- Q1 REVENUES OF £141.0 MILLION

- Q1 ADJUSTED EBITDA OF £36.6

MILLION

- Q1 OPERATING PROFIT OF £15.2

MILLION

Manchester United (NYSE: MANU; the “Company”

and the “Group”) – one of the most popular and successful sports

teams in the world - today announced financial results for the 2018

fiscal first quarter ended 30 September 2017.

Highlights

- Total revenue for the first quarter

£141m – up 17% from first quarter 2017

- Played five tour matches across the

US to a cumulative stadium audience of more than 250,000

- Signed three new players in Victor

Lindelof, Romelu Lukaku and Nemanja Matic

Commentary

Ed Woodward, Executive Vice Chairman,

commented, “We are just over a quarter of the way through what

promises to be another exciting season. In the Champions League we

have won all four games played to-date; we are through to the

Quarter Final of the Carabao Cup; and are looking forward to the

next few months as the number of matches ramps up.”

Outlook

For fiscal 2018, Manchester United continues to

expect:

- Revenue to be £575m to £585m.

- Adjusted EBITDA to be £175m to

£185m.

Key Financials

(unaudited)

£ million (except earnings per

share)

Three months ended

30 September

2017 2016 Change

Commercial revenue

80.5 74.3 8.3%

Broadcasting revenue

38.1 29.1 30.9%

Matchday revenue

22.4 16.8 33.3% Total

revenue

141.0 120.2 17.3% Adjusted

EBITDA1

36.6 31.2 17.3% Operating

profit

15.2 6.2 145.2% Profit

for the period (i.e. net income)

7.9 1.2

558.3% Basic earnings per share

4.84

0.71 581.7% Adjusted profit for the period (i.e. adjusted

net income)1

6.2 0.7 785.7% Adjusted

basic earnings per share (pence)1

3.76 0.43

774.4% Net Debt1/2

268.1 337.7

(20.6%)

1 Adjusted EBITDA, adjusted profit for the

period, adjusted basic earnings per share and net debt are non-IFRS

measures. See “Non-IFRS Measures: Definitions and Use” below and

the accompanying Supplemental Notes for the definitions and

reconciliations for these non-IFRS measures and the reasons we

believe these measures provide useful information to investors

regarding the Group’s financial condition and results of

operations.

2 The gross USD debt principal remains

unchanged.

Revenue

Analysis

CommercialCommercial revenue for the

quarter was £80.5 million, an increase of £6.2 million, or 8.3%,

over the prior year quarter.

- Sponsorship revenue for the quarter of

£53.2 million, an increase of £6.3 million, or 13.4%, over the

prior year quarter, primarily due to playing a greater number of

Tour matches. This quarter includes £2.0 million of mobile and

content revenue (prior year quarter £2.5 million) previously shown

separately in commercial revenue;

- Retail, Merchandising, Apparel &

Product Licensing revenue for the quarter was £27.3 million, a

decrease of £0.1 million, or 0.4%, over the prior year

quarter.

BroadcastingBroadcasting revenue for the

quarter was £38.1 million, an increase of £9.0 million, or 30.9%,

over the prior year quarter, primarily due to participation in the

UEFA Champions League, playing one additional PL home game and

participation in the UEFA Super Cup final, partially offset by one

fewer PL game broadcast live.

MatchdayMatchday revenue for the quarter

was £22.4 million, an increase of £5.6 million, or 33.3% over the

prior year quarter, primarily due to playing two additional home

games across all competitions.

Other Financial

Information

Operating expensesTotal operating

expenses for the quarter were £143.1 million, an increase of £20.9

million, or 17.1%, over the prior year quarter.

Employee benefit expensesEmployee

benefit expenses for the quarter were £69.9 million, an increase of

£7.6 million, or 12.2%, over the prior year quarter primarily due

to player salary uplifts due to participation in the UEFA Champions

League.

Other operating expensesOther

operating expenses for the quarter were £34.5 million, an increase

of £7.8 million, or 29.2%, over the prior year quarter primarily

due to playing a greater number of Tour matches and playing two

additional games across all competitions.

Depreciation &

amortizationDepreciation for the quarter was £2.6 million, an

increase of £0.2 million, or 8.3%, over the prior year quarter.

Amortization for the quarter was £36.1 million, an increase of £5.3

million, or 17.2%, over the prior year quarter. The unamortized

balance of players’ registrations at 30 September 2017 was £378.4

million.

Profit on disposal of intangible assetsProfit on disposal

of intangible assets for the quarter was £17.3 million compared to

profit of £8.2 million in the prior year quarter.

