Liberty Interactive Corporation ("Liberty Interactive") (Nasdaq:

QVCA, QVCB, LVNTA, LVNTB) today reported third quarter 2017

results. Highlights include(1):

Attributed to QVC Group

- QVC consolidated revenue up 3% to $2.0

billion and up 4% in constant currency(2)

- Operating income, constant currency(2)

revenue and adjusted OIBDA(3) up in all markets

- QVC US revenue up 3% to $1.4 billion

- Operating income up 14% and adjusted

OIBDA(3) up 2%

- QVC International grew constant

currency(2) revenue 5%, operating income 36% and adjusted OIBDA(3)

18%

- QVC consolidated mobile penetration was

64% of QVC.com orders, a 530 basis point increase

- QVC US mobile penetration was 63% of

QVC.com orders, a 490 basis point increase

- Advanced progress on planned

acquisition of HSN, Inc. ("HSNi"); HSR and FCC regulatory approvals

have been received

- From August 1, 2017 through October 31,

2017, repurchased 21.0 million QVCA shares at an average price per

share of $22.69 and total cost of $477 million

Attributed to Liberty Ventures Group

- Planned acquisition of General

Communication, Inc. (“GCI”) and subsequent split-off of combined

company, GCI Liberty, expected to close first quarter 2018

- Received requisite FCC and Alaskan

regulatory approvals on November 8th

“QVC had an excellent quarter, growing constant currency revenue

and adjusted OIBDA in every market,” said Greg Maffei, Liberty

Interactive President and CEO. “We made progress on the acquisition

of HSN and expect to close in the fourth quarter. We now expect the

acquisition of GCI, split-off of GCI Liberty and creation of two

asset-backed stocks, QVC Group and GCI Liberty, to occur in the

first quarter of 2018.”

Unless otherwise noted, the following discussion compares

financial information for the three months ended September 30, 2017

to the same period in 2016.

QVC GROUP – Approximately $12 million of corporate level

selling, general and administrative expense (“SG&A”) (including

stock-based compensation expense) was allocated to the QVC Group in

the third quarter of 2017.

On July 6, 2017, Liberty Interactive entered into an agreement

to acquire the 62% of HSNi it does not already own in an all-stock

transaction. Liberty Interactive currently owns approximately 38%

of HSNi and, upon acquisition of the remaining stake, HSNi will

become a wholly-owned subsidiary attributed to the QVC Group.

Additional information is available in the amended registration

statement on Form S-4 that Liberty Interactive filed with the SEC

on October 23, 2017.

The acquisition of HSNi is expected to be completed during the

fourth quarter of 2017 and is subject to certain customary

conditions, including, among other things, approval by a majority

of the outstanding voting power of HSNi stockholders. A voting

agreement has been obtained from Liberty Interactive to vote its

HSNi shares in-favor of the transaction. Approval of the Liberty

Interactive stockholders is not required, and is not being sought,

for the HSNi acquisition. In August 2017, the applicable waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act

expired. In September 2017, the Federal Communications Commission

granted requisite approvals to complete the acquisition.

QVC

“We are very pleased with our strong results,” said QVC

President and CEO, Mike George. “Our US business returned to growth

and our International segment continued its solid momentum. Our

performance demonstrates our ability to execute our strategic

initiatives to improve product freshness and discovery, leverage

our commerce content across platforms, increase customer engagement

and attract new customers. We remain excited about the pending

transaction to acquire HSNi and the formation of the new QVC

Group.”

The following table provides QVC’s consolidated financial and

operating results for the third quarter of 2017. US Dollar

denominated results were unfavorably impacted by exchange rate

fluctuations in the third quarter. The Dollar strengthened versus

the Japanese Yen and British Pound 8% and 1%, respectively, and

weakened against the Euro 5%. The following table also provides a

comparison of the year over year percentage change in QVC’s results

in constant currency(2) (where applicable) to the comparable

figures calculated in accordance with US GAAP for the three months

ended September 30, 2017.

(amounts in millions unless otherwise noted) 3Q16

3Q17 % Change

% ChangeConstantCurrency(3)

QVC – Consolidated Financial Metrics Revenue $ 1,948

$ 2,010 3 % 4 % Operating Income $ 231 $ 274 19 % 19 % Operating

Income Margin (%) 11.9 % 13.6 % 170bps Adjusted OIBDA $ 393 $ 412 5

% 5 % Adjusted OIBDA Margin (%) 20.2 % 20.5 % 30bps

Operating

Metrics eCommerce Revenue $ 882 $ 973 10 % 11 % eCommerce % of

Total Revenue 45.3 % 48.4 % 310bps Mobile % of eCommerce Revenue(1)

59.0 % 64.3 % 530bps LTM Total Customers(2) 12.7 12.6 (1 )%

(1) Based on gross US Dollar orders. (2) LTM: Last twelve

months. (3) For a definition of constant currency financial

metrics, see the accompanying schedules.

The following table provides QVC US’s financial and operating

results for the third quarter of 2017.

