Mall Short Sellers Feel Some Pain

November 14 2017 - 5:39PM

Dow Jones News

By Esther Fung

Short sellers of mall operators have gotten pounded over the

past week as expectations of corporate takeouts and heightened

activist investor interest in landlords of class-A malls drives up

share prices.

Short sellers of the seven U.S. mall real-estate investment

trusts suffered declines in their positions of $280 million from

Nov. 4 to Nov. 13, according to data from financial analytics firm

S3 Partners. Through Nov. 3 of this year, they had been sitting on

profits of $981 million.

On Nov. 3, Santa Monica, Calif.-based mall REIT Macerich Co.

announced changes to severance pay for senior executives in the

event of a change in control of the company.

In the past week, speculation that Brookfield Property Partners

could make an offer for Chicago-based mall REIT GGP Inc. and news

that activist investor Daniel Loeb's hedge fund Third Point had

acquired a 1.2% stake in Macerich fueled gains in the shares of

A-mall REITs, which generally own the most productive malls in the

country.

Another hedge fund, Elliott Management, also has taken a stake

in Bloomingfield, Mich-based luxury mall REIT Taubman Centers Inc.

and has spoken with the company executives, according to a person

familiar with the matter.

On Monday, Brookfield Property confirmed it is making an offer

to pay $23 a share for the remaining 66% of GGP it doesn't already

own, driving up GGP shares further. The stock closed at $24.05

Monday and $23.95 on Tuesday.

Since Nov. 3, shares of Macerich have risen 19%, while GGP is up

25% and Taubman Centers has jumped 22%. Shares of Simon Property

Group, the world's largest REIT, have climbed 4%.

The short sellers "are licking their wounds now," said Ihor

Dusaniwsky, managing director and head of research at S3

Partners.

Short sellers borrow shares of a company and sell them, in hopes

of buying the shares later at a lower price, repaying the loan and

pocketing the difference. Some short sellers have been targeting

retail-focused landlords, betting they would struggle with higher

vacancies and higher costs of replacing tenants following an

increase in retailer bankruptcies and store closures this year.

Write to Esther Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

November 14, 2017 17:24 ET (22:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

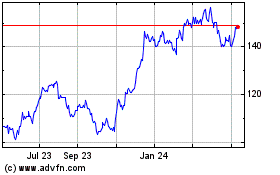

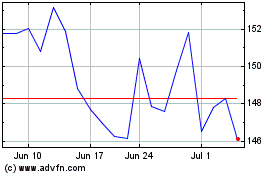

Simon Property (NYSE:SPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Simon Property (NYSE:SPG)

Historical Stock Chart

From Apr 2023 to Apr 2024