Net finance costsNet finance costs for the quarter were

£0.8 million, a decrease of £5.1 million, or 86.4%, over the prior

year quarter, due to foreign exchange gains on unhedged USD

borrowings.

TaxThe tax expense for the quarter was £6.5 million,

compared to a credit of £0.9 million in the prior year quarter.

Cash flowsNet cash generated from operating activities

for the quarter was £17.9 million, a decrease of £34.7 million over

the prior year quarter.

Net capital expenditure on property, plant and equipment and

investment property for the quarter was £4.4 million, an increase

of £2.2 million over the prior year quarter.

Net capital expenditure on intangible assets for the quarter was

£84.9 million, a decrease of £37.8 million over the prior year

quarter.

Overall cash and cash equivalents (including the effects of

exchange rate changes) decreased by £74.1 million in the

quarter.

Net DebtNet Debt as of 30 September 2017 was £268.1

million, a decrease of £69.6 million over the year. The gross USD

debt principal remains unchanged.

DividendA semi-annual cash

dividend of $0.09 per share will

be paid on 5 January 2018, to shareholders of record on

30 November 2017. The stock will begin to trade ex-dividend on 29

November 2017.

Conference Call

Information

The Company’s conference call to review first

quarter fiscal 2018 results will be broadcast live over the

internet today, 16 November 2017 at 8:00 a.m. Eastern Time and will

be available on Manchester United’s investor relations website at

http://ir.manutd.com. Thereafter, a replay of the webcast will be

available for thirty days.

About Manchester

United

Manchester United is one of the most popular and successful

sports teams in the world, playing one of the most popular

spectator sports on Earth.

Through our 139-year heritage we have won 66 trophies, enabling

us to develop what we believe is one of the world’s leading sports

brands and a global community of 659 million followers. Our

large, passionate community provides Manchester United with a

worldwide platform to generate significant revenue from multiple

sources, including sponsorship, merchandising, product licensing,

broadcasting and matchday.

Cautionary

Statement

This press release contains forward-looking

statements. You should not place undue reliance on such statements

because they are subject to numerous risks and uncertainties

relating to the Company’s operations and business environment, all

of which are difficult to predict and many are beyond the Company’s

control. Forward-looking statements include information concerning

the Company’s possible or assumed future results of operations,

including descriptions of its business strategy. These statements

often include words such as “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“seek,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” or similar expressions. The

forward-looking statements contained in this press release are

based on our current expectations and estimates of future events

and trends, which affect or may affect our businesses and

operations. You should understand that these statements are not

guarantees of performance or results. They involve known and

unknown risks, uncertainties and assumptions. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, you should be aware that many factors could

affect its actual financial results or results of operations and

could cause actual results to differ materially from those in these

forward-looking statements. These factors are more fully discussed

in the “Risk Factors” section and elsewhere in the Company’s

Registration Statement on Form F-1, as amended (File No.

333-182535) and the Company’s Annual Report on Form 20-F (File No.

001-35627).

Non-IFRS Measures:

Definitions and Use

1. Adjusted

EBITDAAdjusted EBITDA is defined as profit for the period

before depreciation, amortization, profit on disposal of intangible

assets, exceptional items, net finance costs, and tax.

We believe Adjusted EBITDA is useful as a measure of comparative

operating performance from period to period and among companies as

it is reflective of changes in pricing decisions, cost controls and

other factors that affect operating performance, and it removes the

effect of our asset base (primarily depreciation and amortization),

capital structure (primarily finance costs), and items outside the

control of our management (primarily taxes). Adjusted EBITDA has

limitations as an analytical tool, and you should not consider it

in isolation, or as a substitute for an analysis of our results as

reported under IFRS as issued by the IASB. A reconciliation of

profit for the period to Adjusted EBITDA is presented in

supplemental note 2.

2. Adjusted profit for the period (i.e.

adjusted net income)Adjusted profit for the period is

calculated, where appropriate, by adjusting for charges/credits

related to exceptional items, foreign exchange gains/losses on

unhedged US dollar denominated borrowings, and fair value movements

on derivative financial instruments, adding/subtracting the actual

tax expense/credit for the period, and subtracting the adjusted tax

expense for the period (based on a normalized tax rate of 35%;

2017: 35%). The normalized tax rate of 35% is the current US

federal income tax rate.

