Materialise NV (NASDAQ:MTLS), a leading provider of additive

manufacturing software and of sophisticated 3D printing services,

today announced its financial results for the third quarter ended

September 30, 2017.

Highlights – Third Quarter 2017

- Total revenue increased 12.4% from the

third quarter of 2016 to 32,307 kEUR, with increases in all three

business segments.

- Adjusted EBITDA increased 15.0% from

2,833 kEUR for the third quarter of 2016 to 3,259 kEUR.

- Revenue and Adjusted EBITDA guidance

for 2017 updated to reflect the acquisition of ACTech on October 4,

2017.

Executive Chairman Peter Leys commented, “During the third

quarter, Materialise invested significantly in our future growth,

finishing our new production and office facilities in Poland and

Belgium and completing negotiations for the acquisition of ACTech

GmbH in Germany, a full-service manufacturer of complex metal

parts. The expertise and in-house infrastructure of ACTech GmbH

position us to accelerate the development of our existing metal

competence center, including our software suite for 3D metal

printing. Simultaneously, we continued to execute on other elements

of our strategy: we were the first to receive the U.S. green light

for our 3D-printed maxillofacial implants that will allow our

long-term collaborator DePuy Synthes to bring these products to

market in the United States. Meanwhile, our three segments all

continued to contribute to our topline growth and generated

positive EBITDA.”

Third Quarter 2017 Results

Total revenue for the third quarter of 2017 increased 12.4% to

32,307 kEUR compared to 28,736 kEUR for the third quarter

of 2016, with gains in all three of our segments. Total deferred

revenue from annual software sales and maintenance contracts

amounted to 16,607 kEUR at the end of the third quarter of

2017 compared 16,799 kEUR at the end of the fourth quarter of 2016.

Adjusted EBITDA, which in the third quarter of 2017 excludes 266

kEUR of expenses related to the acquisition of ACTech, increased to

3,259 kEUR from 2,833 kEUR as a result of the combination of

continued revenue growth (12.4%) and a lower increase in

operational expenses compared to the third quarter of 2016. The

Adjusted EBITDA margin (Adjusted EBITDA divided by total revenue)

in the third quarter of 2017 was 10.1% compared to 9.9% in the

third quarter of 2016.

Revenue from our Materialise Software segment increased 10.4% to

8,422 kEUR for the third quarter of 2017 from 7,632 kEUR for

the same quarter last year. Segment EBITDA rose to 3,362 kEUR

from 2,814 kEUR while the segment EBITDA margin was 39.9%

compared to 36.9% for the prior-year period.

Revenue from our Materialise Medical segment increased 9.3% to

10,421 kEUR for the third quarter of 2017 compared to

9,537 kEUR for the same period in 2016. Compared to the same

quarter in 2016, revenues from our medical software grew 24.6%, and

revenues from medical devices and services grew 2.1%. Segment

EBITDA was 1,170 kEUR compared to 754 kEUR while the

segment EBITDA margin increased to 11.2% from 7.9% in the third

quarter of 2016.

Revenue from our Materialise Manufacturing segment increased

16.3% to 13,456 kEUR for the third quarter of 2017 from

11,567 kEUR for the third quarter of 2016. Segment EBITDA

decreased to 499 kEUR from 1,723 kEUR while the segment

EBITDA margin decreased to 3.7% from 14.9% for the same quarter in

2016. While last year’s third quarter segment EBITDA included 460

kEUR related to an updated accounting valuation of resin materials

stock, in the 2017 period, segment EBITDA was affected by higher

cost of sales from the sales of eyewear scanners.

Gross profit was 17,873 kEUR, or 55.3% of total revenue, for the

third quarter of 2017 compared to 16,937 kEUR, or 58.9% of

total revenue, for the third quarter of 2016.

Research and development (“R&D”), sales and marketing

(“S&M”) and general and administrative (“G&A”) expenses

increased, in the aggregate, 8.5% to 19,509 kEUR for the third

quarter of 2017 from 17,974 kEUR for the third quarter of

2016. R&D expenses increased from 4,389 kEUR to

4,701 kEUR while S&M expenses increased from

8,299 kEUR to 8,753 kEUR. G&A expenses increased from

5,286 kEUR to 6,055 kEUR. The G&A expenses for the

third quarter of 2017 included a portion of the expenses related to

the acquisition of ACTech, which are excluded from Adjusted

EBITDA.

Net other operating income increased by 45 kEUR to

1,414 kEUR compared to 1,369 kEUR for the third quarter

of 2016.

