UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 13e-4)

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR SECTION 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

NATIONAL

OILWELL VARCO, INC.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

CERTAIN STOCK APPRECIATION RIGHTS

(Title of Class of Securities)

637071101

(CUSIP Number

of Class Of Securities (Underlying Common Stock))

Brigitte M. Hunt

Vice President

National

Oilwell Varco, Inc.

7909 Parkwood Circle Drive

Houston, Texas 77036-6565

(713) 346-7500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Filing Person)

Copy to:

J. Eric Johnson

Locke

Lord LLP

JPMorgan Chase Tower

600 Travis, Suite 2800

Houston, Texas 77002

(713) 226-1200

CALCULATION OF

FILING FEE

|

|

|

|

|

TRANSACTION VALUATION*

|

|

AMOUNT OF FILING FEE*

|

|

$34,261,346

|

|

$4,265.54

|

|

*

|

Calculated solely for purposes of determining the filing fee. This amount assumes that 3,823,811 stock appreciation rights (“SARs”) having an aggregate value of $34,261,346 as of November 20, 2017, will

be tendered pursuant to this offer. The aggregate value of such SARs was calculated based on the market value thereof in accordance with Rule

0-11

of the Securities Exchange Act of 1934, as amended.

|

|

☐

|

Check box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

Amount Previously Paid:

|

|

Not applicable

|

|

Filing party:

|

|

Not applicable

|

|

Form or Registration No.:

|

|

Not applicable

|

|

Date Filed:

|

|

Not applicable

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to

Rule 14d-1

|

|

|

☒

|

issuer tender offer subject to

Rule 13e-4

|

|

|

☐

|

going private transaction subject to

Rule 13e-3

|

|

|

☐

|

amendment to Schedule 13D under

Rule 13d-2

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

Item 1.

Summary Term Sheet.

The information set forth in the introductory pages and under “Summary Term Sheet—Questions and Answers” in the Offering

Memorandum relating to our Offer to Exchange Certain Outstanding Stock Appreciation Rights for a Cash Payment, Amended SARs and New Options to purchase common stock, par value $0.01 per share, dated November 21, 2017 (the “Offering

Memorandum”), attached hereto as Exhibit (a)(1)(i), is incorporated herein by reference.

Item 2. Subject Company Information.

(a) The name of the issuer is National Oilwell Varco, Inc., a Delaware corporation (“NOV”, or the “Company”) and the

address of its principal executive office is 7909 Parkwood Circle Drive, Houston, Texas 77036-6565. The telephone number at that address is (713)

346-7500.

The information set forth in the Offering Memorandum

under Section 9 (“Information Concerning National Oilwell Varco, Inc.”) is incorporated herein by reference.

(b) This

Tender Offer Statement on Schedule TO relates to an offer (the “Offer”) by the Company to provide certain eligible employees of NOV and its wholly-owned subsidiaries (“Eligible Holders”) the opportunity to exchange certain

outstanding and unexercised stock appreciation rights (“SARs”) issued on February 24, 2016 and March 28, 2016 under the Company’s Stock Appreciation Rights & Phantom Equity Plan (the “SAR Plan”) (the

“Eligible SARs Awards”) for 1) a cash payment for the spread (as defined in the Offering Memorandum) on the vested and unexercised portion of the Eligible SARs Awards (in connection with the Offer, the Company is accelerating the vesting

of Eligible SARs Awards through the second vesting date such that each Eligible SARs Award tendered and accepted in the Offer will be deemed two thirds (2/3) vested as of the date the Offer expires) (the “Cash Payment”), 2) an amended and

restated SAR award for the unvested portion of the Eligible SARs Awards (the “Amended SARs”), and 3) a new award of options to purchase the Company’s common stock (the “New Options”), each as more fully described in the

Offering Memorandum. The Cash Payment, the Amended SARs and the New Options are collectively referred to as the “New Awards.” Only Eligible SARs Awards that are outstanding on November 21, 2017, held by Eligible Holders during the

entire period from and including November 21, 2017 through the Expiration Date (as defined in the Offering Memorandum) (the “Eligibility Period”), will be eligible to tender in the Offer. During the Eligibility Period, the Eligible

Holder must: 1) be employed by the Company or one of its wholly-owned subsidiaries on the date the Offer commences, 2) continue to be an employee of the Company or one of its wholly-owned subsidiaries and not submit or receive a notice of

termination on or prior to the Expiration Date, and 3) hold an Eligible SARs Award.

