UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CIDARA THERAPEUTICS, INC.

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

46-1537286

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

6310 Nancy Ridge Drive, Suite 101

San Diego, California 92121

(858) 752-6170

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey Stein, Ph.D., Chief Executive Officer

Cidara Therapeutics, Inc.

6310 Nancy Ridge Drive, Suite 101

San Diego, California 92121

(858) 752-6170

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

Charles J. Bair, Esq.

Cooley LLP

4401 Eastgate Mall

San Diego, California 92121

(858) 550-6000

|

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

T

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b–2 of the Exchange Act.

Large accelerated filer

¨

Accelerated filer

T

Non-accelerated filer

¨

(Do not check if a smaller reporting company) Smaller reporting company

¨

Emerging growth company

T

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

T

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

Amount

to be

Registered(1)

|

Proposed

Maximum

Offering Price

per Share(2)

|

Proposed

Maximum

Aggregate

Offering Price(2)

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.0001 per share

|

3,360,000

|

$7.93

|

$26,628,000

|

$3,316

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares of common stock being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares of common stock being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

Pursuant to Rule 457(c), calculated on the basis of the average of the high and low prices per share of the registrant’s Common Stock reported on the Nasdaq Global Market on November 10, 2017, a date within five business days prior to the filing of this registration statement.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 13, 2017

PROSPECTUS

3,360,000 shares of Common Stock

This prospectus covers the offer and resale by the selling stockholders identified in this prospectus of up to an aggregate of 3,360,000 shares of our common stock issued to the selling stockholders in a private placement on October 24, 2017.

We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale by the selling stockholders of such shares. We are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The selling stockholders are responsible for all selling commissions, transfer taxes and other costs related to the offer and sale of their shares.

Sales of the shares by the selling stockholders may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. The selling stockholders may sell shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholders, the purchasers of the shares, or both. If required, the number of shares to be sold, the public offering price of those shares, the names of any underwriters, broker-dealers or agents and any applicable commission or discount will be included in a supplement to this prospectus, called a prospectus supplement.

Our common stock is listed on The Nasdaq Global Market under the symbol “CDTX.” On November 10, 2017, the last reported sale price of our common stock was $7.80 per share.

Investing in our common stock involves a high degree of risk. Before making an investment decision, please read the information under “Risk Factors” beginning on page 3 of this prospectus and under similar headings in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017, which have been filed with the Securities and Exchange Commission, or the SEC, and are incorporated by reference in this prospectus and in the other documents that are filed after the date hereof and incorporated by reference into this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

ABOUT THIS PROSPECTUS

|

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

|

|

|

PROSPECTUS SUMMARY

|

|

|

|

|

|

RISK FACTORS

|

|

|

|

|

|

USE OF PROCEEDS

|

|

|

|

|

|

SELLING STOCKHOLDERS

|

|

|

|

|

|

PLAN OF DISTRIBUTION

|

|

|

|

|

|

EXPERTS

|

|

|

|

|

|

LEGAL MATTERS

|

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

|

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

|

ABOUT THIS PROSPECTUS

You should read this prospectus, any applicable prospectus supplement and the documents incorporated by reference in this prospectus before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

You should rely only on the information contained in or incorporated by reference in this prospectus (as supplemented or amended). We have not authorized anyone to provide you with different information. This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. The information contained in this prospectus, as well as the information filed previously with the SEC, and incorporated by reference in this prospectus, is accurate only as of the date of the document containing the information, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sale of our common stock.

Unless otherwise stated, all references in this prospectus to “we,” “us,” “our,” “Cidara,” the “Company” and similar designations refer to Cidara Therapeutics, Inc. and its subsidiaries on a consolidated basis. We have filed the word trademark “Cidara” for registration on the Principal Register of the United States Patent and Trademark Office. Solely for convenience, trademarks and trade names referred to in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. This prospectus, any applicable prospectus supplement and the documents incorporated by reference in this prospectus may contain trademarks and trade names of other companies, and those trademarks and trade names are the property of their respective owners. We do not intend our use or display of other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies or products.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any applicable prospectus supplement or free writing prospectus, including the documents that we incorporate by reference herein and therein, contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. As such, our actual results may differ significantly from those expressed in any forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

We discuss many of these risks in greater detail under “Risk Factors” in this prospectus, in the "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections incorporated by reference from our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC.

Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus, any applicable prospectus supplement, together with the documents that we have filed with the SEC that are incorporated by reference and any free writing prospectus we have authorized for use in connection with this offering, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before making an investment decision. For a more complete understanding of our company, you should read and consider carefully the more detailed information included or incorporated by reference in this prospectus and any applicable prospectus supplement, including the factors described under the heading “Risk Factors” beginning on page 3 of this prospectus, as well as the information incorporated by reference from our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q, before making an investment decision.

ABOUT THE COMPANY

Company Overview

We are a biotechnology company focused on the discovery, development and commercialization of novel anti-infectives for the treatment and prevention of diseases that are inadequately addressed by current standard of care therapies. We are developing a balanced pipeline of product and development candidates, with an initial focus on serious fungal and bacterial infections.

Our lead product candidate is rezafungin acetate, formerly known as CD101 IV, an intravenous formulation of a novel echinocandin. Rezafungin acetate has been approved as the international nonproprietary name, or INN, for CD101 by the World Health Organization, and as a United States Adopted Name, or USAN, for CD101 by the USAN Council.

Rezafungin has improved pharmacokinetics compared to existing echinocandins and has the potential for expanded utility across patient settings. Rezafungin is the only once-weekly product candidate currently in development that is intended for the treatment and prevention of life-threatening invasive fungal infections.

In addition, we are developing CD201 and our antibody-drug conjugates for multidrug-resistant bacterial infections as part of our proprietary Cloudbreak™ platform, which is designed to discover compounds that directly kill bacterial, fungal or viral pathogens and also direct a patient’s immune system to attack and eliminate such pathogens.

Rezafungin

Rezafungin acetate is a novel molecule in the echinocandin class of antifungals. We are developing rezafungin for the treatment and prevention of systemic fungal infections associated with high mortality rates. We are currently enrolling patients with candidemia and invasive candidiasis in a Phase 2 clinical trial called the STRIVE study. We plan to enroll at least 90 patients in the microbiological intent-to-treat, or mITT, population in the STRIVE study, with 30 patients in each of two rezafungin arms and 30 patients receiving the comparator drug, caspofungin. We expect topline data from this study in the first quarter of 2018.

Cloudbreak Immunotherapy Platform

We continue to advance our Cloudbreak immunotherapy platform, which we believe has broad potential applications across a wide spectrum of infectious diseases, including bacterial, fungal and viral infections. We believe that our Cloudbreak platform is a fundamentally new approach for the treatment of infectious disease. To date, we have generated preclinical,

in vivo

proof of concept data in both our Cloudbreak antibacterial program and our Cloudbreak antifungal program. In September 2016, we selected a lead Cloudbreak development candidate, CD201.

CD201 is a novel, bispecific antimicrobial immunotherapy being developed for the treatment of multidrug-resistant Gram-negative bacterial infections, including those caused by pathogens harboring the mcr-1 plasmid. Cidara has received a grant for up to $6.9 million from the Combating Antibiotic Resistance Accelerator, or CARB-X, to advance the development of CD201 and back-up candidates. The back-up candidates include antibody-drug conjugates that we are testing in various animal models of bacterial infections.

Company Information

We were incorporated in Delaware as K2 Therapeutics, Inc. in December 2012. In July 2014, we changed our name to Cidara Therapeutics, Inc. Our principal executive offices are located at 6310 Nancy Ridge Drive, Suite 101, San Diego, California 92121, and our telephone number is (858) 752-6170. Our corporate website address is www.cidara.com. Information contained

in or accessible through our website is not a part of, and is not incorporated into, this prospectus or any applicable prospectus supplement, and you should not consider it part of this prospectus supplement or the accompanying prospectus. The inclusion of our website address in this prospectus supplement is an inactive textual reference only.

