Filed Pursuant to Rule 424(b)(5)

Registration No. 333-207245

Prospectus Supplement

(To Prospectus Dated October 19, 2015)

4,969,805 Shares

PROQR

THERAPEUTICS N.V.

Ordinary Shares

We are offering 4,969,805

ordinary shares, with a nominal value of €0.04 per share, in this offering. Our ordinary shares are listed on the NASDAQ Global Market under the symbol “PRQR”. ProQR Therapeutics N.V. is a public company with limited liability

(

naamloze vennootschap

) incorporated under the laws of the Netherlands. On November 13, 2017, the last reported sale price of our ordinary shares on the NASDAQ Global Market was $3.48 per share.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and are subject to reduced public company reporting

requirements.

Investing in our ordinary shares involves a high degree of risk. Please read “

Risk Factors

” on page S-14 of

this prospectus supplement and in the other documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this

prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

3.25

|

|

|

$

|

16,151,866

|

|

|

Underwriting discounts and commissions (1)

|

|

$

|

0.195

|

|

|

$

|

850,357

|

|

|

Proceeds, before expenses, to us

|

|

$

|

3.055

|

|

|

$

|

15,301,510

|

|

|

(1)

|

Certain of our existing shareholders, including certain affiliates of members of our management and supervisory boards, have agreed to purchase an aggregate of approximately $4.0 million of ordinary shares in this

offering at the public offering price. The underwriters will receive a reduced underwriting commission in respect of shares sold to these shareholders, as reflected in the “Total” column in the table above. In addition, we have agreed to

reimburse the underwriters for certain expenses. See “Underwriting.”

|

With this offering of ordinary shares and pursuant to a

separate prospectus supplement, we have agreed to sell up to an aggregate of approximately $4.6 million of ordinary shares to certain investors, in a registered direct offering at the same price per share as the public offering price set forth in

the table above, which we refer to herein as our concurrent registered direct offering. The concurrent registered direct offering is being made without an underwriter or placement agent.

The underwriters may also purchase up to an additional 745,471 ordinary shares from us at the public offering price, less underwriting discounts and

commissions, within 30 days of the date of this prospectus supplement.

The underwriters expect to deliver the ordinary shares to the purchasers on or

about November 16, 2017.

Sole Book-Running Manager

H.C. Wainwright & Co.

Co-Manager

National Securities Corporation

The date of

this prospectus supplement is November 14, 2017.

TABLE OF CONTENTS

S-i

We have not, and the underwriters have not, authorized anyone to provide you with information different than

that which is contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering. We are not, and the underwriters are

not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by

reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents. Our business,

financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the

accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to

which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

S-ii

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of ordinary shares, and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, provides more general

information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in

the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these

documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes

the earlier statement. The information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein, is accurate only as of the respective dates thereof, regardless of the time of delivery of this

prospectus supplement and the accompanying prospectus or of any sale of our ordinary shares. Unless the context otherwise indicates, references in this prospectus to “we,” “our,” and “us” refer to ProQR

Therapeutics N.V., a company organized under the laws of the Netherlands, and its consolidated subsidiaries. As adjusted financial numbers presented in this prospectus supplement have been converted from Euro to U.S. dollars at a rate of

$1.1590 to €1.00, the official exchange rate quoted by the European Central Bank at the close of business on November 8, 2017.

S-1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the documents incorporated herein and therein by reference contain forward-looking statements

based on beliefs of our management. Any statements contained in this prospectus supplement, the accompanying prospectus, and the documents incorporated herein and therein by reference that are not historical facts are forward-looking statements as

defined in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. For this purpose, any statements contained herein, other than

statements of historical fact, including statements regarding: the progress and timing of our product development programs and related trials; our future opportunities; our strategy, future operations, anticipated financial position, future revenues

and projected costs; our management’s prospects, plans and objectives; and any other statements about management’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. We may, in some cases, use

words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “target,”

“will,” “would” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a

result of various important factors, including the risks described under the heading “Risk Factors” in this prospectus supplement, the accompanying prospectus, and our most recent Annual Report on

Form 20-F,

as well as any amendments thereto reflected in subsequent filings with the SEC. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual

results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Our forward-looking statements do not reflect the potential impact of any

acquisitions, mergers, dispositions, business development transactions, joint ventures or investments we may enter into or make in the future.

You should

rely only on information contained, or incorporated by reference, in this prospectus supplement, the accompanying prospectus, and the documents incorporated herein and therein by reference, and understand that our actual future results may be

materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements. Although we believe that the expectations reflected in our forward-looking statements are

reasonable, we cannot guarantee future results, events, levels of activity, performance or achievement. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law. Before deciding to purchase our securities, you should carefully consider the risk factors included or

incorporated herein by reference, in addition to the other information set forth in this prospectus supplement, the accompanying prospectus, and the documents incorporated herein and therein by reference.

You should rely only on the information provided in this prospectus supplement, the accompanying prospectus, and the documents incorporated herein and therein

by reference. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus

supplement, the accompanying prospectus, and the documents incorporated herein and therein by reference is accurate as of any date other than the date of the applicable document.

S-2

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere in this prospectus supplement and the accompanying prospectus and in the

documents we incorporate by reference. This summary does not contain all the information you should consider before investing in our ordinary shares. You should carefully read this entire prospectus supplement and accompanying prospectus, including

the documents incorporated by reference, particularly the risks and discussion of risks in the “Risk Factors” beginning on page

S-14

of this prospectus supplement and the “Operating and

Financial Review and Prospects” section and our consolidated financial statements and related notes contained in our Annual Report on

Form 20-F

for the year ended December 31, 2016, filed with

the SEC on March 31, 2017, as well as the information included in any free writing prospectus that we have authorized for use in connection with this offering. This summary contains forward-looking statements that involve risks and

uncertainties. Our actual results may differ significantly from the results stated in or suggested by such forward-looking statements due to a variety of factors, including those set forth in the “Risk Factors” and “Special Note

Regarding Forward-Looking Statements” sections.

ProQR Therapeutics N.V.

