Current Report Filing (8-k)

November 17 2017 - 4:21PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

November 14, 2017

Akoustis

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

(State

or Other Jurisdiction

of

Incorporation)

|

001-38029

(Commission

File

Number)

|

33-1229046

(I.R.S.

Employer

Identification

Number)

|

9805

Northcross Center Court, Suite H

Huntersville,

NC 28078

(Address

of principal executive offices, including zip code)

704-997-5735

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.b-2 of this chapter)

Emerging

Growth Company

☑

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item

1.01

|

Entry

into a Material Definitive Agreement

|

On

November 14, 2017 and November 16, 2017, Akoustis Technologies, Inc. (“Akoustis” or the “Company”) held

closings of a private placement offering (the “Offering”) in which the Company sold an aggregate of 181,815 shares

of its common stock, par value $0.001 per share (the “Common Stock”) to accredited investors, at a purchase price

of $5.50 per share (the “Offering Price”) for aggregate gross proceeds of approximately $1,000,000. The round was

led by Jerry D. Neal, Co-Chairman of the Board, and included certain other directors (the “Investors”). The Offering

was exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”),

in reliance upon the safe harbor provided by Rule 506(b) of Regulation D. The Company did not engage, or pay any commissions to,

any placement agents or brokers.

In

connection with the Offering, the Company entered into a registration rights agreement (the “Registration Rights Agreement”)

with the Investors, pursuant to which the Company agreed to file a registration statement (the “Registration Statement”)

with the SEC, within 90 calendar days of the final closing of the Offering, to register the resale of the shares of Common Stock

issued in the Offering (the “Registrable Shares”). The Company must use commercially reasonable efforts to have the

Registration Statement declared effective by the SEC within 180 days after the Registration Statement is first filed with the

SEC. If (a) the Company is late in filing the Registration Statement with the SEC, (b) the Registration Statement ceases for any

reason to remain continuously effective during the term of the Registration Rights Agreement or the holders of the Registrable

Shares are not otherwise permitted to use the prospectus therein for more than 15 consecutive trading days, or (c) the Registrable

Shares are not listed or included for quotation on the OTC Markets, the Nasdaq Capital Market, the New York Stock Exchange, or

the NYSE MKT, or trading in the Common Stock is suspended for more than 3 full consecutive trading days, the Company will make

payments to each holder of Registrable Securities, as liquidated damages, a cash sum calculated at a rate of 12% per annum of

the aggregate purchase price paid by such holder pursuant to the Subscription Agreement with respect to such holder’s affected

Registrable Shares, on a daily pro rata basis for the period during which such shares are affected. The maximum amount of liquidated

damages that the Company will pay will be an amount equal to 8% of the Offering Price per affected share. No liquidated damages

will be paid with respect to Registrable Shares removed from the Registration Statement in response to a comment from the staff

of the SEC limiting the number of shares of Common Stock that may be included in the Registration Statement or with respect to

Registrable Shares that may be resold under Securities Act Rule 144 or another exemption from registration under the Securities

Act.

The

Company must keep the Registration Statement effective until the earlier of (a) two years from the date it is declared effective

by the SEC and (b) the date Rule 144 is available to the holders of Registrable Shares with respect to all of their Registrable

Shares without volume or other limitations.

The

holders of Registrable Shares have “piggyback” registration rights for such Registrable Shares with respect to up

to two registration statements filed by the Company following the effectiveness of the Registration Statement that would permit

the inclusion of such shares, subject to customary conditions.

The

Company will pay all expenses in connection with any registration obligation provided in the Registration Rights Agreement, including,

without limitation, all registration, filing, stock exchange fees, printing expenses, all fees and expenses of complying with

applicable securities laws, and the fees and disbursements of the Company’s counsel and independent accountants. Each holder

of Registrable Shares will be responsible for its own sales commissions, if any, transfer taxes and the expenses of any attorney

or other advisor such holder decides to employ.

The

foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the text thereof, which

is filed as Exhibit 10.1 hereto and incorporated herein by reference.

|

|

Item

3.02

|

Unregistered

Sales of Equity Securities

|

The

information set forth under Item 1.01 above is incorporated herein by reference. In addition, the sale of Common Stock at a price

of $5.50 per share triggered the price-protection rights of investors who purchased shares of Common Stock from us in our May

2017 private placement. Pursuant to such rights, approximately 542,455 shares are issuable to those investors for no additional

consideration.

The

shares of Common Stock issued in the Offering have not been registered under the Securities Act and may not be offered or sold

in the United States absent registration or an applicable exemption from registration requirements. This Current Report on Form

8-K is neither an offer to sell any securities, nor a solicitation of an offer to buy any securities, nor will there be any offer

or sale of any securities in any state or jurisdiction absent registration or compliance with an applicable exemption from registration

requirements.

|

|

Item

5.07

|

Submission

of Matters to a Vote of Security Holders

|

The

Company’s stockholders approved the two proposals that were presented at the Company’s 2017 annual meeting of stockholders

held on November 16, 2017 (the “Annual Meeting”), which were described in the definitive proxy statement relating

to the Annual Meeting filed with the SEC on October 12, 2017. There were 19,084,583 shares of common stock eligible to be voted

at the Annual Meeting, and 12,538,218 shares were represented in person or by proxy at the Annual Meeting, which constituted a

quorum to conduct business at the Annual Meeting. The final voting results of the two proposals are set forth below.

Proposal

1: Election of Directors

The

Company’s stockholders approved the slate of directors consisting of seven members to hold office until the 2018 annual

meeting of stockholders and until their successors are duly elected and qualified, or until their earlier resignation or removal,

based on the following voting results:

|

Nominee

|

|

For

|

|

Withheld

|

|

Broker

Non-Votes

|

|

Steven

P. DenBaars

|

|

9,131,521

|

|

507,384

|

|

2,899,313

|

|

Arthur

E. Geiss

|

|

9,596,915

|

|

41,990

|

|

2,899,313

|

|

Jeffrey

K. McMahon

|

|

9,598,415

|

|

40,490

|

|

2,899,313

|

|

Steven

P. Miller

|

|

9,598,178

|

|

40,727

|

|

2,899,313

|

|

Jerry

D. Neal

|

|

9,598,415

|

|

40,490

|

|

2,899,313

|

|

Suzanne

B. Rudy

|

|

9,598,415

|

|

40,490

|

|

2,899,313

|

|

Jeffrey

B. Shealy

|

|

9,596,915

|

|

41,990

|

|

2,899,313

|

Proposal

2: Ratification of the Independent Registered Public Accounting Firm

The

Company’s stockholders ratified the appointment of Marcum LLP as the Company’s independent registered public accounting

firm for the fiscal year ending June 30, 2018, based on the following voting results:

|

For

|

12,501,426

|

|

Against

|

26,835

|

|

Abstain

|

9,957

|

|

Broker

Non-Votes

|

0

|

|

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d)

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AKOUSTIS TECHNOLOGIES, INC.

|

|

|

|

|

|

By:

|

/s/

Jeffrey B. Shealy

|

|

|

|

Name:

Jeffrey B. Shealy

Title:

Chief Executive Officer

|

Date:

November 17, 2017

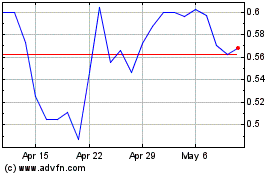

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

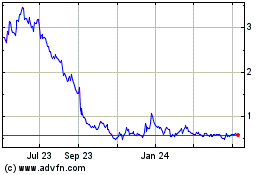

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Apr 2023 to Apr 2024