(amounts in millions unless otherwise noted) 3Q16

3Q17 % Change

QVC – US

Financial Metrics Revenue $ 1,338 $ 1,374 3 % Gross Margin

35.2 % 35.6 % 40bps Operating Income $ 175 $ 200 14 % Operating

Income Margin (%) 13.1 % 14.6 % 150bps Adjusted OIBDA $ 308 $ 313 2

% Adjusted OIBDA Margin (%) 23.0 % 22.8 % (20)bps

Operating

Metrics Average Selling Price $ 54.75 $ 52.82 (4 )% Units Sold

9 % Return Rate(1) 17.5 % 17.9 % 40bps eCommerce Revenue $ 684 $

744 9 % eCommerce % of Total Revenue 51.1 % 54.1 % 300bps Mobile %

of eCommerce Revenue(2) 58.0 % 62.9 % 490bps LTM Total Customers(3)

8.1 8.0 (1 )% (1) Measured as returned sales over

gross shipped sales. (2) Based on gross US Dollar orders. (3) LTM:

Last twelve months.

QVC US realized year-over-year gains in the apparel, beauty,

accessories and electronics categories in the third quarter. Home

was essentially flat and jewelry declined. Average selling price

(“ASP”) declined 4% in the quarter, primarily driven by product mix

within the electronics category, as several successful items sold

in the quarter carry lower price points than items sold in the

prior year. The number of US new customers increased 7% in the

quarter. Operating income margin and adjusted OIBDA margin

performance primarily reflect higher fixed costs associated with

incentive compensation and HSNi integration consulting services,

higher inventory obsolescence and marketing expense, which were

partially offset by higher product margins, lower bad debt and

lower amortization expenses. As noted last quarter, the US business

experienced a systems outage late in the second quarter of 2017,

which resulted in an estimated 1% shift in net revenue to the third

quarter.

The following table provides QVC International’s financial and

operating results for the third quarter of 2017, including the year

over year percentage change in QVC’s results in constant

currency(2) (where applicable) to the comparable figures calculated

in accordance with US GAAP due to the net impact of unfavorable

exchange rate fluctuations.

(amounts in millions unless otherwise noted) 3Q16

3Q17 % Change

% ChangeConstantCurrency(4)

QVC – International(1) Financial Metrics

Revenue $ 610 $ 636 4 % 5 % Gross Margin 37.0 % 37.4 % 40bps

Operating Income $ 56 $ 74 32 % 36 % Operating Income Margin (%)

9.2 % 11.6 % 240bps Adjusted OIBDA $ 85

$

99 16 % 18 % Adjusted OIBDA Margin (%) 13.9 % 15.6 % 170bps

Operating Metrics Average Selling Price (5 )% (5 )% Units

Sold 10 % eCommerce Revenue $ 198 $ 229 16 % 17 % eCommerce % of

Total Revenue 32.5 % 36.0 % 350bps Mobile % of eCommerce Revenue(2)

62.3 % 68.7 % 640bps LTM Total Customers(3) 4.6 4.6 0 % (1)

Includes QVC France, QVC Germany, QVC Italy, QVC Japan and

QVC UK. (2) Based on gross US Dollar orders. (3) LTM: Last twelve

months. (4) For a definition of constant currency financial

metrics, see the accompanying schedules.

In the third quarter of 2017, QVC International experienced

year-over-year constant currency(2) growth in the apparel,

accessories, beauty and home categories, which were partially

offset by declines in electronics and jewelry. Increases in

operating income margin and adjusted OIBDA margin in constant

currency(2) primarily reflect lower marketing and fixed costs,

higher product margins and lower amortization, which were partially

offset by higher freight costs.

CNR Home Shopping Co., Ltd. ("CNRS"), QVC's joint venture in

China, is being accounted for as an equity method investment. It

had no material impact to QVC’s net income for the quarter.

zulily

“We continue to be obsessively focused on our customer

experience and every day it is our mission to make every one of our

customers a passionate fan of zulily. We are pleased by the growth

of our active customer count to 5.3 million, the highest count

ever, which contributed to a strong finish during the third

quarter,” said zulily President and CEO, Darrell Cavens. “Driving

active customer growth and ensuring an amazing customer experience

will allow us to achieve the growth levels that this business has

the ability to deliver, and I am excited by our strong momentum

going into the holiday season.”

The following table provides zulily’s stand-alone financial and

operating results for the third quarter of 2017. Revenue was up 2%

in the third quarter, primarily attributed to a 6% increase in

orders placed driven by an increase in active customers, partially

offset by increased backlog due to timing of orders within the

quarter. In addition, units per order increased but was offset by

lower ASP. An active customer is defined as an individual who has

purchased at least once in the last twelve months, measured from

the last date of a period. Operating income margin improved, driven

primarily by decelerating amortization of intangible assets related

to purchase accounting. Adjusted OIBDA margin decreased primarily

due to a decline in ASP, increased promotional offers, and

increased supply chain expenses resulting from an increase in

international shipping, a shift in product mix, and ramping of

zulily’s Pennsylvania fulfillment center.

(amounts in millions unless otherwise noted) 3Q16

3Q17 % Change

zulily

Financial Metrics Net Revenue $ 359 $ 367 2 % Gross Margin

28.4 % 25.9 % (250)bps Operating Income (Loss) $ (52 ) $ (44 ) 15 %

Operating Income Margin (%) (14.5 )% (12.0 )% 250bps Adjusted OIBDA

$ 18 $ 12 (33 )% Adjusted OIBDA Margin (%) 5.0 % 3.3 % (170)bps

Operating Metrics Mobile % of Total Orders 65.5 % 67.3 %

180bps LTM Total Customers(1) 5.0 5.3 6 % (1) LTM:

Last twelve months.

