Q3 Total Revenue of $100.5 million, up 41%

year-over-year

Q3 Base Revenue of $92.0 million, up 43%

year-over-year

Q3 Dollar-Based Net Expansion Rate of 122%

Twilio Inc. (NYSE: TWLO), the leading Cloud Communications

Platform company, today reported financial results for its third

quarter ended September 30, 2017.

“We hit a number of exciting milestones in Q3, including our

first $100 million revenue quarter, our first enterprise license

agreement for our higher level software products, and the launch of

Twilio Studio,” said Jeff Lawson, Twilio’s Co-Founder and Chief

Executive Officer. “With Twilio Studio, the visual builder for

Twilio, we can accelerate our customers’ roadmaps and help an even

larger set of users build on our platform. We are excited by the

size, scale and diversity of what new and existing customers are

creating with Twilio.”

Third Quarter 2017 Financial Highlights

- Total revenue of $100.5 million for the

third quarter of 2017, up 41% from the third quarter of 2016 and 5%

sequentially from the second quarter of 2017.

- Base revenue of $92.0 million for the

third quarter of 2017, up 43% from the third quarter of 2016 and 5%

sequentially from the second quarter of 2017.

- GAAP loss from operations of $24.0

million for the third quarter of 2017, compared with GAAP loss from

operations of $11.3 million for the third quarter of 2016. Non-GAAP

loss from operations of $7.7 million for the third quarter of 2017,

compared with non-GAAP loss from operations of $3.4 million for the

third quarter of 2016.

- GAAP net loss per share attributable to

common stockholders of $0.25 based on 92.2 million weighted average

shares outstanding in the third quarter of 2017, compared with GAAP

net loss per share attributable to common stockholders of $0.13

based on 83.9 million weighted average shares outstanding in the

third quarter of 2016.

- Non-GAAP net loss per share

attributable to common stockholders of $0.08 based on 92.2 million

weighted average shares outstanding in the third quarter of 2017,

compared with non-GAAP net loss per share attributable to common

stockholders of $0.04 based on 83.9 million weighted average shares

outstanding in the third quarter of 2016.

Key Metrics and Recent Business Highlights

- 46,489 Active Customer Accounts as of

September 30, 2017, compared to 34,457 Active Customer Accounts as

of September 30, 2016.

- Dollar-Based Net Expansion Rate was

122% for the third quarter of 2017, compared to 155% for the third

quarter of 2016.

- Gathered developers, executives, and

partners from companies around the world to celebrate what they are

building on our platform at our second annual Signal London

event.

- Advanced the Twilio Engagement Cloud

through the launch of Twilio Studio in preview. Twilio Studio is a

drag and drop visual editor designed to both expand the universe of

people that can engage with our platform and accelerate their

development time.

- Announced our commitment to meet the

new GDPR (General Data Protection Regulation) requirements coming

from the EU, using this as an opportunity to raise the bar for data

protection worldwide for all of our customers.

- Expanded the reach of our Super Network

by announcing the availability of Twilio phone numbers in more than

100 countries.

Outlook

Twilio is providing guidance for the fourth quarter ending

December 31, 2017 and full year ending December 31, 2017 as

follows:

Quarter ending December 31,

2017: Total

Revenue (millions) $ 102.5 to $ 104.5 Base Revenue (millions) $

96.5 to $ 97.5 Non-GAAP loss from operations (millions) $ 6.5 to $

5.5 Non-GAAP net loss per share 0.06 to 0.05 Weighted average

shares outstanding 93.5

Full year ending December

31, 2017:

Total Revenue (millions) $ 386.5 to $ 388.5 Base Revenue (millions)

$ 356.5 to $ 357.5 Non-GAAP loss from operations (millions) $ 23.0

to $ 22.0 Non-GAAP net loss per share 0.23 to 0.22 Non-GAAP

weighted average shares outstanding 92.0

Conference Call Information

Twilio will host a conference call today, November 8, 2017, to

discuss third quarter 2017 financial results, as well as the fourth

quarter and full year 2017 outlook, at 2 p.m. Pacific Time, 5 p.m.

