Report of Foreign Issuer (6-k)

November 13 2017 - 5:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to

Rule 13a-16

or

15d-16

of the Securities Exchange Act of 1934

November 13, 2017

PROQR

THERAPEUTICS N.V.

Zernikedreef 9

2333 CK

Leiden

The Netherlands

Tel: +31 88 166 7000

(Address, Including ZIP Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F

or

Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

On November 13, 2017, ProQR Therapeutics N.V. (“ProQR” or the “Company”)

(NASDAQ: PRQR), announced that it had commenced a public offering of its ordinary shares (plus any additional ordinary shares to which the Company expects to grant a

30-day

option to the underwriters to

purchase), nominal value €0.04 per ordinary share, in an underwritten public offering (the “Offering”). In addition, the Company announced a proposed concurrent registered direct offering of its ordinary shares.

In the prospectus supplement used in connection with the Offering and filed with the Securities and Exchange Commission (“SEC”), the

Company provided the following disclosures as to recent developments:

|

|

•

|

|

The Company’s Phase 2 clinical program for

QR-010

for CF, a severe genetic disease that affects approximately 77,000 people in the United States, the European Union, Canada

and Australia, is currently under design. The Company intends to seek a strategic partner for further development of

QR-010

for CF.

|

|

|

•

|

|

The Company commenced patient dosing in its ongoing Phase 1/2 safety and efficacy study of

QR-110,

its lead product candidate for Leber’s congenital amaurosis type 10, in

November 2017. The objectives of the trial will include safety, tolerability, pharmacokinetics and efficacy as measured by restoration or improvement of visual function and retinal structure through ophthalmic endpoints such as visual acuity, full

field stimulus testing, or FST, optical coherence tomography, OCT, pupillary light reflex, or PLR, mobility course and fixation stability. Changes in quality of life in the trial subjects will also be evaluated. The Company expects interim safety

and efficacy trial results from the majority of patients after six months of treatment in 2018, with full 12 month treatment data from all patients in the trial in 2019. In pre-clinical studies of QR-110, it was shown to convert close to 100 percent

of the mutant mRNA to wild-type in a homozygous optic cup organoid model, which led to a functional CEP290 protein. QR-110 is designed to be administered through an intravitreal injection in the eye which is considered a routine procedure, and has

been shown in vivo that QR-110 reaches the outer nuclear layer of the eye following a single intravitreal injection. The company conducted a pre-evaluation/retrospective natural history study collection data of 22 LCA 10 patients over a period of 16

years in 2017.

|

|

|

•

|

|

The Company is developing

QRX-421

for ophthalmic manifestations of Usher syndrome due to exon 13 mutations of the USH2A gene, which affect approximately 12,000 patients in the

United States, the European Union, Canada and Australia, and

QRX-411

for the ophthalmic manifestations of Usher syndrome due to the mutations in

PE-40

of the USH2A gene,

which affect approximately 1,000 patients in the United States, the European Union, Canada and Australia. The Company initiated

pre-clinical

development of

QRX-421

and

plans to initiate a clinical trial towards the end of 2018. This planned clinical trial consists of a single dose arm and a

six-month

adaptive multiple dose arm. The Company expects to receive

top-line

data from the single dose arm in the first half of 2019 and from the adaptive multiple dose arm in 2019.

QRX-411

is also currently in

pre-clinical

development, with the goal of starting a clinical trial towards the end of 2018 with a

top-line

data readout expected in 2019.

|

|

|

•

|

|

The Company expects to start its first in human study of

QR-313

in dystrophic epidermolysis bullosa, or DEB, in early 2018. The Company plans to conduct this study as a Phase 1/2

clinical trial in two parts, each enrolling six to ten DEB patients with exon 73 mutations, and each evaluating safety, tolerability and pharmacokinetics. Part A of the clinical trial is expected to be an open label, single wound treatment for 28

days, while Part B of the clinical trial is expected to be a placebo controlled, multiple wound treatment for 28 days. The Company expects to receive interim data from Part A of the trial in 2018 and full results that include Part B of the trial in

early 2019.

