UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14 C

(Rule

14c-101)

INFORMATION

REQUIRED IN INFORMATION STATEMENT

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities

Exchange

Act of 1934

|

|

Check

the appropriate box:

[X] Preliminary Information Statement

|

|

|

[ ] Definitive Information Statement

|

|

|

[ ]

Confidential, For Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

BAGGER

DAVE’S BURGER TAVERN, INC.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14c5(g) and 0-11.

(1)

Title of each class of securities to which transaction applies:

Not

Applicable

(2)

Aggregate number of securities to which transaction applies:

Not

Applicable

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing is calculated and state how it was determined):

Not

Applicable

(4)

Proposed maximum aggregate value of transaction:

Not

Applicable

(5)

Total fee paid:

Not

Applicable

[ ] Fee paid previously with preliminary materials:

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of

its filing.

(1)

Amount previously paid:

Not

Applicable

(2)

Form, Schedule or Registration Statement No.

Not

Applicable

(3)

Filing Party:

Not

Applicable

(4)

Date Filed:

Not

Applicable

INFORMATION

STATEMENT

Relating

to Annual Meeting of Bagger Dave’s Burger Tavern, Inc.

BAGGER

DAVE’S BURGER TAVERN, INC.

Dear

Bagger Dave’s Burger Tavern, Inc. Shareholders:

NOTICE

IS HEREBY GIVEN that we have received written consents in lieu of a meeting from stockholders representing a majority of our outstanding

shares of voting stock, approving the following actions:

|

|

1.)

|

Approval

of a Reverse /Forward Split and Plan of Recapitalization.

|

|

|

|

|

|

|

2.)

|

Approval

of the election of Directors.

|

|

|

|

|

|

|

3.)

|

Approval

of the ratification of BDO USA, LLP, as our outside auditors.

|

As

of the close of business on October 14, 2017, the record date for shares entitled to notice of and to sign written consents in

connection with the annual meeting, there were 27,297,727 shares of our common stock and no shares of our preferred stock outstanding.

Prior to the mailing of this Information Statement, certain shareholders who represent a majority of our outstanding voting shares,

signed written consents approving each of the actions listed above on the terms described herein (the “Actions”).

As a result, the Actions have been approved and neither a meeting of our stockholders nor additional written consents are necessary.

We are not asking you for a Proxy and you are requested not to send us a Proxy

. The Actions will be effective 20 days from

the mailing of this Information Statement, which is expected to take place on November 18, 2017, and such Actions will result

in the following:

1.) Each

four hundred (400) shares of our common stock outstanding will be converted into one share of common stock of the Company, and

immediately following that all shareholders with at least one whole share, will receive a forward split of 400 shares of common

stock for each one share held.

The

Plan of Recapitalization provides for the mandatory exchange of shares from the current common stock to new common stock representing

one-four hundredth (1/400

th

) of the previous number of shares held and then a multiple of 400 for each share or portion

thereof held. We urge you to follow the instructions set forth in the attached Information Statement under “Exchange of

Stock”.

2.) The

following persons were elected to the board of directors to serve until the next annual meeting or until their replacement is

elected:

|

T.

Michael Ansley

|

Director

|

|

David

G. Burke

|

Director

|

|

Phyllis

Knight

David

Fisher

Shawn

Lilley

|

Director

Director

Director

|

3.) BDO

USA, LLP was approved to act as our outside auditor for our fiscal year ending December 31, 2017, to the extent such audit is

required in the discretion of the Board.

The

Company will pay all costs associated with the distribution of the Information Statement, including the cost of printing and mailing.

The Company will reimburse brokerage and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in

sending the Information Statement to the beneficial owners of the Company’s common stock.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS: NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN, AND

NO PROXY OR VOTE IS SOLICITED BY THIS NOTICE. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THE ACTIONS, DESCRIBED MORE SPECIFICALLY BELOW, HAVE ALREADY BEEN APPROVED BY WRITTEN CONSENT OF HOLDERS OF A MAJORITY OF THE

OUTSTANDING SHARES OF COMMON STOCK OF THE COMPANY. A VOTE OF THE REMAINING SHAREHOLDERS IS NOT NECESSARY.

By

Order of the Board of Directors,

|

|

/s/

T.

Michael Ansley

|

|

|

|

T.

Michael Ansley, President

|

|

PROPOSAL

TO APPROVE A PLAN OF RECAPITALIZATION AND TO AMEND THE COMPANY’S ARTICLES OF INCORPORATION TO PROVIDE

FOR

A REVERSE/FORWARD STOCK SPLIT

SUMMARY

TERM SHEET

We

are providing this summary term sheet for your convenience. It highlights material information in this document, but you should

realize that it does not describe all of the details of the proposed Reverse/Forward Split to the same extent that they are described

in the body of this document. We urge you to read the entire document and the related letter of transmittal carefully, because

they contain the full details of the Reverse/Forward Split. This summary term sheet is qualified in its entirety by reference

to the more detailed information appearing elsewhere in, or accompanying, this Information Statement.

|

Q:

|

|

What

if the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

The

Company’s Board of Directors (the Board) and the holders of a majority of the Company’s Common Stock have approved

amendments to the Company’s Certificate of Incorporation to effect a reverse stock split of the Company’s Common

Stock, at an exchange ratio of 1-for-400 shares of outstanding Common Stock (the Reverse Split), immediately followed by a

forward stock split of the Company’s outstanding Common Stock, at an exchange ratio of 400-for-1 shares of outstanding

Common Stock (the Forward Split and together with the Reverse Split, the “Reverse/Forward Split”). Such amendments

will not change the par value per share or the number of authorized shares of Common Stock. Holders of record of less than

one share as a result of the reverse stock split will be cashed out at the rate of $0.31 per pre-split share. Holders of record

of at least one share as a result of the Reverse Split will not be entitled to receive any cash payment. The Plan of Recapitalization

effecting the reverse stock split and the forward stock split is attached as an Exhibit to this Information Statement. The

Reverse/Forward Split will become effective upon the filing of the proposed Certificates of Amendment with the Office of the

Secretary of State of the State of Nevada twenty (20) calendar days following the date this Information Statement is first

furnished to our stockholders.

|

|

|

|

|

|

Q:

|

|

What

is the purpose of the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

The

Reverse/Forward Split is part of the Company’s plan to terminate the registration of its Common Stock and suspend its

reporting requirements under the Exchange Act. The Reverse/Forward Split is considered a “going private” transaction

as defined in Rule 13e-3, which was promulgated under the Exchange Act, because certain stockholders will be cashed out as

a result of the Reverse Split, which will cause our Exchange Act reporting obligations to become eligible for suspension under

Rule12h-3 or Section 15(d) of the Exchange Act and cause our Common Stock to become eligible for termination of registration

under Rule 12g-4 and Section 12(g) of the Exchange Act. Accordingly, the Company will file a Rule 13e-3 Transaction Statement

on Schedule 13E-3 with the SEC. The Schedule 13E-3 will be available on the SEC’s website at http://www.sec.gov or from

the Company (including the Investor Relations page on the Company’s website at http://www.baggerdave.com. Upon deregistration

of its Common Stock under the Exchange Act and provided the Common Stock following the Reverse/Forward Split is held of record

by less than 300 persons, the Company expects that the deregistration will eliminate the significant expense that had been

required of the Company to comply with its Exchange Act reporting obligations and the SEC’s proxy rules. The Company

estimates the annual savings to be approximately $300,000 in tangible expenses, in addition to the saving of considerable

senior management time and effort spent on compliance and disclosure matters attributable to the Company’s Exchange