Private Placement

On October 19, 2017, we entered into a Securities Purchase Agreement, or the Purchase Agreement, with the selling stockholders, pursuant to which we agreed to sell and issue to the selling stockholders an aggregate of 3,360,000 shares of our common stock at a purchase price of $6.00 per share. The aggregate purchase price paid by the selling stockholders was $20,160,000. We completed the closing of this private placement on October 24, 2017.

As required by the Purchase Agreement, we agreed to, among other things, (i) file a registration statement with the SEC to cover the resale of the shares by the selling stockholders, (ii) cause such registration statement to become effective as soon as practicable following the filing thereof and (iii) take all other actions as may be necessary to keep such registration statement continuously effective during the timeframes set forth in the Purchase Agreement. As set forth in the Purchase Agreement, if we fail to comply with certain obligations with respect to filing and securing effectiveness of such registration statement, we would be obligated to pay liquidated damages to the selling stockholders in the amount of 1% on the day of such default and on every 30

th

day thereafter, up to a maximum of 6% of each selling stockholder’s aggregate investment.

The registration statement of which this prospectus is a part relates to the resale of the shares of common stock issued to the selling stockholders in connection with foregoing private placement.

The Offering

|

|

|

|

|

|

|

Common stock offered by the selling stockholders

|

|

3,360,000 shares

|

|

Terms of the offering

|

|

Each selling stockholder will determine when and how it will sell the common stock offered in this prospectus, as described in “Plan of Distribution.”

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

|

|

Risk factors

|

|

See “Risk Factors” beginning on page 3, for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

|

Nasdaq Global Market symbol

|

|

CDTX

|

The selling stockholders named in this prospectus may offer and sell up to 3,360,000 shares of our common stock. Our common stock is currently listed on The Nasdaq Global Market under the symbol “CDTX.” Shares of common stock that may be offered under this prospectus will be fully paid and non-assessable. We will not receive any of the proceeds of sales by the selling stockholders of any of the common stock covered by this prospectus. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders for offer and resale, we are referring to the shares of common stock issued to the selling stockholders in connection with our private placement as described above. When we refer to the selling stockholders in this prospectus, we are referring to the selling stockholders identified in this prospectus and, as applicable, their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described in the sections entitled “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on form 10-Q, as filed with the SEC, which are incorporated herein by reference in their entirety, as well any amendment or updates to our risk factors reflected in subsequent filings with the SEC, including any applicable prospectus supplement. Our business, financial condition, results of operations or prospects could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned elsewhere in this prospectus. For more information, see the section entitled “Where You Can Find More Information.” Please also read carefully the section entitled “Special Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

We will not receive any of the proceeds from the sale or other disposition of shares of our common stock held by the selling stockholders pursuant to this prospectus. We will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our common stock to be sold by the selling stockholders, including registration, listing and qualifications fees, printers and accounting fees, and fees and disbursements of counsel, or collectively, the Registration Expenses. Other than Registration Expenses, the selling stockholders will bear underwriting discounts, commissions, placement agent fees or other similar expenses payable with respect to sales of shares.

SELLING STOCKHOLDERS

We are registering the resale of 3,360,000 shares of common stock held by the selling stockholders identified below to permit each of them, or their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, to resell or otherwise dispose of these shares in the manner contemplated under the section entitled “Plan of Distribution” in this prospectus (as may be supplemented and amended).

The selling stockholders may sell some, all or none of their shares. We do not know how long the selling stockholders will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any of the shares. The shares covered hereby may be offered from time to time by the selling stockholders. As a result, we cannot estimate the number of shares of common stock each of the selling stockholders will beneficially own after termination of sales under this prospectus. In addition, each of the selling stockholders may have sold, transferred or otherwise disposed of all or a portion of its shares of common stock since the date on which it provided information for this table.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our common stock. Generally, a person “beneficially owns” shares of our common stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within 60 days.

The information in the table below and the footnotes thereto regarding shares of common stock to be beneficially owned after the offering assumes the sale of all shares being offered by the selling stockholders under this prospectus. The percentage of shares owned prior to and after the offering is based on 20,238,143 shares of common stock outstanding as of October 31, 2017. This information has been obtained from the selling stockholders or in Schedules 13G or 13D and other public documents filed with the SEC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before Offering

(2)

|

|

|

|

After Offering

(2)

|

|

Name and Address

(1)

|

|

Number of Shares Beneficially Owned

|

|

Percentage of Shares Beneficially Owned

|

|

Number of Shares Offered

(2)

|

|

Number of Shares Beneficially Owned

|

|

Percentage of Shares Beneficially Owned

|

|

Biotech Target N.V.

