Securities Registration: Employee Benefit Plan (s-8)

November 20 2017 - 3:47PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 20, 2017

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Golar LNG Limited

(Exact name of registrant as specified in its charter)

|

Bermuda

|

|

N/A

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

2

nd

Floor, S.E. Pearman Building

9 Par-la-Ville Road

Hamilton, HM 11, Bermuda

(Address, including zip code of Registrant’s principal executive offices)

Golar LNG Limited Long-Term Incentive Plan

(Full title of the plan)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Attention: Mr. Donald Puglisi

Telephone: (302) 738-6680

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Catherine S. Gallagher

Vinson & Elkins L.L.P.

2200 Pennsylvania Avenue NW

Suite 500 West

Washington, DC 20037-1701

(202) 639-6544

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

o

|

|

Non-accelerated filer

|

|

o

(

Do not check if smaller reporting company)

|

|

Smaller Reporting Company

o

|

|

|

|

|

|

Emerging Growth Company

o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”).

o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of securities

to be registered

|

|

Amount to be

registered(1)

|

|

Proposed

maximum offering

price per share(2)

|

|

Proposed

maximum

aggregate

offering price(2)

|

|

Amount of

registration fee

|

|

|

Common Shares, par value $1.00 per share

|

|

3,000,000

|

|

$

|

22.79

|

|

$

|

68,370,000

|

|

$

|

8,513

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Represents fully paid common shares, par value $1.00 per share (the “Common Shares”), of Golar LNG Limited (the “Registrant”) reserved for delivery under the Golar LNG Limited Long-Term Incentive Plan (the “Plan”). Pursuant to Rule 416(a) under the Securities Act, this registration statement shall be deemed to cover an indeterminate number of additional Common Shares that may become issuable as a result of share splits, share dividends or similar transactions pursuant to the adjustment or anti-dilution provisions of the Plan.

(2)

The proposed maximum offering price per share and the proposed maximum aggregate offering price of the Common Shares being registered hereby have been estimated solely for purposes of calculating the registration fee pursuant to Rule 457(h) under the Securities Act based on the average of the high and low prices for a share of Common Shares as reported on the NASDAQ Global Select Market on November 15, 2017.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The Registrant will provide all participants in the Plan with the document(s) containing the information required by Part I of Form S-8, as specified in Rule 428(b)(1) promulgated by the Securities and Exchange Commission (the “Commission”) under the Securities Act. In accordance with the rules and regulations of the Commission, the Registrant has not filed such document(s) with the Commission, but such documents (along with the documents incorporated by reference into this Registration Statement on Form S-8 (this “Registration Statement”) pursuant to Item 3 of Part II hereof), taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. The Registrant shall maintain a file of such documents in accordance with the provisions of Rule 428(a)(2) of the Securities Act. Upon request, the Registrant shall furnish to the Commission or its staff a copy or copies of all of the documents included in such file.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3.

Incorporation of Documents by Reference.

Except to the extent that information is deemed furnished and not filed pursuant to securities laws and regulations, the following documents have been filed by the Registrant with the Commission and are incorporated by reference into this Registration Statement and will be deemed to be a part hereof:

(a)

The Registrant’s latest annual report on Form 20-F, filed with the Commission on May 1, 2017;

(b)

The Registrant’s reports on Form 6-K, filed with the Commission on May 31, 2017 (File No. 000-50113) and September 29, 2017; and

(c)

The description of the Common Shares included under the caption “Description of Share Capital” contained in the Registrant’s Registration Statement on Form F-3 filed with the Commission on June 30, 2017, including any amendment or report filed for the purpose of updating such description.

2

Except to the extent that information is deemed furnished and not filed pursuant to securities laws and regulations, all documents filed with the Commission by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date hereof and prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall also be deemed to be incorporated by reference herein and to be a part hereof from the dates of filing of such documents. In addition, the Registrant will incorporate by reference certain future materials furnished to the Commission on Form 6-K, but only to the extent specifically indicated in those submissions or in a future post-effective amendment hereto. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4.

Description of Securities.

Not applicable.

Item 5.

Interests of Named Experts and Counsel.

Not applicable.

Item 6.

Indemnification of Directors and Officers.

Section 98 of the Companies Act 1981 of Bermuda, as amended (the “Companies Act”), permits the Bye-Laws of a Bermuda company to contain a provision exempting from personal liability of a director or officer to the company for any loss arising or liability attaching to him by virtue of any rule of law in respect of any negligence default, breach of duty or breach of trust of which the officer or person may be guilty.

Section 98 of the Companies Act grants companies the power (except in relation to an allegation of fraud or dishonesty proved against them) to indemnify directors and officers of the company if any such person was or is a party or threatened to be made a party to a threatened, pending or completed action, suit or proceeding by reason of the fact that he or she is or was a director and officer of the company or was serving in a similar capacity for another entity at the company’s request.

