Northern Technologies International Corporation Initiates $0.10 per Share Quarterly Cash Dividend

November 20 2017 - 8:05AM

Northern Technologies International Corporation (NASDAQ:NTIC), a

leading developer of corrosion inhibiting products and services, as

well as bio-based and biodegradable polymer resin compounds, today

announced that the Board of Directors initiated a quarterly cash

dividend of $0.10 per share payable on December 21, 2017 to

shareholders of record on December 8, 2017.

“It is my pleasure to announce NTIC’s Board of Directors has

decided to initiate a $0.10 quarterly cash dividend as a result of

the Company’s strong fourth quarter financial results and favorable

business outlook,” said G. Patrick Lynch, President and Chief

Executive Officer of NTIC. “The quarterly cash dividend not only

benefits existing stockholders, but will also increase NTIC’s

exposure to additional investors. We are committed to creating

long-term value for our shareholders, and we believe we have a

sustainable platform to drive sales and earnings growth in fiscal

2018 and beyond.”

About Northern Technologies International

Corporation

Northern Technologies International Corporation develops and

markets proprietary environmentally beneficial products and

services in over 60 countries either directly or via a network of

subsidiaries, joint ventures, independent distributors and agents.

NTIC’s primary business is corrosion prevention marketed primarily

under the ZERUST® brand. NTIC has been selling its proprietary

ZERUST® rust and corrosion inhibiting products and services to the

automotive, electronics, electrical, mechanical, military and

retail consumer markets, for over 40 years, and in recent years has

targeted and expanded into the oil and gas industry. NTIC offers

worldwide on-site technical consulting for rust and corrosion

prevention issues. NTIC’s technical service consultants work

directly with the end users of NTIC’s products to analyze their

specific needs and develop systems to meet their technical

requirements. NTIC also markets and sells a portfolio of bio-based

and biodegradable polymer resins and finished products marketed

under the Natur-Tec® brand.

Forward-Looking Statements

Statements contained in this release that are not historical

information are forward-looking statements as defined within the

Private Securities Litigation Reform Act of 1995. Such statements

include NTIC’s expectations regarding its anticipated future

dividends, the effect of the dividend to increase exposure to

additional investors and anticipated sales and earnings growth for

fiscal 2018 and beyond, and other statements that can be identified

by words such as “expects,” “anticipates,” “potential,” “outlook,”

“will,” or words of similar meaning, the use of future dates and

any other statements that are not historical facts. Such

forward-looking statements are based upon the current beliefs and

expectations of NTIC’s management and are inherently subject to

risks and uncertainties that could cause actual results to differ

materially from those projected or implied. Such potential risks

and uncertainties include, but are not limited to, in no particular

order: the ability of NTIC to achieve its annual financial guidance

and continue to pay dividends; NTIC’s dependence on the success of

its joint ventures and fees and dividend distributions that NTIC

receives from them; NTIC’s relationships with its joint ventures

and its ability to maintain those relationships; NTIC’s dependence

on its joint venture in Germany in particular due to its

significance and the effect of a termination of this or its other

joint ventures on NTIC’s business and operating results; the effect

on NTIC’s business and operating results of the termination of

NTIC’s joint venture relationship in China and sale of products and

services in China through NTIC China; the ability of NTIC China to

achieve significant sales; costs and expenses incurred by NTIC in

connection with its ongoing litigation against its former Chinese

joint venture partner; risks related to the possible exit of the

United Kingdom from the European Union, economic slowdown and

political unrest; risks associated with NTIC’s international

operations; exposure to fluctuations in foreign currency exchange

rates, including in particular the Euro compared to the U.S.

dollar; the health of the U.S. and worldwide economies, including

in particular the U.S. automotive industry; the level of growth in

NTIC’s markets; NTIC’s investments in research and development

efforts; acceptance of existing and new products; timing of NTIC’s

receipt of purchase orders under supply contracts; variability in

sales to customers in the oil and gas industry and the effect on

NTIC’s quarterly financial results; increased competition; the

costs and effects of complying with changes in tax, fiscal,

government and other regulatory policies, including rules relating

to environmental, health and safety matters; pending and potential

litigation; and NTIC’s reliance on its intellectual property rights

and the absence of infringement of the intellectual property rights

of others. More detailed information on these and additional

factors which could affect NTIC’s operating and financial results

is described in the company’s filings with the Securities and

Exchange Commission, including its most recent annual report on

Form 10-K for the fiscal year ended August 31, 2017 to be filed

with the SEC. NTIC urges all interested parties to read these

reports to gain a better understanding of the many business and

other risks that the company faces. Additionally, NTIC undertakes

no obligation to publicly release the results of any revisions to

these forward-looking statements, which may be made to reflect

events or circumstances occurring after the date hereof or to

reflect the occurrence of unanticipated events.

Investor and Media Contacts: Matthew Wolsfeld,

CFO NTIC (763) 225-6600

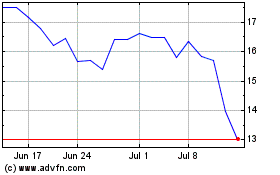

Northern Technologies (NASDAQ:NTIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northern Technologies (NASDAQ:NTIC)

Historical Stock Chart

From Apr 2023 to Apr 2024