REGENXBIO Reports Third Quarter 2017 Financial Results and Recent Operational Highlights

November 08 2017 - 4:05PM

REGENXBIO Inc. (Nasdaq:RGNX), a leading clinical-stage

biotechnology company seeking to improve lives through the curative

potential of gene therapy based on its proprietary NAV® Technology

Platform, today announced financial results for the third quarter

ended September 30, 2017 and recent operational highlights.

“We continue to make meaningful progress in the clinical

development of our lead product candidates, most notably with the

recent completion of dosing of the second cohort in our Phase I

clinical trial evaluating RGX-314 for the treatment of wet AMD and

completion of dosing in the first cohort in our Phase I/II clinical

trial evaluating RGX-501 for the treatment of HoFH,” said Kenneth

T. Mills, President and Chief Executive Officer of

REGENXBIO. "We remain committed to advancing our internal and

partnered gene therapy product candidates, leveraging our

proprietary NAV Technology Platform to evaluate the curative

potential of one-time administrations of gene therapy for patients

with significant unmet need. We look forward to providing

additional trial details on our lead product candidates, including

interim updates from the RGX-314 Phase I clinical trial and the

RGX-501 Phase I/II clinical trial, as part of our year-end 2017

corporate update.”

Recent Operational Highlights

- REGENXBIO completed dosing of the second cohort in the Phase I

clinical trial evaluating RGX-314 for the treatment of wet

age-related macular degeneration (wet AMD). A total of 12 patients,

from four different sites, have now been treated with RGX-314 in

the Phase I clinical trial. Based on the 12 patients dosed, we are

encouraged by the preliminary safety and tolerability profile

observed with RGX-314. Following a scheduled review by an

independent Data Safety and Monitoring Board (DSMB), the Company

expects to initiate dosing of the third cohort in the Phase I

clinical trial by the first quarter of 2018. REGENXBIO expects to

provide further details regarding the RGX-314 clinical trial,

including updates on enrollment, procedural implementation and

preliminary safety and tolerability, in the Company’s year-end 2017

corporate update scheduled to be released during the first week of

January 2018.

- Dosing of the first cohort of three patients was completed in

the Phase I/II clinical trial evaluating RGX-501 for the treatment

of homozygous familial hypercholesterolemia (HoFH). Review of data

from the first cohort has been conducted by an independent DSMB,

who has granted clearance to proceed to the next dosing cohort

based on their assessment of the safety and tolerability data. The

Company anticipates dosing of the second cohort in the trial to be

initiated prior to year-end 2017. REGENXBIO expects to provide

further details regarding the RGX-501 clinical trial, including

updates on enrollment and preliminary safety and tolerability, in

the Company’s year-end 2017 corporate update.

- REGENXBIO’s Investigational New Drug (IND) application is now

active for the Phase I clinical trial of RGX-111 for the treatment

of Mucopolysaccharidosis Type I (MPS I). Site activation in the

planned multi-center, open-label, multiple-cohort, dose-escalation

trial is underway to support recruitment and patient enrollment,

with the first patient expected to be dosed in the first half of

2018.

- REGENXBIO plans to file an IND application for RGX-121 for the

treatment of Mucopolysaccharidosis Type II (MPS II) in the fourth

quarter of 2017, which will incorporate feedback received from the

U.S. Food and Drug Administration (FDA) in its review of the IND

application for RGX-111.

- In September 2017, REGENXBIO further strengthened its

management team with the appointment of Shiva Fritsch as Senior

Vice President, Human Resources. Ms. Fritsch brings significant

expertise in the biotechnology industry, previously serving in

human resources leadership roles at Human Genome Sciences, Inc.,

the Howard Hughes Medical Institute and, most recently, at Novavax,

Inc.

- In October 2017, REGENXBIO initiated the build-out of a

state-of-the-art Research and Development facility and currently

expects to complete the build-out in 2018. The new 15,000

square foot facility supports the expansion of REGENXBIO’s internal

gene therapy research capabilities for the creation of new gene

therapy technologies and the origination of new lead product

candidates and will be adjacent to REGENXBIO’s advanced

manufacturing and analytics lab located in Rockville,

Maryland.

