Debt & Liquidity

Table 10 – D

ebt

|

R$ Million

|

Sep/17

|

Sep/16

|

Jun/17

|

|

% Gross Debt

|

|

Debt

|

|

|

|

|

|

|

Short Term

|

51,827

|

48,325

|

51,930

|

|

100.0%

|

|

Long Term

|

0

|

0

|

0

|

|

0.0%

|

|

Total Debt

|

51,827

|

48,325

|

51,930

|

|

100.0%

|

|

In Local Currency

|

14,531

|

13,044

|

14,197

|

|

28.0%

|

|

In Foreign Currency

|

37,191

|

35,177

|

37,628

|

|

71.8%

|

|

Swaps

|

105

|

105

|

105

|

|

0.2%

|

|

(-) Cash

|

-7,717

|

-7,142

|

-7,431

|

|

-14.9%

|

|

(=) Net Debt

|

44,109

|

41,184

|

44,499

|

|

85.1%

|

Oi S.A. ended 3Q17 with consolidated gross debt of R$ 51,827 million (-0.2% q.o.q. and +7.3% y.o.y.). Debt fell from 2Q17 despite the interest accrual effect following the 4.2% and 0.85% appreciation of the Real against the Dollar and the Euro, respectively. Compared with 3Q16, debt moved up mainly due to interest accrued on debt in Real and foreign currencies in the last 12 months. Since the request for judicial reorganization, on June 20, 2016, no payments of interest or principal amortization of the Company's debts have been made. In annual terms, the Real appreciated 2.41% against the Dollar and depreciated 2.59% against the Euro, with a material year-on-year impact on debt.

At the end of 3Q17, net debt stood at R$ 44,109 million, edging down 0.9% from 2Q17 and increasing 7.0% over 3Q16. The quarter-on-quarter reduction was due both to lower gross debt, as explained earlier, and to the 3.8% increase in consolidated cash, thanks to the strong performance of operational cash generation and financial income on the cash. Compared with 3Q16, net debt increased due to higher gross debt, despite the favorable performance of cash, which moved up year on year.

19

Table 1

1

–

Cash Position

(

Brazilian

opera

tions

)

|

2Q17 Cash Position

|

7,431

|

|

Routine EBITDA

|

1,597

|

|

Capex

|

-1,339

|

|

Working capital

|

-67

|

|

Judicial Deposits + Taxes

|

-61

|

|

Financial operations

|

157

|

|

Other

|

0

|

|

3Q17 Cash Position

|

7,717

|

Table 1

2

–

Gross Debt Breakdown

|

R$ Million

|

|

|

Gross Debt Breakdown

|

3Q17

|

|

Int'l Capital Markets

|

33,413

|

|

Local Capital Markets

|

4,816

|

|

Development Banks and ECAs

|

9,339

|

|

Commercial Banks

|

4,474

|

|

Hedge and Borrowing Costs

|

-216

|

|

Total Gross Debt

|

51,827

|

20

Historical Reclassified Net Revenues and Revenue Generating Units (RGUs)

In 4Q16, the Company revised and changed the criteria for segmenting revenues and revenue generating units (RGUs) among the various business units (BUs), as it believes this new breakdown better reflects how the businesses are managed. Historical revenue and RGU figures were adjusted in order to reflect this change. The historical reclassified data are shown in the tables below:

|

|

3Q17

|

2Q17

|

1Q17

|

4Q16

|

3Q16

|

2Q16

|

1Q16

|

4Q15

|

3Q15

|

2Q15

|

1Q15

|

4Q14

|

3Q14

|

2Q14

|

1Q14

|

4Q13

|

3Q13

|

2Q13

|

1Q13

|

|

Residential

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenues (R$ million)

(1)

|

2,321

|

2,227

|

2,354

|

2,315

|

2,345

|

2,368

|

2,348

|

2,337

|

2,393

|

2,406

|

2,436

|

2,407

|

2,380

|

2,428

|

2,487

|

2,538

|

2,565

|

2,580

|

2,550

|

|

Revenue Generating Units (RGU) - ('000)

(1)

|

16,121

|

16,272

|

16,343

|

16,425

|

16,498

|

16,573

|

16,620

|

16,780

|

17,034

|

17,329

|

17,719

|

18,066

|

18,052

|

18,226

|

18,437

|

18,689

|

19,302

|

19,512

|

19,674

|

|

Fixed Line in Service

|

9,465

|

9,657

|

9,802

|

9,947

|

10,087

|

10,228

|

10,336

|

10,515

|

10,748

|

11,007

|

11,303

|

11,590

|

11,806

|

12,099

|

12,359

|

12,630

|

13,073

|

13,338

|

13,614

|

|

Fixed Broadband

|

5,207

|

5,219

|

5,204

|

5,188

|

5,164

|

5,149

|

5,115

|

5,109

|

5,127

|

5,151

|

5,197

|

5,241

|

5,223

|

5,248

|

5,255

|

5,235

|

5,317

|

5,272

|

5,223

|

|

Pay TV

|

1,449

|

1,396

|

1,336

|

1,290

|

1,247

|

1,197

|

1,168

|

1,156

|

1,158

|

1,171

|

1,220

|

1,235

|

1,023

|

879

|

823

|

824

|

912

|

902

|

837

|

|

ARPU Residential (R$)

|

81.1

|

76.5

|

79.6

|

77.2

|

77.1

|

77.0

|

75.2

|

73.5

|

73.6

|

72.2

|

71.3

|

68.8

|

66.7

|

66.4

|

66.6

|

65.9

|

65.0

|

64.0

|

62.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q17

|

2Q17

|

1Q17

|

4Q16

|

3Q16

|

2Q16

|

1Q16

|

4Q15

|

3Q15

|

2Q15

|

1Q15

|

4Q14

|

3Q14

|

2Q14

|

1Q14

|

4Q13

|

3Q13

|

2Q13

|

1Q13

|

|

Personal Mobility

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenues (R$ million)