We are an innovative biopharmaceutical company engaged in the discovery and development of

RNA-based

therapeutics for

the treatment of severe genetic orphan disorders. Utilizing our RNA platform we are building a pipeline of therapeutics for patients in need. Our drug development programs are based on single stranded RNA oligonucleotides that are chemically

modified to enhance stability and cellular uptake, and aimed to restore protein function through targeting the RNA. While all our compounds are one therapeutic modality, a variety of mechanisms of actions may be used depending on the mutation that

is targeted. We believe that this targeted approach offers several advantages compared to small molecule, gene therapy and other therapeutic approaches in the treatment of the rare genetic diseases we target.

Our current pipeline consists of programs in cystic fibrosis, ophthalmology and dermatology. For cystic fibrosis, or CF, a severe genetic disease that affects

approximately 77,000 people in the United States, European Union, Canada and Australia, we are developing

QR-010

for the F508del mutation, which has completed two clinical trials with positive

top-line

data. We have a discovery pipeline for other genetic mutations causing CF. For ophthalmology, we are developing

QR-110

for Leber’s congenital amaurosis type 10,

or LCA10, which we are currently studying in a Phase 1/2 safety and efficacy clinical trial,

QRX-421

for the ophthalmic manifestations of Usher syndrome due to exon 13 mutations in preclinical development,

QRX-411

for the ophthalmic manifestations of Usher syndrome due to the

PE-40

mutation in preclinical development,

QRX-1011

for

Stargardt’s disease due to an exon 39 splicing mutation in the ABCA4 gene in discovery stage and

QRX-504

for Fuchs endothelial corneal dystrophy in discovery stage. In dermatology, we are developing

QR-313

in preclinical studies for the exon 73 mutation leading to dystrophic epidermolysis bullosa, or DEB, a severe genetic blistering skin disease.

Beyond that, we have discovered and developed a novel proprietary RNA editing platform technology called Axiomer. Axiomer’s editing oligonucleotides, or

EONs, are designed to recruit endogenous Adenosine Deaminases Acting on RNA, or ADAR, enzyme, and direct ADAR to make a change in the RNA at the desired location. ADAR can modify an Adenosine in the RNA into an Inosine, which is translated in the

protein synthesis as a Guanine. We believe that the Axiomer platform may be applicable to more than 20,000 disease-causing mutations. We expect to complete optimization of

proof-of-concept

in vitro

and

in vivo

in 2017.

We have also

discovered and developed together with the Leiden University Medical Center, a program for

HCHWA-D,

or Katwijks disease, a genetically defined subpopulation of cerebral amyloid angiopathy, or CAA. We recently

spun out this program into Amylon Therapeutics BV, in which we maintain a majority ownership.

We continue to assess our development and commercialization

plans for our product candidates and intend to evaluate opportunities for beneficial collaborations or partnerships for these programs. In addition, using our

S-3

discovery engine that is designed to generate a deep and broad pipeline of product candidates, we seek to enter into strategic partnerships for programs that we believe will benefit from such a

partnership, and advance other selected programs independently to commercialization.

Cystic Fibrosis

Our

lead product candidate for CF,

QR-010,

is a single stranded RNA oligonucleotide designed to restore CFTR function in patients suffering from the F508del mutation.

QR-010

is self-administered via an eFlow Nebulizer manufactured by PARI Pharma GmbH. In preclinical studies,

QR-010

was observed to restore CFTR function in three cellular models and two animal models.

QR-010

was observed in

in vitro

and

in vivo

experiments to be able to diffuse through the CF mucous.

QR-010

has been granted orphan drug designation by the

European Commission and Food and Drug Administration, or FDA, for the treatment of CF caused by the F508del mutation.

QR-010

has also received fast track designation from the FDA for the treatment of CF caused

by the F508del mutation. The

QR-010

project received funding from the European Union’s Horizon 2020 research and innovation programme under grant agreement No 633545. We intend to seek a strategic partner

for further development of

QR-010

for CF.

We have conducted two clinical trials of

QR-010.

Study

PQ-010-001

was a Phase 1b safety and tolerability and exploratory efficacy study. Study

PQ-010-002

was a

proof-of-concept

study evaluating topical administration of

QR-010

and its effect on the nasal potential difference, or NPD, a biomarker of CFTR function. The Phase 2 clinical program for

QR-010

is currently under design.

Study

PQ-010-001,

a Phase 1b safety and tolerability study in CF F508del

homozygous patients

PQ-010-001

was a Phase 1b randomized,

double-blind, placebo-controlled, dose-escalation

28-day

study with

follow-up

that enrolled 70 patients with baseline forced expiratory volume in one second, or FEV

1

, of at least 70% in 23 centers in North America and Europe, of which 34 subjects were included in the multiple ascending dose cohorts. This study evaluated the safety, tolerability and, as a

secondary endpoint, pharmacokinetics of

S-4

single and multiple ascending doses of inhaled

QR-010

in CF patients homozygous for the F508del mutation. Exploratory efficacy endpoints included sweat

chloride, weight gain,

CFQ-R

Respiratory Symptom Score, or

CFQ-R

RSS, and lung function as measured by FEV

1

. In

the single dose cohorts, patients received a single dose of

QR-010

of 6.25 mg, 12.5 mg, 25 mg or 50 mg or placebo. In the multiple dose cohorts, patients received over a period of four weeks 12 doses of

QR-010

of 6.25 mg, 12.5 mg, 25 mg or 50 mg or placebo.

All four single dose cohorts and four multiple dose cohorts have

been completed. The safety data from each cohort was reviewed by an independent safety monitoring board. While three serious adverse events were observed, none of these was found to be related to the treatment. No dose-limiting toxicity was observed

up to the highest dose tested.

QR-010

was detected in the blood after inhaled administration in the high dose cohort. Promising results were also found for the exploratory efficacy endpoints of

CFQ-R

RSS and percent predicted FEV

1

or ppFEV

1

in the per protocol study population. In three out of

four multiple dose cohorts, we observed a change in

CFQ-R

RSS that was well above the minimally clinically important difference, or MCID, of 4.0 points. For the same dose cohorts, this trend in improved

CFQ-R

RSS scores was generally stronger in the

pre-specified

subgroup of patients with a baseline ppFEV

1

below 90%. A

supportive trend was observed in ppFEV

1

, this trend was stronger in the

pre-specified

subgroup of patients with a baseline ppFEV

1

below 90%. There was no change detected in sweat chloride and weight. The following figures summarize the exploratory efficacy results from the

PQ-010-001

clinical trial.

