Acushnet Holdings Corp. Announces Pricing of Offering of Common Stock by Selling Shareholder

November 13 2017 - 6:14PM

Business Wire

Acushnet Holdings Corp. (NYSE:GOLF) (“Acushnet”) today announced

the pricing of an offering of 8,332,311 shares of its common stock

by investment funds affiliated with Mirae Asset Global Investments

Co. Ltd. (the “Selling Shareholder”) at a public offering price of

$17.00 per share. The Selling Shareholder granted the underwriters

in the offering a 30-day option to purchase up to an additional

833,231 shares of common stock from the Selling Shareholder.

Acushnet is not selling any shares of common stock in this offering

and will not receive any proceeds from the sale of the shares of

common stock by the Selling Shareholder. The offering is expected

to close on November 16, 2017, subject to customary closing

conditions.

Morgan Stanley and Nomura are acting as joint book-running

managers for the offering.

Acushnet has filed a registration statement (including a

prospectus) with the Securities and Exchange Commission (the “SEC”)

for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration

statement and other documents Acushnet has filed with the SEC for

more complete information about Acushnet, the Selling Shareholder

and this offering. You may get these documents for free by visiting

EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of

the preliminary prospectus relating to the offering may also be

obtained from the office of Morgan Stanley, Attention: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, NY 10014 or

Nomura, Attention: Equity Syndicate, Worldwide Plaza, 309 West 49th

Street, 5th Floor, New York, NY 10019-7316, or by telephone at

(212) 667-9562.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

The statements contained in this release that are not historical

facts are forward-looking statements, including the fact that the

offering will close. These forward-looking statements are based on

current expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to changes in global, regional or local economic,

business, competitive, market, regulatory and other factors, many

of which are beyond Acushnet’s control. Any forward-looking

statement in this release speaks only as of the date of this

release. Acushnet undertakes no obligation to publicly update or

review any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

About Acushnet Holdings Corp.

We are the global leader in the design, development, manufacture

and distribution of performance-driven golf products, which are

widely recognized for their quality excellence. Driven by our focus

on dedicated and discerning golfers and the golf shops that serve

them, we believe we are the most authentic and enduring company in

the golf industry. Our mission - to be the performance and quality

leader in every golf product category in which we compete - has

remained consistent since we entered the golf ball business in

1932. Today, we are the steward of two of the most revered brands

in golf – Titleist, one of golf’s leading performance equipment

brands, and FootJoy, one of golf’s leading performance wear

brands.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171113006434/en/

Media contact:AcushnetPR@icrinc.comInvestor

Contact:IR@AcushnetGolf.com

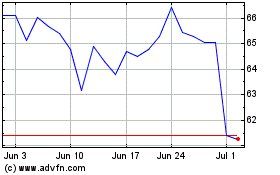

Acushnet (NYSE:GOLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

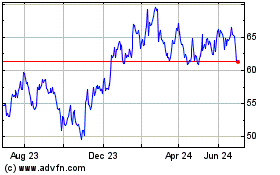

Acushnet (NYSE:GOLF)

Historical Stock Chart

From Apr 2023 to Apr 2024