NetworkNewsWire Editorial

Coverage: After running a poor second to the

internal combustion automobile for a century, the electric vehicle

(EV) now looks very likely to win the race. At the beginning of the

twentieth century, EVs were on track but they lost position to

gasoline automobiles. Now in America, in China and in Europe, EVs

are taking to the roads once again. And in response to a more

environmentally aware citizenry and government mandates, many car

manufacturers plan to phase out fossil-fueled vehicles and increase

output of EVs over the next two decades. The increasing adoption of

EVs is already beginning to raise demand for the metals that

comprise the batteries under their hoods. Chief of these is

lithium, naturally, since lithium-ion is the leading EV battery

technology. However, equally necessary, is the cobalt used in

lithium cobalt oxide (LiCoO2) electrodes, one of the

most common lithium ion (Li-ion) technologies. As search for this

rare metal intensifies, cobalt miners like Quantum Cobalt

Corp. (CSE: QBOT) (FRA: 23B) eCobalt Solutions (OTCQB:

ECSIF) (TSE: ECS), First Cobalt Corporation (CVE: FCC), Fortune

Minerals Limited (OTCQX: FTMDF) (TSE: FT) and Freeport-McMoRan

(NYSE: FCX) are likely to see their share prices rise. In the

coming months, cobalt looks set to make fortunes.

One of the factors driving the shift to EVs has been the Paris

Climate Accord, an international effort to slow global warming by

reducing carbon emissions, which became effective on November 4,

2016. The U.N. Intergovernmental Panel on Climate Change (IPCC) has

estimated that transportation is responsible for fourteen percent

(14 percent) of global greenhouse gas emissions (http://nnw.fm/4G0m7). On November 7, Syria announced

it would sign the agreement, following Nicaragua, which said in

October it would join the Accord (http://nnw.fm/S0uWY). The Central American nation had,

initially, refused to sign because it wanted the Agreement to go

further. This leaves the U.S. as the only country rejecting the

pact. However, under its terms, which the White House said it will

respect, the soonest any country can withdraw from the landmark

agreement is November 4, 2020.

The Accord has prompted a series of initiatives across the

globe. Recently, China, France, Germany, India, Norway, the

Netherlands and the U.K. all announced measures intended to curb

carbon emissions. China, which has the world’s largest vehicle

market, is in the lead. With air pollution at crisis levels in

Beijing and other major cities, the Chinese government wants to see

vehicles using gasoline and diesel phased out. It also, it seems,

plans to dominate the global EV market, according to the LA Times. The government in India is facing similar

problems. India’s carbon emissions are rising: they rose almost 5

percent in 2016. But now there’s hope that trend will be reversed

by replacing fossil fuel cars with EVs by 2030. European nations

are also in the vanguard of this battle against global warming. The

Norwegian government has said, that after 2025, it will only allow

sales of vehicles that are 100 percent electric. And Germany is

following suit, albeit with a less rigorous schedule. It plans a

total ban on all internal combustion engines by 2030. In Britain, a

deadline has been set for 2040, after which time no cars powered by

petrol (gasoline) or diesel will be allowed. The Netherlands is

also considering similar plans, while France, the host of the

Accord, wants all petrol and diesel cars off its roads by 2040.

The big car manufacturers are already making plans to ramp up EV

production. Volkswagen, now the largest global automaker by sales,

is planning 30 new EV models by 2025. It hopes to garner annual

sales of between two and three million units by then. The company

has announced it will invest around $84 billion in batteries and

electric cars. In addition, No. 2 Toyota has formed a joint venture

with Mazda and Denso, the Japanese auto parts manufacturer, to

develop EV technologies for the future. The new company, called EV

Common Architecture Spirit Co. Ltd., will be 90 percent owned by

Toyota, with Mazda and Denso sharing the remaining 10 percent

equally. The joint venture will produce models based on Toyota’s

Prius and 2018 Camry. And Mary Barra, CEO of General Motors, told

an investor conference on November 15 that the company plans to

launch a new EV platform

in 2021. The modular EV stereotype will be the basis for at least

20 new battery-powered vehicles by 2023 and will be flexible enough

to accommodate nine different body styles in multiple sizes,

segments and brands in the U.S., China and elsewhere. Meanwhile in

July, when Tesla delivered the first Model 3s off the line, its CEO

Elon Musk revealed the company had ‘over half a million advance

reservations’. The EV revolution seems unstoppable.