(1)

|

1,939

|

1,872

|

1,947

|

1,945

|

1,940

|

1,938

|

2,027

|

2,090

|

2,042

|

2,012

|

2,251

|

2,417

|

2,164

|

2,210

|

2,147

|

2,369

|

2,327

|

2,250

|

2,311

|

|

Service

|

1,884

|

1,814

|

1,890

|

1,886

|

1,897

|

1,872

|

1,968

|

2,033

|

1,990

|

1,944

|

2,052

|

2,135

|

1,961

|

2,002

|

2,034

|

2,208

|

2,229

|

2,122

|

2,163

|

|

Customer

(2)

|

1,761

|

1,713

|

1,748

|

1,730

|

1,754

|

1,733

|

1,779

|

1,814

|

1,773

|

1,751

|

1,792

|

1,791

|

1,629

|

1,677

|

1,635

|

1,718

|

1,676

|

1,591

|

1,592

|

|

Network Usage

|

123

|

100

|

141

|

156

|

143

|

138

|

189

|

219

|

217

|

193

|

260

|

344

|

332

|

324

|

399

|

490

|

554

|

532

|

571

|

|

Sales of handsets, SIM cards and others

|

55

|

58

|

57

|

59

|

43

|

66

|

58

|

56

|

52

|

68

|

199

|

281

|

202

|

208

|

114

|

161

|

97

|

128

|

148

|

|

Revenue Generating Units (RGU) - ('000)

(1)

|

39,626

|

39,802

|

39,837

|

39,870

|

44,118

|

45,319

|

45,559

|

45,860

|

47,059

|

47,756

|

47,938

|

48,462

|

48,976

|

48,618

|

48,145

|

47,727

|

47,337

|

46,896

|

46,569

|

|

Prepaid Plans

|

32,807

|

32,963

|

32,957

|

32,997

|

37,318

|

38,299

|

38,668

|

39,068

|

40,296

|

40,719

|

40,824

|

41,322

|

41,990

|

41,801

|

41,417

|

41,019

|

40,676

|

40,235

|

39,905

|

|

Postpaid Plans

(3)

|

6,820

|

6,839

|

6,880

|

6,872

|

6,800

|

7,020

|

6,891

|

6,791

|

6,763

|

7,037

|

7,114

|

7,140

|

6,986

|

6,817

|

6,729

|

6,708

|

6,662

|

6,661

|

6,664

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q17

|

2Q17

|

1Q17

|

4Q16

|

3Q16

|

2Q16

|

1Q16

|

4Q15

|

3Q15

|

2Q15

|

1Q15

|

4Q14

|

3Q14

|

2Q14

|

1Q14

|

4Q13

|

3Q13

|

2Q13

|

1Q13

|

|

B2B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenues (R$ million)

(1)

|

1,596

|

1,627

|

1,703

|

1,790

|

1,832

|

1,914

|

2,070

|

1,979

|

1,971

|

2,005

|

2,027

|

2,087

|

2,042

|

2,098

|

2,093

|

2,118

|

2,107

|

2,147

|

2,079

|

|

Revenue Generating Units (RGU) - ('000)

(1)

|

6,543

|

6,501

|

6,550

|

6,617

|

6,634

|

6,661

|

6,668

|

6,757

|

7,084

|

7,223

|

7,249

|

7,296

|

7,335

|

7,375

|

7,339

|

7,370

|

7,559

|

7,660

|

7,718

|

|

Fixed

|

3,685

|

3,696

|

3,727

|

3,760

|

3,794

|

3,831

|

3,875

|

3,941

|

4,053

|

4,110

|

4,154

|

4,189

|

4,231

|

4,255

|

4,247

|

4,225

|

4,239

|

4,211

|

4,167

|

|

Broadband

|

539

|

542

|

547

|

553

|

558

|

561

|

569

|

580

|

594

|

604

|

612

|

617

|

622

|

628

|

630

|

630

|

623

|

615

|

604

|

|

Mobile

|

2,307

|

2,251

|

2,263

|

2,290

|

2,270

|

2,256

|

2,211

|

2,223

|

2,424

|

2,497

|

2,470

|

2,478

|

2,472

|

2,485

|

2,456

|

2,511

|

2,698

|

2,834

|

2,946

|

|

Pay TV

|

12

|

13

|

14

|

13

|

12

|

12

|

12

|

12

|

12

|

13

|

12

|

12

|

9

|

7

|

5

|

4

|

0

|

0

|

0

|

21

Oi S.A.

-

Consolidated

|

Income Statement - R$ million

(1)

|

3Q17

|

3Q16

|

2Q17

|

|

9M17

|

9M16

|

|

Net Operating Revenues

|

5,964

|

6,394

|

5,839

|

|

17,962

|

19,674

|

|

Operating Costs and Expenses

|

-4,358

|

-4,750

|

-4,222

|

|

-13,017

|

-14,828

|

|

Personnel

|

-682

|

-766

|

-614

|

|

-1,954

|

-2,196

|

|

Interconnection

|

-180

|

-294

|

-172

|

|

-585

|

-874

|

|

Third-Party Services

|

-1,573

|

-1,650

|

-1,575

|

|

-4,720

|

-4,824

|

|

Network Maintenance Service

|

-327

|

-257

|

-331

|

|

-945

|

-1,261

|

|

Handset Costs/Other (COGS)

|

-47

|

-69

|

-36

|

|

-160

|

-203

|

|

Marketing

|

-116

|

-67

|

-106

|

|

-285

|

-298

|

|

Rent and Insurance

|

-1,080

|

-1,054

|

-1,062

|

|

-3,207

|

-3,222

|

|

Provision for Contingencies

|

-121

|

-235

|

-93

|

|

-324

|

-729

|

|

Provision for Bad Debt

|

-173

|

-168

|

-186

|

|

-519

|

-460

|

|

Taxes and Other Revenues (Expenses)