Section 98A of the Companies Act permits a company to purchase and maintain insurance on behalf of any officer for any liability asserted against him or her and liability and expenses incurred in his or her capacity as a director, officer, employee or agent arising out of his or her status as such in respect of any loss arising or liability attaching to him or her by virtue of any rule of law in respect of any negligence, default, breach of duty or breach of trust of which the officer may be guilty in relation to the company or any subsidiary thereof. The Registrant currently maintains directors’ and officers’ insurance for its directors and officers.

Bye-laws number 138 through 146 of Golar LNG Limited (the “Company”), provide as follows:

138. No Director, Alternate Director, Officer, member of a committee authorised under Bye-law 109, Resident Representative of the Company or their respective heirs, executors or administrators shall be liable for the acts, receipts, neglects, or defaults of any other such person or any person involved in the formation of the Company, or for any loss or expense incurred by the Company through the insufficiency or deficiency of title to any property acquired by the Company, or for the insufficiency of deficiency of any security in or upon which any of the monies of the Company shall be invested, or for any loss or damage arising from the bankruptcy, insolvency, or tortious act of any person with whom any monies, securities, or effects shall be deposited, or for any loss occasioned by any error of judgment, omission, default, or oversight on his part, or for any other loss, damage or misfortune whatever which shall happen in relation to the execution of his duties, or supposed duties, to the Company or otherwise in relation thereto.

139. Every Director, Alternate Director, Officer, member of a committee constituted under Bye-Law 109, Resident Representative of the Company or their respective heirs, executors or administrators shall be indemnified and held harmless out of the funds of the Company to the fullest extent permitted by Bermuda law against all liabilities loss damage or expense (including but not limited to liabilities under contract, tort and statute or any applicable foreign law or regulation and all reasonable legal and other costs and expenses properly payable) incurred or suffered by him as such Director, Alternate Director, Officer, committee member or Resident Representative and the indemnity contained in this Bye-Law shall extend to any person acting as such Director, Alternate Director, Officer, committee member or Resident Representative in the reasonable belief that he has been so appointed or elected notwithstanding any defect in such appointment or election.

3

140. Every Director, Alternate Director, Officer, member of a committee constituted under Bye-Law 109, Resident Representative of the Company and their respective heirs, executors or administrators shall be indemnified out of the funds of the Company against all liabilities incurred by him as such Director, Alternate Director, Officer, member of a committee constituted under Bye-Law 109, Resident Representative in defending any proceedings, whether civil or criminal, in which judgment is given in his favour, or in which he is acquitted, or in connection with any application under the Companies Acts in which relief from liability is granted to him by the court.

141. To the extent that any Director, Alternate Director, Officer, member of a committee constituted under Bye-Law 109, Resident Representative of the Company or any of their respective heirs, executors or administrators is entitled to claim an indemnity pursuant to these Bye-Laws in respect of amounts paid or discharged by him, the relative indemnity shall take effect as an obligation of the Company to reimburse the person making such payment or effecting such discharge.

142. The Board may arrange for the Company to be insured in respect of all or any part of its liability under the provision of these Bye-laws and may also purchase and maintain insurance for the benefit of any Directors, Alternate Directors, Officers, person or member of a committee authorised under Bye-law 109, employees or Resident Representatives of the Company in respect of any liability that may be incurred by them or any of them howsoever arising in connection with their respective duties or supposed duties to the Company. This Bye-law shall not be construed as limiting the powers of the Board to effect such other insurance on behalf of the Company as it may deem appropriate.

143. Notwithstanding anything contained in the Principal Act, the Company may advance moneys to an Officer or Director for the costs, charges and expenses incurred by the Officer or Director in defending any civil or criminal proceedings against them on the condition that the Director or Officer shall repay the advance if any allegation of fraud or dishonesty is proved against them.

144. Each Member agrees to waive any claim or right of action he might have, whether individually or by or in the right of the Company, against any Director, Alternate Director, Officer of the Company, person or member of a committee authorised under Bye-law 109, Resident Representative of the Company or any of their respective heirs, executors or administrators on account of any action taken by any such person, or the failure of any such person to take any action in the performance of his duties, or supposed duties, to the Company or otherwise in relation thereto.

145. The restrictions on liability, indemnities and waivers provided for in Bye-laws 138 to 144 inclusive shall not extend to any matter which would render the same void pursuant to the Companies Acts.

146. The restrictions on liability, indemnities and waivers contained in Bye-laws 138 to 144 inclusive shall be in addition to any rights which any person concerned may otherwise be entitled by contract or as a matter of applicable Bermuda law.

The Plan also provides that the committee administering the Plan and all members thereof are entitled to, in good faith, rely or act upon any report or other information furnished to them by any officer or employee of the Registrant or its affiliates, or the Registrant’s legal counsel, independent auditors, consultants or any other agents assisting in the administration of the Plan. Members of the committee and any officer or employee of the Registrant or any of its affiliates acting at the direction or on behalf of the committee shall not be personally liable for any action or determination taken or made in good faith with respect to the Plan, and shall, to the fullest extent permitted by law, be indemnified and held harmless by the Registrant with respect to any such action or determination.