Operating result decreased to (222) kEUR from 332 kEUR

for the same period in the prior year. This decrease was the result

of the increase of 8.5% in R&D, S&M and G&A expenses,

which was offset in part by the increase in gross profit of 5.5%.

The operating result was also negatively affected by depreciation

cost, which increased to 2,918 kEUR from 2,144 kEUR for the third

quarter of 2016, and by the 266 kEUR of expenses related to the

acquisition of ACTech.

Net financial result was (593) kEUR compared to

(124) kEUR for the prior-year period, reflecting variances in

currency exchange rates, primarily on the portion of the company’s

IPO proceeds held in U.S. dollars versus the euro.

Net loss for the third quarter of 2017 was (1,413) kEUR

compared to net loss of (52) kEUR for the same period in 2016.

The 2016 period contained income tax expense of (191) kEUR

compared to (433) kEUR this quarter. The variance of

(242) kEUR in income tax, the decrease in the net financial

result of 469 kEUR, a decrease of (96) kEUR in the share in

the loss of a joint venture and the decrease of the operating

result by (554) kEUR explain the increase in the net loss for

the third quarter of 2017. Total comprehensive loss for the third

quarter of 2017, which includes exchange differences on translation

of foreign operations, was (1,568) kEUR compared to

(511) kEUR for the same period in 2016.

At September 30, 2017, we had cash and equivalents of

48,099 kEUR compared to 55,912 kEUR at December 31, 2016.

Cash flow from operating activities in the third quarter of 2017

was 2,518 kEUR compared to 4,315 kEUR in the same period

in 2016.

Net shareholders’ equity at September 30, 2017 was

76,060 kEUR compared to 79,033 kEUR at December 31,

2016.

2017 Guidance

Mr. Leys concluded, “We are adjusting our revenue and Adjusted

EBITDA guidance for 2017 to reflect our acquisition of ACTech in

the fourth quarter. For fiscal 2017, we now expect to report

consolidated revenue between 140,000 – 143,000 kEUR and Adjusted

EBITDA between 13,000 – 14,000 kEUR. Separately, based on

year-to-date software sales, we are revising our outlook for

deferred revenue from annual licenses and maintenance in 2017 and

now expect an increase between 2,000 – 3,000 kEUR as compared to

2016.”

The company previously expected to report consolidated revenue

between 128,000 - 134,000 kEUR and Adjusted EBITDA between 10,500 –

13,500 kEUR in 2017, with amounts closer to the high end of those

ranges. The amount of deferred revenue generated in 2017 from

annual licenses and maintenance was previously expected to increase

by an amount between 4,000 - 5,000 kEUR as compared to 2016.

Non-IFRS Measures

Materialise uses EBITDA and Adjusted EBITDA as supplemental

financial measures of its financial performance. EBITDA is

calculated as net profit plus income taxes, financial expenses

(less financial income), shares of loss in a joint venture and

depreciation and amortization. Adjusted EBITDA is determined by

adding non-cash stock-based compensation expenses and

acquisition-related expenses of business combinations to EBITDA.

Management believes these non-IFRS measures to be important

measures as they exclude the effects of items which primarily

reflect the impact of long-term investment and financing decisions,

rather than the performance of the company's day-to-day operations.

As compared to net profit, these measures are limited in that they

do not reflect the periodic costs of certain capitalized tangible

and intangible assets used in generating revenues in the company's

business, or the charges associated with impairments. Management

evaluates such items through other financial measures such as

capital expenditures and cash flow provided by operating

activities. The company believes that these measurements are useful

to measure a company's ability to grow or as a valuation

measurement. The company's calculation of EBITDA and Adjusted

EBITDA may not be comparable to similarly titled measures reported

by other companies. EBITDA and Adjusted EBITDA should not be

considered as alternatives to net profit or any other performance

measure derived in accordance with IFRS. The company's presentation

of EBITDA and Adjusted EBITDA should not be construed to imply that

its future results will be unaffected by unusual or non-recurring

items.

Exchange Rate

This press release contains translations of certain euro amounts

into U.S. dollars at specified rates solely for the convenience of

readers. Unless otherwise noted, all translations from euros to

U.S. dollars in this press release were made at a rate of EUR 1.00

to USD 1.1806, the reference rate of the European Central Bank on

September 30, 2017.

Conference Call and Webcast

Materialise will hold a conference call and simultaneous webcast

to discuss its financial results for the third quarter of 2017

today, Thursday, November 9, 2017, at 8:30 a.m. ET/2:30 p.m. CET.

Company participants on the call will include Wilfried Vancraen,

Founder and Chief Executive Officer; Peter Leys, Executive

Chairman; and Johan Albrecht, Chief Financial Officer. A

question-and-answer session will follow management’s remarks.