Bloomberg has estimated that EVs will enjoy a 2 percent share

of the auto market by 2020. This is expected to rise to 8 percent

by 2025, to 20 percent by 2030, and to at least 35 percent by 2040.

These statistics have fueled a great deal of anxiety in some

corners, with automakers scrambling to secure supplies. They have

also given rise to a very tight global cobalt market. Recently,

Volkswagen announced it had failed to secure a long-term supplier

for cobalt. In September, the German carmaker put out a tender

seeking a five-year supply of the strategic metal at a fixed price

but there were no takers at the offer price. Demand for cobalt is

expected to surge from 2k tonnes in 2017 to over 300k tonnes by

2030, a stupendous 14,900 percent increase that will see prices

reach record levels. With the battery industry currently uses 42

percent of global cobalt production, the question arises: where is

all this cobalt going to come from?

At present, about 97 percent of the world’s supply of cobalt is

a by-product of nickel or copper mining, mostly out of Africa. A

lot comes from the Democratic Republic of the Congo (DRC), home to

the largest cobalt asset in the world, the Tenke Fungurume mine.

However, political instability and charges that child labor is used

in the mines is putting pressure on producers to seek less

controversial sources. As a result, exploration companies are

turning to North America, and particularly Canada, in what must

seem like déjà vu, particularly in places like Cobalt, Ontario, so

named over a century ago after the mineral was discovered

there.

One such exploration outfit is Quantum Cobalt Corp.

(CSE: QBOT) (FRA: 23B),

which has interests in past producing mines with historic assays of

8.76 percent cobalt. Its Nipissing Lorrain Cobalt Project has

produced over 16,500 tons of cobalt, as well as 5,500 tons of

silver, in the past. The asset consists of 29 claim units covering

approximately 464 hectares. Quantum is also working the Rabbit

Cobalt property, located 14 km southeast of the town of Temagami

near the eastern border of Ontario. The property has in the past

produced cobalt assayed at 8.76 percent. A third project is the

Kahuna Cobalt-Silver mine, which comprises 77 claims over an area

of around 1,200 hectares, and is located 37 km south of Cobalt.

These are encouraging metrics considering that cobalt projects with

assays as low as 0.05 percent are considered viable. Quantum also

has gold projects underway at Grew Creek in the Yukon, Canada and

Musgrove Creek in Lemhi County, Idaho.

Driven by an experienced team, Quantum

Cobalt expects more than quantum success. The

company’s CEO is Greg Burns, who is also the Director of Mergers

and Acquisitions for Capital Investment Partners, a Western

Australian investment bank. Mr. Burns was previously Managing

Director of Xenolith, subsequently Coalspur Mines Ltd., acquired by

the Cline Group in 2015. He was also a director of White Canyon

Uranium before that company’s acquisition by Denison Mines in 2010.

The rest of Board Members include Ken Tollstam, CPA, formerly of

Deloitte Touche, Jerry Huang, CPA, MBA, who has worked in wealth

management and in mining, Von Torres, who brings experience in

corporate management services, and Quinn Field-Dyte, who comes with

a financial services background. Quantum Cobalt was previously

Bravura Ventures Corporation. Its name change became effective in

November 2017.

eCobalt has its primary asset in Idaho. The company claims its

Idaho Cobalt Project is the only advanced-stage, near term,

environmentally permitted, primary cobalt deposit in the United

States. The Idaho Cobalt Project is comprised of the Mine/Mill

(M/M) site located in Lemhi County, Idaho, near the town of Salmon,

Idaho and the Cobalt Production Facility (CPF), a stand-alone

hydrometallurgical facility located in Southern Idaho near the city

of Blackfoot. The CPF will process concentrates from the M/M into

cobalt, copper and gold end products. The project is slated to

produce the equivalent of 1,500 tons of high purity cobalt sulfate

annually over a projected mine life of 12.5 years.

