Marathon Patent Group Announces Third Quarter Financial Results

November 20 2017 - 8:00AM

Marathon Patent Group, Inc. (NASDAQ:MARA) ("Marathon" or

"Company"), today announced its operating results for the three

months ended September 30, 2017, as published in its Quarterly

Report on Form 10-Q filed today with the Securities and Exchange

Commission.

Operating Results for the Three Months Ended September 30,

2017

- Total revenue of $163 thousand and $43 thousand for the three

months ended September 30, 2017 and September 30, 2016,

respectively.

- Operating loss was approximately $3.9 million (including

non-cash expenses) for the three months ended September 30, 2017

compared to an operating loss of $10.7 million for the three months

ended September 30, 2016.

- Our GAAP net loss was $(1.06) per basic and diluted share for

the three months ended September 30, 2017, with 6,270,299 (all

share numbers reflect the one for four reverse split completed on

October 30, 2017) weighted average basic and diluted shares

outstanding as of September 30, 2017, compared to a GAAP loss of

$(1.67) per weighted average basic and diluted share for the three

months ended September 30, 2016, with 3,761,786 weighted average

basic and diluted shares outstanding as of September 30, 2016,

respectively.

- On a per share basis, our Non-GAAP net loss was $(0.23) per

basic and diluted share for the three months ended September 30,

2017, compared to a Non-GAAP loss of $(0.86) per basic and diluted

share for the three months ended September 30, 2017,

respectively.

From a strategic perspective, Marathon entered into a definitive

purchase agreement to acquire 100% ownership of Global Bit Ventures

Inc. (“GBV”), a digital asset technology company that mines

cryptocurrencies. GBV has robust infrastructure in place with

significant capability for expansion. The closing of the

transaction is subject to obtaining requisite approvals. The

Company intends to update investors more specifically on the

transaction on November 27th, when we will be conducting an

investor update conference call.

Conference Call

Marathon will host an investor update conference call to with

Chief Executive Officer Doug Croxall and Chief Financial Officer

Frank Knuettel II on Monday November 27, 2017 at 4:30 PM ET/1:30 PM

PT. To participate in the conference call, investors from the U.S.

and Canada should dial (877) 407-0792 ten minutes prior to the

scheduled start time. International calls should dial (201)

689-8263.

In addition, the call will be broadcast live over the Internet

and can be accessed through the Investor Relations section of the

Company's website at www.marathonpg.com. The broadcast will be

archived online upon completion of the conference call. A

telephonic replay of the conference call will also be available

until 11:59 p.m. ET on Monday December 11, 2017 by dialing (844)

512-2921 in the U.S. and Canada and (412) 317-6671 internationally

and entering the pin number: 13673885.

MARATHON PATENT GROUP, INC. AND

SUBSIDIARIESCONSOLIDATED CONDENSED BALANCE SHEETS(Unaudited)