The information set forth in the Offering Memorandum

on the introductory pages and under Section 1 (“Eligibility; New Awards; Expiration Date”), Section 5 (“Acceptance of Eligible SARs Awards in Exchange for New Awards”) and Section 8 (“Source and Amount of

Consideration; Terms of Cash Payment, Amended SARs and New Options”) is incorporated herein by reference.

(c) The information set

forth in the Offering Memorandum under Section 6 (“Price Range of Common Stock”) is incorporated herein by reference.

Item 3. Identity

and Background of Filing Person.

The Company is both the filing person and the subject company. The information set forth under

Item 2(a) above is incorporated herein by reference. The information set forth in the Offering Memorandum under Section 10 (“Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the

SARs”) is incorporated herein by reference. The information set forth in Schedule A (“Information Concerning the Directors and Executive Officers of National Oilwell Varco, Inc.”) to the Offering Memorandum is incorporated herein

by reference.

Item 4. Terms of the Transaction.

(a) The information set forth in the Offering Memorandum under Section 1 (“Eligibility; New Awards; Expiration Date”),

Section 3 (“Procedures for Electing to Exchange Eligible SARs Awards”), Section 4

(“Withdrawal Rights”), Section 5 (“Acceptance of Eligible SARs Awards in Exchange for New Awards”), Section 7 (“Conditions of this Offer”), Section 8

(“Source and Amount of Consideration; Terms of Cash Payment, Amended SARs and New Options”), Section 11 (“Status of Eligible SARs Awards Acquired by Us in this Offer; Accounting Consequences of this Offer”), Section 12

(“Legal Matters; Regulatory Approvals”), Section 13 (“Material U.S. Federal Income Tax Consequences”) and Section 14 (“Extension of Offer; Termination; Amendment”) is incorporated herein by reference.

(b) Certain employees of NOV and its wholly-owned subsidiaries are eligible to participate in the Offer. The information set forth in the

Offering Memorandum under Section 10 (“Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the SARs”) is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

The information set forth in the Offering Memorandum under Section 10 (“Interests of Directors, Executive Officers and Affiliates;

Transactions and Arrangements Concerning the SARs”) and in the Company’s Definitive Proxy Statement filed with the Securities Exchange Commission on April 17, 2017 is incorporated herein by reference. The SAR Plan, the Company’s

Long-Term Incentive Plan and their respective form of award agreements are incorporated herein by reference to Exhibits (d)(1) to (d)(4).

Item 6.

Purposes of the Transaction and Plans or Proposals.

(a) The information set forth in the Offering Memorandum under Section 2

(“Purpose of this Offer”) is incorporated herein by reference.

(b) The information set forth in the Offering Memorandum under

Section 5 (“Acceptance of Eligible SARs Awards in Exchange for New Awards”) and Section 11 (“Status of Eligible SARs Awards Acquired by Us in this Offer; Accounting Consequences of this Offer”) is incorporated herein by

reference.

(c) The information set forth in the Offering Memorandum under Section 2 (“Purpose of this Offer”) is

incorporated herein by reference.

Item 7. Source and Amount of Funds or Other Consideration.

(a) The information set forth in the Offering Memorandum under Section 8 (“Source and Amount of Consideration; Terms of Cash Payment,

Amended SARs and New Options”) and Section 15 (“Fees and Expenses”) is incorporated herein by reference.

(b) The

information set forth in the Offering Memorandum under Section 7 (“Conditions of this Offer”) is incorporated herein by reference.

(c) Not applicable.

(d) Not

applicable.

Item 8. Interest in Securities of the Subject Company.

(a) The information set forth in the Offering Memorandum under Section 10 (“Interests of Directors, Executive Officers and

Affiliates; Transactions and Arrangements Concerning the SARs”) is incorporated herein by reference.

(b) The information set forth

in the Offering Memorandum under Section 10 (“Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the SARs”) and in Schedule A of the Offering Memorandum is incorporated herein by

reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

Not applicable.

Item 10. Financial Statements.