|

|

|

•

|

|

The Company believes that its novel proprietary RNA editing platform technology called Axiomer may be applicable to more than 20,000 disease-causing mutations. The Company expects to complete optimization of proof of

concept in vitro and in vivo in 2017.

|

|

|

•

|

|

On September 25, 2017, the Company established a Dutch foundation named Stichting Bewaarneming Aandelen ProQR for the administration of option exercises under its 2014 Stock Option Plan. The Company has issued an

aggregate of 3,330,225 ordinary shares to the foundation, with the nominal value of €0.04 per share to be paid out of the Company’s reserves. Upon exercise of outstanding options, the foundation will transfer the appropriate number of

ordinary shares underlying such exercise and the optionee will pay the appropriate exercise price to the Company as share premium. The Company is the sole director of the foundation, and the foundation is not permitted to receive dividends or to

vote the ordinary shares it will hold from time to time.

|

|

|

•

|

|

As of September 30, 2017 and December 31, 2016, the Company had cash and cash equivalents of €39.7

million and €59.2 million, respectively. As of September 30, 2017 and December 31, 2016, we had debt of €6.5 million and €5.7 million, respectively. The cash and cash equivalents as of September 30, 2017 and the

other preliminary financial data for periods subsequent to June 30, 2017 in the paragraphs above are preliminary

|

|

|

and may change, are based on information available to management as of the date of this report, and are subject to completion by management of the financial statements as of and for the quarter

ended September 30, 2017. There can be no assurance that the Company’s cash and cash equivalents as of September 30, 2017 or that any of the other preliminary financial data will not differ from these estimates, including as a result

of

quarter-end

closing and audit procedures or review adjustments and any such changes could be material. In addition, the Company is not able to provide a range of operating or net loss as of the date of this

report.

|

The Company hereby incorporates by reference the information contained in this report into the Company’s

registration statement on Form

F-3

(File

No. 333-207245).

The information contained in this Report of Foreign Private Issuer on Form

6-K

shall not constitute an

offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under

the securities laws of any such jurisdiction. Any offering will be made only by means of a prospectus, including a prospectus supplement, forming a part of the effective registration statement.

Forward-Looking Statements

This Report of Foreign

Private Issuer on Form

6-K

contains forward-looking statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “goal,” “intend,” “look forward to”, “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar expressions. Forward-looking statements are based on management’s beliefs and assumptions and on information available to management

only as of the date of this report. These forward-looking statements include, but are not limited to, statements about the proposed offerings of ProQR’s ordinary shares and recent developments about ProQR’s business, including its clinical

plans for its product candidates and timing of expected results from ongoing or proposed clinical trails. These forward-looking statements involve risks and uncertainties, many of which are beyond ProQR’s control, including risk and

uncertainties related to market conditions and satisfaction of customary closing conditions related to the proposed offerings. There can be no assurance that ProQR will be able to complete the proposed offerings on the anticipated terms, or at all.

Applicable risks also include those that are included in ProQR’s prospectus supplement and accompanying prospectus filed with the SEC for the proposed offerings, including the documents incorporated by reference therein, which include

ProQR’s Annual Report on Form

20-F

for the year ended December 31, 2016, and any subsequent SEC filings. Given these risks, uncertainties and other factors, you should not place undue reliance on

these forward-looking statements, and we assume no obligation to update these forward-looking statements, even if new information becomes available in the future, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PROQR THERAPEUTICS N.V.

|

|

|

|

|

|

|

Date: November 13, 2017

|

|

|

|

By:

|

|

/s/ Smital Shah

|

|

|

|

|

|

|

|

Smital Shah

|

|

|

|

|

|

|

|

Chief Financial Officer

|

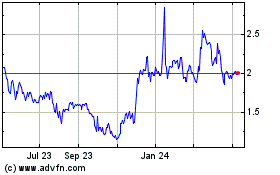

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Apr 2023 to Apr 2024