Amended Tender Offer Statement by Issuer (sc To-i/a)

November 20 2017 - 4:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment

No. 1)

INFOSYS LIMITED

(Name of Subject Company (Issuer) and Filing Person (as Offeror))

Equity Shares, par value Rs. 5 per share

(Title of Class of Securities)

The Equity Shares, which are not traded on U.S. markets, have not been assigned a CUSIP number

(CUSIP Number of Class of Securities)

M.D. Ranganath

Chief

Financial Officer

Infosys Limited

Electronics City, Hosur Road

Bengaluru, Karnataka

India 560 100

+91-80-2852-0261

(Name, address, and telephone number of

person authorized to receive notices and communications on behalf of filing persons)

Copies to:

Steven V. Bernard, Esq.

Bradley L. Finkelstein, Esq.

Wilson Sonsini Goodrich & Rosati

Professional Corporation

650 Page Mill Road

Palo

Alto, CA 94304

Telephone: (650)

493-9300

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

$1,993,666,995.40

|

|

$248,212.00

|

|

*

|

Calculated solely for purposes of determining the filing fee. This amount is based on the purchase of up to 113,043,478 fully

paid-up

equity share(s) of face value of

₹

5/- (Rupees Five only) each at the tender offer price of

₹

1,150/- (Rupees One Thousand One Hundred and Fifty only) per equity share (or USD $17.64 per equity

share).

|

|

**

|

The amount of the filing fee, calculated in accordance with the Securities Exchange Act of 1934, as amended, equals $124.50 for each $1,000,000 of the value of this transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $248,212.00

|

|

Filing Party: Infosys Limited

|

|

Form or Registration No.: Schedule TO

|

|

Date Filed: November 17, 2017

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule

14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule

13e-4.

|

|

|

☐

|

going-private transaction subject to Rule

13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule

13d-2.

|

Check the following box if

the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to

designate the appropriate rule provision(s) relied upon:

|

|

☒

|

Rule

13e-4(i)

(Cross-Border Issuer Tender Offer)

|

|

|

☐

|

Rule

14d-1(d)

(Cross-Border Third-Party Tender Offer)

|

This Amendment No. 1 (this “Amendment”) amends and supplements the Tender Offer Statement on

Schedule TO (together with any subsequent amendments and supplements thereto, the “Schedule TO”), filed with the Securities and Exchange Commission on November 17, 2017 by Infosys Limited, a company organized under the laws of the

Republic of India (the “Company” or “Infosys”). The Schedule TO relates to the tender offer by Infosys to purchase up to 113,043,478 of its fully

paid-up

equity shares of face value of

₹

5/- (Rupees Five only), each at the tender offer price of

₹

1,150/- (Rupees One Thousand One Hundred and Fifty only) per equity share, upon the terms and subject to

the conditions set forth in the Letter of Offer dated November 17, 2017, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(A) (the “Buyback”). This Amendment is being filed to correct an inadvertent typographical error

contained in the Letter of Offer.

Except as otherwise set forth in this Amendment, the information in the Schedule TO and the exhibits thereto remains

unchanged and is incorporated herein by reference. Capitalized terms used but not defined herein have the meaning ascribed to them in the Schedule TO and the related exhibits incorporated therein by reference.

Item 4. Terms of the Transaction

The first sentence

under the heading “Surcharge” in Section 25 “Note on Taxation” on page 55 of the Letter of Offer is hereby deleted and replaced in its entirety with the following:

“In case of individuals, HUF, AOP and BOI: Surcharge at 15% is leviable where the total income

exceeds

₹

10 million (approximately US$ 0.15 million) and at 10% where the total income exceeds

₹

5 million (approximately US$ 0.08

million).”

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

INFOSYS LIMITED

|

|

|

|

/s/ Inderpreet Sawhney

|

|

Inderpreet Sawhney

|

|

General Counsel

|

Date: November 20, 2017

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

(a)(1)(A)

|

|

Letter of Offer dated November 17, 2017. *

|

|

|

|

|

(a)(1)(B)

|

|

Tender Form for Equity Shareholders Holding Shares in Dematerialised Form. *

|

|

|

|

|

(a)(1)(C)

|

|

Tender Form for Equity Shareholders Holding Shares in Physical Form.*

|

|

|

|

|

(a)(1)(D)

|

|

Form No.