Act filings. These activities leave less time for a management to manage and grow our business.

|

|

Q:

|

|

Is

any action required on my part, such as to vote?

|

|

|

|

|

|

A:

|

|

No

action is required on your part. Your approval is not required and is not being sought. The holders of a majority of the Company’s

Common Stock have already approved the Reverse/Forward Split.

|

|

|

|

|

|

Q:

|

|

Am

I entitled to any appraisal or dissenters’ rights?

|

|

|

|

|

|

A:

|

|

Stockholders

will not be entitled to appraisal or dissenters’ rights as a result of the Reverse/Forward Split under Nevada law or

our governance documents.

|

|

|

|

|

|

Q:

|

|

Will

the business plan or operations of the Company change as a result of the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

The

Reverse/Forward Split is not expected to affect in and of itself our current business plan or operations, except for the anticipated

cost and management time savings associated with deregistration of the Company’s Common Stock.

|

|

|

|

|

|

Q:

|

|

Will

Bagger Dave’s Burger Tavern, Inc. remain a public company after the completion of the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

If

we reduce the number of our stockholders of record below 300, we will remain a public company and our Common Stock will continue

to be traded on the Pink Sheets under the symbol BAGR. However, we plan to terminate the registration of our Common Stock

under the Exchange Act, suspend our reporting requirements under the Exchange Act, and become a “non-reporting entity.”

|

|

|

|

|

|

Q:

|

|

What

does the Board of Directors of the Company think of the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

The

Company’s entire Board of Directors (the “Board”) and a majority of the stockholders of the Company voted

in favor of and authorized the Reverse/Forward Split. The Board determined that the Reverse/Forward split is fair to and in

the best interest of all of our stockholders, including the stockholders who will be cashed out and those who will retain

an equity interest in the Company subsequent to the consummation of the Reverse/Forward Split. The Board established the cash

consideration to be paid to redeem shares of holders of record of less than one share as a result of the Reverse Split in

a good faith determination based upon fairness and other factors the Board deemed relevant, as described in more detail herein.

|

|

Q:

|

|

What

are some of the advantages of the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

The

Board believes that the Reverse/Forward Split will have, among others, the following advantages:

|

|

|

|

●

|

The Company will be able to terminate the registration of the Company’s Common Stock under the Exchange Act, which will

eliminate the significant tangible and intangible costs of the Company being a public company, with tangible estimated cost

savings of $300,000 annually.

|

|

|

|

|

|

|

|

|

●

|

The Company will be able to achieve the overhead

reduction associated with the Reverse/Forward Split without negatively affecting our business operations.

|

|

Q:

|

|

What

are some of the disadvantages of the Reverse/Forward Split?

|

|

|

|

|

|

A:

|

|

The

Board believes that the Reverse/Forward Split will have, among others, the following disadvantages:

|

|

|

|

●

|

Stockholders of record owning fewer than 400 shares

of the Company’s Common Stock will not have an opportunity to liquidate their shares at a time and for a price of their

choosing; instead, they will be cashed out, will no longer be stockholders of the Company and will not have the opportunity to

participate in or benefit from any future potential appreciation in our value. Stockholders of record who want to continue to

be stockholders in the Company can attempt to purchase shares after the Reverse Split but prior to us filing to become a non-reporting

entity. After the Company becomes a non-reporting entity, it is anticipated that the Company’s Common Stock will remain

on the Grey Sheets. However, there may be limited liquidity for the Common Stock and you may not be able to purchase or sell the

Common Stock at all or at prices you desire.

|

|

|

|

|

|

|

|

|

●

|

Stockholders holding the Company’s Common

Stock following the Reverse/Forward Split and subsequent filing to become a non-reporting entity may no longer have the information

that is currently provided in our filings with the SEC pursuant to the Exchange Act regarding such matters as our business operations

and developments, legal proceedings involving the Company, our financial results, the compensation of our directors and named

executive officers, and Company securities held by our directors, officers and major stockholders. In addition, it is likely that

there will be limited liquidity for the Common Stock and that trading of shares may only continue in privately negotiated sales.

As a result, you may not be able to purchase or sell the Common Stock at all or at prices you desire.

|

|

|

|

|

|

|

|

|

●

|

Our stockholders will no longer have the protections provided by the liability provisions of the Exchange Act and the Sarbanes-Oxley

Act of 2002 applicable to the Company and our directors, officers and major stockholders, including the short-swing profit

provisions of Section 16, the proxy solicitation rules under Section 14, the stock ownership reporting rules under Section

13, provisions relating to personal attestation by officers about accounting controls and procedures, potential criminal liability

regarding the disclosure by the Company and provisions relating to restrictions on lending.

|

|

|

|

|

|

|

|

|

●

|

There is the potential for renewed applicability of public reporting requirements if continuing stockholders transfer shares

of Common Stock in a manner that results in the Company having more than 500 record holders who are not accredited investors

or 2,000 record holders (in either case, provided the Company has total assets exceeding $10 million).

|

|

Q:

|

|

What

is the total cost of the Reverse/Forward Split to the Company?

|

|

|

|

|

|

A:

|

|

We

estimate that we will pay up to approximately $7,750 to cash out holders of record of less than one share as a result of the

Reverse Split. In addition, we anticipate incurring approximately $30,000 in advisory, legal, financial, accounting and other

fees and costs in connection with the Reverse/Forward Split. We currently have the financial resources to complete the Reverse/Forward

Split.

|

|

|

|

|

|

Q:

|

|

Will

my shares be cashed out in the Reverse/Forward Split and, if so, what will I receive for my shares?

|

|

|

|

|

|

A:

|

|

Stockholders

of record who own less than 400 pre-split shares of Common Stock on the Effective Date will be cashed out at a price of $0.31

per pre-split share.

|

|

|

|

|

|

|

|

Stockholders

of record who hold at least 400 pre-split shares of Common Stock on the Effective Date will not receive any cash payments.