Share Repurchases

From August 1, 2017 through October 31, 2017, Liberty

Interactive repurchased approximately 21.0 million Series A QVC

Group shares (Nasdaq:QVCA) at an average cost per share of $22.69

for total cash consideration of $477 million. Since the creation of

the QVC Group stock (including its predecessor, Liberty Interactive

Group) in May 2006, Liberty Interactive has repurchased shares for

aggregate cash consideration of $7.5 billion, representing

approximately 49% of the shares outstanding at the time of the

creation of the QVC Group stock. All repurchases up to August 9,

2012, the date on which the QVC Group stock was recapitalized to

create the Liberty Ventures common stock, were comprised of shares

of the combined stocks. On September 19, 2017, Liberty

Interactive’s board of directors authorized the repurchase of an

additional $1 billion of Series A QVC Group common stock. The

remaining repurchase authorization for Liberty Interactive as of

November 1, 2017 is approximately $1.5 billion, of which $822

million can be applied to repurchases of either QVC Group or

Liberty Ventures common stock and $650 million can only be applied

to Liberty Ventures common stock.

QVC Group has attributed to it Liberty Interactive’s

subsidiaries, QVC, Inc. and zulily, llc, and Liberty Interactive’s

interest in HSNi.

LIBERTY VENTURES GROUP – Approximately $10 million of

corporate level SG&A expense (including stock-based

compensation expense) was allocated to Liberty Ventures Group in

the third quarter of 2017.

On April 4, 2017, Liberty Interactive entered into an agreement

and plan of reorganization with GCI, the largest communications

provider in Alaska, whereby Liberty Interactive will acquire GCI

through a reorganization in which certain Liberty Ventures Group

assets and liabilities will be contributed to GCI in exchange for a

controlling interest in GCI, followed by a subsequent split-off of

the combined company, GCI Liberty. Additional information is

available in the amended registration statement on Form S-4 that

GCI filed with the SEC on September 26, 2017.

The transactions between Liberty Interactive and GCI are

expected to be completed during the first quarter of 2018, subject

to customary closing conditions including, among other things, the

requisite shareholder approvals. In June 2017, the Federal Trade

Commission granted early termination of the applicable waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act. In

November 2017, the Regulatory Commission of Alaska and the Federal

Communications Commission granted requisite approvals to complete

the acquisition.

Pursuant to a recent amendment to the reorganization agreement

with GCI, Liberty Interactive’s outstanding 1.75% Charter

exchangeable debentures due 2046 (the “1.75% debentures”) will now

be reattributed to the QVC Group at the closing of the GCI

transactions and Liberty Interactive will not conduct the

previously contemplated exchange offer for mirror debentures of GCI

Liberty. At closing, the 1.75% debentures will be reattributed to

the QVC Group, together with approximately $590 million of cash

equal to the NPV of principal and cash interest payments through

the put/call date (October 2023). Such cash, together with any

other cash due to the QVC Group in the reattribution, will be

funded through cash attributed to Liberty Ventures and a $1 billion

LBRDK margin loan to be entered into by a subsidiary of GCI Liberty

at closing.

In addition, Liberty Interactive (which is expected to be

renamed QVC Group after closing) will benefit from an indemnity

obligation from GCI Liberty with respect to any payments made by

Liberty Interactive in excess of the adjusted principal amount of

the debentures to any holder that exercises its exchange right on

or before the put/call date, less any potential tax benefit to

Liberty Interactive from the retirement of such debentures at a

premium. GCI Liberty is supporting this obligation with a negative

pledge in favor of Liberty Interactive on 2.2 million Charter

shares at GCI Liberty that are referenced by the 1.75% debentures.

In addition, Liberty Interactive has agreed to use its commercially

reasonable efforts to repurchase the outstanding debentures within

6 months following the closing, on terms and conditions reasonably

acceptable to GCI Liberty. GCI Liberty will reimburse Liberty

Interactive for the difference between the purchase price of the

tendered debentures and the amount of cash delivered in the

reattribution with respect to the tendered debentures, less any

potential tax benefit to Liberty Interactive from retiring such

debentures at a premium. GCI Liberty's indemnity obligation and the

number of shares subject to the negative pledge will be ratably

reduced with respect to any debentures repurchased by Liberty

Interactive.

GCI Liberty may (but is not required to) complete an offering of

Charter exchangeable debentures, proceeds of which may be used to

reimburse Liberty Interactive with respect to the aforementioned

tender offer. Absent a concurrent offering, GCI Liberty will fund

its payment obligations with funds available under the $1 billion

LBRDK margin loan.

Simultaneous with the closing of the transactions with Liberty

Interactive and GCI, the QVC Group, including wholly-owned

subsidiaries QVC, Inc., zulily and HSNi (or, if the HSNi

acquisition has not yet closed, following such closing), will

become an asset-backed stock and Liberty Interactive will be

renamed QVC Group, Inc. Neither the proposed transactions involving

GCI nor the acquisition of HSNi is conditioned on the completion of

the other, and no assurance can be given as to which of these

transactions will be completed first.

Share Repurchases

There were no repurchases of Liberty Ventures common stock

(Nasdaq: LVNTA) from August 1, 2017 through October 31, 2017. The

remaining repurchase authorization for Liberty Interactive as of

November 1, 2017 is approximately $1.5 billion, of which $822

million can be applied to repurchases of either QVC Group or

Liberty Ventures common stock and $650 million can only be applied

to Liberty Ventures common stock.

The businesses and assets attributed to the Liberty Ventures

Group are all of Liberty Interactive's businesses and assets other

than those attributed to the QVC Group, including its interests in

Liberty Broadband Corporation and FTD, Liberty Interactive’s

subsidiary Evite, and minority interests in ILG, LendingTree and

Charter Communications.