Exploratory efficacy endpoint:

CFQ-R

Respiratory Symptom Score

S-5

Exploratory efficacy endpoint: ppFEV

1

Study

PQ-010-002,

a Nasal Potential

Difference

proof-of-concept

study

PQ-010-002

was an open-label,

proof-of-concept

study evaluating the effect of

QR-010

on the nasal potential difference, or NPD, assay, an important biomarker measurement of CFTR function. The study

was conducted in five NPD specialized centers in the U.S. and Europe. The study enrolled 18 CF patients, ten homozygous for the F508del mutation and eight compound heterozygous, which means the patients have one copy of the F508del mutation and one

copy of another cystic fibrosis disease-causing mutation.

QR-010

was applied topically to the nasal mucosa 12 times over a period of four weeks. The primary endpoint for each cohort was the change from

baseline in CFTR mediated total chloride transport as measured by NPD. Additional measurements of CFTR function included sodium transport measured by average basal PD. An independent blinded central reader scored individual NPD data and an

independent data review committee of NPD experts reviewed the data.

S-6

The study demonstrated that

QR-010

significantly improved CFTR

function in a cohort of homozygous F508del CF patients. The study met its day 26 primary endpoint as measured by a change in total chloride response in patients homozygous for the F508del mutation. In the

per-protocol

population of subjects homozygous for the F508del mutation meeting the

pre-specified

inclusion criteria (n=7), the average change from baseline in NPD at

day 26 was statistically significant,

-4.1

mV (p=0.0389). These findings were supported by a change in sodium channel activity and other sensitivity analyses of the NPD measurements, which indicate improvement

of CFTR activity.

QR-010

did not improve CFTR activity in subjects with CF compound heterozygous for the F508del mutation or for the full per protocol population. While there were adverse events during the

study,

QR-010

was observed to be well-tolerated in both cohorts. The following figures summarize the results from the

PQ-010-002

clinical trial.

|

|

|

|

|

|

|

Ophthalmology

Our lead

product candidate for LCA 10,

QR-110,

a

first-in-class

oligonucleotide, is designed to delay the progression of the disease or

restore vision in patients with LCA 10 due to the p.Cys998X mutation in the CEP290 gene by repairing the underlying cause in the mRNA, which results in the production of the normal, or wild-type, CEP290 protein. The p.Cys998X mutation is a

substitution of one nucleotide in the

pre-mRNA

that leads to a defective mRNA and

non-functional

protein.

QR-110

is designed to

bind to the mutated location in the

pre-mRNA,

thereby leading to normally spliced or wild-type mRNA manifestation, which could lead to the production of normal or wild-type protein. In pre-clinical studies of

QR-110, it was shown to convert close to 100 percent of the mutant mRNA to wild-type in a homozygous optic cup organoid model, which led to a functional CEP290 protein.

QR-110

is designed to be administered

through an intravitreal injection in the eye which is considered a routine procedure, and has been shown in vivo that QR-110 reaches the outer nuclear layer of the eye following a single intravitreal injection. The long half-life of QR-110 in the

eye may allow for infrequent dosing. The company conducted a pre-evaluation/retrospective natural history study collection data of 22 LCA 10 patients over a period of 16 years in 2017. Based on the data collected from the pre-evaluation study as

well as the preclinical safety and efficacy studies, we are currently conducting a clinical trial of

QR-110

in adult and pediatric LCA10 patients with one or two copies of the

CEP290

p.Cys998X mutation.

Our ongoing Phase 1/2 safety and efficacy study will enroll six pediatric patients over the age of six and six adult patients. We dosed our first LCA10 patient in this clinical trial in November 2017. The patients will receive one loading dose and

three maintenance doses over the period of 12 months in one eye, with the other eye serving as the control. Three different dosing regimens will be tested: a low dose group (160 µg loading dose / 80 µg maintenance dose), a mid dose

group (320 µg loading dose / 160 µg maintenance dose) and a high dose group (500 µg loading dose / 270 µg maintenance dose). The objectives of the trial will include safety, tolerability, pharmacokinetics and efficacy as

measured by restoration or improvement of visual function and retinal structure through ophthalmic endpoints such as visual acuity, full field stimulus testing, or FST, optical coherence tomography, OCT, pupillary light reflex, or PLR, mobility

course and fixation stability. Changes in quality of life in the trial subjects will also be evaluated. We are conducting this study at three sites in the U.S. and Belgium and it is being overseen by a Data Monitoring Committee. We expect interim

safety and efficacy trial results from the majority of patients after six months of treatment in 2018, with full 12 month treatment data from all patients in the trial 2019.

S-7

QR-110

was granted orphan drug designation by the FDA and European Commission for the treatment of the p. Cys988X mutation in the CEP290 gene.

QR-110

has also received fast track designation by the FDA for the treatment of LCA10.

For Usher syndrome, a

progressive disease leading to hearing loss and blindness, we are developing

QRX-421

for the ophthalmic manifestation of Usher syndrome due to exon 13 mutations and

QRX-411

for the ophthalmic manifestations of Usher syndrome due to the

PE-40

mutation. Mutations in exon 13 of the USH2A gene affect approximately 12,000 patients in the

United States, European Union, Canada and Australia. Mutations in

PE-40

of the USH2A gene affect approximately 1,000 patients in the United States, European Union, Canada and Australia. Both product candidates

are single stranded oligonucleotides that aim to restore a functional Ush2a protein to restore vision. We have initiated preclinical development of

QRX-421,

and plan to initiate a clinical trial towards the

end of 2018. This planned clinical trial consists of a single dose arm and a

six-month

adaptive multiple dose arm. We expect to receive

top-line

data from the single

dose arm in the first half of 2019 and from the adaptive multiple dose arm in 2019.

QRX-411

is also currently in preclinical development, with the goal of starting a clinical trial towards the end of 2018 with

a topline data readout expected in 2019.

We are also developing

QRX-1011

for Startgards disease due to an exon 93

splicing mutation in the ABCA4 and

QRX-504

for Fuchs’ endothelial corneal dystrophy. Both programs are in the optimization phase, which is the last stage in discovery. Once optimized, we intend to

continue to advance these molecules into preclinical development.

