prescribing

Information.

To be added to Medicure's e-mail list, please visit:

http://medicure.mediaroom.com/alerts

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy

of this release.

Forward Looking Information: Statements contained in

this press release that are not statements of historical fact, including, without limitation, statements containing the words "believes",

"may", "plans", "will", "estimates", "continues", "anticipates", "intends",

"expects" and similar expressions, may constitute "forward-looking information" within the meaning of applicable

Canadian and U.S. federal securities laws (such forward-looking information and forward-looking statements are hereinafter collectively

referred to as "forward-looking statements"). Forward-looking statements, including the target launch date for Prexxartan® and

other new products, estimates, analysis and opinions of management of the Company made in light of its experience and its perception

of trends, current conditions and expected developments, as well as other factors which the Company believes to be relevant and

reasonable in the circumstances. Inherent in forward-looking statements are known and unknown risks, uncertainties and other factors

beyond the Company's ability to predict or control that may cause the actual results, events or developments to be materially different

from any future results, events or developments expressed or implied by such forward-looking statements, and as such, readers are

cautioned not to place undue reliance on forward-looking statements. Such risk factors include, among others, the Company's future

product revenues, stage of development, additional capital requirements, risks associated with the completion and timing of clinical

trials and obtaining regulatory approval to market the Company's products, the ability to protect its intellectual property, dependence

upon collaborative partners, changes in government regulation or regulatory approval processes, and rapid technological change

in the industry. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited

to, assumptions about: general business and economic conditions; the impact of changes in Canadian-US dollar and other foreign

exchange rates on the Company's revenues, costs and results; the timing of the receipt of regulatory and governmental approvals

for the Company's research and development projects; the availability of financing for the Company's commercial operations and/or

research and development projects, or the availability of financing on reasonable terms; results of current and future clinical

trials; the uncertainties associated with the acceptance and demand for new products and market competition. The foregoing list

of important factors and assumptions is not exhaustive. The Company undertakes no obligation to update publicly or otherwise revise

any forward-looking statements or the foregoing list of factors, other than as may be required by applicable legislation. Additional

discussion regarding the risks and uncertainties relating to the Company and its business can be found in the Company's other filings

with the applicable Canadian securities regulatory authorities or the US Securities and Exchange Commission, and in the "Risk

Factors" section of its Form 20F for the year ended December 31, 2016.

AGGRASTAT® (tirofiban hydrochloride) is a registered

trademark of Medicure International, Inc.