(3)

|

|

2,235,272

|

|

11.0

|

%

|

|

900,000

|

|

1,335,272

|

|

|

6.6

|

%

|

|

Entities affiliated with Great Point Partners, LLC

(4)

|

|

800,000

|

|

4.0

|

%

|

|

800,000

|

|

—

|

|

|

*

|

|

|

Entities affiliated with Prosight Partners, LLC

(5)

|

|

1,577,834

|

|

7.8

|

%

|

|

650,000

|

(6)

|

927,834

|

|

|

4.6

|

%

|

|

Pura Vida Master Fund, Ltd.

(7)

|

|

275,000

|

|

1.4

|

%

|

|

275,000

|

|

—

|

|

|

*

|

|

|

Entities affiliated with Sphera Funds Management LP

(8)

|

|

210,800

|

|

1.0

|

%

|

|

210,000

|

|

800

|

|

|

*

|

|

|

Laurence Lytton

(9)

|

|

678,429

|

|

3.4

|

%

|

|

200,000

|

|

478,429

|

|

|

2.4

|

%

|

|

Broadfin Healthcare Master Fund, Ltd.

(10)

|

|

928,897

|

|

4.6

|

%

|

|

150,000

|

|

778,897

|

|

|

3.8

|

%

|

|

Entities affiliated with DAFNA Capital Management, LLC

(11)

|

|

308,458

|

|

1.5

|

%

|

|

100,000

|

(12)

|

208,458

|

|

|

1.0

|

%

|

|

CVI Investments, Inc.

(13)

|

|

75,000

|

|

*

|

|

|

75,000

|

|

—

|

|

|

*

|

|

* Less than one percent.

|

|

|

|

(1)

|

If required, information about other selling security holders, except for any future transferees, pledgees, donees or successors of the selling security holders named in the table above, will be set forth in a prospectus supplement or amendment to the registration statement of which this prospectus is a part. Additionally, post-effective amendments to the registration statement will be filed to disclose any material changes to the plan of distribution from the description contained in the final prospectus.

|

|

|

|

|

(2)

|

Assumes sale of all shares available for sale under this prospectus and no further acquisitions of shares by the selling stockholders.

|

|

|

|

|

(3)

|

Based solely upon a Schedule 13G/A filed with the SEC on October 27, 2017 by BB Biotech AG on behalf of itself and Biotech Target N.V. Represents 2,235,272 shares held by BB Biotech AG and Biotech Target N.V. with shared voting power. The address of BB Biotech AG is Schwertstrasse 6, CH-8200 Schaffhausen, Switzerland and the address of Biotech Target N.V. is Snipweg 26, Curacao.

|

|

|

|

|

(4)

|

Consists of (i) 211,762 shares held by Biomedical Value Fund, L.P., or BVF, (ii) 302,835 shares held by Biomedical Offshore Value Fund, Ltd., or BOVF, (iii) 225,830 shares held by GEF-SMA, L.P., or GEF-SMA, and (iv) 59,573 shares held by Class D Series of GEF-PS, LP, or GEF-PS. Great Point Partners, LLC, or Great Point, is the investment manager of each of BVF, BOVF, GEF-SMA and GEF-PS, and by virtue of such status may be deemed to be the beneficial owner of the shares held by such entities. Each of Dr. Jeffrey R. Jay, M.D., as senior managing member of Great Point, and David E. Kroin, as managing director of Great Point, has voting and investment power with respect to the shares held by BVF, BOVF, GEF-SMA and GEF-PS, and therefore may be deemed to be the beneficial owner of the shares held by such entities. The address of Great Point is 165 Mason Street, 3rd Floor, Greenwich, Connecticut.