Dermatology

Our lead program in dermatology is

QR-313,

a

first-in-class

RNA-based

oligonucleotide designed to address the underlying cause of DEB due to mutations in exon 73 of the

COL7A1 gene. Mutations in this exon can cause loss of functional collagen type VII, or C7 protein. Absence of C7 results in the loss of anchoring fibrils that normally link the dermal and epidermal layers of the skin together.

QR-313

is designed to exclude exon 73 from the mRNA, referred to as exon skipping, and produce truncated but functional C7 protein and thereby restore functionality of the anchoring fibrils. We expect to start our

first in human study of

QR-313

in DEB exon 73 patients in early 2018. We plan to conduct this study as a Phase 1/2 clinical trial in two parts, each enrolling six to ten DEB patients with exon 73 mutations,

and each evaluating safety, tolerability and pharmacokinetics. Part A of the clinical trial is expected to be an open label, single wound treatment for 28 days, while Part B of the clinical trial is expected to be a placebo controlled, multiple

wound treatment for 28 days. We expect to receive interim data from Part A of the trial in 2018 and full results that include Part B of the trial in early 2019. Beyond

QR-313,

we have a pipeline of

discovery-stage programs for other mutations that cause DEB, including

QRX-323

and

QRX-333.

Discovery Programs

Beyond CF, LCA and DEB, our

innovation unit is currently evaluating over 100 disease targets through our internal research or that of external collaborators. These disease targets are based on our multiple RNA technologies that we discovered internally or

in-licensed.

We have a rigorous evaluation process in identifying programs for our pipeline that includes establishing genetic causality, ability to deliver drug to the target organ, intellectual property

protection, strong proof of concept, and a high unmet need. Our early stage programs are in various stages of discovery and target different severe genetic disorders where we believe our technologies have the potential to deliver therapeutic

benefits to affected patients.

Company Information

Our company is registered with the Dutch Trade Register of the Chamber of Commerce (

handelsregister van de Kamer van Koophandel

) under number 54600790.

Our corporate seat is in Leiden, the Netherlands, and our

S-8

registered office is at Zernikedreef 9, 2333 CK Leiden, the Netherlands, and our telephone number is +31 88 166 7000. Our website address is

www.proqr.com

. Information found on, or

accessible through, our website is not a part of, and is not incorporated into, this prospectus supplement or the accompanying prospectus, and you should not consider it part of this prospectus supplement or the accompanying prospectus. Our website

address is included in this document as an inactive textual reference only. Our ordinary shares are traded on the NASDAQ Global Market under the symbol “PRQR”.

ProQR was formed in February 2012 by Daniel de Boer, Gerard Platenburg, the late Henri Termeer and Dinko Valerio. Mr. de Boer is a passionate and driven

entrepreneur and advocate for CF patients, and has assembled an experienced team of successful biotech executives as

co-founders

and early investors. ProQR’s team has extensive experience in discovery,

development and commercialization of CF treatments and RNA therapeutics. To date, we have raised approximately €142 million in gross proceeds from our public offerings of shares on the NASDAQ Global Market and private placements of equity

securities. In addition, we have received grants, loans and other funding from

CF-focused

patient organizations and government institutions supporting our program for CF, including from Cystic Fibrosis

Foundation Therapeutics, Inc., a subsidiary of the Cystic Fibrosis Foundation and the European Commission. Our headquarters are located in Leiden, the Netherlands.

On September 25, 2017, we established a Dutch foundation named Stichting Bewaarneming Aandelen ProQR for the administration of option exercises under our

2014 Plan. We have issued an aggregate of 3,330,225 ordinary shares to the foundation, with the nominal value of €0.04 per share to be paid out of our reserves. Upon exercise of outstanding options, the foundation will transfer the

appropriate number of ordinary shares underlying such exercise and the optionee will pay the appropriate exercise price to us as share premium. Our company is the sole director of the foundation, and the foundation is not permitted to receive

dividends or to vote the ordinary shares it will hold from time to time.

S-9

THE OFFERING

|

Ordinary shares offered by us

|

4,969,805 ordinary shares.

|

|

Option to purchase additional ordinary shares

|

We have granted the underwriters an option for a period of up to 30 days from the date of this prospectus supplement to purchase up to an additional 745,471 ordinary shares at the public offering price less the underwriting discounts and

commissions.

|

|

Ordinary shares to be outstanding immediately after this offering and our concurrent registered direct

offering

|

31,860,347 ordinary shares (32,605,818 shares assuming the underwriters exercise in full their option to purchase additional shares).

|

|

Use of proceeds

|

We estimate that the net proceeds to us from this offering and our concurrent registered direct offering, after deducting underwriting discounts and commissions applicable to this offering and estimated offering expenses payable by us, will be

approximately $19.6 million, or $21.9 million if the underwriters exercise their option to purchase additional shares from us in full. We intend to use the net proceeds from this offering and our concurrent registered direct offering to

fund research and development for our product candidates and for working capital and general corporate purposes. See “Use of Proceeds”.

|

|

Risk factors

|

An investment in our ordinary shares involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors” on page

S-14

of this prospectus supplement,

Item 3.D. of our Annual Report on

Form 20-F

for the year ended December 31, 2016, and under similar headings in the other documents that are incorporated by reference herein and therein, as well as

the other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

Market for the ordinary shares

|

Our ordinary shares are quoted and traded on NASDAQ Global Market under the symbol “PRQR.”

|

Certain of our existing

shareholders, including certain affiliates of members of our management and supervisory boards, have agreed to purchase an aggregate of approximately $4.0 million of ordinary shares in this offering at the public offering price.

Concurrently with this offering, we have agreed to sell an aggregate of $4.6 million of ordinary shares to certain investors, in a concurrent registered

direct offering, at the same price per share as the public offering price. The concurrent registered direct offering is being conducted without an underwriter or placement agent as a separate offering by means of a separate prospectus supplement.

Closing of the concurrent registered direct offering is contingent upon us completing this offering. This offering is not contingent upon the completion of the concurrent registered direct offering.

