UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

(Check

one):

☐

Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form

10-D ☐ Form N-SAR ☐ Form N-CSR

For

Period Ended: September 30, 2017

|

|

☐

|

Transition

Report on Form 10-K

|

|

|

☐

|

Transition

Report on Form 20-F

|

|

|

☐

|

Transition

Report on Form 11-K

|

|

|

☐

|

Transition

Report on Form 10-Q

|

|

|

☐

|

Transition

Report on Form N-SAR

|

For

the Transition Period Ended:

|

|

|

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein.

|

|

|

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

Future

FinTech Group Inc

.

Full Name of Registrant

N/A

Former Name if Applicable

16F,

China Development Bank Tower

Address of Principal Executive Office

(Street and Number)

No.

2, Gaoxin 1st Road, Xi'an, China 710075

City, State and Zip Code

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule

12b-25(b), the following should be completed. (Check box if appropriate)

|

☒

|

(a)

|

The

reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense

|

|

|

|

|

|

|

(b)

|

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR,

or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject

quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be

filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

(c)

|

The

accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART

III — NARRATIVE

State

below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q,10-D, N-SAR, N-CSR, or the transition report or portion thereof, could

not be filed within the prescribed time period.

The

Company is unable to file this Quarterly Report on Form 10-Q for the quarter ended September 30, 2017 within the prescribed time

period without unreasonable effort or expense because additional time is required to complete the preparation of the Company's

financial statements in time for filing. The Company anticipates filing its Form 10-Q on or before the fifth calendar day following

the prescribed due date.

PART

IV — OTHER INFORMATION

|

(1)

|

Name

and telephone number of person to contact in regard to this notification

|

|

|

Crystal

Lee

|

|

011-86-29

|

|

8837-7161

|

|

|

(Name)

|

|

(Area

Code)

|

|

(Telephone

Number)

|

|

(2)

|

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of

the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required

to file such report(s) been filed? If answer is no, identify report(s).

☒ Yes ☐ No

|

|

|

|

|

(3)

|

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal

year will be reflected by the earnings statements to be included in the subject report or portion thereof?

☒ Yes ☐ No

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the

reasons why a reasonable estimate of the results cannot be made.

|

Future

FinTech Group Inc.

(Name of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date:

November/14/2017

|

By:

|

/s/

Hongke Xue

|

|

|

|

Hongke

Xue

|

|

|

Title:

|

Chief

Executive Officer

|

Anticipated

Changes

We

anticipate that we will report the following significant changes in the results of operations from the same period of the last

fiscal year:

Revenue

.

Sales for the three months ended September 30, 2017 were $4.4 million, a decrease of $6.1 million, when compared to sales for

the same period of the prior year. As a percentage, sales decreased by 58% for the three months ended September 30, 2017, when

compared to total net sales for the same period of the prior year.

Sales

from apple-related products as a percentage of total sales were 13% for the three months ended September 30, 2017, as compared

to 3% for the same period of the prior year. The absolute amount of sales were $0.5 million for the three months ended September

30, 2017, an increase of $0.2 million, when compared to the sales of $0.3 million for the same period of the prior year, mainly

because of a sharp decrease in the unit price of apple-related products in the international market due to heavy competition.

The Company sold approximately 738 tons of concentrated apple juice in the three months ended September 30, 2017, compared to

472 tons of concentrated apple juice in the same period of 2016. Most of our concentrated apple juice was sold directly

or indirectly to the international market. In 2017, international demand of concentrated apple juice from China has continued

to drop. According to the data provided by Chinese Customs, the amount of exported concentrated apple juice from China declined

by 7% in year 2016 as compared to 2015, and the unit price of exported concentrated apple juice from China declined by 11.16%

in July of 2017 as compared to the same period of 2016. Over the past three years, the purchase price of fresh apples has increased,

but the sales price of concentrated apple related products has remained low. Because of the negative trends in the international

market and estimated lower margins, our YingKou and Huludao Wonder factories did not operate their concentrated apple juice production

facilities in 2016 and the nine months ended September 30, 2017, which caused a lower inventory of concentrated apple juice and

required us to purchase supply from third-party manufacturers to meet demand.

Sales

from concentrated kiwifruit juice and kiwifruit puree as a percentage of total sales were 4% and 1% for the three months ended

September 30, 2017, and September 30, 2016, respectively. The absolute amount of sales were $0.18 million for the three months

ended September 30, 2017, an increase of $0.07 million, when compared to the sales of $0.11 million the same period of the prior

year, primarily as a result of higher demand and an increase in the amount of products sold in the third quarter of 2017 as compared

to the same period of 2016.

Sales

from concentrated pear juice as a percentage of total sales were 0% and 46% for the three months ended September 30, 2017, and

September 30, 2016, respectively. The absolute amount of sales were $0.01 million for the three months ended September 30, 2017,

a decrease of $4.89 million, when compared to sales of $4.90 million for the same period of the prior year, mainly because of

a decrease in sales volume due to lower demand. We sold 16 tons and 5,967 tons of concentrated pear juice during the second quarters

of 2017 and 2016, respectively

Sales

from our fruit juice beverages as a percentage of total sales were 83% and 44% for the three months ended September 30, 2017,

and September 30, 2016, respectively. The absolute amount of sales were $3.7 million for the three months ended September 30,

2017, a decrease of $0.9 million, when compared to the sales of $4.6 million for the same period of the prior year, primarily

due to a decrease in sales volume as a result of heavy competition in the China market.

Sales

from other products were $0.01 million for the three months ended September 30, 2017 as compared to $0.6 million for the same

period of prior year. We do not expect continued sales from other products as customers’ orders related to other products

are not stable.

Gross

Profit

. The consolidated gross loss for the three months ended September 30, 2017 was $0.08 million, a decrease of $3.1 million,

from net profit of $3.1 million for the same period of 2016, primarily due to a decrease of dollar amounts of sales from all of

our products.

3

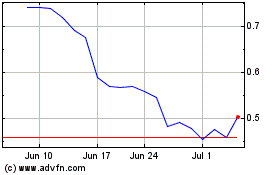

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024