|

-61

|

-188

|

-46

|

|

-318

|

-665

|

|

Other Operating Revenues (Expenses), net

|

0

|

0

|

0

|

|

0

|

-95

|

|

EBITDA

|

1,605

|

1,645

|

1,617

|

|

4,945

|

4,846

|

|

Margin %

|

26.9%

|

25.7%

|

27.7%

|

|

27.5%

|

24.6%

|

|

Depreciation and Amortization

|

-1,450

|

-1,548

|

-1,413

|

|

-4,382

|

-4,768

|

|

EBIT

|

155

|

96

|

205

|

|

563

|

77

|

|

Financial Expenses

|

-371

|

-2,098

|

-5,753

|

|

-6,837

|

-4,092

|

|

Financial Income

|

416

|

397

|

772

|

|

1,786

|

1,110

|

|

Net Earnings (Loss) Before Tax and Social Contribution

|

200

|

-1,605

|

-4,776

|

|

-4,488

|

-2,904

|

|

Income Tax and Social Contribution

|

-226

|

426

|

1,473

|

|

958

|

-911

|

|

Net Earnings (Loss) from Continuing Operations

|

-26

|

-1,178

|

-3,303

|

|

-3,530

|

-3,815

|

|

Net Results from Discontinued Operations

|

0

|

0

|

0

|

|

0

|

0

|

|

Consolidated Net Earnings (Loss)

|

-26

|

-1,178

|

-3,303

|

|

-3,530

|

-3,815

|

|

Margin %

|

-0.4%

|

-18.4%

|

-56.6%

|

|

-19.7%

|

-19.4%

|

|

Profit (Loss) attributed to the controlling shareholders

|

8

|

-1,214

|

-3,272

|

|

-3,465

|

-3,713

|

|

Profit (Loss) attributed to the non-controlling shareholders

|

-33

|

36

|

-31

|

|

-65

|

-102

|

|

Outstanding Shares Thousand (ex-treasury)

|

675,667

|

675,667

|

675,667

|

|

675,667

|

675,667

|

|

Earnings per share (R$)

|

0.0114

|

-1.7974

|

-4.8427

|

|

-5.1276

|

-5.4948

|

(1)

1Q16, 2Q16 and 3Q16 data were restated as explained in the Disclaimer section of this document

.

22

Oi S.A.

-

Consolidated

|

Balance Sheet - R$ million

(1)

|

09/30/2017

|

06/30/2017

|

09/30/2016

|

|

TOTAL ASSETS

|

82,456

|

82,938

|

85,803

|

|

Current

|

25,885

|

26,375

|

28,038

|

|

Cash and cash equivalents

|

7,608

|

7,329

|

6,952

|

|

Financial investments

|

22

|

17

|

108

|

|

Derivatives

|

0

|

0

|

0

|

|

Accounts Receivable

|

8,450

|

8,566

|

9,841

|

|

Inventories

|

541

|

504

|

381

|

|

Recoverable Taxes

|

678

|

582

|

1,059

|

|

Other Taxes

|

1,344

|

1,381

|

1,176

|

|

Assets in Escrow

|

364

|

764

|

1,128

|

|

Held-for-sale Assets

|

4,721

|

4,964

|

5,899

|

|

Other Current Assets

|

2,157

|

2,267

|

1,495

|

|

Non-Current Assets

|

56,571

|

56,563

|

57,766

|

|

Long Term

|

19,198

|

19,090

|

20,595

|

|

.Recoverable and Deferred Taxes

|

3,402

|

3,562

|

5,372

|

|

.Other Taxes

|

706

|

752

|

779

|

|

.Financial investments

|

88

|

85

|

82

|

|

.Assets in Escrow

|

14,634

|

14,328

|

13,982

|

|

.Derivatives

|

0

|

0

|

0

|

|

.Other

|

368

|

362

|

381

|

|

Investments

|

140

|

139

|

134

|

|

Property Plant and Equipment

|

26,545

|

26,343

|

25,754

|

|

Intagible Assets

|

10,688

|

10,991

|

11,282

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

82,456

|

82,938

|

85,803

|

|

Current

|

65,043

|

65,217

|

61,096

|

|

Suppliers

|

7,097

|

7,036

|

7,122

|

|

Loans and Financing

|

51,722

|

51,825

|

48,221

|

|

Financial Instruments

|

105

|

105

|

105

|

|

Payroll and Related Accruals

|

815

|

708

|

764

|

|

Provisions

|

638

|

578

|

868

|

|

Pension Fund Provision

|

185

|

172

|

136

|

|

Payable Taxes

|

511

|

350

|

440

|

|

Other Taxes

|

1,453

|

1,790

|

1,596

|

|

Dividends Payable

|

6

|

6

|

29

|

|

Liabilities associated to held-for-sale assets

|

680

|

673

|

384

|

|

Authorizations and Concessions Payable

|

16

|

12

|

84

|

|

Other Accounts Payable

|

1,816

|

1,961

|

1,345

|

|

Non-Current Liabilities

|

8,776

|

8,936

|

8,801

|

|

Loans and Financing

|

0

|

0

|

0

|

|

Financial Instruments

|

0

|

0

|

0

|

|

Other Taxes

|

859

|

852

|

1,038

|

|

Contingency Provisions

|

4,482

|

4,562

|

3,861

|

|

Pension Fund Provision

|

437

|

442

|

416

|

|

Outstanding authorizations

|

4

|

4

|

7

|

|

Other Accounts Payable

|

2,994

|

3,077

|

3,477

|

|

Shareholders' Equity

|

8,637

|

8,784

|

15,907

|

|

Controlling Interest

|

8,334

|

8,441

|

14,999

|

|

Minority Interest

|

303

|

343

|

908

|

|

(1)

The balance sheet as of September 30, 2016 was restated, as explained in the Disclaimer section of this document.

|

23

Please note

The main tables disclosed in this Earnings Release will be available in Excel format in the “Financial Information / Quarterly Reports” section of the Company’s website (www.oi.com.br/ir).