| Condensed Consolidated Interim Statements of Financial Position |

|

| (expressed in Canadian dollars) |

|

| (unaudited) |

|

| |

|

September 30, 2017 |

December 31, 2016 |

| |

|

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

| |

Cash and cash equivalents |

|

$ |

2,095,597 |

$ |

12,266,177 |

| |

Cash held in escrow |

|

- |

12,809,072 |

| |

Accounts receivable |

|

7,951,266 |

17,200,778 |

| |

Inventories |

|

2,675,705 |

12,176,644 |

| |

Prepaid expenses |

|

1,221,594 |

759,077 |

| |

Assets held for sale |

|

164,277,016 |

- |

| |

Total current assets |

|

178,221,178 |

55,211,748 |

| Non-current assets: |

|

|

|

| |

Property, plant and equipment |

|

227,634 |

10,300,639 |

| |

Goodwill |

|

- |

47,485,572 |

| |

Intangible assets |

|

- |

100,864,817 |

| |

Other assets |

|

- |

161,891 |

| |

Deferred tax assets |

|

650,105 |

701,000 |

| |

Total non-current assets |

|

877,739 |

159,513,919 |

| Total assets |

|

$ |

179,098,917 |

$ |

214,725,667 |

| |

|

|

|

| Liabilities and Equity |

|

|

|

| Current liabilities: |

|

|

|

| |

Short-term borrowings |

|

$ |

- |

$ |

1,383,864 |

| |

Accounts payable and accrued liabilities |

|

3,797,123 |

17,242,366 |

| |

Current income taxes payable |

|

461,352 |

504,586 |

| |

Deferred revenue |

|

- |

1,161,608 |

| |

Current portion of finance lease obligations |

|

- |

89,241 |

| |

Current portion of long-term debt |

|

1,382,809 |

2,883,752 |

| |

Current portion of royalty obligation |

|

1,561,740 |

2,019,243 |

| |

Current portion of due to vendor |

|

3,179,307 |

- |

| |

Derivative option on Apicore Class C shares |

|

- |

32,901,006 |

| |

Liability to repurchase Apicore Class E shares |

|

- |

2,700,101 |

| |

Liabilities held for sale |

|

52,487,309 |

- |

| |

Total current liabilities |

|

62,869,640 |

60,885,767 |

| Non-current liabilities |

|

|

|

| |

Long-term debt |

|

55,811,303 |

68,180,424 |

| |

Finance lease obligations |

|

- |

242,449 |

| |

Royalty obligation |

|

3,249,854 |

3,666,479 |

| |

Due to vendor |

|

- |

2,759,507 |

| |

Fair value of Apicore Series A-1 preferred shares |

|

- |

1,755,530 |

| |

Other long-term liabilities |

|

- |

133,999 |

| |

Deferred tax liabilities |

|

33,685,087 |

38,142,775 |

| |

Total non-current liabilities |

|

92,746,244 |

114,881,163 |

| Total liabilities |

|

155,615,884 |

175,766,930 |

| Condensed Consolidated Interim Statements of Financial Position (continued) |

|

| (expressed in Canadian dollars) |

|

| (unaudited) |

|

|

|

| |

|

September 30, 2017 |

December 31, 2016 |

| Equity: |

|

|

|

| |

Share capital |

|

125,370,957 |

124,700,345 |

| |

Warrants |

|

1,948,805 |

2,020,152 |

| |

Contributed surplus |

|

6,520,997 |

6,756,201 |

| |

Accumulated other comprehensive (loss) income |

|

(7,791,009) |

681,992 |

| |

Deficit |

|

(105,318,235) |

(97,289,953) |

| Total equity attributable to shareholders of the company |

|

20,731,515 |

36,868,737 |

| |

Non-controlling interest |

|

2,751,518 |

2,090,000 |

| Total equity |

|

23,483,033 |

38,958,737 |

| Commitments and contingencies |

|

|

|

| Subsequent events |

|

|

|

| Total liabilities and equity |

|

$ 179,098,917 |

$ 214,725,667 |

| Condensed Consolidated Interim Statements of Net (Loss) Income and Comprehensive (Loss) Income |