FOOTNOTES

1) Liberty Interactive's President and CEO, Greg Maffei,

will discuss these highlights and other matters on Liberty

Interactive's earnings conference call which will begin at 11:00

a.m. (E.S.T.) on November 9, 2017. For information regarding how to

access the call, please see “Important Notice” later in this

document. 2) For a definition of constant currency financial

metrics, see the accompanying schedules. Applicable reconciliations

can be found in the financial tables at the beginning of this press

release. 3) For a definition of adjusted OIBDA and applicable

reconciliations and a definition of adjusted OIBDA margin, see the

accompanying schedules.

QVC GROUP

FINANCIAL METRICS – QUARTER

(amounts in millions) 3Q16 3Q17 % Change

Revenue QVC US $ 1,338 $ 1,374 3 % QVC International(1)

610 636 4 % Total QVC revenue 1,948

2,010 3 % zulily 359 367 2 % Intergroup eliminations (4 )

(2 ) 50 %

Total QVC Group Revenue $

2,303 $ 2,375 3 %

Operating Income QVC US $ 175 $ 200 14 % QVC

International(1) 56 74 32 % Total QVC

operating income 231 274 19 % zulily (52 ) (44 ) 15 % Corporate and

other (12 ) (12 ) - %

Total QVC Group Operating

Income $ 167 $ 218

31 % Adjusted OIBDA QVC US $ 308 $ 313

2 % QVC International(1) 85 99 16 %

Total QVC adjusted OIBDA 393 412 5 % zulily 18 12 (33 )% Corporate

and other (5 ) (8 ) (60 )%

Total QVC Group

Adjusted OIBDA $ 406 $ 416

2 % Net Income and Adjusted Net

Income Total QVC Group net income $ 61 $ 119 95 % Total QVC

Group adjusted net income(2) $ 148 $ 182 23 %

China

JV(3) Revenue $ 36 $ 40 11 % Adjusted OIBDA $ (3 ) $ 1

133 % (amounts in millions)

QVCA Shares

Outstanding 10/31/2016

10/31/2017 Outstanding A and B shares 467 430

(amounts in millions)

Quarter ended Quarter ended

QVCA and QVCB Basic and Diluted Shares

9/30/2016 9/30/2017 Basic

weighted average shares outstanding ("WASO") 473 448 Potentially

dilutive shares 5 4

Diluted WASO

478 452 (1)

Includes QVC France, QVC Germany, QVC Italy, QVC Japan and QVC UK.

(2) See reconciling schedule 4. (3) This joint venture is being

accounted for as an equity investment.

NOTES

The following financial information with respect to Liberty

Interactive's equity affiliates and available for sale securities

is intended to supplement Liberty Interactive's condensed

consolidated statements of operations which are included in its

Form 10-Q.

Fair Value of Public Holdings

(amounts in millions) 6/30/2017

9/30/2017 HSNi(1) $ 639 $ 782

Total Attributed QVC Group

$ 639 $ 782 Charter(2) $ 1,805 $

1,947 Liberty Broadband(2) 3,703 4,068 LendingTree(3) 557 788

ILG(2) 457 445 Other public holdings(4) 206 134

Total Attributed Liberty Ventures Group $

6,728 $ 7,382 (1) Represents

fair value of the investment in HSNi attributed to QVC Group. In

accordance with GAAP, this investment is accounted for using the

equity method of accounting and is included in the attributed

balance sheet of QVC Group at historical carrying value which

aggregated $193 million and $198 million at June 30, 2017 and

September 30, 2017, respectively. (2) Represents fair value of the

investments in Charter, Liberty Broadband and ILG attributed to

Liberty Ventures Group, which are accounted for at fair value. (3)

Represents fair value of the investment in LendingTree attributed

to Liberty Ventures Group. In accordance with GAAP, this investment

is accounted for using the equity method of accounting and is

included in the attributed balance sheet of Liberty Ventures Group

at historical carrying values which aggregated $111 million and

$113 million at June 30, 2017 and September 30, 2017, respectively.

(4) Other public holdings includes fair value of the investment in

FTD attributed to Liberty Ventures Group. In accordance with GAAP,

this investment is accounted for using the equity method of

accounting and is included in the attributed balance sheet of

Liberty Ventures Group at historical carrying values which

aggregated $213 million and $133 million at June 30, 2017 and

September 30, 2017, respectively.

Cash and Debt

The following presentation is provided to separately identify

cash and liquid investments and debt information.

(amounts in millions) 6/30/2017

9/30/2017

Cash and Liquid Investments

Attributable to: QVC Group $ 420 $ 383 Liberty Ventures Group

485 512

Total Liberty Consolidated

Cash and Liquid Investments $ 905 $

895 Debt: Senior notes and

debentures(1) $ 791 $ 791 QVC senior notes(1) 3,550 3,550 QVC bank

credit facility 1,611 1,690 Other 181 177

Total Attributed QVC Group Debt $ 6,133

$ 6,208 Unamortized discount, fair market value

adjustment and deferred loan costs (36 ) (33 )

Total Attributed QVC Group Debt (GAAP) $ 6,097

$ 6,175 Senior exchangeable

debentures(2) 1,955 1,949

Total

Attributed Liberty Ventures Group Debt $ 1,955

$ 1,949 Fair market value adjustment (156 )

(63 )

Total Attributed Liberty Ventures Group Debt

(GAAP) $ 1,799 $ 1,886

Total Liberty Interactive Corporation Debt

(GAAP) $ 7,896 $ 8,061

(1) Face amount of Senior Notes and Debentures

with no reduction for the unamortized discount. (2) Face amount of

Senior Exchangeable Debentures with no reduction for the fair

market value adjustment.