Eastern Time. A live webcast of the conference call, as well as a

replay of the call, will be available at

https://investors.twilio.com. The conference call can also be

accessed by dialing (844) 453-4207, or +1 (647) 253-8638 (outside

the U.S. and Canada). The conference ID is 89077229. Following the

completion of the call through 11:59 PM Eastern Time on November

15, 2017, a replay will be available by dialing (800) 585-8367 or

+1 (416) 621-4642 (outside the U.S. and Canada) and entering

passcode 89077229. Twilio has used, and intends to continue to use,

its investor relations website as a means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD.

About Twilio Inc.

Twilio's mission is to fuel the future of communications.

Developers and businesses use Twilio to make

communications relevant and contextual by embedding messaging,

voice, and video capabilities directly into their software

applications. Founded in 2008, Twilio has over 900 employees,

with headquarters in San Francisco and other offices in

Bogotá, Dublin, Hong Kong, London, Madrid, Malm�,

Mountain View, Munich, New York

City, Singapore and Tallinn.

Forward-Looking Statements

This press release and the accompanying conference call contains

forward-looking statements within the meaning of the federal

securities laws, which statements involve substantial risks and

uncertainties. Forward-looking statements generally relate to

future events or our future financial or operating performance. In

some cases, you can identify forward-looking statements because

they contain words such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential” or

“continue” or the negative of these words or other similar terms or

expressions that concern our expectations, strategy, plans or

intentions. Forward-looking statements contained in this press

release include, but are not limited to, statements about: Twilio’s

outlook for the quarter ending December 31, 2017 and full year

ending December 31, 2017; Twilio’s commitment to comply with the

new EU General Data Protection Regulation going into effect in

2018; and Twilio’s expectations regarding its products and

solutions. You should not rely upon forward-looking statements as

predictions of future events.

The outcome of the events described in these forward-looking

statements is subject to known and unknown risks, uncertainties,

and other factors that may cause Twilio’s actual results,

performance, or achievements to differ materially from those

described in the forward-looking statements, including, among other

things: adverse changes in general economic or market conditions;

changes in the market for communications; Twilio’s ability to adapt

its products to meet evolving market and customer demands and rapid

technological change; Twilio’s ability to generate sufficient

revenues to achieve or sustain profitability; Twilio’s ability to

retain customers and attract new customers; Twilio’s limited

operating history, which makes it difficult to evaluate its

prospects and future operating results; Twilio’s ability to

effectively manage its growth; and Twilio’s ability to compete

effectively in an intensely competitive market.

The forward-looking statements contained in this press release

are also subject to additional risks, uncertainties, and factors,

including those more fully described in Twilio’s most recent

filings with the Securities and Exchange Commission, including its

Form 10-Q for the quarter ended June 30, 2017 filed on August 10,

2017. Further information on potential risks that could affect

actual results will be included in the subsequent periodic and

current reports and other filings that Twilio makes with the

Securities and Exchange Commission from time to time. Moreover,

Twilio operates in a very competitive and rapidly changing

environment, and new risks and uncertainties may emerge that could

have an impact on the forward-looking statements contained in this

press release.

Forward-looking statements represent Twilio’s management’s

beliefs and assumptions only as of the date such statements are

made. Twilio undertakes no obligation to update any forward-looking

statements made in this press release to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

Use of Non-GAAP Financial Measures

To provide investors and others with additional information

regarding Twilio’s results, the following non-GAAP financial

measures are disclosed: non-GAAP gross profit and gross margin,

non-GAAP operating expenses, non-GAAP loss from operations and

operating margin, non-GAAP net loss attributable to common

stockholders, and non-GAAP net loss per share attributable to

common stockholders, basic and diluted.

Non-GAAP Gross Profit and Non-GAAP Gross Margin. For the

periods presented, Twilio defines non-GAAP gross profit and

non-GAAP gross margin as GAAP gross profit and GAAP gross margin,

respectively, adjusted to exclude stock-based compensation and

amortization of acquired intangibles.

Non-GAAP Operating Expenses. For the periods presented,

Twilio defines non-GAAP operating expenses (including categories of

operating expenses) as GAAP operating expenses (and categories of

operating expenses) adjusted to exclude, as applicable, stock-based

compensation, amortization of acquired intangibles,

acquisition-related expenses, and payroll taxes related to

stock-based compensation.