|

|

|

|

|

(5)

|

Consists of (i) 763,846 shares held by Prosight Fund, LP, (ii) 702,922 shares held by Prosight Plus Fund, LP, and (iii) 111,066 shares held by Undiscovered Value Master Fund SPC – April, 2014 Segregated, or collectively, the Prosight Funds. Prosight Management, LP is the sub-advisor or general partner and investment manager of each of the Prosight Funds, and by virtue of such status may be deemed to be the beneficial owner of the shares held by them. Prosight Partners, LLC is the general partner of Prosight Management, LP, and by virtue of such status may be deemed to be the beneficial owner of the shares held by the Prosight Funds. W. Lawrence Hawkins is the sole member of Prosight Partners, LLC, has voting and investment power with respect to the shares held by the Prosight Funds, and therefore may be deemed to be the beneficial owner of the shares held by them. The address of Prosight Partners, LLC is 2301 Cedar Springs Road, STE 355 Dallas, Texas.

|

|

|

|

|

(6)

|

Consists of (i) 316,081 shares held by Prosight Fund, LP, (ii) 287,962 shares held by Prosight Plus Fund, LP, and (iii) 45,957 shares held by Undiscovered Value Master Fund SPC – April, 2014 Segregated.

|

|

|

|

|

(7)

|

Pura Vida Investments, LLC is the investment manager of Pura Vida Master Fund, Ltd., or Pura Vida, and by virtue of such status may be deemed to be the beneficial owner of the shares held by Pura Vida. Efrem Jason Kamen and Frank Litvack are the partners of Pura Vida Investments, LLC, have voting and investment power with respect to the shares held by Pura Vida, and therefore may be deemed to be the beneficial owners of the shares held by Pura Vida. The address of Pura Vida is 888 Seventh Avenue, Flr 6, New York, New York 10106.

|

|

|

|

|

(8)

|

Consists of (i) 204,012 shares owned by Sphera Global Healthcare Master Fund, and (ii) 6,788 shares owned by HFR HE Sphera Global Healthcare Master Trust, or collectively, the Sphera Entities. Each of the Sphera Entities has delegated its investment management authority to Sphera Global Healthcare Management, LP, or the Management Company, and by virtue of such authority, the Management Company may be deemed to be the beneficial owner of the shares held by such entities. Sphera Global Healthcare GP, Ltd. is the general partner of the Management Company and by virtue of such status may be deemed to be the beneficial owner of the shares held by the Sphera Entities. Moshe Arkin and Sphera Funds Management Ltd. may be deemed to jointly control the Management Company and each, by virtue of such status, may be deemed the beneficial owner of the shares held by Sphera Entities. The address of Sphera Funds Management Ltd. is 21 Ha'arba'ah Street, Tel Aviv 64739, Israel.

|

|

|

|

|

(9)

|

Consists of (i) 614,204 shares held by Laurence Lytton, (ii) 29,525 shares held by AWL Family LLC, (iii) 17,772 shares held by the WWL Trust, and (iv) 16,928 shares held in other related accounts.

|

|

|

|

|

(10)

|

Broadfin Capital, LLC is the Investment Manager of Broadfin Healthcare Master Fund, Ltd., or the Master Fund, and by virtue of such status may be deemed to be the beneficial owner of the shares held by the Master Fund. Kevin Kotler is the managing member of Broadfin Capital, LLC, has shared voting and investment power with respect to the shares held by the Master Fund, and therefore may be deemed to be the beneficial owner of the shares held by the Master Fund. The address of Broadfin Capital, LLC is 300 Park Avenue, 25th floor, New York, New York.

|

|

|

|

|

(11)

|

Consists of (i) 181,300 shares held by DAFNA Life Science LP, and (ii) 127,158 shares held by DAFNA Life Science Select LP, or collectively, the DAFNA Funds. DAFNA Capital Management, LLC, or DAFNA Capital, is the investment advisor of the DAFNA Funds and by virtue of such status may be deemed to be the beneficial owner of the shares held by them. Each of Nathan Fischel, as the Chief Executive Officer of DAFNA Capital, and Fariba Ghodsian, as the Chief Investment Officer of DAFNA Capital, has voting and investment power with respect to the shares held by the DAFNA

|

Funds and therefore may be deemed to be the beneficial owner of the shares held by such entities. The address for DAFNA Capital is 10990 Wilshire Boulevard, Suite 1400, Los Angeles, California.