Definitions of the terms used in the Earnings Release are available in the Glossary section of the Company’s website:

http://ri.oi.com.br/oi2012/web/conteudo_pt.asp?idioma=0&conta=28&tipo=44320

24

PROCESSO DE RECUPERAÇÃO JUDICIAL

On August 10, 2017, the Company informed its shareholders and the market in general that on August 9, 2017, the Chairman of the Company’s Board of Directors received an Official Letter from the Brazilian National Telecommunications Agency (Agência Nacional de Telecomunicações), or Anatel, to determine that a reformulated version of the judicial reorganization plan needed to be presented, in up to 15 (fifteen) days, counting from the received day of the Official Letter, contemplating: a) demonstration that the company is in good conditions to obtain other sources of funding in the same amount which was set out for the bondholders, or to offer legal guarantee for the proposed funding; b) capital contribution alternatives, in addition to the bond conversion proposal; c) viable conditions for immediate funding or in a smaller time period than foreseen in the proposed plan; d) guarantees of execution and timing reliability of capital contribution; e) clarification regarding the interest and viability of settlement of debts before the Anatel, through non-tax credit recovery program, pursuant to Provisional Presidential Measure No. 780/2017.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=B06D67BD-519D-4D97-A092-2AF096E0A30A

Recognition of Judicial Reorganization Proceeding in Portugal

On August 21, 2017, the Company informed its shareholders and the market in general that, on that date, it learned of a judgment rendered on August 9, 2017 by the Commercial Court of Lisbon – Judge Number 5 of the Judicial Court of the Region of Lisbon, recognizing, with respect to Oi Móvel S.A. – In Judicial Reorganization, the decision rendered by the 7th Corporate Court of the District of the Capital of the State of Rio de Janeiro on June 29, 2016 granting the processing of the request for judicial reorganization submitted in Brazil, under the terms of Law No. 11,101/05 and the Brazilian Corporation Law.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=9EA96AFF-661F-49D9-A354-3EE40BCC9DE7

General Meeting of Creditors

On August 25, 2017, the Company informed its shareholders and the market in general that the 7th Corporate Court of the Capital District of the State of Rio de Janeiro approved the dates suggested by the judicial administrator for the General Meeting of Creditors (Assembleia Geral de Credores, or “AGC”), designating October 9, 2017 for the first call of the AGC, and October 23, 2017 for the second call of the ACG, both to be held at Riocentro.

On September 28, 2017, pursuant to Art. 157, paragraph 4 of Law 6,404/76 and pursuant to CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, following a decision of the Company’s Board of Directors, it requested that the 7th Corporate Court of the Capital of the State of Rio de Janeiro (“Judicial Reorganization Court”) postpone the dates of the AGC to October 23, 2017, for the first call, and November 27, 2017, for the second call, in the Riocentro, due to negotiating factors for the approval of the Judicial Reorganization Plan (the “Plan”) and procedures related to the AGC, which may result in adjustments in the AGC voting system. In response to the Company's request, the Judicial Recovery Court granted the Company's request, postponing the AGC's until such dates.

On October 20, 2017, pursuant to Article 157, Paragraph 4, of Law No. 6,404/76 and under CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that certain Company creditors filed a petition with the 7th Corporate Court of the Judicial District of the Capital of Rio de Janeiro, before which the Judicial Reorganization is pending (the “Court”), requesting the rescheduling of the General Meeting of Creditors which was scheduled to should held on Monday, October 23. In response to the request of the creditors, the Court approved the rescheduling of the AGC, establishing that the AGC should be hold on November 6, 2017, for the first call, and, November 27, 2017, for the second call.

On October 23, 2017, pursuant to Article 157, Paragraph 4, of Law No. 6,404/76 and under CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, at the request of the Judicial Administrator and in compliance with the timing set forth in Article 36 of Law No. 11,101/2005, the 7th Corporate Court of the Judicial District of the Capital of Rio de Janeiro, before which the Judicial Reorganization is pending, postponed the AGC, which was scheduled

to be held on November 27, 2017.

25

On November 9, 2017, pursuant to Article 157, Paragraph 4, of Law No. 6,404/76 and under CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, at the request of certain creditors of the Company, the 7th Corporate Court of the Judicial District of the Capital of Rio de Janeiro, before which the Judicial Reorganization is pending, postponed the General Meeting of Creditors (Assembleia Geral de Credores), which was scheduled to be held on November 10, 2017, for the first call, and on November 27, 2017, for the second call, to December 7, 2017 at 11 a.m. (with the possibility of continuing on December 8, 2017, if necessary), for the first call, and to February 1, 2018 (with the possibility of continuing on February 2, 2018, if necessary), for the second call.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=6D36DE7A-E605-4DF7-94D2-415B2E000060

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=671C4B43-EE1A-43B0-A5BE-81F403A1AE0E

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=95E5F2C8-0A37-447B-920C-136E53154A5E

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=97BD4CE4-77B5-4232-913C-FDA1B6657E6A

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=4B55F860-22F9-46D0-8AF2-AF3F6D741F6E

Submission of the new version of the Judicial Reorganization Plan

On October 11, 2017, pursuant to Article 157, Paragraph 4, of Law No. 6,404/76 and under CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, given the approval by the Board of Directors of the Company, by majority, at a meeting held on October 10, 2017, of adjustments to the terms and conditions of the Judicial Reorganization Plan of Oi and its subsidiaries, submitted on September 5, 2016, as well as of its submission to the 7th Corporate Court of the Judicial District of the Capital of Rio de Janeiro, where the Judicial Reorganization is pending, the new version of the Judicial Reorganization Plan was filed that day, in compliance with the deadline set by the Court.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=5442A8AE-A0C1-479A-B089-3CBB59289E99

Restructuring Settlement Negotiations

On October 11 and October 23, 2017, in compliance with Article 157, paragraph 4 of Law 6,404/76 and pursuant to CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that the Company had been involved in discussions and negotiations with certain individual holders (each, a “Noteholder”) of, or managers of entities holding, beneficial interests in Notes. For the avoidance of doubt, the “Noteholders,” as such term is used in the Material Fact disclosed in October 23, 2017, did not include any holders of the Notes that are members of the Steering Committee of the International Bondholder Committee or the Steering Committee of the Ad Hoc Group of Bondholders, and the “Potential Transaction,” as such term is used in that Material Fact, refers to the potential transaction contemplated by the draft term sheet and plan support agreement disclosed by the Company on October 12, 2017.

