Report of Foreign Issuer (6-k)

November 09 2017 - 6:06AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

Report of

Foreign Issuer

Pursuant to Rule

13a-16

or

15d-16

of the Securities Exchange Act of 1934

For the month of November, 2017

Commission File Number:

001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha

Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7):

Yes ☐ No ☒

YPF Sociedad Anónima

TABLE OF CONTENTS

ITEM

1 Translation of letter to the Buenos Aires Stock Exchange dated November 8, 2017.

Autonomous City of Buenos Aires, November 8, 2017

Bolsa de Comercio de Buenos Aires

(Buenos Aires Stock

Exchange)

Sarmiento 299

|

|

Ref.

:

|

Consolidated Results for Q3 2017

|

Dear Sirs,

In connection with the published Consolidated Results for Q3, we inform you that we have detected an error in the columns titled “2017

Jan-Sep”

and “Var 2017/2016” of table 5.5 on page 21.

Please find attached a revised version of such

table with the correct information.

Yours faithfully,

Diego Celaá

Market

Relations Officer

YPF S.A.

5.5

MAIN FINANCIAL MAGNITUDES IN U.S. DOLLARS

(Unaudited figures)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Million USD

|

|

2016

Q3

|

|

|

2017

Q2

|

|

|

2017

Q3

|

|

|

Var

Q3 17 / Q3 16

|

|

|

2016

Jan-Sep

|

|

|

2017

Jan-Sep

|

|

|

Var

2017 / 2016

|

|

|

INCOME STATEMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

3,748

|

|

|

|

3,837

|

|

|

|

3,831

|

|

|

|

2.2

|

%

|

|

|

10,720

|

|

|

|

11,315

|

|

|

|

5.6

|

%

|

|

Costs of sales

|

|

|

(3,224

|

)

|

|

|

(3,168

|

)

|

|

|

(3,255

|

)

|

|

|

1.0

|

%

|

|

|

(9,023

|

)

|

|

|

(9,354

|

)

|

|

|

3.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

525

|

|

|

|

669

|

|

|

|

576

|

|

|

|

9.7

|

%

|

|

|

1,697

|

|

|

|

1,962

|

|

|

|

15.6

|

%

|

|

Other operating expenses, net

|

|

|

(2,846

|

)

|

|

|

(448

|

)

|

|

|

(399

|

)

|

|

|

N/A

|

|

|

|

(3,531

|

)

|

|

|

108

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

(2,321

|

)

|

|

|

221

|

|

|

|

177

|

|

|

|

N/A

|

|

|

|

(1,834

|

)

|

|

|

687

|

|

|

|

N/A

|

|

|

Depreciation and impairment of property, plant & equipment and intangible assets

|

|

|

3,278

|

|

|

|

764

|

|

|

|

796

|

|

|

|

-75.7

|

%

|

|

|

4,799

|

|

|

|

2,312

|

|

|

|

-51.8

|

%

|

|

Amortization of intangible assets

|

|

|

13

|

|

|

|

13

|

|

|

|

13

|

|

|

|

2.1

|

%

|

|

|

35

|

|

|

|

37

|

|

|

|

6.1

|

%

|

|

Unproductive exploratory drillings

|

|

|

11

|

|

|

|

34

|

|

|

|

3

|

|

|

|

-71.2

|

%

|

|

|

57

|

|

|

|

61

|

|

|

|

7.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adj. EBITDA

|

|

|

981

|

|

|

|

1,032

|

|

|

|

989

|

|

|

|

0.9

|

%

|

|

|

3,057

|

|

|

|

3,097

|

|

|

|

1.3

|

%

|

|

UPSTREAM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

1,886

|

|

|

|

1,697

|

|

|

|

1,737

|

|

|

|

-7.9

|

%

|

|

|

5,880

|

|

|

|

5,211

|

|

|

|

-11.4

|

%

|

|

Operating income

|

|

|

(2,358

|

)

|

|

|

(56

|

)

|

|

|

21

|

|

|

|

N/A

|

|

|

|

(1,930

|

)