|

|

|

|

(12)

|

Consists of (i) 59,000 shares held by DAFNA and (ii) 41,000 shares held by DAFNA Select.

|

|

|

|

|

(13)

|

Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc., or CVI, has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. The address for Heights Capital Management, Inc. is 101 California Street, Suite 3250, San Francisco, California.

|

Relationship with Selling Stockholders

As discussed in greater detail above under the section “Prospectus Summary – Private Placement,” on October 19, 2017, we entered into the Purchase Agreement with the selling stockholders pursuant to which we sold and issued shares of common stock to the selling stockholders and agreed with the selling stockholders to file a registration statement to enable the resale of such shares. None of the selling stockholders or any persons having control over such selling stockholders has held any position or office with us or our affiliates within the last three years or has had a material relationship with us or any of our predecessors or affiliates within the past three years, other than as a result of the ownership of our shares or other securities.

PLAN OF DISTRIBUTION

We are registering the shares of common stock issued to the selling stockholders to permit the resale of such shares of common stock by such holders from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register such shares of common stock.

Each selling stockholder, which may include donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of its shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at privately negotiated prices.

A selling stockholder may use any one or more of the following methods when disposing of shares or interests therein:

|

|

|

|

•

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

•

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its own account;

|

|

|

|

|

•

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

•

|

privately negotiated transactions;

|

|

|

|

|

•

|

to the extent permitted by law, short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC;

|

|

|

|

|

•

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

•

|

through agreements between broker-dealers and the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

|

|

•

|

a combination of any such methods of sale; and

|

|

|

|

|

•

|

any other method permitted by applicable law.

|

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the pledgees, transferees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into options or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to each such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The selling stockholders also may resell all or a portion of the shares in open market transactions, rather than under this prospectus, in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

If underwriters are used in the sale, the shares of common stock will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. In connection with any such underwritten sale of shares of common stock, underwriters may receive compensation from the selling stockholders, for whom they may act as agents, in the form of discounts, concessions or commissions. If the selling stockholders use an underwriter or underwriters to effectuate the sale of shares of common stock, we and/or they will execute an underwriting agreement with those underwriters at the time of sale of those shares of common stock. To the extent required by law, the names of the underwriters will be set forth in a prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes the prospectus supplement and the accompanying prospectus used by the underwriters to sell those securities. The obligations of the underwriters to purchase those shares of common stock will be subject to certain conditions precedent, and unless otherwise specified in a prospectus supplement, the underwriters will be obligated to purchase all the shares of common stock offered by such prospectus supplement if any of such shares of common stock are purchased. Any public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We are required to pay certain fees and expenses incurred by us incident to the registration of the shares of common stock of the selling stockholders. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act, and the selling stockholders may be entitled to contribution. We may be indemnified by the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act that may arise from any written information furnished to us by the selling stockholders specifically for use in this prospectus, or we may be entitled to contribution.

We have agreed with the selling stockholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (1) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement or (2) the date on which all of the shares may be sold without restriction pursuant to Rule 144 of the Securities Act.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our annual report on Form 10-K for the year ended December 31, 2016, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s report, given on their authority as experts in accounting and auditing.

LEGAL MATTERS

Certain legal matters, including the validity of the shares of common stock offered pursuant to this registration statement, will be passed upon for us by Cooley LLP, San Diego, California.

WHERE YOU CAN FIND MORE INFORMATION

We must comply with the informational requirements of the Exchange Act, and we are required to file reports and proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies at the prescribed rates from the Public Reference Section of the Securities and Exchange Commission at its principal office in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for further information about the public reference room. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding issuers like us that file electronically with the SEC. You may access the SEC’s web site at http://www.sec.gov. We maintain a website at www.cidara.com. The information contained in, or that can be accessed through, our website is not incorporated by reference herein and is not part of this prospectus.

Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and in each instance we refer you to the copy of the contract or document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference in this prospectus the information that we file with it. Incorporation by reference means that we can disclose important information to you by referring you to other documents that are legally considered to be part of this prospectus. Later information that we file with the SEC will automatically update and supersede the information in this prospectus, any supplement and the documents listed below. Our SEC file number is 001-36912. We incorporate by reference the specific documents listed below and any future filings made with the SEC under Section 13(a), 13(c), 14, or 15(d) of the Exchange Act, as amended, until all of the shares of common stock covered by this prospectus are sold:

|

|

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 15, 2017;

|

|

|

|

|

•

|

our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017, June 30, 2017 and September 30, 2017 filed with the SEC on May 10, 2017, August 9, 2017 and November 8, 2017, respectively;

|

|

|

|

|

•

|

the information specifically incorporated by reference in our Annual Report on Form 10-K for the year ended December 31, 2016, from our definitive proxy statement relating to our 2017 annual meeting of stockholders, which was filed on April 28, 2017;

|

|

|

|

|

•

|

our Current Reports on Form 8-K filed on February 21, 2017, March 31, 2017, June 23, 2017 and October 20, 2017 (except for the information furnished under Items 2.02 or 7.01 and the exhibits furnished thereto);

|

|

|

|

|

•

|

the description of our common stock in our registration statement on Form 8-A filed with the SEC on April 9, 2015, including any amendments or reports filed for the purpose of updating such description; and

|

|

|

|

|

•

|

all documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such forms that are related to such items) after the date of the initial registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, provided that all documents “furnished” by the Company to the SEC and not “filed” are not deemed incorporated by reference herein.

|

We will furnish without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, a copy of any document incorporated by reference. Requests should be addressed to 6310 Nancy Ridge Drive, Suite 101, San Diego, California 92121, Attn: Secretary or may be made telephonically at (858) 752-6170.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. You should not assume that the information contained in this prospectus or the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities are sold on a later date.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following is a statement of the estimated expenses to be incurred by us in connection with the registration of the securities under this registration statement, all of which will be borne by us.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities and Exchange Commission Registration Fee

|

|

$

|

3,316

|

|

|

Legal Fees and Expenses

|

|

$

|

90,000

|

|

|

Accountants’ Fees and Expenses

|

|

$

|

25,000

|

|

|

Miscellaneous

|

|

$

|

5,000

|

|

|

Total

|

|

$

|

123,316

|

|

|

|

|

|

|

|

Item 15. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant indemnity to directors and officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General Corporation Law are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement of expenses incurred, arising under the Securities Act of 1933, as amended (the “Securities Act”).

As permitted by the Delaware General Corporation Law, the registrant’s amended and restated certificate of incorporation contains provisions that eliminate the personal liability of its directors for monetary damages for any breach of fiduciary duties as a director, except liability for the following:

|

|

|

|

•

|

any breach of the director’s duty of loyalty to the registrant or its stockholders;

|

|

|

|

|

•

|

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

|

|

•

|

under Section 174 of the Delaware General Corporation Law (regarding unlawful dividends and stock purchases); or

|

|

|

|

|

•

|

any transaction from which the director derived an improper personal benefit.

|

As permitted by the Delaware General Corporation Law, the registrant’s amended and restated bylaws provide that:

|

|

|

|

•

|

the registrant is required to indemnify its directors and executive officers to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions;

|

|

|

|

|

•

|

the registrant may indemnify its other employees and agents as set forth in the Delaware General Corporation Law;

|

|

|

|

|

•

|

the registrant is required to advance expenses, as incurred, to its directors and executive officers in connection with a legal proceeding to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions; and

|

|

|

|

|

•

|

the rights conferred in the amended and restated bylaws are not exclusive.

|

The registrant has entered, and intends to continue to enter, into separate indemnification agreements with its directors and executive officers to provide these directors and executive officers additional contractual assurances regarding the scope of the indemnification set forth in the registrant’s amended and restated certificate of incorporation and amended and restated bylaws and to provide additional procedural protections. At present, there is no pending litigation or proceeding involving a director or executive officer of the registrant regarding which indemnification is sought. The indemnification provisions in the registrant’s amended and restated certificate of incorporation, amended and restated bylaws and the indemnification agreements entered

into or to be entered into between the registrant and each of its directors and executive officers may be sufficiently broad to permit indemnification of the registrant’s directors and executive officers for liabilities arising under the Securities Act. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

The registrant currently carries liability insurance for its directors and officers.