We believe that in assessing the comparative performance of the

business, in order to get a clearer view of the underlying

financial performance of the business, it is useful to strip out

the distorting effects of the items referred to above and then to

apply a ‘normalized’ tax rate (for both the current and prior

periods) equivalent to the US federal income tax rate of 35%. A

reconciliation of profit for the period to adjusted profit for the

period is presented in supplemental note 3.

3. Adjusted basic and diluted earnings per

shareAdjusted basic and diluted earnings per share are

calculated by dividing the adjusted profit for the period by the

weighted average number of ordinary shares in issue during the

period. Adjusted diluted earnings per share is calculated by

adjusting the weighted average number of ordinary shares in issue

during the period to assume conversion of all dilutive potential

ordinary shares. We have one category of dilutive potential

ordinary shares: share awards pursuant to the 2012 Equity Incentive

Plan (the “Equity Plan”). Share awards pursuant to the Equity Plan

are assumed to have been converted into ordinary shares at the

beginning of the financial year. Adjusted basic and diluted

earnings per share are presented in supplemental note 3.

4. Net debtNet

debt is calculated as non-current and current borrowings minus cash

and cash equivalents.

Key Performance

Indicators

Three months ended30

September

2017 2016

Commercial % of total revenue

57.1% 61.8%

Broadcasting % of total revenue

27.0% 24.2%

Matchday % of total revenue

15.9%

14.0% Home Matches Played PL

4 3 UEFA competitions

1

1 Domestic Cups

1 - Away Matches Played UEFA competitions

2 1 Domestic Cups

- 1

Other Employees

at period end

914 837 Employee benefit expenses % of revenue

49.6% 51.8%

Phasing of Premier League

homegames

Quarter 1 Quarter 2 Quarter 3

Quarter 4 Total 2017/18 season* 4

7 5 3 19 2016/17 season 3 7

4 5 19

*Subject to changes in broadcasting scheduling

CONSOLIDATED INCOME STATEMENT

(unaudited; in £ thousands, except per

share and shares outstanding data)

Three months ended30

September

2017 2016

Revenue 140,980

120,213 Operating expenses

(143,036) (122,242) Profit on

disposal of intangible assets

17,279 8,205

Operating profit 15,223 6,176 Finance

costs

(1,001) (6,098) Finance income

218

180 Net finance costs

(783) (5,918)

Profit before tax 14,440 258 Tax (expense)/credit

(6,493) 903

Profit for the period

7,947 1,161

Basic earnings per

share: Basic earnings per share (pence)

4.84 0.71

Weighted average number of ordinary shares outstanding (thousands)

164,195 164,025

Diluted earnings per share: Diluted

earnings per share (pence)

4.83 0.71 Weighted average number

of ordinary shares outstanding (thousands)

164,585

164,483

CONSOLIDATED BALANCE SHEET

(unaudited; in £ thousands)

As of

30 September

2017

As of

30 June

2017

As of

30 September

2016

ASSETS Non-current assets Property, plant and

equipment

246,831 244,738 245,004 Investment property

13,934 13,966 14,060 Intangible assets

805,694

717,544 800,290 Derivative financial instruments

479 1,666

3,313 Trade and other receivables

9,991 15,399 4,005

Deferred tax asset

136,705

142,107 148,016

1,213,634

1,135,420 1,214,688

Current assets Inventories

2,074 1,637 1,422

Derivative financial instruments

2,433 3,218 5,218 Trade and

other receivables

80,415 103,732 68,600 Tax receivable

- - 97 Cash and cash equivalents

216,236

290,267 164,277

301,158 398,854

239,614

Total assets 1,514,792

1,534,274 1,454,302

CONSOLIDATED BALANCE SHEET

(continued)

(unaudited; in £ thousands)

As of

30 September

2017

As of

30 June

2017

As of

30 September

2016

EQUITY AND LIABILITIES Equity Share capital

53

53 52 Share premium

68,822 68,822 68,822 Merger reserve

249,030 249,030 249,030 Hedging reserve

(24,264)

(31,724) (37,619) Retained earnings

199,968

191,436 174,985

493,609 477,617

455,270

Non-current liabilities Derivative financial

instruments

523 655 8,773 Trade and other payables

69,898 83,587 67,412 Borrowings

478,065 497,630

499,305 Deferred revenue

35,060 39,648 35,836 Deferred tax

liabilities

25,802 20,828

11,975

609,348

642,348 623,301

Current

liabilities Derivative financial instruments

- 1,253

1,163 Tax liabilities

8,675 9,772 5,054 Trade and other

payables

202,534 190,315 170,705 Borrowings

6,236

5,724 2,683 Deferred revenue

194,390

207,245 196,126

411,835 414,309

375,731

Total equity and liabilities 1,514,792

1,534,274 1,454,302

CONSOLIDATED STATEMENT OF CASH

FLOWS

(unaudited; in £ thousands)