To access the conference call, please dial 844-469-2530 (U.S.)

or 765-507-2679 (international), passcode #98716965. The conference

call will also be broadcast live over the Internet with an

accompanying slide presentation, which can be accessed on the

company’s website at http://investors.materialise.com.

A webcast of the conference call will be archived on the

company's website for one year.

About Materialise

Materialise incorporates 27 years of 3D printing experience into

a range of software solutions and 3D printing services, which

together form the backbone of the 3D printing industry.

Materialise’s open and flexible solutions enable players in a wide

variety of industries, including healthcare, automotive, aerospace,

art and design, and consumer goods, to build innovative 3D printing

applications that aim to make the world a better and healthier

place. Headquartered in Belgium, with branches worldwide,

Materialise combines one of the largest groups of software

developers in the industry with one of the largest 3D printing

facilities in the world. For additional information, please visit:

www.materialise.com.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our intentions, beliefs,

assumptions, projections, outlook, analyses or current

expectations, plans, objectives, strategies and prospects, both

financial and business, including statements concerning, among

other things, current estimates of fiscal 2017 revenues, deferred

revenue from annual licenses and maintenance and Adjusted EBITDA,

the benefits of the ACTech acquisition, completion of start-up

activities associated with our new manufacturing facilities,

results of operations, cash needs, capital expenditures, expenses,

financial condition, liquidity, prospects, growth and strategies,

and the trends and competition that may affect the markets,

industry or us. Such statements are subject to known and unknown

uncertainties and risks. When used in this press release, the words

“estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,”

“believe,” “forecast,” “will,” “may,” “could,” “might,” “aim,”

“should,” and variations of such words or similar expressions are

intended to identify forward-looking statements. These

forward-looking statements are based upon the expectations of

management under current assumptions at the time of this press

release. These expectations, beliefs and projections are expressed

in good faith and the company believes there is a reasonable basis

for them. However, the company cannot offer any assurance that our

expectations, beliefs and projections will actually be achieved. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events, competitive dynamics

and industry change, and depend on economic circumstances that may

or may not occur in the future or may occur on longer or shorter

timelines than anticipated. We caution you that forward-looking

statements are not guarantees of future performance and involve

known and unknown risks, uncertainties and other factors that are

in some cases beyond our control. All of the forward-looking

statements are subject to risks and uncertainties that may cause

the company's actual results to differ materially from our

expectations, including risk factors described in the company's

annual report on Form 20-F filed with the U.S. Securities and

Exchange Commission on May 1, 2017. There are a number of risks and

uncertainties that could cause the company's actual results to

differ materially from the forward-looking statements contained in

this press release.

The company is providing this information as of the date of this

press release and does not undertake any obligation to update any

forward-looking statements contained in this press release as a

result of new information, future events or otherwise, unless it

has obligations under the federal securities laws to update and

disclose material developments related to previously disclosed

information.

Consolidated income statement

(Unaudited)

For the three months

endedSeptember 30

For the nine monthsended

September30

(in thousands, except per share amounts)

2017

2017 2016 2017 2016

U.S.$ € € € € Revenue

38,142 32,307 28,736 97,840 83,000 Cost of sales (17,041 ) (14,434

) (11,799 ) (42,102 ) (33,848 )

Gross profit

21,101 17,873 16,937 55,738

49,152 Gross profit as % of revenue 55.3 % 55.3 % 58.9 %

57.0 % 59.2 % Research and development expenses (5,550 )

(4,701 ) (4,389 ) (14,424 ) (13,521 ) Sales and marketing expenses

(10,334 ) (8,753 ) (8,299 ) (28,370 ) (26,647 ) General and

administrative expenses (7,149 ) (6,055 ) (5,286 ) (17,205 )

(15,225 ) Net other operating income (expenses) 1,669 1,414 1,369

3,660 4,433

Operating (loss) profit (263 )

(222 ) 332 (601 ) (1,808

) Financial expenses (1,249 ) (1,058 ) (182 ) (3,294

) (1,688 ) Financial income 549 465 58 2,132 1,037 Share in loss of

joint venture (195 ) (165 ) (69 ) (596 ) (368 )

(Loss) profit

before taxes (1,158 ) (980 )

139 (2,359 ) (2,827 )

Income taxes (511 ) (433 ) (191 ) (825 ) (812 )

Net (loss)

profit of the period (1,669 ) (1,413

) (52 ) (3,184 ) (3,639

) Net (loss) profit attributable to: The owners of the

parent (1,669 ) (1,413 ) (52 ) (3,184 ) (3,639 ) Non-controlling

interest − − − − −

Earnings per share attributable to

ordinary owners of the parent Basic (0.04 ) (0.03 ) (0.00 )