S-10

The number of ordinary shares expected to be outstanding after this offering and our concurrent registered

direct offering and, unless otherwise indicated, the information in this prospectus supplement are based on 25,462,849 ordinary shares outstanding as of September 30, 2017 and excludes:

|

|

•

|

|

3,330,225 ordinary shares that we issued to the foundation to facilitate the issuance of ordinary shares upon exercise of option awards under our equity incentive plans. Such shares are held by the foundation until

they are transferred to an optionee upon the exercise of options. As of September 30, 2017, 3,353,675 options have been granted by us; and

|

|

|

•

|

|

1,173,577 treasury shares held by us, which had been reserved to transfer ordinary shares to optionees upon exercise of awards under our equity incentive plans as of September 30, 2017.

|

Except as otherwise indicated, we have presented the information in this prospectus supplement assuming:

|

|

•

|

|

no exercise by the underwriters in this offering of their option to purchase additional ordinary shares; and

|

|

|

•

|

|

no exercise of outstanding options described above.

|

S-11

SUMMARY FINANCIAL DATA

The summary consolidated financial data for each of the years ended December 31, 2015 and 2016 have been derived from our audited consolidated financial

statements and notes thereto incorporated by reference in this prospectus supplement and the accompanying prospectus. The summary consolidated financial data for each of the

six-month

period ended

June 30, 2016 and 2017 have been derived from our unaudited condensed consolidated financial statements incorporated by reference in this prospectus supplement and the accompanying prospectus. The unaudited consolidated financial statements

have been prepared on a basis consistent with our audited consolidated financial statements included in this prospectus and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary to fairly

state our financial position as of June 30, 2017 and results of operations for the

six-month

period ended June 30, 2016 and 2017. The following summary consolidated financial data should be read in

conjunction with our “Operating and Financial Review and Prospects” and our consolidated financial statements and the related notes thereto incorporated by reference in this prospectus supplement and the accompanying prospectus. Our

financial statements are prepared in accordance with International Financial Reporting Standards as issued by the IASB, or IFRS.

Condensed

Consolidated Statements of Comprehensive Loss Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended

|

|

|

Six Months Ended

|

|

|

|

|

December 31,

2016

|

|

|

December 31,

2015

|

|

|

June 30,

2017

|

|

|

June 30,

2016

|

|

|

|

|

(€ in thousands, except for per share data)

|

|

|

Statement of comprehensive loss data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

1,828

|

|

|

|

3,235

|

|

|

|

658

|

|

|

|

1,278

|

|

|

Research and development costs

|

|

|

(31,923

|

)

|

|

|

(23,401

|

)

|

|

|

(15,582

|

)

|

|

|

(15,504

|

)

|

|

General and administrative costs

|

|

|

(9,478

|

)

|

|

|

(6,837

|

)

|

|

|

(5,196

|

)

|

|

|

(5,217

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating result

|

|

|

(39,573

|

)

|

|

|

(27,003

|

)

|

|

|

(20,120

|

)

|

|

|

(19,443

|

)

|

|

Finance income and expense

|

|

|

470

|

|

|

|

6,171

|

|

|

|

(1,721

|

)

|

|

|

(714

|

)

|

|

Income taxes

|

|

|

—

|

|

|

|

—

|

|

|

|

(2

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss (attributable to equity holders of the Company)

|

|

|

(39,103

|

)

|

|

|

(20,832

|

)

|

|

|

(21,843

|

)

|

|

|

(20,157

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

(16

|

)

|

|

|

1

|

|

|

|

65

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss (attributable to equity holders of the Company)

|

|

|

(39,119

|

)

|

|

|

(20,831

|

)

|

|

|

(21,778

|

)

|

|

|

(20,157

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

23,346,507

|

|

|

|

23,343,262

|

|

|

|

23,733,885

|

|

|

|

23,346,153

|

|

|

Earnings per share for result attributable to the equity holders of the Company (expressed in Euro

per share)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share

|

|

€

|

(1.68

|

)

|

|

€

|

(0.89

|

)

|

|

€

|

(0.92

|

)

|

|

€

|

(0.86

|

)

|

S-12

Condensed Consolidated Statement of Financial Position:

The following table summarizes our statement of financial position data as of June 30, 2017:

|

•

|

|

on an actual basis; and

|

|

•

|

|

on an as adjusted basis to give effect to the issue and sale of 4,969,805 ordinary shares by us in this offering, at a public offering price of $3.25 per share, after deducting underwriting discounts and commissions and

estimated offering expenses payable by us totaling $1.2 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017

|

|

|

|

|

Actual

|

|

|

As Adjusted (1)(2)

|

|

|

|

|

(€ in thousands)

|

|

|

Statement of financial position data:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

42,321

|

|

|

|

55,234

|

|

|

Total assets

|

|

|

48,386

|

|

|

|

61,299

|

|

|

Total liabilities

|

|

|

11,604

|

|

|

|

11,604

|

|

|

Total shareholders’ equity (deficit)

|

|

|

36,782

|

|

|

|

49,695

|

|

|

(1)

|

The table above does not give effect to the issue and sale of (i) 1,200,000 ordinary shares to investors at the closing of our registered offering in July 2017 and (ii) 218,465 ordinary shares under our at-the-market

facility since June 30, 2017.

|

|

(2)

|

Concurrently with this offering, we have agreed to sell an aggregate of approximately $4.6 million of ordinary shares to certain investors in a concurrent registered direct offering, at the same price per share as

the public offering price. The table above does not give effect to our concurrent registered direct offering.

|

Financial Update

As of September 30, 2017 and December 31, 2016, we had cash and cash equivalents of €39.7 million and

€59.2 million, respectively. As of September 30, 2017 and December 31, 2016, we had debt of €6.5 million and €5.7 million, respectively

The cash and cash equivalents as of September 30, 2017 and the other preliminary financial data for periods subsequent to June 30,

2017 in the paragraphs above are preliminary and may change, are based on information available to management as of the date of this prospectus supplement, and are subject to completion by management of the financial statements as of and for the

quarter ended September 30, 2017. There can be no assurance that our cash and cash equivalents as of September 30, 2017 or that any of the other preliminary financial data will not differ from these estimates, including as a result of

quarter-end

closing and audit procedures or review adjustments and any such changes could be material. In addition, we are not able to provide a range of operating or net loss at this time.

S-13

RISK FACTORS

Investing in our ordinary shares involves a high degree of risk. Before investing in our ordinary shares, you should carefully consider the risks described

below and in the “Risk Factors” section of our Annual Report on

Form 20-F

for the year ended December 31, 2016, together with all of the other information contained in this prospectus

supplement and the accompanying prospectus and incorporated by reference herein and therein, including from our Annual Report on

Form 20-F

for the year ended December 31, 2016. Some of these factors

relate principally to our business and the industry in which we operate. Other factors relate principally to your investment in our securities. The risks and uncertainties described therein and below are not the only risks facing us. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business and operations.