Rather, their shares will be split on a 1-for-400 basis and then immediately split on a 400-for-1 basis, will leave them with

the same number of shares after the forward/reverse split as they had prior to that.

|

|

|

|

|

|

Q:

|

|

If

I own less than 400 pre-split shares of Common Stock on the Effective Date, how and when will I be paid?

|

|

|

|

|

|

A:

|

|

As

soon as practicable after the Effective Date, we will send you a letter of transmittal to be used to transmit your Common

Stock certificates to Island Transfer (the “Exchange Agent”). You will receive a cash payment in the amount of

$0.31 for each pre-split share owned by you. Upon proper completion and execution of the letter of transmittal, and the return

of the letter of transmittal and accompanying stock certificate(s) to the Exchange Agent, you will receive a check for this

amount.

|

|

|

|

|

|

|

|

In

the event we are unable to locate certain stockholders or if a stockholder fails to properly complete, execute and return

the letter of transmittal and accompanying stock certificate to the Exchange Agent, any funds payable to such stockholders

pursuant to the Reverse/Forward Split will be held in escrow until a proper claim is made, subject to applicable abandoned

property laws. Stockholders who hold shares in a book-entry account are not required to take any action to receive a cash

payment. The Exchange Agent will furnish stockholders with the necessary instructions for surrendering their pre-split stock

certificates.

|

|

|

|

|

|

Q:

|

|

What

do I have to do if I have lost my stock certificates, or if they have been mutilated, destroyed or stolen?

|

|

|

|

|

|

A:

|

|

Call

our Exchange Agent, Island Stock Transfer, at (727) 239-0010.

|

|

|

|

|

|

Q:

|

|

What

are the United States federal tax consequences?

|

|

|

|

|

|

A:

|

|

We

believe that the Reverse/Forward Split will be treated as a tax-free “recapitalization” for federal income tax

purposes. We will not apply for any ruling from the Internal Revenue Service, nor will we receive an opinion of counsel with

respect to the tax consequences of the Reverse Split.

|

|

|

|

We

believe that any stockholders who continue to hold Common Stock immediately after the Reverse/Forward Split, and who receive

no cash as a result of the Reverse Split, should not recognize any gain or loss or dividend income as a result of the Reverse/Forward

Split and will have the same adjusted tax basis and holding period in their Common Stock as they had in such stock immediately

prior to the Reverse/Forward Split.

|

|

|

|

|

|

|

|

We

believe that a stockholder who receives cash in the Reverse/Forward Split (i.e., a stockholder of record who holds less than

one share as a result of the Reverse Split) will be treated as having such shares redeemed in a taxable transaction governed

by Section 302 of the Code.

|

|

|

|

|

|

|

|

See

the information set forth below under the caption “Federal Income Tax Consequences of the Reverse/Forward Split.”

|

|

|

|

|

|

Q:

|

|

What

if I hold shares of Common Stock in “street name”?

|

|

|

|

|

|

A:

|

|

If

a person or entity holds shares of Common Stock in “street name,” then its broker, bank or other nominee (the

“Record Owner”) is considered the owner of record with respect to those shares of Common Stock and not such person

or entity. If the Record Owner holds less than one share as a result of the Reverse Split, it will be cashed out at the rate

of $0.31 per pre-split share. Record Owners of at least one share as a result of the Reverse Split will not be entitled to

receive any cash payment, even if a Record Owner hold shares of Common Stock in “street name” for any individual

beneficial owners that held beneficial ownership in less than 400 pre-split shares of Common Stock.

|

DESCRIPTION

OF PLAN

The

Board of Directors of the Company has unanimously approved a proposal to amend the Company’s Articles of Incorporation to

effect a plan of recapitalization that provides for a four hundred for one (400 for 1) reverse stock split followed by a one for

four hundred (1 for 400) forward stock split of our common stock, subject to the approval of such action by the shareholders.

Pursuant to written resolutions, a majority of the shareholders of the Company voted to approve the proposal to authorize the

reverse/forward stock split. We are now notifying you and the other shareholders that did not participate in the action of the

majority of the shareholders. The reverse/forward stock split will take effect, when we file a Certificate of Amendment to the

Articles of Incorporation with the Secretary of State of Nevada.

We

expect that the Certificate of Amendment will be filed promptly after your receipt of this Information Statement. However, our

board of directors may elect not to file, or to delay the filing of, the Certificate of Amendment if they determine that filing

the Certificate of Amendment would not be in the best interest of our shareholders.

Under

the plan of recapitalization and reverse/forward stock split, each four hundred (400) shares of the Company’s outstanding

common stock on the effective date (the “Old Common Stock”) of the reverse stock split (the “Effective Date”)

will be automatically changed into and will become one share of the Company’s New Common Stock (the “New Common Stock”).

No fractional shares will be issued. Shareholders who own fewer than 400 common shares immediately prior to the reverse split

will have their shares cancelled and converted into a right to receive payment per share on a pre-reverse split basis. The cash

payment will be based on the average closing price of the stock over a thirty-day period prior to the Record Date, which will

be increased by a premium of 100%. Any shareholder that owns in excess of one (1) share immediately following the reverse split

will receive a forward stock split of 400 shares for each share and fraction thereof he holds. The practical effect of this transaction

is that all shareholders who own 400 or more shares prior to the Actions will own the same number of shares after the Actions.

All shareholders who own less than 400 shares before the Actions will be paid the value of those shares in cash. The reverse/forward

stock split will not change the current per share par value of the Company’s common stock nor change the current number

of authorized shares of common stock. The effective date of the reverse/forward stock split will be the date the articles of amendment

are accepted for filing by the Nevada Secretary of State.

If

a person or entity holds shares of Common Stock in “street name,” then its broker, bank or other nominee (the “Record

Owner”) is considered the owner of record with respect to those shares of Common Stock and not such person or entity. If

the Record Owner holds less than one share as a result of the Reverse Split, it will be cashed out at the rate of $0.31 per pre-split

share. Record Owners of at least one share as a result of the Reverse Split will not be entitled to receive any cash payment,

even if a Record Owner holds shares of Common Stock in “street name” for any individual beneficial owners that beneficially

own less than 400 pre-split shares of Common Stock.

The

Reverse/Forward Split can be illustrated with the following example:

|

|

a.

|

Stockholder

A holds of record 390 shares of pre-split Common Stock. After the Effective Date, he will receive $120.90 in cash and will

surrender his shares.

|

|

|

|

|

|

|

b.

|

Stockholder

B holds of record 410 shares of pre-split Common Stock. After the Effective Date, he will hold 410 shares of Common Stock and

will receive no cash or other compensation for his shares.

|

As

soon as practicable after the Effective Date, we will send all stockholders of record with less than one share as a result of

the Reverse Split a letter containing a cash payment of $.031 for each pre-split share owned. In the event we are unable to locate

certain stockholders, any funds payable to such stockholders pursuant to the Reverse/Forward Split will be held in escrow until

a proper claim is made, subject to applicable abandoned property laws. Stockholders who hold shares in book-entry form are not

required to take any action to receive a cash payment. The Exchange Agent will furnish stockholders with the necessary instructions

for surrendering their pre-split shares for payment.

Stockholders

who hold shares that are not cashed out as a result of the Reverse/Forward Split will not be required to exchange their certificates

representing pre-split shares for new certificates. The Reverse/Forward Split will take place on the Effective Date without any

action on the part of the holders of the Common Stock and without regard to current certificates representing shares of Common

Stock being physically surrendered for certificates representing the number of shares of Common Stock that each stockholder is

entitled to have access to receive as a result of the Reverse/Forward Split.

Although

the Reverse/Forward Split has been approved by the holders of the requisite majority of the shares of Common Stock of the Company,

the Board reserves the right, in its discretion, to abandon the Reverse/Forward Split prior to the proposed Effective Date if

it determines that abandonment is in the best interests of the Company or the stockholders. Factors that may lead the Board to

abandon the Reverse/Forward Split may include, among other things, increased transaction costs to consummate the transaction,

changes in the current economic environment, and an adverse response from the markets in which the Company operates or adverse

responses from our stockholders. If such a determination to abandon the Reverse/Forward Split is made by the Board, our stockholders

would be notified through the filing of a Current Report with the SEC on Form 8-K.