|

|

|

September 30, 2017 |

|

|

December 31, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

122,172 |

|

|

$ |

4,998,314 |

|

| Restricted Cash |

|

|

3,919,718 |

|

|

|

- |

|

| Total cash |

|

|

4,041,890 |

|

|

|

4,998,314 |

|

| Accounts

receivable - net of allowance for bad debt of $387,976 and $387,976

for September 30, 2017 and December 31, 2016 |

|

|

123,630 |

|

|

|

95,069 |

|

| Note receivable |

|

|

588,864 |

|

|

|

225,982 |

|

| Prepaid

expenses and other current assets, net of discounts of $2,659 for

September 30, 2017 and $3,724 for December 31, 2016 |

|

|

108,878 |

|

|

|

202,067 |

|

| Total current

assets |

|

|

4,863,262 |

|

|

|

5,521,432 |

|

| |

|

|

|

|

|

|

|

|

| Other assets: |

|

|

|

|

|

|

|

|

| Property

and equipment, net of accumulated depreciation of $133,224 and

$108,407 for September 30, 2017 and December 31, 2016 |

|

|

9,803 |

|

|

|

28,329 |

|

|

Intangible assets, net of accumulated amortization of $12,813,915

and $11,323,185 for September 30, 2017 and December 31, 2016 |

|

|

7,590,213 |

|

|

|

12,314,628 |

|

| Other non current

assets, net of discounts of $797 for December 31, 2016 |

|

|

- |

|

|

|

201,203 |

|

| Goodwill |

|

|

228,401 |

|

|

|

222,843 |

|

| Total other assets |

|

|

7,828,417 |

|

|

|

12,767,003 |

|

| |

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

12,691,679 |

|

|

$ |

18,288,435 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and

accrued expenses |

|

$ |

1,954,836 |

|

|

$ |

7,217,078 |

|

| Clouding IP earn out -

current portion |

|

|

32,637 |

|

|

|

81,930 |

|

| Revenue share

liability |

|

|

1,225,000 |

|

|

|

- |

|

| Warrant liability |

|

|

2,411,750 |

|

|

|

- |

|

| Notes

payable, net of discounts of $5,837,363 and $852,404 for September

30, 2017 and December 31, 2016 |

|

|

15,582,156 |

|

|

|

13,162,007 |

|

| |

|

|

21,206,379 |

|

|

|

20,461,015 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

liabilities |

|

|

|

|

|

|

|

|

| Notes Payable, net of

discount of $57,763 for December 31, 2016 |

|

|

- |

|

|

|

4,670,502 |

|

| Clouding IP earn

out |

|

|

681,175 |

|

|

|

1,400,082 |

|

| Revenue share

liability |

|

|

- |

|

|

|

1,000,000 |

|

| Other long term

liability |

|

|

37,236 |

|

|

|

43,978 |

|

| Total long-term

liabilities |

|

|

718,411 |

|

|

|

7,114,562 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

21,924,790 |

|

|

|

27,575,577 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders'

Deficit: |

|

|

|

|

|

|

|

|

| Preferred

stock Series B, $.0001 par value, 50,000,000 shares

authorized: 195,501 issued and outstanding at September 30,

2017 and December 31, 2016 |

|

|

78 |

|

|

|

78 |

|

| Common

stock, $.0001 par value; 200,000,000 shares authorized; 7,776,016

and 4,638,118 at September 30, 2017 and December 31, 2016 |

|

|

3,111 |

|

|

|

1,856 |

|

| Additional paid-in

capital |

|

|

61,833,077 |

|

|

|

49,877,710 |

|

| Accumulated other

comprehensive income (loss) |

|

|

(450,623 |

) |

|

|

(1,060,390 |

) |

| Accumulated

deficit |

|

|

(70,427,472 |

) |

|

|

(57,942,548 |

) |

| |

|

|

|

|

|

|

|

|

| Total Marathon Patent

Group stockholders' equity |

|

|

(9,041,829 |

) |

|

|

(9,123,294 |

) |

| |

|

|

|

|

|

|

|

|

| Noncontrolling

interests |

|

|

(191,282 |

) |

|

|

(163,848 |

) |

| |

|

|

|

|

|

|

|

|

| Total deficit |

|

|

(9,233,111 |

) |

|

|

(9,287,142 |

) |

| |

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders' deficit |

|

$ |

12,691,679 |

|

|

$ |

18,288,435 |

|

| |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part to

these unaudited consolidated condensed financial statements.

MARATHON PATENT GROUP, INC. AND

SUBSIDIARIESCONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME(Unaudited)

|

|

|

For the Three Months Ended 30-Sep-17 |

|

|

For the Three Months Ended 30-Sep-16 |

|

|

For the Nine Months Ended 30-Sep-17 |

|

|

For the Nine Months Ended 30-Sep-16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