(0.07 ) (0.08 ) Diluted (0.04 ) (0.03 ) (0.00 ) (0.07 ) (0.08 )

Weighted average basic shares outstanding 47,325 47,325

47,325 47,325 47,325 Weighted average diluted shares outstanding

47,325 47,325 47,325 47,325 47,325

Consolidated statements of

comprehensive income (Unaudited)

For the three months

endedSeptember 30

For the nine monthsended

September30

(in thousands)

2017 2017 2016

2017 2016 U.S.$ € €

€ € Net profit (loss) for the period

(1,669 ) (1,413 ) (52 )

(3,184 ) (3,639 ) Other comprehensive

income Exchange difference on translation of foreign operations

(183 ) (155 ) (459 ) (481 ) (1,898 ) Other comprehensive income

(loss), net of taxes (183 ) (155 ) (459 ) (481 ) (1,898 )

Total

comprehensive income (loss) for the year, net of taxes

(1,852 ) (1,568 ) (511 )

(3,665 ) (5,537 ) Total comprehensive

income (loss) attributable to: The owners of the parent (1,852 )

(1,568 ) (511 ) (3,665 ) (5,537 ) Non-controlling interest − − − −

−

Consolidated statement of financial

position (Unaudited)

As ofSeptember30

As ofDecember31

(in thousands)

2017 2016 € €

Assets

Non-current assets

Goodwill 8,743 8,860 Intangible assets 11,219 9,765 Property, plant

& equipment 62,643 45,063 Investments in joint ventures − −

Deferred tax assets 408 336 Other non-current assets 2,740 2,154

Total non-current assets 85,753 66,178

Current assets

Inventories 8,642 7,870 Trade receivables 30,656 27,479 Held to

maturity investments − − Other current assets 6,991 4,481 Cash and

cash equivalents 48,099 55,912

Total current assets

94,388 95,742 Total assets 180,141

161,920

As ofSeptember30

As ofDecember31

(in thousands)

2017 2016 € €

Equity and liabilities

Equity Share capital 2,729 2,729 Share premium 79,703 79,019

Consolidated reserves (4,779 ) (1,603 ) Other comprehensive income

(1,593 ) (1,112 )

Equity attributable to the owners of the

parent 76,060 79,033 Non-controlling interest − −

Total

equity 76,060 79,033

Non-current liabilities

Loans & borrowings 46,532 28,267 Deferred tax liabilities 932

1,325 Deferred income 3,728 3,588 Other non-current liabilities

2,220 1,873

Total non-current liabilities 53,412

35,053

Current liabilities

Loans & borrowings 7,033 5,539 Trade payables 14,171 13,400 Tax

payables 967 926 Deferred income 18,130 17,822 Other current

liabilities 10,368 10,147

Total current liabilities

50,669 47,834 Total equity and liabilities

180,141 161,920

Consolidated statement of cash flows

(Unaudited)

For the nine monthsended

September 30

(in thousands)

2017 2016 € €

Operating activities Net (loss) profit of the period (3,184

) (3,639 ) Non-cash and operational adjustments Depreciation of

property, plant & equipment 6,008 4,669 Amortization of

intangible assets 2,134 1,425 Share-based payment expense 997 718

Loss (gain) on disposal of property, plant & equipment (7 )

(147 ) Fair value contingent liabilities − 54 Movement in

provisions 21 − Movement reserve for bad debt 191 (2 ) Financial

income (416 ) (126 ) Financial expense 957 668 Impact of foreign

currencies 621 55 Share in loss of a joint venture (equity method)

596 368 Deferred tax expense (income) (395 ) 225 Income taxes 1,219

587 Other (42 ) 7

Working capital adjustment & income tax

paid Increase in trade receivables and other receivables (5,916

) (2,394 ) Decrease (increase) in inventories (804 ) (828 )

Increase in trade payables and other payables 1,789 3,203 Income

tax paid (1,251 ) (528 )

Net cash flow from operating

activities 2,518 4,315

For the nine monthsended

September 30

(in thousands)

2017 2016 € €

Investing activities Purchase of property, plant &

equipment (22,245 ) (6,816 ) Purchase of intangible assets (3,739 )

(871 ) Proceeds from the sale of property, plant & equipment

(net) 54 192 Proceeds from the sale of intangible assets (net) 36 −

Acquisition of subsidiary − − Investments in joint-ventures (500 )

− Interest received 267 7

Net cash flow used in investing

activities (26,127 ) (7,488 )