Non-GAAP Loss from Operations and Non-GAAP Operating

Margin. For the periods presented, Twilio defines non-GAAP loss

from operations and non-GAAP operating margin as GAAP loss from

operations and GAAP operating margin, respectively, adjusted to

exclude stock-based compensation, amortization of acquired

intangibles, acquisition-related expenses, and payroll taxes

related to stock-based compensation.

Non-GAAP Net Loss Attributable to Common Stockholders and

Non-GAAP Net Loss Per Share Attributable to Common Stockholders,

Basic and Diluted. For the periods presented, Twilio defines

non-GAAP net loss attributable to common stockholders and non-GAAP

net loss per share attributable to common stockholders, basic and

diluted, as GAAP net loss attributable to common stockholders and

GAAP net loss per share attributable to common stockholders, basic

and diluted, respectively, adjusted to exclude stock-based

compensation, amortization of acquired intangibles,

acquisition-related expenses, and payroll taxes related to

stock-based compensation.

Twilio’s management uses the foregoing non-GAAP financial

information, collectively, to evaluate its ongoing operations and

for internal planning and forecasting purposes. Twilio’s management

believes that non-GAAP financial information, when taken

collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance,

facilitates period-to-period comparisons of results of operations,

and assists in comparisons with other companies, many of which use

similar non-GAAP financial information to supplement their GAAP

results. Non-GAAP financial information is presented for

supplemental informational purposes only, and should not be

considered a substitute for financial information presented in

accordance with GAAP, and may be different from similarly-titled

non-GAAP measures used by other companies. Whenever Twilio uses a

non-GAAP financial measure, a reconciliation is provided to the

most directly comparable financial measure stated in accordance

with GAAP. Investors are encouraged to review the related GAAP

financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measures.

With respect to Twilio’s guidance as provided under “Outlook”

above, Twilio has not reconciled its expectations as to non-GAAP

loss from operations to GAAP loss from operations or non-GAAP net

loss per share to GAAP net loss per share because stock-based

compensation expense cannot be reasonably calculated or predicted

at this time. Accordingly, a reconciliation is not available

without unreasonable effort.

Operating Metrics

Twilio reviews a number of operating metrics to evaluate its

business, measure performance, identify trends, formulate business

plans, and make strategic decisions. These include the number of

Active Customer Accounts, Base Revenue, and Dollar-Based Net

Expansion Rate.

Number of Active Customer Accounts. Twilio believes that

the number of Active Customer Accounts is an important indicator of

the growth of its business, the market acceptance of its platform

and future revenue trends. Twilio defines an Active Customer

Account at the end of any period as an individual account, as

identified by a unique account identifier, for which Twilio has

recognized at least $5 of revenue in the last month of the period.

Twilio believes that use of its platform by customers at or above

the $5 per month threshold is a stronger indicator of potential

future engagement than trial usage of its platform or usage at

levels below $5 per month. A single organization may constitute

multiple unique Active Customer Accounts if it has multiple account

identifiers, each of which is treated as a separate Active Customer

Account.

Base Revenue. Twilio monitors Base Revenue as one of the

more reliable indicators of future revenue trends. Base Revenue

consists of all revenue other than revenue from large Active

Customer Accounts that have never entered into 12-month minimum

revenue commitment contracts with Twilio, which the Company refers

to as Variable Customer Accounts. While almost all of Twilio’s

customers exhibit some level of variability in the usage of its

products, based on the experience of Twilio’s management, Twilio

believes that Variable Customer Accounts are more likely to have

significant fluctuations in usage of its products from period to

period, and therefore that revenue from Variable Customer Accounts

may also fluctuate significantly from period to period. This

behavior is best evidenced by the decision of such customers not to

enter into contracts with Twilio that contain minimum revenue

commitments, even though they may spend significant amounts on the

use of the Company’s products and they may be foregoing more

favorable terms often available to customers that enter into

committed contracts with Twilio. This variability adversely affects

Twilio’s ability to rely upon revenue from Variable Customer

Accounts when analyzing expected trends in future revenue.