162,713 |

|

|

$ |

43,113 |

|

|

$ |

609,650 |

|

|

$ |

36,452,551 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

|

64,836 |

|

|

|

1,094,378 |

|

|

|

1,544,322 |

|

|

|

19,202,118 |

|

|

Amortization of patents and website |

|

|

457,419 |

|

|

|

2,030,886 |

|

|

|

1,803,264 |

|

|

|

6,018,196 |

|

|

Compensation and related taxes |

|

|

1,871,946 |

|

|

|

1,252,571 |

|

|

|

3,718,034 |

|

|

|

3,406,841 |

|

|

Consulting fees |

|

|

133,018 |

|

|

|

257,420 |

|

|

|

189,819 |

|

|

|

903,032 |

|

|

Professional fees |

|

|

616,125 |

|

|

|

432,496 |

|

|

|

1,686,955 |

|

|

|

1,336,201 |

|

| General

and administrative |

|

|

213,130 |

|

|

|

183,771 |

|

|

|

599,416 |

|

|

|

612,284 |

|

| Goodwill

impairment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

83,000 |

|

| Patent

impairment |

|

|

723,218 |

|

|

|

5,531,383 |

|

|

|

723,218 |

|

|

|

6,525,273 |

|

| Total

operating expenses |

|

|

4,079,692 |

|

|

|

10,782,905 |

|

|

|

10,265,028 |

|

|

|

38,086,945 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss from

continuing operations |

|

|

(3,916,979 |

) |

|

|

(10,739,792 |

) |

|

|

(9,655,378 |

) |

|

|

(1,634,394 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income (expense) |

|

|

2,252,886 |

|

|

|

(37,116 |

) |

|

|

3,151,418 |

|

|

|

(68,647 |

) |

| Foreign

exchange (loss) |

|

|

(480,240 |

) |

|

|

(175,850 |

) |

|

|

(463,191 |

) |

|

|

(238,073 |

) |

| Loss on

debt extinguishment |

|

|

(283,237 |

) |

|

|

- |

|

|

|

(283,237 |

) |

|

|

- |

|

| Loss on

sale of company |

|

|

(1,519,875 |

) |

|

|

- |

|

|

|

(1,519,875 |

) |

|

|

- |

|

| Change in

fair value adjustment of Clouding IP earn out |

|

|

754,321 |

|

|

|

1,954,378 |

|

|

|

768,200 |

|

|

|

2,122,208 |

|

| Warrant

income (expense) |

|

|

(1,909,879 |

) |

|

|

- |

|

|

|

(1,914,786 |

) |

|

|

- |

|

| Interest

income |

|

|

931 |

|

|

|

931 |

|

|

|

2,793 |

|

|

|

2,793 |

|

| Interest

expense |

|

|

(1,283,223 |

) |

|

|

(649,065 |

) |

|

|

(2,416,722 |

) |

|

|

(2,500,321 |

) |

| Total

other income (expenses) |

|

|

(2,468,316 |

) |

|

|

1,093,278 |

|

|

|

(2,675,400 |

) |

|

|

(682,040 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations before benefit for income taxes |

|

|

(6,385,295 |

) |

|

|

(9,646,514 |

) |

|

|

(12,330,778 |

) |

|

|

(2,316,434 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax benefit

(expense) |

|

|

(12,191 |

) |

|

|

3,347,909 |

|

|

|

(29,433 |

) |

|

|

26,974 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (loss) |

|

|

(6,397,486 |

) |

|

|

(6,298,605 |

) |

|

|

(12,360,211 |

) |

|

|

(2,289,460 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to Noncontrolling interests |