Back in Canada, First Cobalt is currently advancing its

2,100-hectare Silver Centre, Ontario property, which includes the

former producing Keely-Frontier mine, a high-grade mine that has

produced over 3.3 million pounds of cobalt and 19.1 million ounces

of silver. First Cobalt, which pulled out of the DRC just months

after signing a copper and cobalt deal with the government, has

past-producing assets and a market capitalization of CAD$39

million, expected to reach CAD$156 million pending an

acquisition.

Meanwhile, Fortune Minerals is ploughing ahead with its NICO

Cobalt-Gold-Bismuth-Copper Project in Canada’s Northwest

Territories, which the company is positioning as a dedicated North

American cobalt asset. Freeport-McMoRan is also in hot pursuit of

the hard, lustrous, silver-gray metal. Together with Lundin Mining

Corporation and La Générale des Carrières et des Mines (Gécamines),

it has formed Freeport Cobalt, which will operate the world’s

largest cobalt refinery, located in Kokkola, Finland. This will

link its global sales and marketing distribution network with

output from the Tenke Fungurume Mine in the Democratic Republic of

Congo (DRC).

The attention cobalt is enjoying at present is pushing up share

prices. eCobalt (ECSIF) trading at around $0.40 a year ago has

appreciated by over 100 percent and is now at $0.84. First Cobalt

(FCC), down at $0.25 a year ago has gone up by 180 percent and

currently trades at $0.70. Fortune Minerals (FTMDF) has risen by 67

percent over the past twelve months, from $0.09 to $0.15. It seems

like Quantum Cobalt, may be undervalued. Quantum Cobalt

is “One to Watch”

Other players to keep your eye on:

Freeport-McMoRan (NYSE: FCX) traded 15,328,018 shares and closed at

$ 13.86 on Friday.

eCobalt Solutions (OTCQB: ECSIF) traded 166,456 shares and closed

at $ 0.83 on Friday.

First Cobalt Corporation (CVE: FCC) traded 169,405 shares and

closed at $ 0.72 on Friday.

Fortune Minerals Limited (OTCQX: FTMDF) traded 401,789 shares and

closed at $ 0.15 on Friday.

For more information about the Quantum Cobalt please visit:

Quantum Cobalt

(CSE: QBOT)

Other Quantum Cobalt Articles:

Quantum Cobalt

is “One to Watch”

Cobalt Perfectly

Positioned As Global Cobalt Demand Surges

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. FN Media

Group (FNM) is a third-party publisher and news dissemination

service provider, which disseminates electronic information through

multiple online media channels. FNM is NOT affiliated with NNW or

any company mentioned herein. The commentary, views and opinions

expressed in this release by NNW are solely those of NNW and are

not shared by and do not reflect in any manner the views or

opinions of FNM. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW and FNM for any

investment decisions by their readers or subscribers. NNW and FNM

and their respective affiliated companies are a news dissemination

and financial marketing solutions provider and are NOT registered

broker-dealers/analysts/investment advisers, hold no investment

licenses and may NOT sell, offer to sell or offer to buy any

security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, FNM, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer's filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer's securities, including, but not

limited to, the complete loss of your investment.

NNW & FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS

RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements

in this release are made as of the date hereof and NNW and FNM

undertake no obligation to update such statements.

NetworkNewsWire (NNW) is affiliated with the Investor Based

Brand Network (IBBN).

About IBBN

Over the past 10+ years we have consistently introduced new network

brands, each specifically designed to fulfil the unique needs of

our growing client base and services. Today, we continue to expand

our branded network of highly influential properties, leveraging

the knowledge and energy of specialized teams of experts to serve

our increasingly diversified list of clients.

Please feel free to visit the Investor Based Brand Network

(IBBN) www.InvestorBasedBrandNetwork.com

Corporate Communications Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

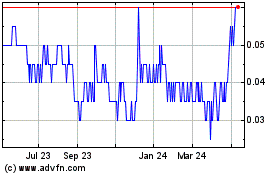

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Mar 2024 to Apr 2024

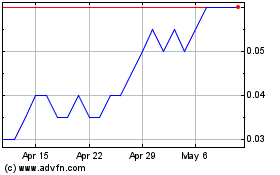

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Apr 2023 to Apr 2024