Total cash and liquid investments attributed to the QVC Group

decreased $37 million in the third quarter. Share repurchases,

inter-group tax payments and capital expenditures more than offset

cash from operations and additional borrowings. Total debt

attributed to the QVC Group increased by $75 million primarily due

to borrowings on QVC’s credit facility.

Total cash and liquid investments attributed to the Liberty

Ventures Group increased $27 million, primarily due to inter-group

tax payments received, partially offset by additional investments

related to green energy and other minority investments. Total debt

attributed to Liberty Ventures Group decreased by $6 million in the

third quarter.

Important Notice: Liberty Interactive (Nasdaq: QVCA,

QVCB, LVNTA, LVNTB) President and CEO, Greg Maffei, will discuss

Liberty Interactive's earnings release on a conference call which

will begin at 11:00 a.m. (E.S.T.) on November 9, 2017. The call can

be accessed by dialing (844) 307-2219 or (678) 509-7635 at least 10

minutes prior to the start time. The call will also be broadcast

live across the Internet and archived on our website. To access the

webcast go to http://www.libertyinteractive.com/events. Links to

this press release and replays of the call will also be available

on Liberty Interactive's website.

This press release includes certain forward-looking statements,

including statements about business strategies, market potential,

future financial prospects, market conditions, sales demand,

statements about the proposed acquisition (the “HSNi acquisition”)

of HSNi by Liberty Interactive, including those about timing of the

HSNi acquisition, the proposed acquisition of GCI by Liberty

Interactive and the proposed split-off of GCI and certain Liberty

Ventures Group assets and liabilities (the “proposed split-off” and

together with the proposed acquisition of GCI, the “proposed

transactions”), the timing of the proposed transactions, the

renaming of Liberty Interactive, new service and product offerings,

the monetization of our non-core assets, the continuation of our

stock repurchase program and other matters that are not historical

facts. These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements, including,

without limitation, possible changes in market acceptance of new

products or services, competitive issues, regulatory matters

affecting our businesses, continued access to capital on terms

acceptable to Liberty Interactive, changes in law and government

regulations that may impact the derivative instruments that hedge

certain of our financial risks, the availability of investment

opportunities, the satisfaction of conditions to complete each of

the HSNi acquisition and the proposed transactions and market

conditions conducive to stock repurchases. These forward-looking

statements speak only as of the date of this press release, and

Liberty Interactive expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

Liberty Interactive's expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based. Please refer to the publicly filed documents of

Liberty Interactive, including the most recent Forms 10-K and 10-Q,

for additional information about Liberty Interactive and about the

risks and uncertainties related to Liberty Interactive's business

which may affect the statements made in this press release.

Additional Information

Nothing in this press release shall constitute a solicitation to

buy or an offer to sell shares of GCI Liberty, GCI common stock or

any of Liberty Interactive’s tracking stocks. The offer and

issuance of shares in the proposed transactions will only be made

pursuant to GCI Liberty’s effective registration statement. Liberty

Interactive stockholders, GCI stockholders and other investors are

urged to read the registration statement and the joint proxy

statement/prospectus regarding the proposed transactions (a

preliminary filing of which has been made with the SEC) and any

other relevant documents filed with the SEC, as well as any

amendments or supplements to those documents, because they contain

important information about the proposed transactions. Copies of

these SEC filings will be available free of charge at the SEC’s

website (http://www.sec.gov). Copies of the filings together with

the materials incorporated by reference therein will also be

available, without charge, by directing a request to Liberty

Interactive Corporation, 12300 Liberty Boulevard, Englewood,

Colorado 80112, Attention: Investor Relations, Telephone: (720)

875-5420. GCI investors can access additional information at

ir.gci.com.

Participants in a Solicitation

The directors and executive officers of Liberty Interactive and

GCI and other persons may be deemed to be participants in the

solicitation of proxies in respect of proposals to approve the

proposed transactions. Information regarding the directors and

executive officers of Liberty Interactive is available in its

definitive proxy statement, which was filed with the SEC on April

20, 2017. Information regarding the directors and executive

officers of GCI is available as part of its Annual Report on Form

10-K filed with the SEC on March 2, 2017. Other information

regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, will be available in the proxy materials

regarding the foregoing to be filed with the SEC. Free copies of

these documents may be obtained as described in the preceding

paragraph.

NON-GAAP FINANCIAL MEASURES

This press release includes a presentation of adjusted OIBDA,

which is a non-GAAP financial measure, for Liberty Interactive, the

QVC Group, QVC (and certain of its subsidiaries), zulily and the

Liberty Ventures Group together with a reconciliation to that

entity or such businesses’ operating income, as determined under

GAAP. Liberty Interactive defines adjusted OIBDA as revenue less

cost of sales, operating expenses, and selling, general and

administrative expenses, excluding all stock based compensation,

and excludes from that definition depreciation and amortization and

restructuring and impairment charges that are included in the

measurement of operating income pursuant to GAAP. Further, this

press release includes adjusted OIBDA margin which is also a

non-GAAP financial measure. Liberty Interactive defines adjusted

OIBDA margin as adjusted OIBDA divided by revenue.