|

|

|

22

|

|

|

|

N/A

|

|

|

Depreciation

|

|

|

736

|

|

|

|

643

|

|

|

|

666

|

|

|

|

-9.5

|

%

|

|

|

2,052

|

|

|

|

1,945

|

|

|

|

-5.2

|

%

|

|

Capital expenditures

|

|

|

783

|

|

|

|

632

|

|

|

|

725

|

|

|

|

-7.4

|

%

|

|

|

2,436

|

|

|

|

1,961

|

|

|

|

-19.5

|

%

|

|

Adj. EBITDA

|

|

|

817

|

|

|

|

621

|

|

|

|

690

|

|

|

|

N/A

|

|

|

|

179

|

|

|

|

2,028

|

|

|

|

N/A

|

|

|

DOWNSTREAM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

2,886

|

|

|

|

2,909

|

|

|

|

2,875

|

|

|

|

-0.3

|

%

|

|

|

8,299

|

|

|

|

8,611

|

|

|

|

3.8

|

%

|

|

Operating income

|

|

|

22

|

|

|

|

197

|

|

|

|

186

|

|

|

|

734.3

|

%

|

|

|

181

|

|

|

|

662

|

|

|

|

265.3

|

%

|

|

Depreciation

|

|

|

88

|

|

|

|

103

|

|

|

|

107

|

|

|

|

20.6

|

%

|

|

|

262

|

|

|

|

310

|

|

|

|

18.6

|

%

|

|

Capital expenditures

|

|

|

167

|

|

|

|

123

|

|

|

|

141

|

|

|

|

-15.4

|

%

|

|

|

449

|

|

|

|

346

|

|

|

|

-22.8

|

%

|

|

Adj. EBITDA

|

|

|

111

|

|

|

|

301

|

|

|

|

292

|

|

|

|

164.3

|

%

|

|

|

443

|

|

|

|

973

|

|

|

|

119.6

|

%

|

|

GAS & ENERGY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

561

|

|

|

|

1,004

|

|

|

|

940

|

|

|

|

67.6

|

%

|

|

|

1,415

|

|

|

|

2,824

|

|

|

|

99.6

|

%

|

|

Operating income

|

|

|

53

|

|

|

|

65

|

|

|

|

86

|

|

|

|

62.9

|

%

|

|

|

80

|

|

|

|

187

|

|

|

|

132.3

|

%

|

|

Depreciation

|

|

|

5

|

|

|

|

4

|

|

|

|

4

|

|

|

|

-19.6

|

%

|

|

|

15

|

|

|

|

12

|

|

|

|

-18.2

|

%

|

|

Capital expenditures

|

|

|

28

|

|

|

|

63

|

|

|

|

39

|

|

|

|

37.9

|

%

|

|

|

86

|

|

|

|

162

|

|

|

|

88.0

|

%

|

|

Adj. EBITDA

|

|

|

58

|

|

|

|

70

|

|

|

|

90

|

|

|

|

56.0

|

%

|

|

|

95

|

|

|

|

199

|

|

|

|

108.8

|

%

|

|

CORPORATE AND OTHER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

(47

|

)

|

|

|

-15

|

|

|

|

-74

|

|

|

|

58.1

|

%

|

|

|

(54

|

)

|

|

|

(172

|

)

|

|

|

219.9

|

%

|

|

Capital expenditures

|

|

|

29

|

|

|

|

13

|

|

|

|

17

|

|

|

|

-39.1

|

%

|

|

|

80

|

|

|

|

48

|

|

|

|

-40.4

|

%

|

|

CONSOLIDATION ADJUSTMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

9

|

|

|

|

49

|

|

|

|

(42

|

)

|

|

|

N/A

|

|

|

|

(11

|

)

|

|

|

(12

|

)

|

|

|

10.2

|

%

|

|

Average exchange rate of period

|

|

|

14.90

|

|

|

|

15.68

|

|

|

|

17.23

|

|

|

|

|

|

|

|

14.51

|

|

|

|

16.18

|

|

|

|

|

|

|

Exchange rate end of period

|

|

|

15.26

|

|

|

|

16.58

|

|

|

|

17.26

|

|

|

|

|

|

|

|

15.26

|

|

|

|

17.26

|

|

|

|

|

|

NOTE: The calculation of the main financial figures in U.S. dollars is derived from the calculation of the financial results

expressed in Argentine pesos using the average exchange rate for each period. Accumulated periods correspond to the sum of the quarterly results.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima

|

|

|

|

|

|

|

Date: November 8, 2017

|

|

|

|

By:

|

|

/s/ Diego Celaá

|

|

|

|

|

|

Name:

|

|

Diego Celaá

|

|

|

|

|

|

Title:

|

|

Market Relations Officer

|

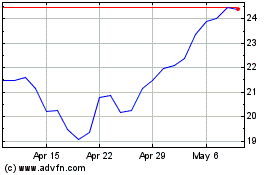

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

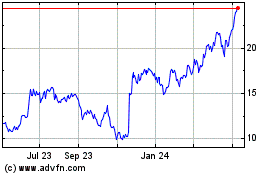

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024