The

Reverse/Forward Split will not materially change the rights, preferences or limitations of those stockholders who will retain

an interest in the Company subsequent to the consummation of the Reverse/Forward Split.

The

Reverse/Forward Split is not expected to affect in and of itself our current business plan or operations, except for the anticipated

cost and management time savings associated with termination of our obligations to file periodic reports under the Exchange Act

with the SEC. Nevertheless, if operating losses continue at the Company following the Reverse/Forward Split and any other cost

saving measures instituted by the Company and the Company is unable to improve its revenues or profitability, the Company may

need to explore other revenue improvement and cost reduction strategies. Once we deregister our Common Stock under the Exchange

Act, we will not be required to provide our stockholders with periodic, annual, quarterly or other reports regarding the Company,

although we intend to provide certain information to our stockholders on an annual basis. However, we do not intend to make available

to stockholders any financial or other information about us that is not required by law. We do not intend, but may in our discretion

elect, to distribute press releases for material and other events. We will continue to hold meetings as required under Nevada

law, including annual meetings, or to take actions by written consent of stockholders in lieu of meetings.

The

bullet points below provide information regarding the essential features and significance of the proposed transaction. A more

detailed discussion of these matters may be found under the heading “Detailed Discussion and Reasons for Reverse/Forward

Split.”

Effects

of the Reverse Stock Split

As

a result of the Reverse Stock Split:

|

|

●

|

The

number of record holders of our Common Shares will be reduced below 300, which will allow us to terminate the registration

of our Common Shares under the Exchange Act. Accordingly, we will no longer be subject to any reporting requirements under

the Exchange Act or the rules of the SEC applicable to public companies. We will, therefore, cease to file annual, quarterly,

current, and other reports and documents with the SEC, and shareholders will cease to receive annual reports and proxy statements.

Persons that remain our shareholders after the Transaction and subsequent deregistration are completed will, therefore, have

access to much less information about us and our business, operations and financial performance. We will also no longer be

subject to the provisions of the Sarbanes-Oxley Act of 2002 and the liability provisions of the Exchange Act, including the

requirement that our officers certify the accuracy of our financial statements. Our officers, directors and 10% shareholders

will no longer be subject to the reporting requirements of Section 16 of the Exchange Act or be subject to the prohibitions

against retaining short-swing profits in our Common Shares.

|

|

|

●

|

Shareholders

who have fewer than 400 shares of our Common Shares before the Reverse Stock Split will receive cash in exchange for their

shares of our Common Shares, and will no longer be shareholders or have any ownership interest in the Company and shall cease

to participate in any of our future earnings and growth. The cash payment will be equal to $0.31 per share held prior to the

effectiveness of the Reverse Stock Split.

|

|

|

|

|

|

|

●

|

Shareholders

who have more than 400 shares of our Common Shares before the Transaction will not receive any payment for their shares and

shall continue to hold the same number of shares that they held before the Transaction.

|

|

|

|

|

|

|

●

|

Our

Common Shares will no longer be traded on the OTCQB Market. Any trading in our Common Shares will occur in the “pink

sheets” or in privately negotiated transactions. Shareholders should note that market makers (not the Company) quote

Common Shares in the “pink sheets.” Therefore, we cannot guarantee that our Common Shares will be available for

trading in the “pink sheets.” The limited trading market for our Common Shares after the Transaction may cause

a decrease in the market price of our Common Shares.

|

|

|

|

|

|

|

●

|

After

we de-register it will be more difficult for us to access the public equity and public debt markets, and it will be more expensive

to access the private debt markets.

|

Effects

of the Forward Stock Split

As

a result of the Forward Stock Split:

|

|

●

|

Shareholders

who have fewer than 400 shares of our Common Shares before the Reverse Stock Split will receive cash in exchange for their

shares of our Common Shares and will not be affected by the Forward Stock Split;

|

|

|

|

|

|

|

●

|

Shareholders

who have more than 400 shares of our Common Shares before the Transaction will, as a result of the Forward Stock Split, continue

to hold the same number of shares as before the Transaction, without having to tender their shares to the Company’s

stock transfer agent;

|

|

|

|

|

|

|

●

|

Options

and warrants evidencing rights to purchase Common Shares would be unaffected by the Transaction, because the options will,

after the Transaction, be exercisable into the same number of Common Shares as before the Transaction.

|

Fairness

of the Transaction

The

Board of Directors unanimously approved the Transaction, including the price to be paid for fractional Common Shares following

the Reverse Stock Split, and recommended that our shareholders approve the Transaction. Our Board of Directors determined that

the Transaction and the price to be paid for the fractional shares resulting from the Reverse Stock Split are substantively and

procedurally fair to and in the best interest of the Company and our unaffiliated shareholders (including both Continuing Shareholders

and Cashed Out Shareholders).

The

Board of Directors considered various factors regarding the fairness of the Actions to us and our unaffiliated Continuing Shareholders

and unaffiliated Cashed Out Shareholders, including the following:

|

|

●

|

the

direct and indirect cost savings to be realized from the elimination of expenses related to our disclosure and reporting requirements

under the Exchange Act;

|

|

|

|

|

|

|

●

|

the

ability of shareholders with less than 400 shares to exchange their shares for cash at premium to market prices prevailing

at the time of the approval of the Transaction and without incurring brokerage commissions or, alternatively, to purchase

additional shares if they desire to remain a shareholder;

|

|

|

|

|

|

|

●

|

the

fact that the Reverse Stock Split will apply to all shareholders;

|

|

|

|

|

|

|

●

|

the

fact that there are no unusual conditions to the consummation of the Transaction;

|

|

|

|

|

|

|

●

|

the

likely reduction in liquidity for our Common Shares following the termination of our Exchange Act registration, OTCQB listing

and periodic reporting;

|

|

|

|

|

|

|

●

|

the

possible decrease in the trading price of the Common Shares;

|

|

|

|

|

|

|

●

|

the

reduction in publicly available information about us that will result from the Transaction;

|

|

|

|

|

|

|

●

|

the

inability of Cashed Out Shareholders to participate in any future increases in the value of our stock.

|

Detailed

Discussion and Reasons for the Reverse/Forward Split

The

primary purpose of the Reverse/Forward Split is to ensure that the number of record holders of our Common Stock will be below

300 so that we can terminate the registration of our Common Stock under Section 12(g) of the Exchange Act. The Reverse/Forward

Split is expected to result in the elimination of the expenses related to our disclosure and reporting requirements under the

Exchange Act. For some time, the management of the Company has been concerned about the expense of continuing to comply with the

periodic reporting requirements of the Exchange Act, given the earnings and overhead of the Company and the extremely low trading

volume of our shares. Significantly, the Company had an annual operating loss during the year ended December 25, 2016 of $11,420,515,

and during the quarter ended September 24, 2017, the Company had an operating loss of $5,339,224. For these reasons, among others

the Board decided to consider whether it should remain a reporting company. The Board believes that any material benefit derived

from continued registration under the Exchange Act is outweighed by the cost, including the cost and tangible and intangible burdens

associated with compliance with the Sarbanes-Oxley Act of 2002.