|

|

(280,000 |

) |

|

|

24,195 |

|

|

|

(124,714 |

) |

|

|

27,918 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) attributable

to common shareholders |

|

$ |

(6,677,486 |

) |

|

$ |

(6,274,410 |

) |

|

$ |

(12,484,925 |

) |

|

$ |

(2,261,542 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) per

common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(1.06 |

) |

|

$ |

(1.67 |

) |

|

$ |

(2.24 |

) |

|

$ |

(0.61 |

) |

| Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE COMMON

SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

6,270,299 |

|

|

|

3,761,786 |

|

|

|

5,564,465 |

|

|

|

3,736,213 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(6,677,486 |

) |

|

$ |

(6,274,410 |

) |

|

$ |

(12,484,925 |

) |

|

$ |

(2,261,542 |

) |

| Other comprehensive

loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gain on

foreign currency translation |

|

|

482,622 |

|

|

|

209,159 |

|

|

|

609,768 |

|

|

|

306,411 |

|

| Comprehensive loss |

|

|

(6,194,864 |

) |

|

|

(6,065,251 |

) |

|

|

(11,875,157 |

) |

|

|

(1,955,131 |

) |

| Less: comprehensive

income (loss) related to non-controlling interest |

|

|

(280,000 |

) |

|

|

24,195 |

|

|

|

(124,714 |

) |

|

|

27,918 |

|

| Comprehensive loss

attributable to Marathon Patent Group, Inc. |

|

$ |

(6,474,864 |

) |

|

$ |

(6,041,056 |

) |

|

$ |

(11,999,871 |

) |

|

$ |

(1,927,213 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part to

these unaudited consolidated condensed financial statements.

MARATHON PATENT GROUP, INC. AND

SUBSIDIARIESCONSOLIDATED CONDENSED STATEMENTS OF CASH

FLOWS(Unaudited)

|

|

|

For The Nine MonthsEnded September 30,2017 |

|

|

For The Nine Months Ended September 30,2016 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(12,484,924 |

) |

|

$ |

(2,261,542 |

) |

| Adjustments to

reconcile net loss to net cash provided by (used in) operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