Liberty Interactive believes adjusted OIBDA is an important

indicator of the operational strength and performance of its

businesses, including each business' ability to service debt and

fund capital expenditures. In addition, this measure allows

management to view operating results and perform analytical

comparisons and benchmarking between businesses and identify

strategies to improve performance. Because adjusted OIBDA is used

as a measure of operating performance, Liberty Interactive views

operating income as the most directly comparable GAAP measure.

Adjusted OIBDA is not meant to replace or supersede operating

income or any other GAAP measure, but rather to supplement such

GAAP measures in order to present investors with the same

information that Liberty Interactive's management considers in

assessing the results of operations and performance of its assets.

Please see the attached schedules for applicable

reconciliations.

In addition, this press release includes references to adjusted

net income, which is a non-GAAP financial measure, for QVC Group.

Liberty Interactive defines adjusted net income as net income,

excluding the impact of purchase accounting amortization (net of

deferred tax benefit).

Liberty Interactive believes adjusted net income is an important

indicator of financial performance, in particular for QVC Group,

due to the impact of purchase accounting amortization. Because

adjusted net income is used as a measure of overall financial

performance, Liberty Interactive views net income as the most

directly comparable GAAP measure. Adjusted net income is not meant

to replace or supersede net income or any other GAAP measure, but

rather to supplement such GAAP measures in order to present

investors with a supplemental metric of financial performance.

Please see the attached schedules for a reconciliation of adjusted

net income to net income (loss) calculated in accordance with GAAP

for QVC Group (Schedule 4).

This press release also references certain financial metrics on

a constant currency basis, which is a non-GAAP measure, for QVC

Group. Constant currency financial metrics, as presented herein,

are calculated by translating the current-year and prior-year

reported amounts into comparable amounts using a single foreign

exchange rate for each currency.

Liberty Interactive believes constant currency financial metrics

are an important indicator of financial performance, in particular

for QVC Group, due to the translational impact of foreign currency

fluctuations relating to its subsidiaries in the UK, Germany,

Italy, Japan and France, as well as its JV in China. We use

constant currency financial metrics to provide a framework to

assess how our businesses performed excluding the effects of

foreign currency exchange fluctuations. Please see the financial

tables at the beginning of this press release for a reconciliation

of the impact of foreign currency fluctuations on revenue,

operating income, adjusted OIBDA and average selling price.

SCHEDULE 1

The following table provides a reconciliation of QVC Group's

adjusted OIBDA to its operating income calculated in accordance

with GAAP for the three months ended September 30, 2016, December

31, 2016, March 31, 2017, June 30, 2017 and September 30, 2017,

respectively.

QUARTERLY SUMMARY

(amounts in millions) 3Q16 4Q16

1Q17 2Q17 3Q17

QVC Group

Adjusted OIBDA 406 610 445 488 416 Depreciation and amortization

(219 ) (208 ) (207 ) (205 ) (180 ) Stock compensation expense

(20 ) (18 ) (12 ) (18 ) (18 )

Operating Income $ 167 $

384 $ 226 $ 265

$ 218

SCHEDULE 2

The following table provides a reconciliation of adjusted OIBDA

for QVC (and certain of its subsidiaries) and zulily to that entity

or such businesses' operating income (loss) calculated in

accordance with GAAP for the three months ended September 30, 2016,

December 31, 2016, March 31, 2017, June 30, 2017 and September 30,

2017, respectively. As there are no material reconciling items

between adjusted OIBDA and operating income for the QVC China joint

venture for the referenced periods, no reconciliation has been

provided.

QUARTERLY SUMMARY

(amounts in millions) 3Q16 4Q16

1Q17 2Q17 3Q17

QVC

Group QVC Adjusted OIBDA QVC US $ 308 $ 438 $ 336

$ 361 $ 313 QVC International 85 131 98 107 99 Consolidated

QVC adjusted OIBDA 393 569 434 468 412 Depreciation and

amortization (154 ) (157 ) (157 ) (154 ) (129 ) Stock compensation

(8 ) (8 ) (6 ) (8 ) (9 )

QVC

Operating Income $ 231 $ 404

$ 271 $ 306

$ 274 zulily Adjusted OIBDA $ 18

$ 40 $ 15 $ 26 $ 12 Depreciation and amortization (65 ) (51 ) (50 )

(51 ) (51 ) Stock compensation (5 ) (3 ) (3 )

(4 ) (5 )

zulily Operating Income (Loss)

$ (52 ) $ (14 ) $

(38 ) $ (29 ) $

(44 )

SCHEDULE 3

The following table provides a reconciliation of adjusted OIBDA

for QVC Group and the Liberty Ventures Group to the Liberty

Interactive Corporation operating income (loss) calculated in

accordance with GAAP for the three months ended September 30, 2016,

December 31, 2016, March 31, 2017, June 30, 2017 and September 30,

2017, respectively.

QUARTERLY SUMMARY

(amounts in millions) 3Q16 4Q16

1Q17 2Q17 3Q17 QVC Group

adjusted OIBDA $ 406 $ 610 $ 445 $ 488 $ 416 Liberty Ventures Group

adjusted OIBDA (4 ) (5 ) (8 ) (7 )

(6 )

Consolidated Liberty Interactive Corp. Adjusted

OIBDA $ 402 $ 605

$ 437 $ 481 $

410 Depreciation and amortization (225 ) (211 ) (208

) (206 ) (180 ) Stock compensation (20 ) (22 )

(16 ) (21 ) (22 )

Consolidated Liberty Interactive

Corp. Operating Income $ 157 $

372 $ 213 $ 254

$ 208

SCHEDULE 4

The following table provides a reconciliation of QVC Group's

adjusted net income to its net income calculated in accordance with

GAAP for the three months ended September 30, 2016, December 31,

2016, March 31, 2017, June 30, 2017 and September 30, 2017,

respectively.