The

Board believes that the significant costs are not justified, because we have not been able to realize many of the benefits that

publicly traded companies sometimes realize. The Board does not believe that we are in a position to use our status as a public

company to raise capital through sales of securities in a public offering, or otherwise to access the public markets to raise

equity capital. In addition, our Common Stock’s extremely limited trading volume, stock price and public float have all

but eliminated our ability to use our Common Stock as acquisition currency or to attract and retain employees.

Our

Common Stock’s limited trading volume and public float have also hindered our stockholders’ ability to sell their

shares, which has prevented them from realizing the full benefits of holding publicly traded stock. Our low market capitalization

has resulted in limited interest from market makers or financial analysts who might report on our activity to the investment community.

Because the Common Stock has been thinly traded, any attempt to trade a large block of shares in the public markets, to the extent

possible, would risk a significant impact on the market price of our Common Stock. The Board believes that it is unlikely that

our market capitalization and trading liquidity will increase significantly in the foreseeable future.

The

overall executive time expended on the preparation and review of our public filings is likely to continue to increase rather than

decrease. Since we have relatively few executive personnel, these indirect costs can be significant relative to our overall expenses

and, although there will be no direct monetary savings with respect to these indirect costs when the Reverse/Forward Split is

effected and we cease filing periodic reports with the SEC, the time currently devoted by management to our public company reporting

obligations could be devoted to other purposes, such as operational concerns to further our business objectives and the interests

of our stockholders. The Board believes that it is in our best interests and the best interests of our stockholders to eliminate

the administrative, financial and additional accounting burdens associated with periodic reporting to the SEC by consummating

the Reverse/Forward Split at this time rather than continue to subject the Company to these burdens.

Strategic

Alternatives Considered

While

considering the merits of the Reverse/Forward Split, the Board evaluated a number of strategic alternatives. In evaluating the

risks and benefits of each strategic alternative, the Board determined that the Reverse/Forward Split would be the simplest and

most cost-effective approach to achieve the purposes described above. The Board considered the following alternatives:

|

|

●

|

Self-tender

offer

. The Board considered a self-tender offer considerably more costly than the Reverse/Forward Split, and as a result,

rejected this alternative.

|

|

|

●

|

Purchase

of shares in the open market

. The Board considered a stock repurchase program, but believes that it is unlikely that open

market purchases will achieve the intended result of the Reverse/Forward Split, which is to ensure that the number of our record

stockholders will be below 300. Due to the expense and logistical problems associated with the open market purchases the Board

determined this option was not viable.

|

|

|

●

|

Maintaining

the status quo

. The Board also considered taking no action to reduce the number of our stockholders of record. However, due

to the significant and increasing costs of being an SEC registered public company, not being able to realize many of the benefits

that publicly traded companies sometimes realize and other factors enumerated elsewhere in this Information Statement, such as

the operating losses of the Company, the Board believed that maintaining the status quo would be detrimental to all stockholders.

We would continue to incur the expenses of being a public company without realizing the benefits of public company status.

|

Fairness

of the Reverse/Forward Split to Stockholders

The

Company is required, under Item 1014(a) of Regulation M-A (17 C.F.R. §229.1014), to determine whether it reasonably believes

that a going private transaction, such as the Reverse/Forward Split, is fair or unfair to its unaffiliated stockholders. The Board,

on behalf of the Company, has itself made that determination and, for the reasons set forth below, has reached a decision that

the Reverse/Forward Split is fair to the unaffiliated stockholders.

The

Board did not obtain a report, opinion, or appraisal from an appraiser or financial advisor with respect to the consideration

to be paid to holders of record of less than one share as a result of the Reverse Split. In addition, no representative or advisor

was retained on behalf of the unaffiliated stockholders to review or negotiate the transactions. Further, the result of the Reverse/Forward

Split is anticipated to affect less than 25,000 shares, or less than 1%, of the Common Stock of the Company for a total cost to

the Company of approximately $7,750, which will be paid out of the Company’s available cash reserves.

No

director who is not an employee of the Company has retained an unaffiliated representative to act solely on behalf of unaffiliated

security holders for purposes of negotiating the terms of the Reverse/Forward Split and/or preparing a report concerning the fairness

of the transaction.

Each

Director on the Board approved the Reverse/Forward Split. The Board, which has unanimously approved the Reverse/Forward Split,

concluded that the expense of these procedures was not reasonable in relation to the size of the transaction contemplated and

concluded that the Board could adequately establish the fairness of the Reverse/Forward Split without such outside persons.

The

Board did not create a Special Committee of the Board to approve the Reverse/Forward Split. Creating a Special Committee by hiring

new directors and retaining independent counsel for such a committee would significantly increase the cost of the Reverse/Forward

Split.

The

Board determined that the Reverse/Forward Split, including the proposed cash payment of $0.31 per pre-split share, which represents

a 100% premium to the 30-day average closing price prior to the Record Date to stockholders whose shares will be cashed out, is

substantively and procedurally fair, in form and from a financial point of view, to all of our unaffiliated stockholders, including

those whose shares will be cashed out and those who continue to be stockholders of the Company.

The

Board determined that certain additional factors supported the fairness of the Reverse/Forward Split to those unaffiliated stockholders

whose shares will be cashed out, including the fact that they will not pay the brokerage commissions they would have paid if they

attempted to sell their shares in the open market.

Furthermore,

the Board considered that, with extremely limited liquidity in the public market for our Common Stock, only a small portion of

our stockholders would have been able to attain the historical closing prices before the stock price decreased measurably. The

proposed transaction price of $0.31 per pre-split share does not include any discount for the lack of liquidity of our Common

Stock or for the minority status of the shares of our Common Stock owned by unaffiliated stockholders.

For

the thirty trading days prior to the Record Date, the average daily trading volume has been 14,742, shares, with an average closing

price of $0.155. The cash payment of $0.31 per pre-split share to stockholders whose shares will be cashed out represents a premium

of 100% over the average closing price from September 1, 2017 through October 13, 2017, inclusive.

With

respect to the fairness of the Reverse/Forward Split to the stockholders whose stock would not be cashed out in the Reverse/Forward

Split, the Board also relied on the fact that the amount being paid to stockholders whose stock would be cashed out was fair.

In addition, the Board noted that voting control of approximately 11,723,650 of the shares held by stockholders who would remain

stockholders after the Reverse/Forward Split was held by members of the Board so that the interests of such stockholders would

remain aligned with the interests of the Board.

The

Board determined that current and historical market prices of its Common Stock were the best measures of the fairness of the cash

out price for holders of record of less than one share as a result of the Reverse Split to unaffiliated stockholders, because

recent and historical prices provide valuable insight into how the market has historically valued our Common Stock. The Board

also reviewed stockholders’ equity, which at September 24, 2017 was $10,010,967 million under generally accepted accounting

principles (“GAAP”), and net book value, which as of September 24, 2017 was $562,604, under GAAP, as alternative measures

of the cash out price per pre-split share for holders of record of less than one share as a result of the Reverse Split. The cash

payment of $0.31 per pre-split share to stockholders whose shares will be cashed out represents a premium of 15.5 times net book

value as of September 24, 2017. It also discussed liquidation value as another measure by comparing stockholders’ equity

of approximately $10,000,000 at September 24, 2017. However, the Board did not ultimately explicitly establish or consider liquidation

value as a factor in determining the fairness of the transaction since the Company has no present intent to liquidate and only

a small fraction of existing stockholders will be eliminated as equity holders as a result of the Reverse/Forward Split. Accordingly,

the Board did not consider or establish, explicitly or otherwise, the going concern value of the Company in connection with determining

the fairness of the Reverse/Forward Split, because only a small number of stockholders will be cashed out in the Reverse/Forward

Split. The Company has not engaged in any stock repurchases.

