Independence Realty Trust Obtains $100 Million Term Loan

November 20 2017 - 4:05PM

Business Wire

Independence Realty Trust, Inc. (“IRT”) (NYSE:IRT), a

multi-family apartment REIT, today announced it entered into a

seven-year, $100 million unsecured term loan agreement (the “Term

Loan”), that will reach maturity in November 2024.

The proceeds will reduce borrowings currently outstanding under

the revolving portion of IRT’s $300 million unsecured credit

facility. The Term Loan bears interest at a spread over LIBOR,

based on IRT’s overall leverage. At closing, the spread to LIBOR

was 165 basis points. To continue IRT’s practice of reducing

exposure to floating interest rates, IRT purchased a collar that

caps LIBOR at 2.00%, subject to a floor on LIBOR of 1.25%, during

the entire seven-year term of the new Term Loan.

“This agreement increases the capacity on our current line of

credit, maintains our flexibility for future growth initiatives,

and extends the maturity an additional 3 years beyond our current

line of credit,” said Scott Schaeffer, IRT’s Chairman and Chief

Executive Officer. “We continue to focus on maintaining a low-risk,

high-quality balance sheet, and thank our lending partners for

their continued support.”

The term loan was led by Keybanc Capital Markets, as

administrative agent, as well as Capital One, National Association

and the Huntington National Bank, as Co-Syndication Agents.

About Independence Realty Trust, Inc.

Independence Realty Trust (NYSE: IRT) is a real estate

investment trust. Upon completion of the previously announced nine

community portfolio acquisition, IRT will own and operate 55

multifamily apartment properties, totaling 15,165 units, across

non-gateway U.S. markets, including Louisville, Memphis, Atlanta

and Raleigh. IRT’s investment strategy is focused on gaining scale

within key amenity rich submarkets that offer good school

districts, high-quality retail and major employment centers. IRT

aims to provide stockholders attractive risk-adjusted returns

through diligent portfolio management, strong operational

performance, and a consistent return of capital through

distributions and capital appreciation.

Forward-Looking Statements

This press release may contain certain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Such forward-looking statements can generally

be identified by our use of forward-looking terminology such as

“will,” “strategy,” “expects,” “seeks,” “believes,” “potential,” or

other similar words. Because such statements include risks,

uncertainties and contingencies, actual results may differ

materially from the expectations, intentions, beliefs, plans or

predictions of the future expressed or implied by such

forward-looking statements. These forward-looking statements are

based upon the current beliefs and expectations of IRT’s management

and are inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and generally not within IRT’s control. In

addition, these forward-looking statements are subject to

assumptions with respect to future business strategies and

decisions that are subject to change. These risks, uncertainties

and contingencies include, but are not limited to, those disclosed

in IRT’s filings with the Securities and Exchange Commission. IRT

undertakes no obligation to update these forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events, except as may be

required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171120006076/en/

Independence Realty Trust, Inc.Edelman Financial

Communications & Capital MarketsTed McHugh and Lauren

Tarola212-277-4322IRT@edelman.com

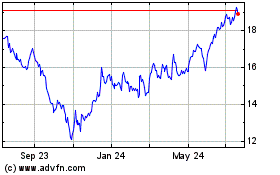

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Apr 2023 to Apr 2024