If any of the matters included in the following risks were to occur, our business, financial condition, results of operations, cash flows or prospects

could be materially and adversely affected. In such case, you may lose all or part of your investment.

Risks Related to this

Offering, our Concurrent Registered Direct Offering and

Ownership of our Ordinary Shares

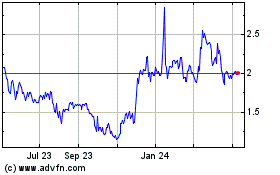

We cannot predict what the market price of our ordinary shares will be. As a result it may be difficult for you to sell your ordinary shares at or above

the price at which you purchased them.

An active trading market for our shares may not be sustained and the market value of our ordinary shares

may decrease from time to time. As a result of these and other factors, you may be unable to resell your shares at or above the price at which you purchased them. The lack of an active market may impair your ability to sell your shares at the time

you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of our shares. Further, an inactive market may also impair our ability to raise capital by offering ordinary shares

and may impair our ability to enter into strategic partnerships or acquire companies or products by using our ordinary shares as consideration. The market price of our shares may be volatile and you could lose all or part of your investment. For

example, the closing price of our ordinary shares reached a high of $24.99 per share on March 10, 2015 and a low of $3.48 per share on November 13, 2017. The trading price of our ordinary shares is likely to continue to be highly volatile and

could continue to be subject to wide fluctuations in response to various factors, some of which are beyond our control. In addition to the factors discussed in this “Risk Factors” section and elsewhere in our annual report on Form

20-F

for the year ended December 31, 2016, these factors include:

|

|

•

|

|

the presentation of data at industry conferences by us and/or our competitors;

|

|

|

•

|

|

the responses to any of our IND applications with the FDA and any of our CTA applications with the regulatory authorities in Europe;

|

|

|

•

|

|

any current or future preclinical studies or clinical trials of our product candidates, including any delays in enrollment rates or timing of these trials and any correspondence from the applicable regulatory

authorities;

|

|

|

•

|

|

regulatory actions with respect to our product candidates or our competitors’ products or product candidates;

|

|

|

•

|

|

the recruitment or departure of key personnel;

|

|

|

•

|

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations or capital commitments;

|

|

|

•

|

|

results of clinical trials conducted by us, our partners or our competitors;

|

|

|

•

|

|

the success of competitive products or technologies;

|

|

|

•

|

|

actual or anticipated changes in our growth rate relative to our competitors;

|

S-14

|

|

•

|

|

regulatory or legal developments in the United States, the European Union and other jurisdictions;

|

|

|

•

|

|

developments or disputes concerning patent applications, issued patents or other proprietary rights;

|

|

|

•

|

|

the level of expenses related to any of our product candidates or preclinical or clinical development programs;

|

|

|

•

|

|

actual or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts;

|

|

|

•

|

|

variations in our financial results or those of companies that are perceived to be similar to us;

|

|

|

•

|

|

fluctuations in the valuation of companies perceived by investors to be comparable to us;

|

|

|

•

|

|

share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

|

|

|

•

|

|

announcement or expectation of additional financing efforts;

|

|

|

•

|

|

sales of our ordinary shares by us, our insiders or our other shareholders;

|

|

|

•

|

|

changes in the structure of healthcare payment systems;

|

|

|

•

|

|

market conditions in the pharmaceutical and biotechnology sectors; and

|

|

|

•

|

|

general economic, industry and market conditions.

|

In addition, the stock market in general, and shares of

pharmaceutical and biotechnology companies in particular, have experienced extreme price and volume fluctuations that have sometimes been unrelated or disproportionate to the operating performance of these companies. Broad market and industry

factors may negatively affect the market price of our ordinary shares, regardless of our actual operating performance. The realization of any of the above risks or any of a broad range of other risks, including those described in these “Risk

Factors” and in the “Risk Factors” section of our Annual Report on

Form 20-F

for the year ended December 31, 2016 could have a dramatic and material adverse impact on the market price

of our ordinary shares.

If securities or industry analysts publish inaccurate or unfavorable research or cease to publish research about our

business, our share price and trading volume could decline.

The trading market for our ordinary shares depends in part on the research and reports

that securities or industry analysts publish about us or our business. In the event securities or industry analysts who cover us downgrade our ordinary shares, publish inaccurate or unfavorable research about our business, or cease publishing about

us, our share price would likely decline. If one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, demand for our ordinary shares could decrease, which might cause our share price and trading volume

to decline.

Management will have broad discretion as to the use of the net proceeds from this offering and our concurrent registered direct

offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this

offering and our concurrent registered direct offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our ordinary shares. Our failure to apply these funds effectively could have a material

adverse effect on our business, delay the development of our product candidates, and cause the price of our ordinary shares to decline.

Members of

our management board and supervisory board and our principal shareholders and their affiliates have significant control over our company, which will limit your ability to influence corporate matters and could delay or prevent a change in corporate

control.

The holdings of the members of our management and supervisory boards and our principal shareholders, and their affiliates, represent a

significant ownership percentage, in the aggregate, of our outstanding ordinary shares.

S-15

As a result, these shareholders, if they act together, will be able to influence our management and affairs and control the outcome of matters submitted to our shareholders for approval,

including the election of members of our management and supervisory boards and any company sale, merger, consolidation, or sale of all or substantially all of our assets. Certain of our existing shareholders, including certain affiliates of members

of our management and supervisory boards, have indicated an interest in purchasing an aggregate of approximately $4.5 million of ordinary shares in this offering at the public offering price. However, because indications of interest are not

binding agreements or commitments to purchase, the underwriters may determine to sell more, less or no shares in this offering to any of these shareholders, or any of these shareholders may determine to purchase more, less or no shares in this

offering. These shareholders may have interests, with respect to their ordinary shares, that are different from other investors and the concentration of voting power among these shareholders may have an adverse effect on the price of our ordinary

shares. In addition, this concentration of ownership might adversely affect the market price of our ordinary shares by:

|

|

•

|

|

delaying, deferring or preventing a change of control of our company;

|

|

|

•

|

|

impeding a merger, consolidation, takeover or other business combination involving our company; or

|

|

|

•

|

|

discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our company.

|

Because we do not anticipate paying any cash dividends on our ordinary shares in the foreseeable future, capital appreciation, if any, will be your sole

source of potential gain.