The

Reverse/Forward Split is not expected to affect in and of itself our current business plan or operations, except for the anticipated

cost and management time savings associated with termination of our obligations to file periodic reports under the Exchange Act

with the SEC. Once we deregister our Common Stock under the Exchange Act, we will not be required to provide our stockholders

with periodic, annual, quarterly or other reports regarding the Company, although we intend to provide certain information to

our stockholders on an annual basis. However, we do not intend to make available to stockholders any financial or other information

about us that is not required by law. We do not intend, but may in our discretion elect, to distribute press releases for material

and other events. We will continue to hold meetings as required under Nevada law, including annual meetings, or to take actions

by written consent of stockholders in lieu of meetings.

We

estimate that we will pay approximately $7,750 to cash out holders of record of less than one share as a result of the Reverse

Split. In addition, we anticipate incurring approximately $30,000 in advisory, legal, financial, accounting and other fees and

costs in connection with the Reverse/Forward Split. The Company has sufficient cash on hand to cover the cost of cashing out holders

of record of less than one share as a result of the Reverse Split and the related fees and costs of implementing the Reverse/Forward

Split and this Information Statement. The Company will not be using borrowed funds to finance the cost of the Reverse/Forward

Split, there are no conditions relating to the use of the cash to cover the cost of the Reverse/Forward Split, and there are no

alternative financing arrangements or alternative financing plans in place to cover the ultimate cost of the Reverse/Forward Split.

The estimated costs consist of the following, although actual costs may vary.

|

Department

|

|

Cost

|

|

|

Legal

|

|

$

|

15,000

|

|

|

Accounting

|

|

|

5,000

|

|

|

Printing

|

|

|

1,000

|

|

|

Distribution

|

|

|

4,000

|

|

|

Administrative

|

|

|

5,000

|

|

|

Total

|

|

$

|

30,000

|

|

On

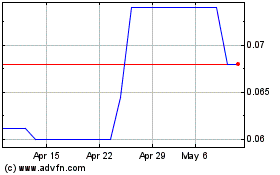

October 13, 2017, at the close of the trading day, which was prior to the Record Date, our Common Stock’s closing price

per share was $0.15 on trading volume of 2,462 shares. Previous to this date, our average closing price for the 30 trading days

prior to October 13, 2017 was approximately $.15 per share on an unweighted basis.

Procedural

Fairness of the Reverse/Forward Split

As

stated above, the Company is required, under Item 1014(a) of Regulation M-A (17 C.F.R.§229.1014), to determine whether it

reasonably believes that a going private transaction, such as the Reverse/Forward Split, is fair or unfair to its unaffiliated

stockholders. The Board, on behalf of the Company, has itself made that determination and, for the reasons set forth below, has

reached a decision that the Reverse/Forward Split is also procedurally fair to all unaffiliated stockholders, including both stockholders

who will receive cash payments in connection with the Reverse/Forward Split and will not be continuing stockholders of the Company

and stockholders who will retain an equity interest in the Company. In reaching this conclusion, the Board noted that the potential

ability of unaffiliated stockholders of record to decide whether or not to remain stockholders following the Reverse/Forward Split

by attempting to buy or sell shares of Common Stock in the open market, if permissible at prices acceptable to such stockholders,

afforded protection to those stockholders who would not be continuing stockholders of the Company. Specifically, the Board noted

that current holders of record of fewer than 400 shares may be able to remain stockholders of the Company by acquiring additional

shares, if available at prices they are willing to pay, so that they own at least 400 shares immediately before the Reverse/Forward

Split. Conversely, stockholders of record that own 400 or more shares and desire to liquidate their shares in connection with

the Reverse/Forward Split may be able to sell or otherwise reduce their holdings to less than 400 shares prior to the Reverse/Forward

Split. It should be noted that, because there has historically been very limited trading in the Company’s Common Stock,

stockholders seeking to either increase or decrease their holdings prior to the Reverse/Forward Split may not be able to do so

at all or at a price they are willing to pay or accept.

In

addition, the Board noted that voting control of approximately 99% of the shares will be held by stockholders who will remain

stockholders after the Reverse/Forward Split. Therefore, there would be no change in control as a result of the reverse/forward

split, and the interests of remaining stockholders would not be substantially diminished. Further, the result of the Reverse/Forward

Split is anticipated to affect less than 25,000 shares, or less than 1%, of the Common Stock of the Company.

In

light of the Board’s determination that the interests of unaffiliated stockholders were protected by (i) the representation

of stockholders who will remain stockholders after the Reverse/Forward Split on the Board, and (ii) the ability of unaffiliated

stockholders to decide whether or not to remain stockholders following the Reverse/Forward Split by buying or selling shares of

Common Stock in the open market, the Board did not create a Special Committee or retain independent counsel.

The

Board determined not to condition the approval of the Reverse/Forward Split on approval by a majority of unaffiliated stockholders

for several reasons. First, the Board believes that any such vote would not provide additional protection to those unaffiliated

stockholders who will be cashed out because the majority of the shares held by unaffiliated stockholders are held by stockholders

who would not be cashed out and who may therefore have different interests from the unaffiliated stockholders who would be cashed

out in the Reverse/Forward Split. The Reverse/Forward Split is also a matter that could not be voted on by brokers without instruction

from the beneficial owners of the shares so even shares beneficially owned by holders of small numbers of shares held in brokerage

accounts might be unlikely to be voted.

The

Board did not retain an unaffiliated representative to act solely on behalf of the unaffiliated stockholders due to the fact that

it would not affect the outcome of the Actions, because a majority vote of the unaffiliated stockholders is not required under

Nevada law.

The

Board did not grant unaffiliated stockholders access to our corporate files, except as provided under Nevada law. The Board determined

that this Information Statement, together with our other filings with the SEC, provides adequate information for unaffiliated

stockholders.

The

Board determined that the process leading up to the approval of the Reverse/Forward Split was procedurally fair to the stockholders,

because of the structural fairness of the Reverse/Forward Split and the procedural protections available to stockholders.

Federal

Income Tax Consequences of the Reverse/Forward Split

We

have summarized below what we believe to be certain federal income tax consequences to the Company and its stockholders resulting

from the Reverse/Forward Split. This summary is based on United States federal income tax law, existing as of the date of this

Information Statement. Such tax laws may change, even retroactively. This summary does not discuss all aspects of federal income

taxation that may be important to you in light of your individual circumstances. In addition, this summary does not discuss any

state, local, foreign, or other tax considerations. This summary assumes that you are a United States citizen and have held, and

will hold, your shares as capital assets under the Internal Revenue Code (the “Code”). You should consult your tax

advisor as to the particular federal, state, local, foreign, and other tax consequences, in light of your specific circumstances.