About the Confidentiality Agreements

The Company executed confidentiality agreements with each Noteholder to facilitate discussions and negotiations concerning the Company’s capital structure and potential alternatives for a proposed restructuring of, and capital infusion by means of a capital increase into, the Company (a “Potential Transaction”). Pursuant to the Confidentiality Agreements, the Company agreed to disclose publicly, after the expiration of a period set forth in the Confidentiality Agreements, certain information (the “Confidential Information”) regarding, or shared in connection with, the discussions and/or negotiations that have taken place between the Company and each Noteholder concerning a Potential Transaction. The public information was furnished to satisfy the Company’s public disclosure obligations under the Confidentiality Agreements. The Confidentiality Agreements have terminated in accordance with their terms, except as otherwise provided therein.

26

About the Discussions with the Noteholders:

Beginning on August 31, 2017 and continuing on multiple dates throughout September and October 2017, representatives of the Company and the Company’s financial and legal advisors met in New York and Rio de Janeiro with representatives of each Noteholder and each Noteholder’s respective financial and legal advisors to discuss the terms of a Potential Transaction. Until the publication date of the documents on October 11, 2017, although no agreement concerning the terms of a Potential Transaction had been reached, discussions and negotiations between the Company and each Noteholder regarding the execution of plan support agreements and equity commitment agreements have reached an advanced stage. Notwithstanding the foregoing, while negotiations between the Company and each Noteholder may continue in the future, there can be no assurance that negotiations could continue or if they do continue, that they will result in an agreement regarding the terms of a Potential Transaction.

On October 19, 2017, representatives of the Company and the Company’s financial and legal advisors met in person or by phone with representatives from and/or advisors to each Noteholder of each Noteholder and each Noteholder’s respective financial and legal advisors to discuss the terms of a Potential Transaction. Until the date of disclosure of the Material Fact on October 23, 2017, no agreement concerning the terms of a Potential Transaction had been reached with the Noteholders. As previously mentioned in the Material Fact disclosed on October 11, 2017, even if the negotiations between the Company and each Noteholder may continue in the future, there can be no assurance that negotiations will continue or if they do continue, that they will result in an agreement regarding the terms of a Potential Transaction.

About the Confidential Information:

During the course of the discussions that led to the disclosure of the Material Fact on October 11, 2017, each of the Company Representatives and each of the Noteholder Representatives submitted written plan support agreements and restructuring term sheets representing the terms of a Potential Transaction. On October 11, 2017, the Company Representatives and each of the Noteholder Representatives discussed and negotiated (i) a draft written restructuring term sheet representing the terms of a Potential Transaction (contemplating, among other things, the terms of a potential capital increase, and (ii) a draft form of plan support agreement (the “Draft PSA”). The Draft Term Sheet represents the last term sheet or proposal exchanged among the Company and each of the Noteholders concerning the terms of a Potential Transaction, and the Draft PSA represents the last draft of a form of plan support agreement exchanged among the Company and each of the Noteholders, in each case, since the date that the Confidentiality Agreements were executed. Further, the Company Representatives provided to each of the Noteholder Representatives some Cleansing Materials. The Company believes that the Cleansing Materials include all documents constituting or including nonpublic information exchanged between the Company and each of the Noteholders during the course of discussions that would reasonably be expected to be material to an investor making an investment decision with respect to the purchase or sale of the securities of the Company and/or its affiliates.

During the meeting hold on October 19, 2017, the Company Representatives and each of the Noteholder Representatives discussed certain objections from other creditors of the Company to the new version of the plan of reorganization filed on October 11, 2017 in the judicial reorganization proceeding of the Company pending in Brazil and discussed and negotiated certain oral proposals with respect to the terms of a Potential Transaction. Specifically, the Company Representatives delivered an oral proposal (“Company Proposal”) regarding certain modifications to the October 12 Materials. Those terms were summarized in the Material Fact disclosed on October 23, 2017. The Noteholder Representatives did not accept the Company Proposal and responded with an oral proposal and, together with the Company Proposal, the “Proposals”), the material terms of which were summarized in the Material Fact disclosed on October 23, 2017. The Company believes that the foregoing written summary of the material terms of the Proposals includes all nonpublic information exchanged between the Company and each of the Noteholders during the course of discussions that would reasonably be expected to be material to an investor making an investment decision with respect to the purchase or sale of the securities of the Company and/or its affiliates.

27

About Certain Other Important Information:

In addition to the disclaimers and qualifiers set forth in the materials themselves, all statements made in the Cleansing Materials and in the Proposals are in the nature of settlement discussions and compromise, are not intended to be and do not constitute representations of any fact or admissions of any liability and are for the purpose of attempting to reach a consensual

compromise and settlement. In the event that any statement herein on the Cleansing Materials is inconsistent with or conflicts with the new version of the plan of reorganization filed substantially contemporaneously herewith in the judicial reorganization proceeding of the Company pending in Brazil, the terms and conditions of the New Version of the Plan prevail; provided, that any inconsistency or conflict between the terms and conditions of the New Version of the Plan, on the one hand, and the Draft Term Sheet and/or the Draft PSA or in the the Proposals and/or the written summary of the material terms of such Proposals contained in the press release on October 23, 2017, on the other hand, remains under discussion. Nothing contained in the Cleansing Materials or in the Proposals and/or the written summary of the material terms of such Proposals contained in the press released on October 23, 2017, should be intended to or should be construed to be an admission or a waiver of any rights, remedies, claims, causes of action or defenses. The information contained in the Cleansing Materials or in the in the Proposals and/or the written summary of the material terms of such Proposals was for discussion purposes only and should not constitute a commitment to consummate any transaction, or otherwise take any decisions or actions contemplated in the Cleansing Materials or in the Proposals.