We have never declared or paid cash dividends on our ordinary shares. We currently intend to retain all of our future

earnings, if any, to finance the growth and development of our business. In addition, the terms of any future debt agreements may preclude us from paying dividends. As a result, capital appreciation, if any, of our ordinary shares will be your sole

source of gain for the foreseeable future.

We are an “emerging growth company” and we intend to continue to take advantage of reduced

disclosure and governance requirements applicable to emerging growth companies, which could result in our ordinary shares being less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we take advantage of certain exemptions from various reporting requirements that

are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure

obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments

not previously approved. We do not know if investors will find our ordinary shares less attractive because we are relying on these exemptions. We may take advantage of these reporting exemptions until we are no longer an emerging growth company,

which could be for up to five years after our initial public offering in September 2014. Even after such time, we may continue to qualify for the more limited reporting and other requirements applicable to foreign private issuers, as described

below.

If investors find our ordinary shares less attractive as a result of our reduced reporting requirements, there may be a less active trading market

for our ordinary shares and our share price may be more volatile. We may also be unable to raise additional capital as and when we need it.

We have

a limited history operating as a public company and complying with public company obligations. Complying with all requirements, particularly after we are no longer an “emerging growth company” that enjoys reduced requirements, will

increase our costs and require additional management resources and qualified accounting and financial personnel, and we may fail to meet all of these obligations.

We face significant legal, accounting, administrative and other costs and expenses as a public company. Compliance with the Sarbanes-Oxley Act of 2002, the

Dodd-Frank Act of 2010, the Dutch Financial Supervision Act and the rules promulgated thereunder, as well as rules of the SEC and NASDAQ and the Dutch Corporate Governance Code, or DCGC, for example, are expected to continue to result in substantial

ongoing legal, audit and financial compliance costs, particularly after we are no longer an “emerging growth company.” The

S-16

Securities Exchange Act of 1934, as amended, or the Exchange Act, requires, among other things, that we file certain periodic reports with respect to our business and financial condition. Our

management board, officers and other personnel need to devote a substantial amount of time to these compliance initiatives. We expect to incur significant expense and devote substantial management effort toward ensuring compliance with

Section 404 of the Sarbanes-Oxley Act of 2002 in preparation for and once we lose our status as an “emerging growth company.” We currently do not have an internal audit group, and we will need to continue to hire additional accounting

and financial staff with appropriate public company experience and technical accounting knowledge, and it may be difficult to recruit and maintain such personnel. Implementing any appropriate changes to our internal controls may require specific

compliance training for our directors, officers and employees, entail substantial costs to modify our existing accounting systems, and take a significant period of time to complete. Such changes may not, however, be effective in maintaining the

adequacy of our internal controls, and any failure to maintain that adequacy, or consequent inability to produce accurate financial statements or other reports on a timely basis, could increase our operating costs and could materially impair our

ability to operate our business.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to

accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our ordinary shares.

Effective internal controls over financial reporting are necessary for us to provide reliable financial reports and, together with adequate disclosure controls

and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In addition, any testing by us

conducted in connection with Section 404 of the Sarbanes-Oxley Act of 2002, or any subsequent testing by our independent registered public accounting firm, may reveal deficiencies in our internal controls over financial reporting that are

deemed to be material weaknesses or that may require prospective or retroactive changes to our financial statements or identify other areas for further attention or improvement. Inferior internal controls could also cause investors to lose

confidence in our reported financial information, which could have a negative effect on the trading price of our ordinary shares.

We are required to

disclose changes made in our internal controls and procedures and our management board is required to assess the effectiveness of these controls annually. However, for as long as we are an “emerging growth company” under the JOBS Act, our

independent registered public accounting firm will not be required to attest to the effectiveness of our internal controls over financial reporting pursuant to Section 404. We could be an “emerging growth company” for up to five years

from September 2014. An independent assessment of the effectiveness of our internal controls could detect problems that our management’s assessment might not. Undetected material weaknesses in our internal controls could lead to financial

statement restatements and require us to incur the expense of remediation.

Our disclosure controls and procedures may not prevent or detect all

errors or acts of fraud.

We are subject to certain reporting requirements of the Exchange Act. Our disclosure controls and procedures are designed

to reasonably assure that information required to be disclosed by us in reports we file or submit under the Exchange Act is accumulated and communicated to management, recorded, processed, summarized and reported within the time periods specified in

the rules and forms of the SEC. We believe that any disclosure controls and procedures or internal controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the

control system are met. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual

acts of some persons, by collusion of two or more people or by an unauthorized override of the controls. Accordingly, because of the inherent limitations in our control system, misstatements or insufficient disclosures due to error or fraud may

occur and not be detected.

S-17

If you purchase the ordinary shares sold in this offering, you will experience immediate and substantial

dilution in your investment. You will experience further dilution if we issue additional equity securities in the future.

Because the price per

ordinary share being offered is substantially higher than the net tangible book value per ordinary share, you will suffer substantial dilution with respect to the net tangible book value of the ordinary shares you purchase in this offering. After

giving effect to the sale of 4,969,805 ordinary shares in this offering at the public offering price of $3.25 per share, and based on our net tangible book value as of June 30, 2017, if you purchase ordinary shares in this offering, you will

suffer immediate and substantial dilution of $1.27 per ordinary share with respect to the net tangible book value of the ordinary shares. With this offering, we have agreed to sell an aggregate of approximately $4.6 million of ordinary shares

to certain investors, in a concurrent registered direct offering, at the same price per share as the public offering price. The above discussion does not reflect the ordinary shares we may sell in our concurrent registered direct offering. See

“Dilution” for a more detailed discussion of the dilution you will incur if you purchase ordinary shares in this offering.

In addition, we have

a significant number of share options outstanding. To the extent that outstanding share options have been or may be exercised or other shares issued, investors purchasing our ordinary shares in this offering may experience further dilution. In

addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through

the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our shareholders or result in downward pressure on the price of our ordinary shares.

Sales of a substantial number of our ordinary shares by our existing shareholders in the public market could cause our share price to fall.