We

believe that the Reverse/Forward Split will be treated as a tax-free “recapitalization” for federal income tax purposes.

We will not apply for any ruling from the Internal Revenue Service, nor will we receive an opinion of counsel with respect to

the tax consequences of the Reverse Split.

We

believe that any stockholders who continue to hold Common Stock immediately after the Reverse/Forward Split, and who receive no

cash as a result of the Reverse Split, should not recognize any gain or loss or dividend income as a result of the Reverse/Forward

Split and will have the same adjusted tax basis and holding period in their Common Stock as they had in such stock immediately

prior to the Reverse/Forward Split.

We

believe that a stockholder who receives cash in the Reverse/Forward Split (i.e., a stockholder of record who holds less than one

share as a result of the Reverse Split) will be treated as having such shares redeemed in a taxable transaction governed by Section

302 of the Code and, depending on a stockholder’s situation, the transaction will be taxed as either: (a) a sale or exchange

of the redeemed shares, in which case the stockholder will recognize gain or loss equal to the difference between the cash payment

and the stockholder’s tax basis for the redeemed shares; or (b) a cash distribution which is treated: (i) first, as a taxable

dividend to the extent of allocable earnings and profits, if any; (ii) second, as a tax-free return of capital to the extent of

the stockholder’s tax basis in the redeemed shares; and (iii) finally, as gain from the sale or exchange of the redeemed

shares. Amounts treated as gain or loss from the sale or exchange of redeemed shares will be capital gain or loss. Amounts treated

as a taxable dividend are ordinary income to the recipient; however, a corporate taxpayer (other than an S corporation) may be

allowed a dividend received deduction subject to applicable limitations and other special rules.

The

foregoing discussion summarizing certain federal income tax consequences does not refer to the particular facts and circumstances

of any specific stockholder. Stockholders are urged to consult their own tax advisors for more specific and definitive advice

as to the federal income tax consequences to them of the Reverse/Forward Split, as well as advice as to the application and effect

of state, local and foreign income and other tax laws.

Termination

of Exchange Act Registration

Our

Common Stock is currently registered under the Exchange Act and bought and sold on the OTCQB Market. We are permitted to terminate

such registration if there are fewer than 300 record holders of outstanding shares of our Common Stock. As of October 1, 2017,

we had approximately 400 record holders of our Common Stock. Upon the effectiveness of the Reverse/Forward Split, we expect to

have approximately 230 record holders of our Common Stock. We intend to terminate the registration of our Common Stock under the

Exchange Act promptly after the Effective Date.

Termination

of registration under the Exchange Act will substantially reduce the information which we will be required to furnish to our stockholders

under the Exchange Act. After deregistration of our shares, our stockholders will have access to our corporate books and records

to the extent provided by the Nevada General Corporation Law, and to any additional disclosures required by our directors’

and officers’ fiduciary duties to the Company and our stockholders.

We

estimate that termination of registration of our Common Stock under the Exchange Act will save us an estimated $300,000 per year

in legal, accounting, auditing, printing and other expenses, and will also enable our management to devote more time to our operations.

By reducing the Company’s number of stockholders of record to less than 300 and deregistering our Common Stock under the

Exchange Act as intended, based on historical expenses, the Company expects to save (i) approximately $200,000 per year in professional

fees and expenses for the preparation and filing of reports required by the Exchange Act and (ii) approximately $100,000 per year

in other costs related to being a public reporting entity, such as Edgarization and XBRL costs, printing and mailing costs, expenses

for compliance with the internal control and procedure requirements associated with Sarbanes-Oxley, the Dodd-Frank Act and regulatory

compliance issues applicable to public entities, other than internal personnel expenses. The termination of the Company’s

public reporting obligations will also alleviate a significant amount of time and effort previously required of the Company’s

employees in preparing and reviewing the periodic reports and filings required of public entities under the Exchange Act and the

pressure and expense of hiring staff to satisfy the regulatory and accounting reporting requirements of the Exchange Act. The

Company will also have no further requirement to engage an independent auditor to complete quarterly revenue or an annual audit.

EFFECT

OF THE REVERSE/FORWARD SPLIT

ON THE NUMBER OF AUTHORIZED AND ISSUED SHARES

As

of September 24, 2017, the Company had a total of 27,297,727 of its 100,000,000 authorized shares of Common Stock issued and outstanding.

The total number of authorized shares of Common Stock will not change as a result of the Reverse/Forward Split. The table below

illustrates the estimated effect on the number of authorized shares available for issuance as a result of the Reverse/Forward

Split. Significantly, the result of the Reverse/Forward Split is anticipated to affect approximately 25,000 shares, or less than

1%, of the Common Stock of the Company.

|

|

|

Shares

Authorized

|

|

|

Shares

Issued

and

Outstanding

|

|

|

Authorized

Shares

Available for Issuance

|

|

|

Before

Reverse/Forward Split

|

|

|

100,000,000

|

|

|

|

27,297,727

|

|

|

|

72,702,273

|

|

|

After Reverse/Forward

Split

|

|

|

100,000,000

|

|

|

|

27,272,727

|

|

|

|

72,727,273

|

|

The

shares acquired in the Reverse/Forward Split will be retired and returned to the status of authorized but unissued shares of Company

Common Stock.

CERTAIN

INFORMATION CONCERNING THE COMPANY

Bagger

Dave’s Burger Tavern’s administrative and executive offices are located at 807 W. Front Street, Suite B, Traverse

City, Michigan 49684, and its telephone number is (231) 486-0527.

As

of September 24, 2017 the Company had 27,297,727 shares of its $.0001 par value common stock issued and outstanding.

TRADING

MARKET AND PRICE

Our

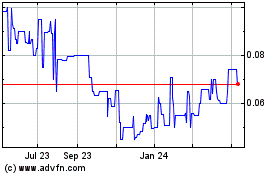

Common Stock is currently bought and sold on the OTCQB Market. The following is a schedule of the reported high and low closing

prices per share for our Common Stock during the period from March 26, 2017 through September 24, 2017 (the past two quarters),

all of which quotations represent prices between dealers, do not include retail mark-up, mark-down or commission and may not necessarily

represent actual transactions:

|

Quarter Ending

|

|

|

High

|

|

|

Low

|

|

|

June

24, 2017

|

|

|

$

|

0.75

|

|

|

$

|

0.08

|

|

|

September

24, 2017

|

|

|

$

|

0.37

|

|

|

$

|

0.12

|

|

DIVIDENDS

PAID BY THE COMPANY

The

Company has not paid cash dividends on its common stock, and due to operating losses, does not expect to pay a cash dividend in

the future.

STOCK

PURCHASES BY THE COMPANY

The

Company has not purchased shares of its Common Stock on the open market.

AMENDMENT

TO THE ARTICLES OF INCORPORATION

The

Reverse/Forward Stock Split Amendment will amend the Company’s Articles of Incorporation to add two new paragraphs. At the

effective date, without further action on the part of the Company or the holders, each share of the common stock will be converted

into one four-hundredth (1/400

th

) of a share of common stock and then the forward stock split will be implemented and

that will give all the shareholders holding one whole share or more, 400 shares of Common Stock for a every whole share or fraction

thereof. The Reverse/Forward Split Amendment will be filed with the Secretary of State of Nevada and will become effective on

the date of filing.