1,248 |

|

|

|

3,780 |

|

|

Amortization of patents and website |

|

|

1,803,264 |

|

|

|

6,018,196 |

|

| Deferred

tax asset |

|

|

- |

|

|

|

531,757 |

|

| Deferred

tax liability |

|

|

- |

|

|

|

(638,268 |

) |

| Loss on

sale of companies |

|

|

- |

|

|

|

- |

|

| Warrant

liability |

|

|

- |

|

|

|

- |

|

|

Impairment of intangible assets |

|

|

704,678 |

|

|

|

6,525,273 |

|

|

Impairment of goodwill |

|

|

- |

|

|

|

83,000 |

|

| Stock

based compensation |

|

|

1,523,187 |

|

|

|

1,541,615 |

|

| Stock

issued for services |

|

|

- |

|

|

|

136,000 |

|

| Non-cash

interest, discount, and financing costs |

|

|

(4,397,381 |

) |

|

|

952,231 |

|

| Change in

fair value of Clouding earnout |

|

|

(768,200 |

) |

|

|

(2,122,198 |

) |

| Allowance

for doubtful accounts |

|

|

- |

|

|

|

12,226 |

|

|

Beneficial conversion feature |

|

|

4,017,729 |

|

|

|

- |

|

|

Noncontrolling interest |

|

|

(27,435 |

) |

|

|

(27,918 |

) |

| Other

non-cash adjustments |

|

|

182,024 |

|

|

|

96,996 |

|

| Changes in operating

assets and liabilities |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

(28,561 |

) |

|

|

43,763 |

|

| Bonds

posted with courts |

|

|

- |

|

|

|

883,695 |

|

| Prepaid

expenses and other assets |

|

|

(269,693 |

) |

|

|

(6,652 |

) |

| Other non

current assets |

|

|

201,203 |

|

|

|

- |

|

| Accounts

payable and accrued expenses |

|

|

(5,262,242 |

) |

|

|

(557,832 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash

and restricted cash provided by (used in) operating

activities |

|

|

(14,805,103 |

) |

|

|

11,214,122 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of patents |

|

|

- |

|

|

|

(3,552,656 |

) |

| Disposal

of patents |

|

|

2,771,757 |

|

|

|

- |

|

| Purchase

of property, equipment, and other intangible assets |

|

|

(6,291 |

) |

|

|

(8,387 |

) |

| Net cash

provided by (used in) investing activities |

|

|

2,765,466 |

|

|

|

(3,561,043 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| Payment

on note payable in connection with the acquisition of Medtech and

Orthophoenix |

|

|

- |

|

|

|

(2,953,779 |

) |

| Payment

on Fortress note payable |

|

|

(63,286 |

) |

|

|

(5,379,105 |

) |

| Payment

on 3D Nano license note payable |

|

|

(100,000 |

) |

|

|

- |

|

| Cash

received upon issuance of equity (net of issuance costs) |

|

|

5,158,906 |

|

|

|

- |

|

| Issuance

of warrants |

|

|

2,549,084 |

|

|

|

- |

|

| Issuance

of convertible notes payable |

|

|

5,500,000 |

|

|

|

|

|

| Medtronic

note payable |

|

|

600,000 |

|

|

|

- |

|

| Payment

of Medtronic note payable |

|

|

(600,000 |

) |

|

|

|

|

| Payments

on Seimens notes payable |

|

|

(1,750,000 |

) |

|

|

- |

|

| Payments

on notes payable to vendors |

|

|

(125,000 |

) |

|

|

- |

|

| Payments

on notes payable, net |

|

|

(103,000 |

) |

|

|

(578,804 |

) |

| Net cash

provided (used in) by financing activities |

|

|

11,066,704 |

|

|

|

(8,911,688 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash |

|

|

16,509 |

|

|

|

(1,592 |

) |

| |

|

|

|

|

|

|

|

|

| Net decrease in

cash |

|

|

(956,424 |

) |

|

|

(1,260,201 |

) |

| |

|

|

|

|

|

|

|

|

| Cash at beginning of

period |

|

|

4,998,314 |

|

|

|

2,555,151 |

|

| |

|

|

|

|

|

|

|

|

| Cash and restricted

cash at end of period |

|

$ |

4,041,890 |

|

|

$ |

1,294,950 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE

OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

| Cash paid

for: |

|

|

|

|

|

|

|

|

| Interest

expense |

|

$ |

368,923 |

|

|

$ |

1,187,074 |

|

| Taxes

paid |

|

$ |

29,433 |

|

|

$ |

27,682 |

|

| Cash

invested in 3D Nano |

|

$ |

- |

|

|

$ |

115,000 |

|

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE

OF NON-CASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Revenue share liability

incurred in conjunction with note payable |

|

$ |

225,000 |

|

|

$ |

- |

|

| Warrant issued in

conjunction with common stock issuance |

|

$ |

257,957 |

|

|

$ |

- |

|

| Note payable issued in

conjunction with the acquisition of Munitech patents |

|

$ |

- |

|

|

$ |

1,755,635 |

|

| Note payable issued in

conjunction with the acquisition of GE patent |

|

|

- |

|

|

|

1,000,000 |

|

| Note payable issued in

conjunction with the acquisition of 3D Nano License |

|

|

- |

|

|

|

200,000 |

|

| |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part to

these unaudited consolidated condensed financial statements.

| |

|

|

|

|

|

|

| |

|

Non-GAAP Reconciliation |

|

|

Non-GAAP Reconciliation |

|

| |

|

For the QuarterEnded September 30, 2017 |

|

|

For the QuarterEnded September 30, 2016 |

|

|

For the Nine Months Ended September 30, 2017 |

|

|

For the Nine Months Ended September 30, 2016 |

|

| Net income (loss)