For historical periods through March 31, 2016, Twilio defined a

Variable Customer Account as an Active Customer Account that (i)

had never signed a minimum revenue commitment contract with the

Company for a term of at least 12 months and (ii) has met or

exceeded 1% of the Company’s revenue in any quarter in the periods

presented through March 31, 2016. To allow for consistent

period-to-period comparisons, in the event a customer qualified as

a Variable Customer Account as of March 31, 2016, or a previously

Variable Customer Account ceased to be an Active Customer Account

as of such date, Twilio included such customer as a Variable

Customer Account in all periods presented. For reporting periods

starting with the three months ended June 30, 2016, Twilio defines

a Variable Customer Account as a customer account that (a) has been

categorized as a Variable Customer Account in any prior quarter, as

well as (b) any new customer account that (i) has never signed a

minimum revenue commitment contract with Twilio for a term of at

least 12 months and (ii) meets or exceeds 1% of the Company’s

revenue in a quarter. Once a customer account is deemed to be a

Variable Customer Account in any period, they remain a Variable

Customer Account in subsequent periods unless they enter into a

minimum revenue commitment contract with Twilio for a term of at

least 12 months.

Dollar-Based Net Expansion Rate. Twilio’s ability to

drive growth and generate incremental revenue depends, in part, on

the Company’s ability to maintain and grow its relationships with

existing Active Customer Accounts and to increase their use of the

platform. An important way in which Twilio tracks its performance

in this area is by measuring the Dollar-Based Net Expansion Rate

for Active Customer Accounts, other than Variable Customer

Accounts. Twilio’s Dollar-Based Net Expansion Rate increases when

such Active Customer Accounts increase their usage of a product,

extend their usage of a product to new applications or adopt a new

product. Twilio’s Dollar-Based Net Expansion Rate decreases when

such Active Customer Accounts cease or reduce their usage of a

product or when the Company lowers usage prices on a product. As

our customers grow their businesses and extend the use of our

platform, they sometimes create multiple customer accounts with us

for operational or other reasons. As such, for reporting periods

starting with the three months ended December 31, 2016, when we

identify a significant customer organization (defined as a single

customer organization generating more than 1% of revenue in a

quarterly reporting period) that has created a new Active Customer

Account, this new Active Customer Account is tied to, and revenue

from this new Active Customer Account is included with, the

original Active Customer Account for the purposes of calculating

this metric. Twilio believes that measuring Dollar-Based Net

Expansion Rate on revenue generated from Active Customer Accounts,

other than Variable Customer Accounts, provides a more meaningful

indication of the performance of the Company’s efforts to increase

revenue from existing customer accounts.

Twilio’s Dollar-Based Net Expansion Rate compares the revenue

from Active Customer Accounts, other than Variable Customer

Accounts, in a quarter to the same quarter in the prior year. To

calculate the Dollar-Based Net Expansion Rate, the Company first

identifies the cohort of Active Customer Accounts, other than

Variable Customer Accounts, that were Active Customer Accounts in

the same quarter of the prior year. The Dollar-Based Net Expansion

Rate is the quotient obtained by dividing the revenue generated

from that cohort in a quarter, by the revenue generated from that

same cohort in the corresponding quarter in the prior year. When

Twilio calculates Dollar-Based Net Expansion Rate for periods

longer than one quarter, it uses the average of the applicable

quarterly Dollar-Based Net Expansion Rates for each of the quarters

in such period.

Source: Twilio Inc.

TWILIO INC. Condensed

Consolidated Statements of Operations (In thousands, except

share and per share amounts) (Unaudited) Three Months

Ended September 30, 2017 2016

Revenue $ 100,542 $ 71,533 Cost of revenue 48,254

31,285 Gross profit 52,288 40,248 Operating

expenses: Research and development 31,674 21,106 Sales and

marketing 25,778 15,873 General and administrative 18,867

14,545 Total operating expenses 76,319 51,524

Loss from operations (24,031 ) (11,276 ) Other income, net 1,000

138 Loss before provision for income taxes (23,031 )

(11,138 ) Provision for income taxes (422 ) (116 ) Net loss

attributable to common stockholders $ (23,453 ) $ (11,254 )