Furthermore, the contents of the Cleansing Materials should not be construed as guidance by the Company in relation to its future results, and the Company does not assumed and expressly disclaimed any responsibility to update such contents or information at any time.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=E688E06D-060A-4663-B25A-BB7C05F4BDC8

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=0F99F25C-1726-4A34-B244-9E06A9E2D9F1

Restructuring Settlement Discussions

On October 11, 2017, in compliance with Article 157, paragraph 4 of Law 6,404/76 and pursuant to CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, has held a meeting with certain holders of, or managers of entities holding, beneficial interests in Notes.

On November 6, 2017, in compliance with Article 157, paragraph 4 of Law 6,404/76 and pursuant to CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, was been involved in discussions with, and provided certain information to, certain holders of, or managers of entities holding, beneficial interests in Notes and the holders thereof, the Noteholders.

About the Confidentiality Agreements with Members of the Steering Committee of the International Bondholder Committee and the Steering Committee of the Ad Hoc Group of Bondholders:

On October 10 and 18, 2017, the Company executed confidentiality agreements with the Noteholders who are members of the Steering Committee of the International Bondholder Committee (the “IBC”) and the Steering Committee of the Ad Hoc Group of Bondholders (the “Ad Hoc Group” or “AHG”) to facilitate potential discussions and negotiations concerning the Company’s capital structure and potential alternatives for a proposed restructuring of, and capital infusion by means of a capital increase into, the Company (a “Potential Transaction”). Pursuant to the IBC/AHG Confidentiality Agreements, the Company agreed to disclose publicly, after the expiration of a period set forth in the IBC/AHG Confidentiality Agreements, certain information (the “Confidential Information”) regarding, or shared in connection with, the discussions and/or negotiations that had taken place between the Company, the IBC and the Ad Hoc Group concerning a Potential Transaction. The information included in these press releases and certain documents posted on the Company’s website referenced in those dates were being furnished to satisfy the Company’s public disclosure obligations under the IBC/AHG Confidentiality Agreements. The IBC/AHG Confidentiality Agreements have terminated in accordance with their terms, except as otherwise provided therein.

About the meetings with the IBC, the Ad Hoc Group and ECAs:

On October 10, 18, 19, 20, 23 and 24, 2017, representatives of the Company and the Company’s financial and legal advisors met in New York with representatives of the IBC, the Ad Hoc Group, advisors to certain export credit agencies (the “ECAs”) that hold Class III Claims, and the IBC’s and the Ad Hoc Group’s respective financial and legal advisors (the “IBC/AHG/ECA Representatives”) to disclose (but expressly not to negotiate) and before discuss, the terms of a Potential Transaction.

Until the date of the disclosure of those Material Facts, no agreement concerning the terms of a Potential Transaction had been reached with the IBC, the AHG or the ECAs. While discussions between these parties and the Company may continue in the future, there can be no assurance that discussions would continue or if they do continue, that they woult result in an agreement regarding the terms of a Potential Transaction.

28

About the Confidential Information:

During the IBC/AHG/ECA meetings, the Company Representatives shared certain documents with the IBC, Ad Hoc Group, and ECA Representatives, which were detailed in the Material facts disclosed on October 11, 2017, and on November 6, 2017. In addition to the documents, the Company Representatives shared orally certain Confidential Information with the IBC/AHG/ECA Representatives to clarify the Confidential Information, which were detailed in the Material Fact disclosed on October 11, 2017.

In the Material Fact disclosed on October 11, 2017, it was informed that the Company Representatives and the IBC/AHG/ECA Representatives discussed the non-assignable instrument providing for a principal amount thereunder equal to the amount of such holders’ prepetition unsecured claims (such claims, the “Class III Claims”) offered as one treatment option under the New Version of the Plan (the “Par Fixed Payment Debt Instrument Option”) that holders of Class III Claims would be entitled to elect to receive under the New Version of the Plan. Under the New Version of the Plan, in the event that the Par Fixed Payment Debt Instrument Option is oversubscribed, the excess of Class III Claims the holders of which selected the Par Fixed Payment Debt Instrument Option over the subscription cap for the Par Fixed Payment Debt Instrument Option would be treated by default under another treatment option under the New Version of the Plan providing for, among other things, the general payment option described on slide 15 of the Laplace Presentation (the “General Payment Default Option”) and as set forth in the New Version of the Plan; such General Payment Default Option provides a debt instrument with a 19-year term, a 10-year principal grace period and interest rate of TR+0.5% p.a. for credits in Brazilian Reais and of 0.5% p.a. for credits in U.S. Dollars or Euros.

In the Material Fact disclosed on November 6, 2017, it was informed that, during the IBC/AHG/ECA Meetings and during informal discussions after the IBC/AHG/ECA Meetings, the Company Representatives provided to each of the IBC, AHG, and ECA Representatives certain written materials that the Company is required to make public under the IBC/AHG Confidentiality Agreements, as applicable, that were detailed in that Material Fact. On October 26, 2017, the IBC/AHG/ECA Representatives provided to the Company Representatives the IBC/AHG/ECA Term Sheet, which made certain modifications to the IBC/AHG/ECA Alternative Proposal disclosed by the IBC, AHG and ECAs on October 13, 2017. As of the date hereof, the Company had not made a counterproposal to the IBC/AHG/ECA Term Sheet. As they have done with other creditors and stakeholders of the Company, the Company Representatives had continued discussions informally with the IBC/AHG/ECA Representatives following the IBC/AHG/ECA Meetings and have tentatively agreed to meet again with the IBC/AHG/ECA Representatives in Brazil during the week of November 6, 2017. In addition to the Cleansing Materials, the Company Representatives shared orally certain Confidential Information with the IBC/AHG/ECA Representatives that were also summarized in the Material Fact disclosed on November 6, 2017.