NO

DISSENTER’S RIGHTS

Under

Nevada law, you are not entitled to dissenter’s rights or rights of appraisal with respect to the amendment of the articles

of incorporation or the reverse/forward stock split.

RECOMMENDATION

OF THE BOARD OF DIRECTORS

For

the above reasons, the reverse/forward stock split and the deregistration of our common stock under the 34 Act was approved by

the unanimous vote of our Board of Directors, including a majority of Directors who are not employees of the Company, all of whom

believe that the transaction is in the Company’s best interest and in the best interests of our shareholders. There can

be no guarantee, however, that the market price of our common stock after the reverse/forward stock split will be equal to the

market price before the reverse stock, or that the market price following the reverse/forward stock split will either exceed or

remain in excess of the current market price.

POTENTIAL

REINSTATEMENT OF REPORTING OBLIGATIONS

The

intended effect of the Reverse/Forward Split is to reduce the number of record holders of our Common Stock to fewer than 300.

This will make us eligible to terminate the registration of our Common Stock under Rule 12g-4 and Section 12(g) of the Exchange

Act. We expect to reduce the number of our record holders to approximately 230 as a result of the Reverse/Forward Split. However,

if the Reverse/Forward Split does not have the intended effect, or if the number of record holders of our Common Stock rises to

either 500 or more persons who are not accredited investors or 2,000 persons after the consummation of the Reverse/Forward Split

for any reason (in each case, provided the Company has total assets exceeding $10 million), we may once again be subject to the

periodic reporting obligations under the Exchange Act and the SEC’s proxy rules, which would negate much, if not all, of

the savings intended to be accomplished through the Reverse/Forward Split.

FINANCIAL

INFORMATION

The

following documents that we filed with the SEC, are incorporated by reference in this Information Statement: (i) the Annual Report

on Form 10-K for the fiscal year ended December 25, 2016, (ii) the Quarterly Report on Form 10-Q for the fiscal quarter ended

March 25, 2017, (iii) the Quarterly Report on Form 10-Q for the fiscal quarter ended June 24, 2017, (iv) the Quarterly Report

on Form 10-Q for the fiscal quarter ended September 24, 2017, and (v) any filings with the SEC pursuant to Section 13, 14 or 15(d)

of the Exchange Act following the date of this Information Statement.

The

Reverse/Forward split is not anticipated to have a material effect on (1) the Company’s balance sheet as of September 24,

2017; (2) the Company’s statement of income, earnings per share, and ratio of earnings to fixed charges for the fiscal year

ended December 25, 2016 and the quarterly period ended September 24, 2017; and (3) the Company’s book value per common share

as of September 25, 2017.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this Information Statement to the extent that a statement contained herein (or in any other subsequently

filed documents which also is deemed to be incorporated by reference herein) modifies or supersedes the statement. Any statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Information Statement.

PROPOSAL

TO ELECT DIRECTORS

The

Board currently consists of five members, each of whom serve one-year terms or until their successor is elected. The current board

consists of T. Michael Ansley, David G. Burke, David Fisher, Shawn Lilley and Phyllis Knight. These individuals have been elected

by the vote of the Shareholders to serve as Directors until the Annual Meeting of Shareholders in Fiscal 2018, until their successors

have been duly elected and qualified or until their earlier death, resignation or removal.

The

following table provides information concerning our officers and directors.

|

Name

and Address

|

|

Age

|

|

Position(s)

|

|

T.

Michael Ansley

|

|

46

|

|

President,

CEO, CFO, and Director

|

|

David

G. Burke

|

|

46

|

|

Secretary,

Director

|

|

David

Fisher

|

|

46

|

|

Director

|

|

Shawn

Lilley

|

|

56

|

|

Director

|

|

Phyllis

Knight

|

|

54

|

|

Director

|

The

directors named above serve for one-year terms or until their successors are elected or they are re-elected at the annual stockholders’

meeting. Officers hold their positions at the pleasure of the board of directors, absent any employment agreement. There is no

arrangement or understanding between any of our directors or officers and any other person pursuant to which any director or officer

was or is to be selected as a director or officer, and there is no arrangement, plan or understanding as to whether non-management

shareholders will exercise their voting rights to continue to elect the current directors to the Company’s board.

The

address of each officer and director is c/o Bagger Dave’s Burger Tavern, 807 W. Front Street, Suite B, Traverse City, Michigan

49684, and the telephone number is (231) 486-0527. No officer or director of the Company has been convicted in a criminal, judicial

or administrative proceeding in the last five (5) years.

Executive

Officers

The

following individual serves as Bagger’s executive officer as of October 1, 2017:

|

Name

|

|

Age

|

|

Position

|

|

T.

Michael Ansley

|

|

46

|

|

Chairman

of the Board, Chief Executive Officer, President and Chief Financial Officer

|

The

members of our board of directors are subject to change from time to time by the vote of the stockholders at special or annual

meetings to elect directors.

The

foregoing notwithstanding, except as otherwise provided in any resolution or resolutions of the board, directors who are elected

at an annual meeting of stockholders, and directors elected in the interim to fill vacancies and newly created directorships,

will hold office for the term for which elected and until their successors are elected and qualified or until their earlier death,

resignation or removal.

Whenever

the holders of any class or classes of stock or any series thereof are entitled to elect one or more directors pursuant to any

resolution or resolutions of the board, vacancies and newly created directorships of such class or classes or series thereof may

generally be filled by a majority of the directors elected by such class or classes or series then in office, by a sole remaining

director so elected or by the unanimous written consent or the affirmative vote of a majority of the outstanding shares of such

class or classes or series entitled to elect such director or directors. Officers are elected annually by the directors.

We

may employ additional management personnel, as our board of directors deems necessary. Bagger Dave’s has not identified

or reached an agreement or understanding with any other individuals to serve in management positions, but does not anticipate

any problem in employing qualified staff.

The

factual information below for each director and for each executive officer has been provided by that person. The particular experience,

qualifications, attributes or skills that led our Board to conclude that each should serve on our Board, in light of our business

and structure, was determined by our Board or independent members of the Board.

T.

Michael Ansley

has served as our President, Chief Executive Officer, Chief Financial Officer and Chairman since our inception.

Mr. Ansley served as both Executive Chairman and Chief Executive Officer for Diversified Restaurant Holdings, Inc. (“DRH”),

a reporting company pursuant to Section 12 of the Exchange Act. Mr. Ansley held similar positions for DRH’s wholly-owned

subsidiaries AMC Group, Inc., AMC Wings, Inc. and AMC Real Estate, Inc. The Company’s roots can be traced back to 2008 when

Mr. Ansley opened his first Bagger Dave’s restaurant in Berkley, Michigan. Mr. Ansley received a Bachelor of Science degree

in business administration from the University of Dayton and currently serves on the Board of Directors of the Michigan Restaurant

Association.

We

believe Mr. Ansley is qualified to serve as a director of the Company due to his extensive experience in restaurant management,

operations and development as well as his demonstrated business leadership abilities and long history with the Company as its

founder.

David

G. Burke

has been a member of the Board since our inception. Mr. Burke also serves on the Board of Directors of DRH, a position