| (expressed in Canadian dollars) |

|

|

|

| (unaudited) |

|

|

|

|

| |

Three

months

ended

September 30,

2017 |

Three

months

ended

September 30,

2016 |

Nine

months

ended

September 30,

2017 |

Nine

months

ended

September 30,

2016 |

| Revenue, net |

|

|

|

|

| |

AGGRASTAT® |

$ |

7,037,280 |

$ |

8,203,523 |

$ |

22,104,857 |

$ |

21,974,689 |

| Cost of goods sold |

843,743 |

992,045 |

2,175,591 |

2,731,142 |

| Gross Profit |

6,193,537 |

7,211,478 |

19,929,266 |

19,243,547 |

| |

|

|

|

|

| Expenses |

|

|

|

|

| |

Selling, general and administrative |

3,578,040 |

3,724,094 |

11,191,072 |

11,939,821 |

| |

Research and development |

807,062 |

1,018,201 |

3,561,630 |

2,926,186 |

| |

4,385,102 |

4,742,295 |

14,752,702 |

14,866,007 |

| Income before the undernoted |

1,808,435 |

2,469,183 |

5,176,564 |

4,377,540 |

| |

|

|

|

|

| Other expense: |

|

|

|

|

| |

Revaluation of long-term derivative |

- |

129,507 |

- |

214,487 |

| |

- |

129,507 |

- |

214,487 |

| |

|

|

|

|

| Finance costs (income): |

|

|

|

|

| |

Finance expense, net |

2,502,645 |

296,561 |

6,826,337 |

946,754 |

| |

Foreign exchange (loss) gain, net |

(180,258) |

39,778 |

(454,727) |

(11,389) |

| |

2,322,387 |

336,339 |

6,371,610 |

935,365 |

| Net (loss) income before taxes |

(513,952) |

2,003,337 |

(1,195,046) |

3,227,688 |

| Income taxes (expense) recovery |

|

|

|

|

| |

Current |

(133,710) |

- |

(419,992) |

- |

| |

Deferred |

1,874,093 |

- |

3,788,483 |

- |

| Net income before discontinued operations |

$ |

1,226,431 |

$ |

2,003,337 |

$ |

2,173,445 |

$ |

3,227,688 |

| Net loss from discontinued operations, net of tax |

(5,534,193) |

- |

(10,201,727) |

- |

| Net (loss) income |

$ |

(4,307,762) |

$ |

2,003,337 |

$ |

(8,028,282) |

$ |

3,227,688 |

| Translation adjustment |

(8,211,132) |

205,430 |

(8,473,001) |

(493,129) |

| Comprehensive (loss) income |

$ |

(12,518,894) |

$ |

2,208,767 |

$ |

(16,501,283) |

$ |

2,734,559 |

| Condensed Consolidated Interim Statements of Cash Flows |

| (expressed in Canadian dollars) |

|

|

| (unaudited) |

|

|

| For the nine months ended September 30 |

2017 |

2016 |

| |

|

|

| Cash (used in) provided by: |

|

|

| Operating activities: |

|

|

| |

Net (loss) income for the period |

$ |

(8,020,282) |

$ |

3,227,688 |

| |

Adjustments for: |

|

|

| |

|

Current income tax expense |

419,992 |

- |

| |

|

Deferred income tax recovery |

(3,788,483) |

- |

| |

|

Amortization of property and equipment |

1,111,106 |

63,482 |

| |

|

Amortization of intangible assets |

6,633,940 |

1,214,171 |

| |

|

Share-based compensation |

132,346 |

1,340,001 |

| |

|

Reversal of previous write-down of inventory |

- |

(69,592) |

| |

|

Finance expense, net |

8,183,727 |

946,754 |

| |

|

Unrealized foreign exchange gain |

(758,815) |

(8,976) |

| |

|

Revaluation of long-term derivative |

- |

214,487 |

| |

Change in the following: |

|

|

| |

|

Accounts receivable |

5,544,375 |

3,208,552 |

| |

|

Inventories |

1,473,826 |

(1,180,642) |

| |

|

Prepaid expenses |

(8,032,325) |

1,385,169 |

| |

|

Other assets |

50,895 |

- |

| |

|

Accounts payable and accrued liabilities |

1,552,124 |

(4,049,915) |

| |

|

Deferred revenue |

30,511,346 |

- |

| |

|

Other long-term liabilities |

36,309 |

(100,000) |

| |

Interest paid |

(4,657,877) |

(149,615) |

| |

Income taxes paid |

(439,143) |

- |

| |

Royalties paid |

(1,374,534) |

(1,247,791) |

| Cash flows (used in) from operating activities |

28,578,527 |

4,793,773 |

| Investing activities: |

|

|

| |

Acquisition of Class C common shares of Apicore |

(31,606,865) |

- |

| |

Acquisition of Class E common shares of Apicore |

(2,640,725) |

- |

| |

Acquisition of property and equipment |

(1,089,868) |

(112,660) |

| Cash flows used in investing activities |

(35,337,458) |

(112,660) |

| Financing activities: |

|

|

| |

Proceeds from exercise of stock options |

271,729 |

1,814,780 |

| |

Proceeds from exercise of Apicore stock options |

421,942 |

- |

| |

Proceeds from exercise of warrants |

92,332 |

28,173 |

| |

Repayment of long-term debt |

(13,628,614) |

(1,250,001) |

| |

Decrease in cash in escrow |

12,809,072 |

- |

| |

Finance lease payments |

(119,355) |

- |

| |

Proceeds from short-term borrowings |

(343,802) |

- |

| Cash flows from (used in) financing activities |

(496,696) |

592,952 |

| Foreign exchange loss on cash held in foreign currency |

(11,364) |

(20,365) |

| (Decrease) increase in cash |

(7,266,991) |

5,253,700 |

| Cash used in discontinued operations |

(220,417) |

- |

| Cash and cash equivalents, beginning of period |

12,266,177 |

3,568,592 |

| Cash and cash equivalents, end of period * |

$ |

4,778,769 |

$ |

8,822,292 |

| |

|

|

* Cash and cash equivalents at September 30, 2017 contains $2,683,172, which is classified within

assets held for sale on the statement of financial position. |

SOURCE Medicure Inc.

View original content: http://www.newswire.ca/en/releases/archive/November2017/21/c6861.html

%CIK: 0001133519

For further information: James Kinley, Chief Financial Officer,

Tel. 888-435-2220, Fax 204-488-9823, E-mail: info@medicure.com, www.medicure.com

CO: Medicure Inc.

CNW 17:00e 21-NOV-17

This regulatory filing also includes additional resources:

ex991.pdf

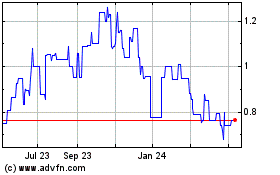

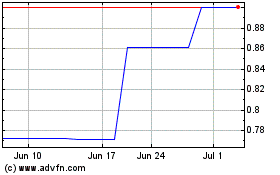

Medicure (PK) (USOTC:MCUJF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicure (PK) (USOTC:MCUJF)

Historical Stock Chart

From Apr 2023 to Apr 2024