About Certain Other Important Information:

In addition to the disclaimers and qualifiers set forth in the materials themselves, all statements made in the Cleansing Materials and in the Presentations was in the nature of settlement discussions and compromise, and were not intended to be and do not constituted representations of any fact or admissions of any liability and was for the purpose of attempting to reach a consensual compromise and settlement. In the event that any statement herein, or in the Cleansing Materials, or in the Presentations was inconsistent with or conflicts with the new version of the plan of reorganization filed on October 11, 2017 in the judicial reorganization proceeding of the Company pending in Brazil, the terms and conditions of the New Version of the Plan would prevail. Nothing contained in the Cleansing Materials or in the Presentations was intended to or should be construed to be an admission or a waiver of any rights, remedies, claims, causes of action or defenses. The information contained in the Cleansing Materials and in the Presentations was for discussion purposes only and should not constitute a commitment to consummate any transaction, or otherwise take any decisions or actions contemplated in the Cleansing Materials or the Presentations.

29

Furthermore, the contents of the Presentations and of the Cleansing Materials should not be construed as guidance by the Company in relation to its future results, and the Company does not assumed and expressly disclaimed any responsibility to update such contents or information at any time.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=764AEB8D-9C70-4E5E-BA15-FA55AB98AF7C

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=B719C2CC-B2A7-4701-91A7-21CE2D54CD58

Note from the Board of Directors

On November 4, 2017, the Company informed its shareholders and the market in general that the Board of Directors, after a meeting hold on November 3, 2017, issued a note for disclosure by the Company announcing that the Company's Board of Directors resolved, by majority vote, with 3 votes against, to (i) approve the final terms of a proposal to support the Plan Support Agreement (“PSA”), which will be offered to all the Notes Holders of the Company; (ii) authorize the Company to file an amendment to the judicial reorganization plan (the “Plan”) before the Court of the 7th Corporate Court of the Capital of the State of Rio de Janeiro, contemplating the final terms of the PSA until November 6, 2017; and (iii) determine that, from the presentation of the final terms of the PSA in court, the Company makes an effort to seek adherence to said PSA with creditors. The Company also informed that the Board of Directors assessed the correspondence received on October 26, 2017 from the advisors Moelis & Company, G5 Evercore and FTI, who advise a specific group of Note Holders, and decided that it was impossible to accept their terms, among other reasons because it was not a firm and binding proposal, it proposed an imbalance of treatment between different stakeholders, reserved the right to continue litigating against the interests of the Company and/or against administrators and presupposes a change in the regulatory regime for its implementation, thus causing delay and uncertainty for the Judicial Reorganization.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=06955929-F318-44E3-AC8E-D65D0ABBB684

Anatel Precautionary Measure

On November 6, 2017, in compliance with Article 157, paragraph 4, of Law 6,404/76 (“Brazilian Corporation Law”) and pursuant to CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that, on that date, the Directors’ Council of the National Telecommunications Agency (“Anatel”), which, through Decision Order Judgment No. 510 (“Decision Order”), ordered Oi to, among other things:

(i) notify the Superintendence of Competition, on the same date that the Board of Directors and Executive Board meetings of the Company are convened, in order to send a representative to attend said meeting, and, furthermore, grant the Anatel representative access to the Company's accounting, legal, economic-financial and operating documents, information so that it can immediately inform the Anatel’s Directors’ Councilof any acts or facts relevant to the maintenance of the concession and compliance with the duties or fiduciary powers by the company's directors and may suggest to the Anatel’s Directors’ Councilthat precautionary measures be taken in the public interest and to avoid ruinous acts against the Company;

(ii) formally submit to the Anatel’s Directors’ Council, within 24 hours from the notification of the Decision, the draft Plan Support Agreement (“PSA”) approved at the meeting of the Board of Directors held on November 3, 2017, demonstrating that the approval and execution of the instrument do not present risks to the continuity of the various services offered by the Company, to the Anatel’s Directors’ Council, the Company’s Board of Directors or the Company’s Board of Executive Officers; and

(iii) refrain from signing the PSA prior to the review of the draft by the Anatel’s Directors’ Council, an examination that will preserve the company's governance autonomy and will be exclusively related to the existence or non-existence clauses ruinous to the company, particularly those which content implies anticipation of pecuniary obligations that, once executed, may affect the operation of the company and the concession, as well as impact consumers, the provision of services and, relationally, the entire Brazilian Telecommunications System.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=525F7072-1508-4A63-B4E2-84786EB69CA9

30

Hiring of Market Maker

On September 29, 2017, the Company discloses to its shareholders and the market in general that it has hired Credit Suisse (Brasil) S.A. Corretora de Títulos e Valores Mobiliários, to perform the duties of Market Maker of the Company’s common shares (ticker OIBR3) and preferred shares (ticker OIBR4) with ISIN codes BROIBRACNOR1 and BROIBRACNPR8, respectively, within the scope of the São Paulo Stock Exchange (BM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros), in accordance with the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários - CVM) Instruction No. 384, dated March 17, 2003, the Accreditation Rules for Market Makers in Managed Markets by the BM&FBOVESPA and all other applicable laws and regulations, to substitute BTG Pactual Corretora de Valores Mobiliários SA, which will act as market maker until October 31, 2017.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=44AE7858-F1E9-4A8B-8536-5974F77075A6

Resignation of Chief Financial Officer and Investor Relations Officer

On October 2, 2017, in compliance with Article 157, paragraph 4 of Law 6,404/76 and pursuant to CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that on that date Mr. Ricardo Malavazi Martins presented his resignation as Chief Financial Officer and Investor Relations Officer of the Company. Besides that, the Company informed that at a meeting held on that date, Pursuant to Article 37 of the Company’s Bylaws, the Board of Executive Officers appointed Mr. Carlos Augusto Machado Pereira de Almeida Brandão to act as interim Chief Financial Officer and Investor Relations Officer, concurrently with his present position as Officer, until such time as the Board of Directors deliberates on this matter.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=3AB53AAC-2171-4280-8B39-6B24D9DA68F7