Net loss per share attributable to common stockholders, basic and

diluted $ (0.25 ) $ (0.13 ) Weighted-average shares used in

computing net loss per share attributable to common stockholders,

basic and diluted 92,156,768 83,887,901

TWILIO INC. Condensed Consolidated Balance Sheets

(In thousands) (Unaudited) As of As

of September 30, December 31, Assets

2017 2016 Current assets: Cash and cash equivalents $

91,906 $ 305,665 Short-term marketable securities 192,031 -

Accounts receivable, net 37,258 26,203 Prepaid expenses and other

current assets 26,420 21,512 Total current assets

347,615 353,380 Restricted cash 7,450 7,445 Property and equipment,

net 47,718 37,552 Intangible assets, net 21,274 10,268 Goodwill

17,407 3,565 Other long-term assets 2,084 484 Total

assets $ 443,548 $ 412,694

Liabilities and

Stockholders’ Equity Current liabilities: Accounts payable $

7,117 $ 4,174 Accrued expenses and other current liabilities 55,283

59,308 Deferred revenue 13,599 10,222 Total current

liabilities 75,999 73,704 Long-term liabilities 12,549 9,543

Total liabilities 88,548 83,247 Commitments

and contingencies Stockholders’ equity: Common stock 93 87

Additional paid-in capital 584,390 516,090 Accumulated other

comprehensive income 2,036 - Accumulated deficit (231,519 )

(186,730 ) Total stockholders’ equity 355,000 329,447

Total liabilities and stockholders’ equity $ 443,548 $

412,694

TWILIO INC. Condensed

Consolidated Statements of Cash Flow (In thousands)

(Unaudited) Nine Months Ended

September 30, 2017 2016

Operating Activities: Net loss $ (44,789 ) $ (28,716 )

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: Depreciation and amortization 13,406 5,292

Amortization of bond premium 153 - Stock-based compensation 35,973

15,649 Provision for doubtful accounts 407 1,017 Gain on lease

termination (295 ) - Write-off of internally developed software 96

188 Changes in assets and liabilities: Accounts receivable (9,173 )

(11,275 ) Prepaid expenses and other current assets (4,947 )

(11,561 ) Other long-term assets (1,512 ) (59 ) Accounts payable

1,411 2,317 Accrued expenses and other current liabilities (1,454 )

18,625 Deferred revenue 3,364 3,346 Long-term liabilities 306

9,596 Net cash provided by (used in) operating

activities $ (7,054 ) $ 4,419

Investing

Activities: (Increase) decrease in restricted cash 1,170 (7,439

) Purchases of marketable securities (280,569 ) - Maturities of

marketable securities 87,325 - Capitalized software development

costs (12,281 ) (8,447 ) Purchases of property and equipment (8,613

) (5,282 ) Purchases of intangible assets (206 ) (646 )

Acquisition, net of cash acquired (22,621 ) - Net cash used

in investing activities $ (235,795 ) $ (21,814 )

Financing Activities: Proceeds from initial public offering,

net of underwriting discounts - 160,426 Payments of costs related

to public offerings (430 ) (3,936 ) Proceeds from exercises of

stock options 22,504 4,751 Proceeds from shares issued in ESPP

7,404 - Tax benefit related to stock-based compensation - 62 Value

of equity awards withheld for tax liabilities (476 ) (518 ) Net

cash provided by financing activities $ 29,002 $ 160,785

Effect of exchange rate changes on cash and cash

equivalents 88 - Net increase (decrease) in cash and cash

equivalents (213,759 ) 143,390 Cash and cash equivalents at

beginning of period 305,665 108,835 Cash and cash

equivalents at end of period $ 91,906 $ 252,225

TWILIO INC. Reconciliation to

Non-GAAP Financial Measures (In thousands, except share and

per share amounts) (Unaudited) Three Months Ended

September 30, 2017 2016

Gross profit $ 52,288 $ 40,248 Non-GAAP adjustments:

Stock-based compensation 180 84 Amortization of acquired

intangibles 1,250 70 Non-GAAP gross profit $ 53,718

$ 40,402 Non-GAAP gross margin 53 % 56 %

Research and development $ 31,674 $ 21,106 Non-GAAP

adjustments: Stock-based compensation (6,493 ) (3,741 )