SH-4

Securities Transfer Form.*

|

|

|

|

|

(a)(1)(E)

|

|

Summary Advertisement.*

|

|

|

|

|

(a)(1)(F)

|

|

Notice to Stock Exchanges dated August 16, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on August 16, 2017).

|

|

|

|

|

(a)(1)(G)

|

|

Notice to Stock Exchanges dated August 19, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on August 21, 2017).

|

|

|

|

|

(a)(1)(H)

|

|

Notice to Stock Exchanges dated August 28, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on August 28, 2017).

|

|

|

|

|

(a)(1)(I)

|

|

Notice to Stock Exchanges dated September 1, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on September 1, 2017).

|

|

|

|

|

(a)(1)(J)

|

|

Postal Ballot Notice dated August 25, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on September 1, 2017).

|

|

|

|

|

(a)(1)(K)

|

|

Postal Ballot Form (incorporated by reference to the Company’s Schedule

TO-C

filed on September 1, 2017).

|

|

|

|

|

(a)(1)(L)

|

|

Certain Tax Considerations for

Non-Resident

Shareholders related to the Buyback (incorporated by reference to the Company’s Schedule

TO-C

filed on

September 1, 2017).

|

|

|

|

|

(a)(1)(M)

|

|

Notice to Shareholders of Infosys Limited dated September 7, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on September 8, 2017).

|

|

|

|

|

(a)(1)(N)

|

|

Voting Results Notice (incorporated by reference to the Company’s Schedule

TO-C

filed on October 10, 2017).

|

|

|

|

|

(a)(1)(O)

|

|

Record Date Notice (incorporated by reference to the Company’s Schedule

TO-C

filed on October 10, 2017).

|

|

|

|

|

(a)(1)(P)

|

|

Public Announcement, dated October 9, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on October 10, 2017).

|

|

|

|

|

(a)(1)(Q)

|

|

August 19, 2017 Resolutions (incorporated by reference to the Company’s Schedule

TO-C

filed on October 10, 2017).

|

|

|

|

|

(a)(1)(R)

|

|

August 25, 2017 Resolutions (incorporated by reference to the Company’s Schedule

TO-C

filed on October 10, 2017).

|

|

|

|

|

(a)(1)(S)

|

|

Special Resolutions (incorporated by reference to the Company’s Schedule

TO-C

filed on October 10, 2017).

|

|

|

|

|

(a)(1)(T)

|

|

Draft Letter of Offer, dated October 17, 2017 (incorporated by reference to the Company’s Schedule

TO-C

filed on October 17, 2017).

|

|

|

|

|

(d)(1)(A)

|

|

Escrow Agreement dated October 27, 2017 between Infosys Limited, Kotak Mahindra Bank Limited and Kotak Mahindra Capital Company Limited and J.P. Morgan India Private Limited.*

|

|

|

|

|

(d)(1)(B)

|

|

Form of Deposit Agreement among the Registrant, Deutsche Bank Trust Company Americas and holders from time to time of American Depositary Receipts issued thereunder (including as an exhibit, the form of American Depositary Receipt)

(incorporated by reference from Exhibit 4.1 to the Company’s Form

20-F

filed on June 12, 2017).

|

|

|

|

|

(d)(1)(C)

|

|

The Company’s 2015 Stock Incentive Compensation Plan (incorporated by reference from Exhibit 4.3 to the Company’s Form

20-F

filed on June 12, 2017).

|

|

|

|

|

(d)(1)(D)

|

|

Employees Welfare Trust Deed of the Company Pursuant to Employee Stock Offer Plan (incorporated by reference from Exhibit 4.5 to the Company’s Form

20-F

filed on June 12,

2017).

|

|

|

|

|

(d)(1)(E)

|

|

Form of Employment Agreement with the Chief Operating Officer (incorporated by reference from Exhibit 4.7 to the Company’s Form

20-F

filed on June 12, 2017).

|

|

|

|

|

(d)(1)(F)

|

|

Form of Employment Agreement with the Chief Executive Officer (incorporated by reference from Exhibit 4.8 to the Company’s Form

20-F

filed on June 12, 2017).

|

|

•

|

Previously Filed with the Schedule TO

|

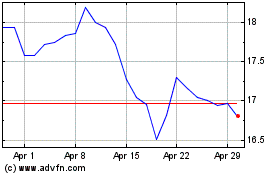

Infosys (NYSE:INFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Infosys (NYSE:INFY)

Historical Stock Chart

From Apr 2023 to Apr 2024