Capital Southwest Increases Credit Facility to $180 Million

November 16 2017 - 4:01PM

Capital Southwest Corporation (“Capital Southwest” or the

“Company”) (Nasdaq:CSWC), an internally managed Business

Development Company focused on providing flexible financing

solutions to support the acquisition and growth of middle market

businesses, today announced an amendment to its Senior Secured

Credit Facility (the “Credit Facility”). The amended Credit

Facility provides total commitments of $180 million and an

expansion of the accordion feature to $250 million to accommodate

future growth of the Company. The amendment also includes, among

other things, a reduction in pricing, an extension to the revolving

period and final maturity, and an increase in advance rates on

first lien loans made by the Company. The financing was led by ING

Capital LLC.

Total commitments under the amended Credit

Facility increased by $65 million, to an aggregate of $180 million,

provided by a diversified group of eight lenders. The accordion

feature of the amended Credit Facility allows for an increase in

total commitments under the facility from new and existing lenders

on the same terms and conditions as the existing commitments.

As of quarter end September 30, 2017, Capital Southwest had

$56 million outstanding on the Credit Facility.

The pricing on the facility was reduced from

LIBOR plus 3.25% to LIBOR plus 3.00%, with a step-down to LIBOR

plus 2.75% when certain conditions, as outlined in the credit

agreement, are met. Unused commitment fees were also reduced.

The Credit Facility’s revolving period was

extended from August 30, 2019 to November 16, 2020; and the final

maturity was extended from August 30, 2020 to November 16,

2021.

Michael Sarner, Chief Financial Officer,

commented, “We were pleased with the substantial interest in the

amendment and upsize of our credit facility. This amendment

provides us significant funding capacity to continue to grow our

investment portfolio and increase balance sheet leverage towards

our target, while lowering the facility cost and increasing advance

rates. Improving the cost and efficiency of our financing

sources allows us to generate attractive risk adjusted returns for

our shareholders without reaching for yield in our investment

portfolio. We value our relationships with our existing and

new lenders and are grateful for their continued support.”

About Capital Southwest

Capital Southwest Corporation (Nasdaq:CSWC) is a

Dallas, Texas-based, internally managed Business Development

Company, with approximately $293 million in net assets as of

September 30, 2017. Capital Southwest is a middle-market

lending firm focused on supporting the acquisition and growth of

middle market businesses and makes investments ranging from $5 to

$20 million in securities across the capital structure, including

first lien, unitranche, second lien, subordinated debt and

non-control equity co-investments. As a public company with a

permanent capital base, Capital Southwest has the flexibility to be

creative in its financing solutions and to invest to support the

growth of its portfolio companies over long periods of time.

About ING Capital LLC

ING Capital LLC is a financial services firm

offering a full array of wholesale financial lending products and

advisory services to its corporate and institutional clients. ING

Capital LLC is an indirect U.S. subsidiary of ING Bank NV, part of

ING Group (NYSE:ING), a global financial institution of Dutch

origin. The purpose of ING Bank is empowering people to stay a step

ahead in life and in business. The Investment Industry Finance

(IIF) group at ING Capital offers a broad range of structured

finance solutions to its clients active in the investment industry,

including Business Development Companies.

Forward-Looking Statements

This press release contains historical

information and forward-looking statements within the meaning of

The Private Securities Litigation Reform Act of 1995 with respect

to the business and investments of Capital Southwest.

Forward-looking statements are statements that are not historical

statements and can often be identified by words such as “will, “

“may,” “could,” “believe, ““expect“ and similar expressions and

variations or negatives of these words. These statements are based

on management's current expectations, assumptions and beliefs. They

are not guarantees of future results and are subject to numerous

risks, uncertainties and assumptions that could cause actual

results to differ materially from those expressed in any

forward-looking statement. These risks include risks related to

changes in the markets in which Capital Southwest invests, changes

in the financial and lending markets, regulatory changes, tax

treatment and general economic and business conditions.

Readers should not place undue reliance on any

forward-looking statements and are encouraged to review Capital

Southwest's Annual Report on Form 10-K for the year ended March 31,

2017 and subsequent filings with the Securities and Exchange

Commission for a more complete discussion of the risks and other

factors that could affect any forward-looking statements. Except as

required by the federal securities laws, Capital Southwest does not

undertake any obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, changing circumstances or any other reason after the

date of this press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial

Officer214-884-3829

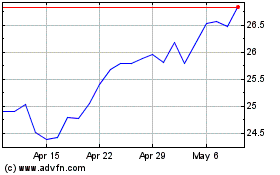

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Mar 2024 to Apr 2024

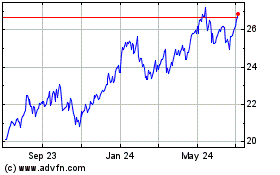

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Apr 2023 to Apr 2024