Report of Foreign Issuer (6-k)

November 20 2017 - 6:07AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule

13a-16

or

15d-16

of the Securities Exchange Act of 1934

For the Month of November 2017

KOREA

ELECTRIC POWER CORPORATION

(Translation of registrant’s name into English)

55

Jeollyeok-ro,

Naju-si,

Jeollanam-do, 58217, Korea

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the

Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

82-

.

On September 28, 2017, KEPCO entered into a Joint Development Agreement (JDA) with TADMAX, a Malaysian

corporation, in relation to a

gas-fired

power plant with capacity of 1,200 megawatts in Pulau Indah, Malaysia. KEPCO has obtained approval for this project from Malaysian Energy Commission, the project

sponsor.

KEPCO will hold a 25% equity interest in this project, and TADMAX will hold a 75% equity interest in it. The total project cost is expected to

be approximately US$1 billion, and KEPCO expects to invest approximately US$50 million for the equity interest.

The closing of the financing

and construction for this project will begin in the fourth quarter of 2019 following the approval of the applicable tariff rates by the Malaysian Energy Commission, which is currently expected to occur in the fourth quarter of 2018.

This project marks KEPCO’s first entry into the Malaysian power generation market. The equity financing for KEPCO is expected to involve Islamic bond

financing, which upon completion is expected to be the first such financing for a Korean company. KEPCO also expects to enter into a power purchase agreement with Tenaga Nasional Berhad for a term of 21 years, which is expected to generate a stable

revenue stream from this project.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

By:

|

|

/s/ Kim, Jong-soo

|

|

Name:

|

|

Kim, Jong-soo

|

|

Title:

|

|

Vice President

|

Date: November 20, 2017

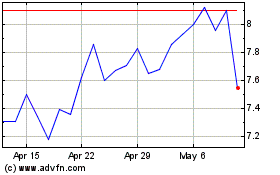

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

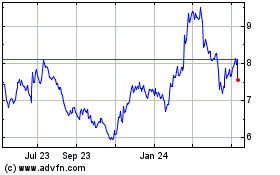

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Apr 2023 to Apr 2024