QUARTERLY SUMMARY

(amounts in millions) 3Q16 4Q16

1Q17 2Q17 3Q17 LTM

QVC Group Net income $ 61 $ 188 $ 91 $ 111 $ 119 $ 509 QVC

purchase accounting amort., net deferred tax benefit (1) 50 49 49

49 34 181 zulily purchase accounting amort., net deferred tax

benefit (2) 37 29 28 28 29

114 QVC Group adjusted net income $ 148 $ 266 $ 168 $ 188 $

182 $ 804 QVCA/B shares outstanding as of October 31, 2017

430 Adjusted LTM earnings per share $ 1.87 (1)

Add-back relates to non-cash, non-tax deductible purchase

accounting amortization from Liberty Interactive’s acquisition of

QVC, net of book deferred tax benefit (gross non-cash, non-tax

deductible purchase accounting amortization is expected to be $212

million for the twelve months ending December 31, 2017. The

majority of the intangible assets established in purchase

accounting as a result of the acquisition have been fully amortized

as of the end of the third quarter of 2017). (2) Add-back relates

to non-cash, non-tax deductible purchase accounting amortization

from Liberty Interactive’s acquisition of zulily, net of book

deferred tax benefit.

LIBERTY INTERACTIVE CORPORATION BALANCE SHEET

INFORMATION September 30, 2017 - (unaudited)

Attributed QVC Ventures Consolidated

Group Group Liberty amounts in millions

Assets Current assets: Cash and cash equivalents $ 383 512

895 Trade and other receivables, net 908 37 945 Inventory, net

1,197 — 1,197 Other current assets 79 2 81 Total

current assets 2,567 551 3,118 Investments in

available-for-sale securities and other cost investments 4 2,477

2,481 Investments in affiliates, accounted for using the equity

method 236 337 573 Investment in Liberty Broadband measured at fair

value — 4,068 4,068 Property and equipment, net 1,116 1 1,117

Intangible assets not subject to amortization 9,396 29 9,425

Intangible assets subject to amortization, net 631 4 635 Other

assets, at cost, net of accumulated amortization 30 —

30 Total assets $ 13,980 7,467 21,447

Liabilities and

Equity Current liabilities: Intergroup payable (receivable) $

46 (46 ) — Accounts payable 833 — 833 Accrued liabilities 621 20

641 Current portion of debt 17 994 1,011 Other current liabilities

158 3 161 Total current liabilities 1,675 971

2,646 Long-term debt 6,158 892 7,050 Deferred income tax

liabilities 1,024 2,991 4,015 Other liabilities 137 40

177 Total liabilities 8,994 4,894 13,888

Equity/Attributed net assets (liabilities) 4,871 2,583 7,454

Non-controlling interests in equity of subsidiaries 115 (10

) 105 Total liabilities and equity $ 13,980 7,467 21,447

LIBERTY

INTERACTIVE CORPORATION STATEMENT OF OPERATIONS

INFORMATION Three months ended September 30, 2017 -

(unaudited) Attributed QVC Ventures

Consolidated Group Group Liberty

amounts in millions Revenue: Total revenue, net $ 2,375 6 2,381

Operating costs and expenses: Cost of sales 1,554 — 1,554

Operating 156 4 160 Selling, general and administrative, including

stock-based compensation 267 12 279 Depreciation and amortization

180 — 180 2,157 16

2,173 Operating income (loss) 218 (10 ) 208 Other

income (expense): Interest expense (73 ) (15 ) (88 ) Share of

earnings (losses) of affiliates, net 11 (97 ) (86 ) Realized and

unrealized gains (losses) on financial instruments, net 1 368 369

Other, net 5 2 7 (56 ) 258

202 Earnings (loss) from continuing operations before

income taxes 162 248 410 Income tax benefit (expense) (31 )

(71 ) (102 ) Net earnings (loss) 131 177 308 Less net earnings

(loss) attributable to noncontrolling interests 12 —

12 Net earnings (loss) attributable to Liberty

Interactive Corporation shareholders $ 119 177 296

LIBERTY

INTERACTIVE CORPORATION STATEMENT OF OPERATIONS

INFORMATION Three months ended September 30, 2016 -

(unaudited) Attributed QVC Ventures

Consolidated Group Group Liberty

amounts in millions Revenue: Total revenue, net $ 2,303 109 2,412

Operating costs and expenses: Cost of sales 1,504 71 1,575

Operating 152 13 165 Selling, general and administrative, including

stock-based compensation 261 29 290 Depreciation and amortization

219 6 225 2,136 119

2,255 Operating income (loss) 167 (10 ) 157

Other income (expense): Interest expense (73 ) (19 ) (92 ) Share of

earnings (losses) of affiliates, net 8 (30 ) (22 ) Realized and

unrealized gains (losses) on financial instruments, net (6 ) 612

606 Other, net 6 (14 ) (8 ) (65 ) 549

484 Earnings (loss) from continuing operations before income

taxes 102 539 641 Income tax benefit (expense) (32 ) (158 )