Item 16. Exhibit Index.

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

3.1(1)

|

|

|

|

3.2(1)

|

|

|

|

4.1(2)

|

|

|

|

4.2(2)

|

|

|

|

4.3(3)

|

|

|

|

5.1

|

|

|

|

10.1(4)

|

|

|

|

23.1

|

|

|

|

23.2

|

|

|

|

24.1

|

|

Power of Attorney (included on signature page).

|

|

|

|

|

(1)

|

Incorporated by reference to the Registrant’s Current Report on Form 8-K, filed on April 24, 2015.

|

|

|

|

|

(2)

|

Incorporated by reference to the Registrant’s Registration Statement on Form S-1 (File No. 333-202740), as amended, originally filed on March 13, 2015.

|

|

|

|

|

(3)

|

Incorporated by reference to the Registrant's Current Report on Form 8-K, filed on October 3, 2016.

|

|

|

|

|

(4)

|

Incorporated by reference to the Registrant’s Current Report on Form 8-K, filed on October 20, 2017.

|

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

|

|

|

|

|

|

(a)(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

|

|

|

|

|

|

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

|

|

|

|

|

|

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission (the “SEC”) pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement;

|

|

|

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however

, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

|

|

|

|

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

|

|

|

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

|

|

|

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

|

|

|

|

|

|

(i)

|

each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

|

|

|

|

|

|

(ii)

|

each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided, however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

|

|

|

|

|

(b)

|

The undersigned registrant undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant's annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

|

|

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling person of the registrant in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of San Diego, state of California, on November 13, 2017.

|

|

|

|

|

|

|

|

|

|

|

Cidara Therapeutics, Inc.

|

|

|

|

|

By:

|

|

/s/ Jeffrey Stein, Ph.D.

|

|

|

|

Jeffrey Stein, Ph.D.

|

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Jeffrey Stein and Matthew Onaitis, and each of them, as his true and lawful attorney-in-fact and agent, each acting alone, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any or all amendments (including post-effective amendments) to this Registration Statement on Form S-3, and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

Name

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Jeffrey Stein, Ph.D.

|

|

President and Chief Executive Officer

|

|

November 13, 2017

|

|

Jeffrey Stein, Ph.D.

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Matthew Onaitis, J.D.

|

|

Chief Financial Officer, General Counsel and Secretary

|

|

November 13, 2017

|

|

Matthew Onaitis, J.D.

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Marc J.S. Wilson

|

|

Vice President, Finance and Accounting

|

|

November 13, 2017

|

|

Marc J.S. Wilson

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Scott M. Rocklage, Ph.D.

|

|

Chairman of the Board of Directors

|

|

November 13, 2017

|

|

Scott M. Rocklage, Ph.D.

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Daniel D. Burgess

|

|

Member of the Board of Directors

|

|

November 13, 2017

|

|

Daniel D. Burgess

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Timothy R. Franson, M.D.

|

|

Member of the Board of Directors

|

|

November 13, 2017

|

|

Timothy R. Franson, M.D.

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Robert J. Perez

|

|

Member of the Board of Directors

|

|

November 13, 2017

|

|

Robert J. Perez

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Theodore R. Schroeder

|

|

Member of the Board of Directors

|

|

November 13, 2017

|

|

Theodore R. Schroeder

|

|

|

|

|

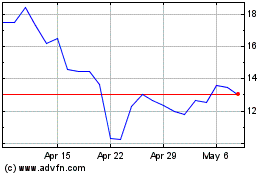

Cidara Therapeutics (NASDAQ:CDTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

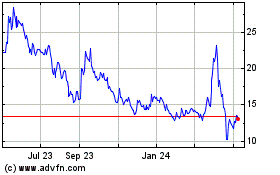

Cidara Therapeutics (NASDAQ:CDTX)

Historical Stock Chart

From Apr 2023 to Apr 2024