Financing activities

Proceeds from loans & borrowings 22,794 7,004 Repayment of

loans & borrowings (2,827 ) (2,116 ) Repayment of finance

leases (2,081 ) (1,293 ) Interest paid (502 ) (406 ) Other

financial income (expense) (251 ) (7 )

Net cash flow from (used

in) financing activities 17,133 3,182

Net increase of cash & cash equivalents (6,476

) 9 Cash & cash equivalents at beginning of the

year 55,912 50,726 Exchange rate differences on cash & cash

equivalents (1,337 ) (245 )

Cash & cash equivalents at end

of the year 48,099 50,490

Reconciliation of Net Profit (Loss) to

EBITDA and Adjusted EBITDA (Unaudited)

For the threemonths

endedSeptember 30

For the nine monthsended

September30

(in thousands)

2017 2016 2017

2016 € € € € Net

profit (loss) for the period (1,413 ) (52

) (3,184 ) (3,639 )

Income taxes 433 191 825 812 Financial expenses 1,058 181 3,294

1,688 Financial income (465 ) (58 ) (2,132 ) (1,037 ) Share in loss

of joint venture 165 69 596 368 Depreciation and amortization 2,918

2,144 8,142 6,094

EBITDA 2,696 2,475

7,541 4,286 Non-cash stock-based compensation

expense (1) 297 358 997 717 Acquisition-related expenses (2) 266 −

266 −

ADJUSTED EBITDA 3,259 2,833

8,804 5,003 (1) Non-cash stock-based

compensation expenses represent the cost of equity-settled and

cash-settled share-based payments to employees. (2)

Acquisition-related expenses of business combinations represent

expenses incurred in connection with the ACTech acquisition.

Segment P&L (Unaudited)

(in thousands)

MaterialiseSoftware

MaterialiseMedical

MaterialiseManufact-uring

Totalsegments

Unallocated

Consoli-dated

€ € € € € € For

the three months ended September 30, 2017 Revenues 8,422 10,421

13,456 32,299 8 32,307 Segment EBITDA 3,362 1,170 499 5,031 (2,335

) 2,696

Segment EBITDA %

39.9 % 11.2 % 3.7 % 15.6 % 8.3 %

For the three months

ended September 30, 2016 Revenues 7,632 9,537 11,567 28,736 −

28,736 Segment EBITDA 2,814 754 1,723 5,291 (2,816 ) 2,475

Segment EBITDA %

36.9 % 7.9 % 14.9 % 18.4 % 8.6 %

(in thousands)

MaterialiseSoftware

MaterialiseMedical

MaterialiseManufact-uring

Totalsegments

Unallocated

Consoli-dated

€ € € € € € For

the nine months ended September 30, 2017 Revenues 25,302 30,999

41,318 97,619 221 97,840 Segment EBITDA 9,307 2,242 3,062 14,611

(7,070 ) 7,541

Segment EBITDA %

36.8 % 7.2 % 7.4 % 15.0 % 7.7 %

For the nine months ended

September 30, 2016 Revenues 22,044 27,849 33,080 82,973 27

83,000 Segment EBITDA 7,181 238 2,410 9,829 (5,543 ) 4,286

Segment EBITDA %

32.6 % 0.9 % 7.3 % 11.8 % 5.2 %

Reconciliation of Net Profit (Loss) to

Segment EBITDA (Unaudited)

For the three monthsended

September 30

For the nine monthsended

September 30

(in thousands)

2017 2016 2017

2016 € € € € Net

profit (loss) for the period (1,413 ) (52

) (3,184 ) (3,639 ) Income taxes

433 191 825 812 Financial expenses 1,058 182 3,294 1,688 Financial

income (465 ) (58 ) (2,132 ) (1,037 ) Share in loss of joint

venture 165 69 596 368

Operating profit (222

) 332 (601 ) (1,808 )

Depreciation and amortization 2,918 2,144 8,142 6,094

Corporate research and development 502 242 1,527 1,201 Corporate

headquarter costs 2,447 3,326 6,984 6,865 Other operating income

(expense) (614 ) (753 ) (1,441 ) (2,523 )

Segment

EBITDA 5,031 5,291 14,611 9,829

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109005172/en/

Investor:LHAHarriet Fried/Jody

Burfening212-838-3777hfried@lhai.com

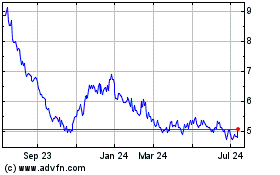

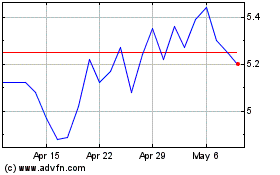

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Apr 2023 to Apr 2024