Current Report Filing (8-k)

November 16 2017 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 9, 2017

Humanigen, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-35798

|

|

77-0557236

|

|

(State or other Jurisdiction of

Incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

1000 Marina Boulevard, Suite 250

Brisbane, CA 94005-1878

(Address of principal executive offices, including zip code)

(650) 243-3100

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (

§

230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (

§

240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 9, 2017, Dale Chappell and Ezra Friedberg resigned from the

Humanigen, Inc. (the “Company”)

board of directors, effective immediately. Dr. Chappell’s and Mr. Friedberg’s resignations were not due to any disagreement with the Company. Dr. Chappell is an affiliate of Black Horse Capital Master Fund Ltd., Black Horse Capital LP and Cheval Holdings, Ltd., each of which is a term loan lender as described under Item 8.01 below.

On November 16, 2017, the Company obtained an extension from its lenders of the maturity of the Company’s obligations under the Credit and Security Agreement dated December 21, 2016, as amended on March 21, 2017 and on July 8, 2017 (the “Credit Agreement”) with Black Horse Capital Master Fund Ltd., as administrative agent and lender (“BHCMF” or “Agent”), Black Horse Capital LP, as a lender (“BHC”), Cheval Holdings, Ltd., as a lender (“Cheval”) and Nomis Bay LTD, as a lender (“Nomis” and, together with BHCMF, BHC and Cheval, the “Lenders”). As of October 31, 2017, the aggregate amount of the Company’s obligations under the Credit Agreement, including accrued interest and fees, approximated $16.1 million.

The extension agreed with the Lenders extends the maturity date of the Company’s obligations under the Credit Agreement to the earlier of (i) December 1, 2017, or (ii) the date that the Company consummates one or more alternative transactions with the Lenders. Aside from the extension of the Maturity Date, the extension did not modify any of the terms under the Credit Agreement.

The Company does not have access to sufficient funds to repay the outstanding obligations under the Credit Agreement. Accordingly, the Company has been discussing and continues to discuss with its Lenders alternative transactions that might result in the satisfaction of the Company’s obligations, including the possible conversion of the term loans into equity of the Company, which might occur at a significant discount to current market prices and be dilutive to the ownership interests of existing stockholders. There can be no assurances that the Lenders will agree to continue discussing any such alternative transactions or that the Company ultimately will be able to reach agreement with such Lenders on the terms of any alternative transaction. Neither the delivery of the extension extending the maturity date nor any action taken in connection therewith will give rise to any obligation on the part of the Lenders (i) to continue any discussions or negotiations with respect to any potential alternative transactions, or (ii) to pursue or enter into any transaction of any nature with the Company. No legal or equitable rights, responsibilities or duties with respect to any potential alternative will be created by the delivery of the extension or any action taken in connection with the extension.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HUMANIGEN, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Cameron Durrant

|

|

|

|

Name: Cameron Durrant

Title: Chairman of the Board and Chief Executive Officer

|

Dated: November 16, 2017

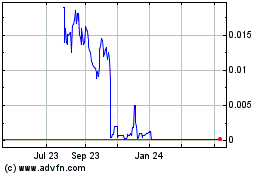

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024