attributable to Common Shareholders |

|

$ |

(6,677,486 |

) |

|

$ |

(6,274,410 |

) |

|

$ |

(12,484,925 |

) |

|

$ |

(2,261,542 |

) |

| Non-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets & depreciation |

|

|

457,719 |

|

|

|

2,030,886 |

|

|

|

1,804,512 |

|

|

|

6,018,196 |

|

|

Equity-based compensation |

|

|

1,371,480 |

|

|

|

478,819 |

|

|

|

1,554,835 |

|

|

|

1,677,616 |

|

|

Impairment of intangible assets |

|

|

723,218 |

|

|

|

5,531,383 |

|

|

|

723,218 |

|

|

|

6,608,273 |

|

| Change in

the fair value of the clouding IP liability |

|

|

(754,320 |

) |

|

|

(1,954,378 |

) |

|

|

(768,199 |

) |

|

|

(2,122,208 |

) |

| Loss on

debt extinguishment |

|

|

283,237 |

|

|

|

- |

|

|

|

283,237 |

|

|

|

- |

|

| Loss on

sale of companies |

|

|

1,519,875 |

|

|

|

- |

|

|

|

1,519,875 |

|

|

|

- |

|

| Warrant

(Income) Expense, net |

|

|

1,909,879 |

|

|

|

- |

|

|

|

1,914,786 |

|

|

|

- |

|

| Non-cash

Other (Income) expense, net |

|

|

(1,323,407 |

) |

|

|

- |

|

|

|

(2,221,939 |

) |

|

|

- |

|

| Non-cash

interest expense |

|

|

1,043,012 |

|

|

|

288,049 |

|

|

|

1,489,678 |

|

|

|

952,231 |

|

| Deferred

tax benefit |

|

|

- |

|

|

|

(3,347,909 |

) |

|

|

- |

|

|

|

(26,974 |

) |

|

Other |

|

|

(1,486 |

) |

|

|

12,468 |

|

|

|

(3,072 |

) |

|

|

28,488 |

|

| Non-GAAP earnings

(loss) |

|

$ |

(1,448,278 |

) |

|

$ |

(3,235,092 |

) |

|

$ |

(6,187,993 |

) |

|

$ |

10,874,080 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table sets forth the computation of basic and

diluted loss per share on a Non-GAAP basis:

| |

|

|

|

|

|

|

| |

|

Non-GAAP Reconciliation |

|

|

Non-GAAP Reconciliation |

|

| |

|

For the QuarterEnded September 30, 2017 |

|

|

For the QuarterEnded September 30, 2016 |

|

|

For the Nine MonthsEndedSeptember 30, 2017 |

|

|

For the Nine MonthsEnded September 30, 2016 |

|

| Non-GAAP

net income (loss) |

|

$ |

(1,448,278 |

) |

|

$ |

(3,235,092 |

) |

|

$ |

(6,187,993 |

) |

|

$ |

10,874,080 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denominator |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average common shares - Basic |

|

|

6,270,299 |

|

|

|

3,761,785 |

|

|

|

5,564,464 |

|

|

|

3,736,213 |

|

| Weighted

average common shares - Diluted |

|

|

6,270,299 |

|

|

|

3,761,785 |

|

|

|

5,564,464 |

|

|

|

3,996,067 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP earnings

(loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

earnings (loss) - Basic |

|

$ |

(0.23 |

) |

|

$ |

(0.86 |

) |

|

$ |

(1.11 |

) |

|

$ |

2.91 |

|

| Non-GAAP

earnings (loss) - Diluted |

|

|

NA |

|

|

|

NA |

|

|

|

NA |

|

|

|

2.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About Marathon Patent Group

Marathon is formerly an IP licensing company. On November 2,

2017, the Company announced that it has entered into a definitive

purchase agreement to acquire 100% ownership of Global Bit Ventures

Inc. (“GBV”), a digital asset technology company that mines

cryptocurrencies. GBV has robust infrastructure in place with

significant capability for expansion. The closing of the

transaction is subject to obtaining requisite approvals. To learn

more about Marathon Patent Group, visit www.marathonpg.com. To

learn more about Global Bit Ventures, visit

www.globalbitventures.com

Safe Harbor Statement

Certain statements in this press release constitute

"forward-looking statements" within the meaning of the federal

securities laws. Words such as "may," "might," "will," "should,"

"believe," "expect," "anticipate," "estimate," "continue,"

"predict," "forecast," "project," "plan," "intend" or similar

expressions, or statements regarding intent, belief, or current

expectations, are forward-looking statements. While the Company

believes these forward-looking statements are reasonable, undue

reliance should not be placed on any such forward-looking

statements, which are based on information available to us on the

date of this release. These forward looking statements are based

upon current estimates and assumptions and are subject to various

risks and uncertainties, including without limitation those set

forth in the Company's filings with the Securities and Exchange

Commission (the "SEC"), not limited to Risk Factors relating to its

patent business contained therein. Thus, actual results could be

materially different. The Company expressly disclaims any

obligation to update or alter statements whether as a result of new

information, future events or otherwise, except as required by

law.

Contact Information

Marathon Patent Group Jason Assad 678-570-6791

Jason@marathonpg.com

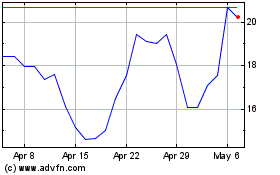

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024