Item 7.

Exemption from Registration Claimed.

Not applicable.

Item 8.

Exhibits.

Unless otherwise indicated below as being incorporated by reference to another filing of the Registrant with the Commission, each of the following exhibits is filed herewith:

4

|

Exhibit

Number

|

|

Description

|

|

4.1

|

|

Memorandum of Association of the Registrant, incorporated by reference to Exhibit 1.1 of the Registrant’s Registration Statement on Form 20-F, filed on November 27, 2002.

|

|

|

|

|

|

4.2

|

|

Amended and Restated Bye-laws of the Registrant, dated September 20, 2013, incorporated by reference as Exhibit 3.1 of the Registrant’s report on Form 6-K, filed on July 1, 2014.

|

|

|

|

|

|

4.3

|

|

Certificate of Incorporation, incorporated by reference to Exhibit 1.3 of the Registrant’s Registration Statement on Form 20-F, filed on November 27, 2002.

|

|

|

|

|

|

4.4

|

|

Certificate of Deposit of Memorandum of Increase of Share Capital of the Registrant, incorporated by reference to Exhibit 1.4 of the Registrant’s Registration Statement on Form 20-F, filed on November 27, 2002.

|

|

|

|

|

|

4.5

|

|

Certificate of Deposit of Memorandum of Increase of Share Capital of the Registrant, incorporated by reference to Exhibit 1.6 of the Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2014, filed on April 30, 2015.

|

|

|

|

|

|

4.6*

|

|

Golar LNG Limited Long-Term Incentive Plan.

|

|

|

|

|

|

5.1*

|

|

Opinion of MJM Limited, Bermuda counsel to the Registrant as to the validity of the common shares.

|

|

|

|

|

|

23.1*

|

|

Consent of MJM Limited (included in Exhibit 5.1 to this Registration Statement).

|

|

|

|

|

|

23.2*

|

|

Consent of Ernst & Young LLP.

|

|

|

|

|

|

24.1*

|

|

Power of Attorney (included as part of the signature pages to this Registration Statement).

|

* Filed herewith.

Item 9.

Undertakings.

(a)

The undersigned Registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

5

provided, however,

that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b)

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

6

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of London, in the United Kingdom, on November 20, 2017.

|

|

GOLAR LNG LIMITED

|

|

|

|

|

|

By:

|

/s/

Brian Tienzo

|

|

|

|

Brian Tienzo

|

|

|

|

Chief Financial Officer

|

|

|

|

Golar Management Ltd.

|

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Brian Tienzo and Siu-Yee Mac his true and lawful attorneys-in-fact, with full power of substitution and resubstitution for him and in his name, place and stead, in any and all capacities to sign any and all amendments including post-effective amendments to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, hereby ratifying and confirming all that said attorneys-in-fact or their substitutes, each acting alone, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Iain Ross

|

|

Chief Executive Officer, Golar Management Ltd.

|

|

|

|

Iain Ross

|

|

(Principal Executive Officer)

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Brian Tienzo

|

|

Chief Financial Officer, Golar Management Ltd.

|

|

|

|

Brian Tienzo

|

|

(Principal Financial and Accounting Officer)

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Tor Olav Trøim

|

|

Chairman of the Board

|

|

|

|

Tor Olav Trøim

|

|

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Daniel Rabun

|

|

Director

|

|

|

|

Daniel Rabun

|

|

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Fredrik Halvorsen

|

|

Director

|

|

|

|

Fredrik Halvorsen

|

|

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Carl Steen

|

|

Director

|

|

|

|

Carl Steen

|

|

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Niels Stolt-Nielsen

|

|

Director

|

|

|

|

Niels Stolt-Nielsen

|

|

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Lori Wheeler Naess

|

|

Director

|

|

|

|

Lori Wheeler Naess

|

|

|

|

November 20, 2017

|

|

|

|

|

|

|

|

/s/ Michael Ashford

|

|

Director

|

|

|

|

Michael Ashford

|

|

|

|

November 20, 2017

|

7

SIGNATURE OF

AUTHORIZED REPRESENTATIVE

IN THE UNITED STATES

Pursuant to the requirement of the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of the aforementioned Registrant, has signed this Registration Statement in the City of Newark, State of Delaware, on November 20, 2017.

|

PUGLISI & ASSOCIATES

|

|

|

|

|

|

|

By:

|

/s/ Donald J. Puglisi

|

|

|

Name:

|

Donald J. Puglisi

|

|

|

Title:

|

Authorized Representative in the United States

|

|

8

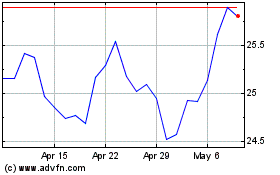

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

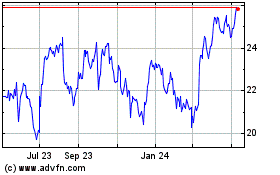

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Apr 2023 to Apr 2024