Amortization of acquired intangibles (25 ) (38 ) Payroll taxes

related to stock-based compensation (315 ) - Non-GAAP

research and development $ 24,841 $ 17,327

Non-GAAP research and development as % of revenue 25 % 24 %

Sales and marketing $ 25,778 $ 15,873 Non-GAAP adjustments:

Stock-based compensation (2,603 ) (1,432 ) Amortization of acquired

intangibles (220 ) - Payroll taxes related to stock-based

compensation (148 ) - Non-GAAP sales and marketing $ 22,807

$ 14,441 Non-GAAP sales and marketing as % of

revenue 23 % 20 %

General and administrative $ 18,867

$ 14,545 Non-GAAP adjustments: Stock-based compensation (4,912 )

(2,391 ) Amortization of acquired intangibles (20 ) (28 )

Acquisition related expenses (35 ) (137 ) Payroll taxes related to

stock-based compensation (132 ) - Non-GAAP general and

administrative $ 13,768 $ 11,989 Non-GAAP

general and administrative as % of revenue 14 % 17 %

Loss

from operations and margin $ (24,031 ) $ (11,276 ) Non-GAAP

adjustments: Stock-based compensation 14,188 7,648 Amortization of

acquired intangibles 1,515 136 Acquisition related expenses 35 137

Payroll taxes related to stock-based compensation 595 -

Non-GAAP loss from operations $ (7,698 ) $ (3,355 )

Non-GAAP operating margin (8 %) (5 %)

TWILIO INC.

Reconciliation to Non-GAAP Financial

Measures

(In thousands, except share and per

share amounts)

Three Months Ended

(Unaudited)

September 30,

2017

2016

Net loss attributable to common

stockholders

$

(23,453

)

$

(11,254

)

Non-GAAP adjustments: Stock-based compensation 14,188 7,648

Amortization of acquired intangibles 1,515 136 Acquisition related

expenses 35 137 Payroll taxes related to stock-based compensation

595 - Non-GAAP net loss attributable to common

stockholders $ (7,120 ) $ (3,333 )

Non-GAAP net loss attributable to common

stockholders as % of revenue

(7 %) (5 %)

Net loss per share attributable to

common stockholders, basic and diluted*

$ (0.25 ) $ (0.13 ) Non-GAAP adjustments: Stock-based compensation

0.15 0.09 Amortization of acquired intangibles 0.02 0.00

Acquisition related expenses 0.00 0.00 Payroll taxes related to

stock-based compensation 0.01 - Non-GAAP net loss per

share attributable to common stockholders, basic and diluted $

(0.08 ) $ (0.04 )

Weighted-average shares used to compute

Non-GAAP net loss per share attributable to common stockholders,

basic and diluted

92,156,768 83,887,901 * Some columns may not add due to

rounding

TWILIO INC.

Key Metrics (Unaudited) March 31,

June 30, Sept. 30, Dec. 31, March 31,

June 30, Sept. 30, 2016

2016 2016 2016

2017 2017

2017 Number of Active Customers (as of period

end date) 28,648 30,780 34,457 36,606 40,696 43,431 46,489 Base

Revenue (in thousands) $ 49,834 $ 56,370 $ 64,099 $ 75,245 $ 80,643

$ 87,583 $ 91,965 Base Revenue Growth Rate 92 % 84 % 75 % 73 % 62 %

55 % 43 % Dollar-Based Net Expansion Rate 170 % 164 % 155 % 155 %

141 % 131 % 122 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171108006399/en/

Twilio Inc.Investor Contact:Greg Kleinerir@Twilio.comorMedia

Contact:Caitlin Epsteinpress@Twilio.com

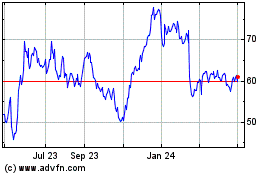

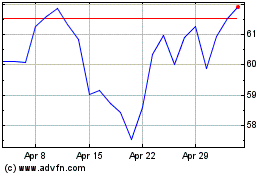

Twilio (NYSE:TWLO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Twilio (NYSE:TWLO)

Historical Stock Chart

From Apr 2023 to Apr 2024