Three months ended

30 September

2017 2016

Cash flows from operating

activities Cash generated from operations (see

supplemental note 4)

26,951 63,783 Interest paid

(8,018) (7,904) Interest received

218 180 Tax paid

(1,238) (3,452)

Net cash generated from

operating activities 17,913 52,607

Cash

flows from investing activities Payments for property, plant

and equipment

(4,344) (1,557) Payments for investment

property

- (644) Payments for intangible assets

(117,121) (158,848) Proceeds from sale of intangible assets

32,186 36,159

Net cash used in investing

activities (89,279) (124,890)

Cash

flows from financing activities Repayment of borrowings

(100) (94)

Net cash used in financing

activities (100) (94)

Net decrease in

cash and cash equivalents (71,466) (72,377) Cash and

cash equivalents at beginning of period

290,267 229,194

Effects of exchange rate changes on cash and cash equivalents

(2,565) 7,460

Cash and cash equivalents at

end of period 216,236 164,277

SUPPLEMENTAL NOTES

1 General information

Manchester United plc (the “Company”) and its subsidiaries

(together the “Group”) is a professional football club together

with related and ancillary activities. The Company incorporated

under the Companies Law (2011 Revision) of the Cayman Islands, as

amended and restated from time to time.

2 Reconciliation of profit for the period to Adjusted

EBITDA

Three months ended

30 September

2017

£’000

2016

£’000

Profit for the period 7,947 1,161 Adjustments:

Tax expense/(credit)

6,493 (903) Net finance costs

783 5,918 Profit on disposal of intangible assets

(17,279) (8,205) Amortization

36,054 30,805

Depreciation

2,574 2,412

Adjusted

EBITDA 36,572 31,188

3 Reconciliation of profit for the period to adjusted

profit for the period and adjusted basic and diluted earnings per

share

Three months ended

30 September

2017

£’000

2016

£’000

Profit for the period 7,947 1,161 Foreign

exchange (gains)/losses on unhedged US dollar borrowings

(5,496) 2,111 Fair value movement on derivative financial

instruments

554 (1,274) Tax expense/(credit)

6,493 (903) Adjusted profit before tax

9,498

1,095

Adjusted tax expense (using a normalized

US statutory rate of 35%)

(3,324) (383)

Adjusted profit for the

period (i.e. adjusted net income) 6,174

712

Adjusted basic earnings per share: Adjusted basic

earnings per share (pence)

3.76 0.43 Weighted average number

of ordinary shares outstanding (thousands)

164,195 164,025

Adjusted diluted earnings per share: Adjusted diluted

earnings per share (pence)

3.75 0.43 Weighted average number

of ordinary shares outstanding (thousands)

164,585

164,483

4 Cash generated from operations

Three months ended

30 September

2017

£’000

2016

£’000

Profit for the period

7,947 1,161 Tax

expense/(credit)

6,493 (903) Profit before tax

14,440 258 Depreciation

2,574 2,412 Amortization

36,054 30,805 Profit on disposal of intangible assets

(17,279) (8,205) Net finance costs

783 5,918

Equity-settled share-based payments

585 457 Foreign exchange

losses/(gains) on operating activities

991 (2,036)

Reclassified from hedging reserve

4,001 766 Increase in

inventories

(437) (496) Decrease in trade and other

receivables

16,673 39,447 Decrease in trade and other

payables and deferred revenue

(31,434) (5,543)

Cash generated from operations 26,951

63,783

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171116005664/en/

Manchester United plcInvestor Relations:Cliff Baty, +44 161 868

8650Chief Financial Officerir@manutd.co.ukorMedia:Manchester United

plcPhilip Townsend, +44 161 868

8148philip.townsend@manutd.co.ukorSard Verbinnen & CoJim Barron

/ Michael Henson+ 1 212 687 8080JBarron@SARDVERB.com

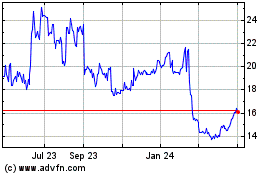

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Apr 2024

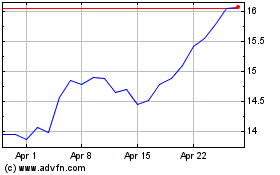

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2023 to Apr 2024