If our existing shareholders sell, or indicate an intention to sell, substantial amounts of our ordinary shares in the public market, the trading price of our

ordinary shares could decline. In addition, a substantial number of ordinary shares are subject to outstanding options are or will become eligible for sale in the public market to the extent permitted by the provisions of various vesting schedules.

If these additional ordinary shares are sold, or if it is perceived that they will be sold, in the public market, the trading price of our ordinary shares could decline.

We, the members of our management and supervisory boards and our senior management team have agreed that, subject to certain exceptions, during the period

ending 90 days after the date of this prospectus supplement, we will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any of our ordinary shares or securities convertible into or exchangeable or

exercisable for any of our ordinary shares, enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of our

ordinary shares, whether any of these transactions are to be settled by delivery of our ordinary shares or other securities, in cash or otherwise, or publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into

any transaction, swap, hedge or other arrangement, without, in each case, the prior written consent of the representatives of the underwriters for this offering who may release any of the securities subject to these

lock-up

agreements at any time without notice. Exceptions to the

lock-up

restrictions are described in more detail in this prospectus supplement under the caption

“Underwriting.”

S-18

Risks Related to Investing in a Foreign Private Issuer or a Dutch Company

We are a foreign private issuer and, as a result, we are not subject to U.S. proxy rules and are subject to Exchange Act reporting obligations that, to

some extent, are more lenient and less frequent than those of a U.S. domestic public company.

We report under the Exchange Act as a

non-U.S.

company with foreign private issuer status. Because we qualify as a foreign private issuer under the Exchange Act and although we are subject to Dutch laws and regulations with regard to such matters and

intend to furnish quarterly financial information to the SEC, we are exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

|

|

•

|

|

the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

|

|

|

•

|

|

the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

|

|

|

•

|

|

the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form

10-Q

containing unaudited financial and other specified information, or current

reports on Form

8-K,

upon the occurrence of specified significant events.

|

In addition, foreign

private issuers are not required to file their annual report on Form

20-F

until 120 days after the end of each fiscal year, while U.S. domestic issuers that are accelerated filers are required to file their

annual report on Form

10-K

within 75 days after the end of each fiscal year. Foreign private issuers are also exempt from the Regulation Fair Disclosure, aimed at preventing issuers from making selective

disclosures of material information. As a result of the above, you may not have the same protections afforded to shareholders of companies that are not foreign private issuers.

We may lose our foreign private issuer status which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us

to incur significant legal, accounting and other expenses.

We are a foreign private issuer and therefore we are not required to comply with all of

the periodic disclosure and current reporting requirements of the Exchange Act applicable to U.S. domestic issuers. In order to maintain our current status as a foreign private issuer, either:

|

|

•

|

|

a majority of our ordinary shares must be either directly or indirectly owned of record by

non-residents

of the United States; or

|

|

|

•

|

|

a majority of our “executive officers” or directors may not be U.S. citizens or residents, more than 50% of our assets cannot be located in the United States and our business must be administered principally

outside the United States.

|

If we lose this status, we would be required to comply with the Exchange Act reporting and other requirements

applicable to U.S. domestic issuers, which are more detailed and extensive than the requirements for foreign private issuers.

We may also be required to

make changes in our corporate governance practices in accordance with various SEC and NASDAQ rules. The regulatory and compliance costs to us under U.S. securities laws if we are required to comply with the reporting requirements applicable to a

U.S. domestic issuer may be significantly higher than the costs we would incur as a foreign private issuer. As a result, we expect that a loss of foreign private issuer status would increase our legal and financial compliance costs and would make

some activities more time consuming and costly. We also expect that if we were required to comply with the rules and regulations applicable to U.S. domestic issuers, it would make it more difficult and expensive for us to obtain director and officer

liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These rules and regulations could also make it more difficult for us to attract and retain qualified members of our

supervisory board.

S-19

We currently report our financial results under IFRS, which differ in certain significant respects from

U.S. GAAP.

Currently we report our financial statements under IFRS. There have been and there may in the future be certain significant differences

between IFRS and U.S. GAAP, including differences related to revenue recognition, share-based compensation expense, income tax and earnings per share. As a result, our financial information and reported earnings for historical or future periods

could be significantly different if they were prepared in accordance with U.S. GAAP. In addition, we do not intend to provide a reconciliation between IFRS and U.S. GAAP unless it is required under applicable law. As a result, you may not be able to

meaningfully compare our financial statements under IFRS with those companies that prepare financial statements under U.S. GAAP.

Provisions of our

articles of association or Dutch corporate law might deter acquisition bids for us that might be considered favorable and prevent or frustrate any attempt to replace or remove the management board and supervisory board.

Certain provisions of our articles of association may make it more difficult for a third party to acquire control of us or effect a change in our management

board or supervisory board. These provisions include:

|

|

•

|

|

the authorization of a class of preferred shares that may be issued against payment of 25% of the nominal value thereof to a protection foundation, for which we have granted a perpetual and repeatedly exercisable call

option to such protection foundation, for up to such number of preferred shares as equals, at the time of exercise of the call option, the lesser of: (i) the total number of shares equal to our issued share capital at that time minus the number

of preferred shares already held by the protection foundation at that time (if any) or (ii) the maximum number of preferred shares that may be issued under our authorized share capital under our articles of association from time to time;

|

|

|

•

|

|

the staggered four-year terms of our supervisory board members, as a result of which only approximately

one-fourth

of our supervisory board members will be subject to election in

any one year;

|

|

|

•

|

|

a provision that our management board members and supervisory board members may only be appointed upon a binding nomination by our supervisory board, which can be set aside by a

two-thirds

majority of our shareholders representing more than half of our issued share capital;

|

|

|

•

|

|

a provision that our management board members and supervisory board members may only be removed by our general meeting of shareholders by a

two-thirds

majority of the votes cast

representing more than 50% of our issued share capital (unless the removal was proposed by the supervisory board); and

|

|

|

•

|

|

a requirement that certain matters, including an amendment of our articles of association, may only be brought to our shareholders for a vote upon a proposal by our management board that has been approved by our

supervisory board.

|

As indicated above, we have adopted an anti-takeover measure by granting a perpetual and repeatedly exercisable call

option to the protection foundation, which confers upon the protection foundation the right to acquire, under certain conditions, the number of preferred shares described above. The issuance of such preferred shares will occur upon the protection