(a) The information set forth in the Offering Memorandum under Section 9 (“Information Concerning National Oilwell Varco,

Inc.”), Section 16 (“Additional Information”) and the information set forth in the Company’s Annual Report on

Form 10-K

for the year ended December 31, 2016 under Item 6

“Selected Financial Data,” Item 8 “Financial Statements and Supplementary Data” and Item 15(1) “Financial Statements”, and in the Company’s Quarterly Report on Form

10-Q

for the quarter ended September 30, 2017 under Item 1 “Financial Statements” is incorporated herein by reference.

(b) Not

applicable.

Item 11. Additional Information.

(a) The information set forth in the Offering Memorandum under Section 10 (“Interests of Directors, Executive Officers and

Affiliates; Transactions and Arrangements Concerning the SARs”) and Section 12 (“Legal Matters; Regulatory Approvals”) is incorporated herein by reference.

(c) Not applicable.

Item 12. Exhibits.

|

|

|

|

|

|

|

(a)(1)(i)

|

|

*

|

|

Offering Memorandum relating to our Offer to Exchange Certain Outstanding Stock Appreciation Rights for Cash, Amended SARs and New Options to

Purchase Common Stock, par value $0.01 Per Share, dated November 21, 2017

|

|

(a)(1)(ii)

|

|

*

|

|

Communication to Eligible Holders of National Oilwell Varco, Inc. Announcing the Opening of the Exchange Program, to be delivered via

e-mail

on November 21, 2017.

|

|

(a)(1)(iii)

|

|

*

|

|

Highlights of the National Oilwell Varco, Inc. Stock Appreciation Right Exchange Program.

|

|

(a)(1)(iv)

|

|

*

|

|

Reminder Communication to Eligible Holders of National Oilwell Varco, Inc. to be delivered via email on November 27, 2017 and

December 11, 2017.

|

|

(a)(1)(v)

|

|

*

|

|

Communication to Eligible Holders after market close on the Expiration Date.

|

|

(a)(1)(vi)

|

|

*

|

|

National Oilwell Varco, Inc. Exchange Program Election Form.

|

|

(a)(1)(vii)

|

|

*

|

|

National Oilwell Varco, Inc. Election Confirmation Form.

|

|

(a)(2)

|

|

|

|

Not applicable.

|

|

(a)(3)

|

|

|

|

Not applicable.

|

|

(a)(4)

|

|

|

|

Not applicable.

|

|

(a)(5)

|

|

|

|

Not applicable.

|

|

(b)

|

|

|

|

Not applicable.

|

|

(c)

|

|

|

|

Not applicable.

|

|

(d)(1)

|

|

*

|

|

National Oilwell Varco, Inc. Stock Appreciation Rights and Phantom Equity Plan.

|

|

(d)(2)

|

|

*

|

|

Form of Amended and Restated Stock Appreciation Rights Agreement.

|

|

(d)(3)

|

|

|

|

The National Oilwell Varco, Inc. Long-Term Incentive Plan, as amended and restated, is incorporated herein by reference to the National

Oilwell Varco, Inc. Registration Statement on

Form S-8

as filed with the Securities and Exchange Commission on May 23, 2016.

|

|

|

|

|

|

|

|

(d)(4)

|

|

|

|

The National Oilwell Varco, Inc. Form of Employee Nonqualified Stock Option Agreement is incorporated herein by reference to National Oilwell

Varco, Inc. Current Report on Form

8-K

filed with the Securities and Exchange Commission on February 26, 2016.

|

|

(e)

|

|

|

|

Not applicable.

|

|

(f)

|

|

|

|

Not applicable.

|

|

(g)

|

|

|

|

Not applicable.

|

|

(h)

|

|

|

|

Not applicable.

|

|

*

|

Filed electronically herewith

|

Item 13. Information Required by Schedule

13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

|

|

Date: November 21, 2017

|

|

|

|

NATIONAL OILWELL VARCO, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Brigitte M. Hunt

|

|

|

|

|

|

Name:

|

|

Brigitte M. Hunt

|

|

|

|

|

|

Title:

|

|

Vice President

|

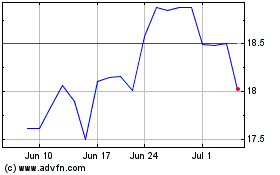

NOV (NYSE:NOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

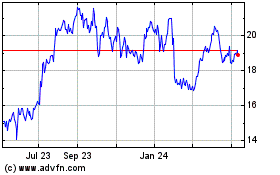

NOV (NYSE:NOV)

Historical Stock Chart

From Apr 2023 to Apr 2024