(190 ) Net earnings (loss) from continuing operations 70 381 451

Earnings (loss) from discontinued operations — 27

27 Net earnings (loss) 70 408 478 Less net earnings

(loss) attributable to noncontrolling interests 9 —

9 Net earnings (loss) attributable to Liberty

Interactive Corporation shareholders $ 61 408 469

LIBERTY

INTERACTIVE CORPORATION STATEMENT OF CASH FLOWS

INFORMATION Nine months ended September 30, 2017-

(unaudited) Attributed QVC Ventures

Consolidated Group Group Liberty

amounts in millions CASH FLOWS FROM OPERATING ACTIVITIES: Net

earnings (loss) $ 354 657 1,011 Adjustments to reconcile net

earnings to net cash provided by operating activities: Depreciation

and amortization 592 2 594 Stock-based compensation 48 11 59 Share

of (earnings) losses of affiliates, net (31 ) 153 122 Cash receipts

from return on equity investments 21 — 21 Realized and unrealized

gains (losses) on financial instruments, net — (1,186 ) (1,186 )

Deferred income tax (benefit) expense (115 ) 471 356 Other, net 7 1

8 Intergroup tax allocations 167 (167 ) — Intergroup tax (payments)

receipts (231 ) 231 — Changes in operating assets and liabilities

Current and other assets 152 9 161 Payables and other current

liabilities (63 ) (4 ) (67 ) Net cash provided (used) by

operating activities 901 178 1,079

CASH FLOWS FROM INVESTING ACTIVITIES: Investments in and

loans to cost and equity investees — (140 ) (140 ) Capital expended

for property and equipment (124 ) (2 ) (126 ) Other investing

activities, net (35 ) (1 ) (36 ) Net cash provided (used) by

investing activities (159 ) (143 ) (302 ) CASH FLOWS

FROM FINANCING ACTIVITIES: Borrowings of debt 1,689 — 1,689

Repayments of debt (1,906 ) (11 ) (1,917 ) Repurchases of QVC Group

common stock (452 ) — (452 ) Withholding taxes on net settlements

of stock-based compensation (13 ) (1 ) (14 ) Other financing

activities, net (28 ) 2 (26 ) Net cash provided

(used) by financing activities (710 ) (10 ) (720 ) Effect of

foreign currency rates on cash 13 — 13

Net increase (decrease) in cash and cash equivalents 45 25 70 Cash

and cash equivalents at beginning of period 338 487

825 Cash and cash equivalents at end period $ 383

512 895

LIBERTY INTERACTIVE CORPORATION STATEMENT

OF CASH FLOWS INFORMATION Nine months ended September 30,

2016 - (unaudited) Attributed QVC

Ventures Consolidated Group Group

Liberty amounts in millions CASH FLOWS FROM OPERATING

ACTIVITIES: Net earnings (loss) $ 313 631 944 Adjustments to

reconcile net earnings to net cash provided by operating

activities: (Earnings) loss from discontinued operations — (14 )

(14 ) Depreciation and amortization 642 21 663 Stock-based

compensation 57 18 75 Cash payments for stock based compensation —

(92 ) (92 ) Share of losses (earnings) of affiliates, net (38 ) 59

21 Cash receipts from return on equity investments 21 3 24 Realized

and unrealized gains (losses) on financial instruments, net 2 (944

) (942 ) Deferred income tax (benefit) expense (167 ) 589 422

Other, net 31 (77 ) (46 ) Intergroup tax allocation 301 (301 ) —

Intergroup tax (payments) receipts (224 ) 224 — Changes in

operating assets and liabilities Current and other assets 312 37

349 Payables and other current liabilities (357 ) (27 ) (384

) Net cash provided (used) by operating activities 893

127 1,020 CASH FLOWS FROM INVESTING

ACTIVITIES: Cash proceeds from disposition — 350 350 Investments in

and loans to cost and equity investees — (67 ) (67 ) Capital

expended for property and equipment (158 ) (19 ) (177 ) Purchases

of short term and other marketable securities — (264 ) (264 ) Sales

of short term and other marketable securities 12 1,162 1,174

Investment in Liberty Broadband — (2,400 ) (2,400 ) Other investing

activities, net (11 ) (3 ) (14 ) Net cash provided (used) by

investing activities (157 ) (1,241 ) (1,398 ) CASH

FLOWS FROM FINANCING ACTIVITIES: Borrowings of debt 1,143 1,545

2,688 Repayments of debt (1,340 ) (2,289 ) (3,629 ) Repurchases of

QVC Group common stock (603 ) — (603 ) Withholding taxes on net

settlements of stock-based compensation (15 ) (1 ) (16 ) Other

financing activities, net (6 ) (22 ) (28 ) Net cash provided

(used) by financing activities (821 ) (767 ) (1,588 ) Effect

of foreign currency rates on cash 7 — 7 Net cash provided (used) by

discontinued operations: Cash provided (used) by operating

activities — 15 15 Cash provided (used) by investing activities — —

— Cash provided (used) by financing activities — — — Change in

available cash held by discontinued operations — —

— Net cash provided (used) by discontinued operations

— 15 15 Net increase (decrease) in cash

and cash equivalents (78 ) (1,866 ) (1,944 ) Cash and cash

equivalents at beginning of period 426 2,023

2,449 Cash and cash equivalents at end period $ 348

157 505

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109005496/en/

Liberty Interactive CorporationCourtnee Chun, 720-875-5420

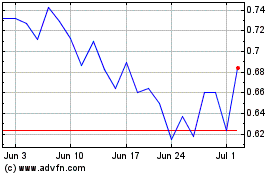

Qurate Retail (NASDAQ:QRTEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qurate Retail (NASDAQ:QRTEA)

Historical Stock Chart

From Apr 2023 to Apr 2024