Current Report Filing (8-k)

November 13 2017 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 10, 2017

Piedmont Office Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34626

|

|

|

|

|

|

|

Maryland

|

|

58-2328421

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation)

|

|

Identification No.)

|

11695 Johns Creek Parkway

Suite 350

Johns Creek, GA 30097-1523

(Address of principal executive offices, including zip code)

770-418-8800

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 7.01 Regulation FD Disclosure

On November 14, 2017, Piedmont Office Realty Trust, Inc. (the “Registrant”) will present the information attached as Exhibit 99.1 to this current report on Form 8-K to various parties in conjunction with the National Association of Real Estate Investment Trust (NAREIT)’s REITworld Conference occurring November 14 - 16, 2017 in Dallas, Texas. The presentation will include updates on certain leasing and transactional activity of the Registrant’s as follows:

|

|

|

|

▪

|

As further described in the press release attached hereto as Exhibit 99.2, the Registrant has completed a new, full building (approximately 152,000 square foot) lease at 6011 Connection Drive in Irving, Texas with Gartner, Inc., the world's leading research and advisory company. The 15+ year lease will commence in the fall of 2018; and,

|

|

|

|

|

•

|

On November 10, 2017, the Registrant entered into two binding contracts with two different buyers to sell 14 assets for a total minimum gross sales price of approximately $425.9 million. An additional $5 million to $10 million of gross sales price is contingent upon certain leasing activity occurring within six months after the closing date of the transactions which is currently anticipated to be in January of 2018. The Registrant anticipates recording a gain on sale of approximately $40 million in conjunction with the closing of one of the transactions and a non-cash impairment loss of approximately $48 million (prior to consideration of any contingent sales proceeds earned on future uncertain leasing activity mentioned above) during the fourth quarter of 2017 for the other transaction. Both contracts are subject to customary closing conditions. The buyers’ contractual due diligence periods have ended and both buyers have posted earnest money deposits that are nonrefundable except in limited circumstances. The 14 assets include:

|

|

|

|

|

◦

|

300 Desert Canyon, Phoenix, Arizona

|

|

|

|

|

◦

|

Windy Point I and II, Schaumburg, Illinois

|

|

|

|

|

◦

|

2300 Cabot Drive, Lisle, Illinois

|

|

|

|

|

◦

|

1075 West Entrance Drive, Auburn Hills, Michigan

|

|

|

|

|

◦

|

Auburn Hills Corporate Center, Auburn Hills, Michigan

|

|

|

|

|

◦

|

5301 Maryland Way, Brentwood, Tennessee

|

|

|

|

|

◦

|

Suwanee Gateway One, Suwanee, Georgia

|

|

|

|

|

◦

|

5601 Hiatus Road, Tamarac, Florida

|

|

|

|

|

◦

|

2001 NW 64

th

Street, Fort Lauderdale, Florida

|

|

|

|

|

◦

|

Piedmont Pointe I & II, Bethesda, Maryland

|

|

|

|

|

◦

|

1200 Crown Colony Drive, Quincy, Massachusetts

|

|

|

|

|

◦

|

2120 West End Avenue, Nashville, Tennessee

|

For further details, please refer to page 14 of the attached Exhibit 99.1.

Pursuant to the rules and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein are deemed to have been furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934.

Additionally, the exhibit to this Form 8-K may contain certain statements which constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such information is subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “continue” or similar words or phrases that are predictions of future events or trends and which do not relate solely to historical matters. Examples of such statements in this release include whether either of the two sale transactions described above will close in January of 2018 and the amount of gain on sale and impairment loss that will be recorded in conjunction with each transaction. A number of important factors could cause actual results or outcomes to differ materially from those contemplated by the forward-looking statements, including events that could give rise to a termination of the binding contracts for the two sale transactions described above and the other risks and uncertainties discussed under Item 1A of Piedmont's Amended Annual Report on Form 10-K/A for the year ended December 31, 2016. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Current Report on Form 8-K. The Company cannot guarantee the accuracy of any such forward-looking statements contained in this press release, and the Company does not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Piedmont Office Realty Trust, Inc.

|

|

|

|

|

|

|

|

Date: November 13, 2017

|

|

By:

|

|

/s/ Laura P. Moon

|

|

|

|

|

|

Laura P. Moon

|

|

|

|

|

|

Chief Accounting Officer and Senior Vice President

|

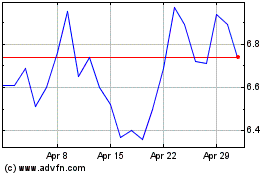

Piedmont Office Realty (NYSE:PDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

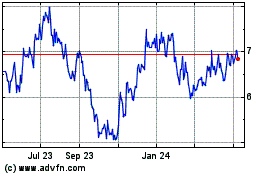

Piedmont Office Realty (NYSE:PDM)

Historical Stock Chart

From Apr 2023 to Apr 2024