Changes in Management

On November 3, 2017, pursuant to Article 157, Paragraph 4, of Law No. 6,404/76 and under CVM Instruction No. 358/02, the Company informed its shareholders and the market in general that its Board of Directors, in a meeting hold on that date, approved by majority, with three dissenting votes, the alteration of its Board of Executive Officers to included the members of its Board of Directors: Hélio Calixto da Costa and João do Passo Vicente Ribeiro, as Executive Officers without designation, who will hold this position in addition to their current positions as members of the Board of Directors.

http://ri.oi.com.br/oi2012/web/download_arquivos.asp?id_arquivo=263007BA-B051-4364-8EA7-99FEF784A230

31

CVM INSTRUCTION 358, ART. 12:

Direct or indirect controlling shareholders and shareholders who elect members of the Board of Directors or the Fiscal Council, and any other individual or legal entity, or group of persons, acting as a group or representing the same interests, that attains a direct or indirect interest representing five percent (5%) or more of a type or class of shares of the capital of a publicly-held company, must notify the Securities Commission (CVM) and the Company of the fact, in accordance with the above article.

Oi recommends that its shareholders comply with the terms of article 12 of CVM Instruction 358, but it takes no responsibility for the disclosure or otherwise of acquisitions or disposals by third parties of interests corresponding to 5% or more of any type or class of its share, or of rights over those shares or other securities that it has issued.

|

|

Capital

|

Treasury

|

Free-Float

1

|

|

Common

|

668,033,661

|

148,282,000

|

519,748,556

|

|

Preferred

|

157,727,241

|

1,811,755

|

155,915,263

|

|

Total

|

825,760,902

|

150,093,755

|

675,663,819

|

Shareholder’s position as of September 30

th

, 2017.

(1) The outstanding shares do not consider treasury shares and the shares held by members of the Board of Directors and the Executive Board.

32

Rio de Janeiro – November 13, 2017

. This report includes consolidated financial and operating data for Oi S.A. – Under Judicial Reorganization (“Oi S.A.” or “Oi” or “Company”) and its direct and indirect subsidiaries as of September 30, 2017. In compliance with CVM instructions, the data are presented in accordance with International Financial Reporting Standards (IFRS).

Due to the seasonality of the telecom sector in its quarterly results, the Company will focus on comparing its financial results with the same period of the previous year.

This report contains projections and/or estimates of future events. The projections contained herein were compiled with due care, taking into account the current situation, based on work in progress and the corresponding estimates. The use of terms such as “projects”, “estimates”, “anticipates”, “expects”, “plans”, “hopes” and so on, is intended to indicate possible trends and forward-looking statements which, clearly, involve uncertainty and risk, so that future results that may differ from current expectations. These statements are based on various assumptions and factors, including general economic, market, industry, and operational factors. Any changes to these assumptions or factors may lead to practical results that differ from current expectations.

Excessive reliance should not be placed on these statements.

Forward-looking statements relate only to the date on which they are made, and the Company is not obliged to update them as new information or future developments arise. Oi takes no responsibility for transactions carried out or investment decisions taken on the basis of these projections or estimates. The financial information contained herein is

unaudited and may therefore differ from the final results.

It is worth mentioning that the assets of Telemar Participações S.A. (“TmarPart” former parent company of the Company) included the goodwill arising on the acquisition (“goodwill”), on January 8, 2009, of Brasil Telecom S.A. (“BrT”, current Oi). Upon the corporate restructuring of 2012, the CVM allowed, through its OFFICIAL LETTER/CVM/SEP/GEA-5/No. 119/2013, that this goodwill was kept only in TmarPart’s consolidated reporting.

On September 1, 2015, there was a downstream merger of TmarPart with and into the C, which did not include the goodwill in the merged net assets. Similarly, the Company decided to make a technical inquiry to the CVM about the adopted accounting policy. On July 29, 2016 the CVM, through its Official Letter No. 149/2016-CVM/SEP/GEA-5, expressed its understanding that the goodwill should be kept in the net assets to merged with and into the Company, using the valuation basis of the net assets acquired as a result of the business combination between independent parties made at the time of the acquisition of BrT.

Thus, the Company restated the corresponding amounts for the period ended September 30, 2016, as prescribed by Brazilian accounting pronouncement CPC 23 – Accounting Policies, Changes in Accounting Estimates and Errors, to retrospectively restate the corresponding amounts for the period ended September 30, 2016 taking into account the effects of goodwill on TmarPart’s net assets, effective beginning September 1, 2015, date of approval of TmarPart’s merger with and into Oi. The accounting treatment of goodwill was a material fact disclosed by the Company on August 1, 2016. It is worth noting that on August 1, 2017 the CVM reported that, because of the withdrawal of the appeal filed by the Company and because of the recognition of goodwill in Company books, it would shelve the proceedings filed on the matter.

For more details on this subject, please refer to the Financial Statements for the quarter ended September 30, 2017 which can be accessed through CVM’s website (

www.cvm.gov.br

) and Oi’s Investor Relations website (

www.oi.com.br/ir

).

_____________________________________________________________________________________________________________________________

Oi – Investor Relations

Marcelo Ferreira +55 (21) 3131-1314 marcelo.asferreira@oi.net.br

Bruno Nader +55 (21) 3131-1629 bruno.nader@oi.net.br

33

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 14, 2017

OI S.A. – In Judicial Reorganization

By:

/s/ Carlos Augusto Machado Pereira de Almeida Brandão

Name: Carlos Augusto Machado Pereira de Almeida Brandão

Title: Chief Financial Officer and Investor Relations Officer

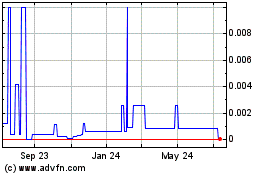

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

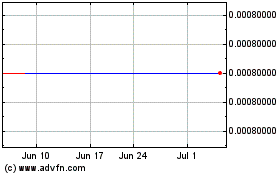

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024