Current Report Filing (8-k)

November 22 2017 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 20, 2017

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Florida

|

|

001-10613

|

|

59-1277135

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission file number)

|

|

(I.R.S. employer identification no.)

|

|

|

|

|

|

|

|

|

|

11780 U.S. Highway One, Suite 600,

|

|

|

|

|

|

Palm Beach Gardens, Florida 33408

|

|

|

|

|

|

(Address of principal executive offices) (Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

(561) 627-7171

|

|

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

o

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 5.08 Shareholder Director Nominations.

To the extent applicable, the information set forth under Item 8.01 of this Current Report on Form 8-K is incorporated by reference in this Item 5.08.

Item 8.01 Other Events.

As previously reported, on September 1, 2017, the Board of Directors of Dycom Industries, Inc. (the “Company”) approved a change in the Company’s fiscal year end from July to January. Beginning with a six-month transition period ending January 27, 2018, the Company’s fiscal year will end on the last Saturday of January. As a result, on November 20, 2017, the Board of Directors scheduled the Company’s 2018 Annual Meeting of Shareholders (the “2018 Annual Meeting”) for May 22, 2018. The exact time and location of the Annual Meeting will be specified in the Company’s proxy statement for the 2018 Annual Meeting. Because the date of the 2018 Annual Meeting is more than 30 days before the anniversary of the date of the Company’s 2017 Annual Meeting of Shareholders, a new deadline has been set for the receipt of shareholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). If a shareholder intends to present a proposal at the 2018 Annual Meeting, such proposal must be received by the Secretary of the Company on or before December 13, 2017 to be considered for inclusion in the Company’s proxy materials for the 2018 Annual Meeting. Any such proposals must also comply with the requirements of the Company’s Amended and Restated By-laws and Rule 14a-8 under the Exchange Act.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act. These statements are based on management’s current expectations, estimates and projections. Forward-looking statements are subject to risks and uncertainties that may cause actual results in the future to differ materially from the results projected or implied in any forward-looking statements contained in this Current Report on Form 8-K. The most significant of these risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) and include business and economic conditions and trends in the telecommunications industry affecting the Company’s customers, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, preliminary purchase price allocations of acquired businesses, expected benefits and synergies of acquisitions, future financial and operating results, the future impact of any acquisitions or dispositions, adjustments and cancellations related to the Company’s backlog, the anticipated outcome of other contingent events, including litigation, liquidity and other financial needs, the availability of financing, and the other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. These filings are available on a website maintained by the Securities and Exchange Commission at http://www.sec.gov. The Company does not undertake to update forward looking statements except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: November 21, 2017

|

|

|

|

|

|

DYCOM INDUSTRIES, INC.

(Registrant)

|

|

By:

|

/s/ Richard B. Vilsoet

|

|

Name:

|

Richard B. Vilsoet

|

|

Title:

|

Vice President, General Counsel and Corporate Secretary

|

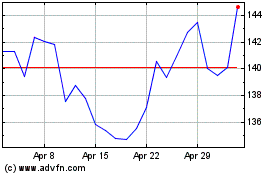

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Mar 2024 to Apr 2024

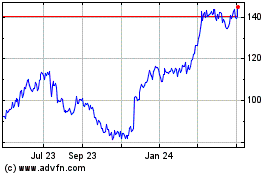

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Apr 2023 to Apr 2024