- As of September 30, 2017, REGENXBIO’s NAV Technology Platform

was being applied in the development of more than 20 partnered

product candidates by 10 NAV Technology Licensees. Seven of these

partnered product candidates are in active clinical

development.

- In October 2017, Shire plc announced the FDA had awarded Orphan

Drug Designation to its gene therapy candidate SHP654 for the

treatment of hemophilia A. SHP654 uses the NAV AAV8

vector.

- In September 2017, AveXis, Inc. announced that it has commenced

the pivotal trial of AVXS-101 for the treatment of spinal muscular

atrophy (SMA) Type 1. AVXS-101 uses the NAV AAV9 vector.

- Also in September 2017, Audentes Therapeutics, Inc. announced

dosing of the first patient in the Phase I/II clinical trial

evaluating AT132 for the treatment of X-linked myotubular myopathy.

AT132 uses the NAV AAV8 vector.

- In August 2017, Dimension Therapeutics, Inc., which was

subsequently acquired by Ultragenyx Pharmaceutical Inc., announced

dosing of the first patient in the Phase I/II clinical trial of

DTX301 for the treatment of ornithine transcarbamylase (OTC)

deficiency. DTX301 uses the NAV AAV8 vector.

Financial Results

Cash, cash equivalents and marketable securities were $191.1

million as of September 30, 2017, compared to $159.0 million as of

December 31, 2016. Revenues were $1.3 million for the three months

ended September 30, 2017, compared to $0.1 million for the three

months ended September 30, 2016. Total operating expenses were

$22.6 million for the three months ended September 30, 2017,

compared to $18.8 million for the three months ended September 30,

2016. Net loss was $20.7 million, or $0.67 net loss per basic and

diluted common share, for the three months ended September 30,

2017, compared to $18.2 million, or $0.69 net loss per basic and

diluted share, for the three months ended September 30, 2016.

Financial Guidance

REGENXBIO continues to expect full-year 2017 cash burn to be

between $75 million and $80 million, which will support the

continued development of its lead product candidate programs.

Full-year 2017 cash burn guidance excludes the effect of

REGENXBIO’s previously announced underwritten public offering of

common stock in March 2017, which resulted in aggregate net

proceeds to REGENXBIO of approximately $81.5 million, after

deducting underwriting discounts and commissions and offering

expenses.

Conference Call Information

In connection with the earnings release, REGENXBIO will host a

conference call today at 4:30 p.m. ET. To access the live call

by phone, dial (855) 422-8964 (domestic) or (210) 229-8819

(international), and enter the passcode 96009722. To access a live

or recorded webcast of the call, please visit the “Investors”

section of the REGENXBIO website

at www.regenxbio.com. The recorded webcast will be available

for approximately 30 days following the call.

About REGENXBIO Inc.

REGENXBIO is a leading clinical-stage biotechnology company

seeking to improve lives through the curative potential of gene

therapy. REGENXBIO’s NAV® Technology Platform, a proprietary

adeno-associated virus (AAV) gene delivery platform, consists of

exclusive rights to more than 100 novel AAV vectors, including

AAV7, AAV8, AAV9 and AAVrh10. REGENXBIO and its

third-party NAV Technology Platform Licensees are applying the NAV

Technology Platform in the development of a broad pipeline of

candidates in multiple therapeutic areas.

Forward Looking Statements

This press release includes “forward-looking statements,” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These statements express a belief,

expectation or intention and are generally accompanied by words

that convey projected future events or outcomes such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “design,”

“intend,” “expect,” “could,” “plan,” “potential,” “predict,”

“seek,” “should,” “would” or by variations of such words or by

similar expressions. The forward-looking statements include

statements relating to, among other things, statements about

REGENXBIO’s future operations, costs and cash flow. REGENXBIO

has based these forward-looking statements on its current

expectations and assumptions and analyses made by REGENXBIO in

light of its experience and its perception of historical trends,

current conditions and expected future developments, as well as

other factors REGENXBIO believes are appropriate under the

circumstances. However, whether actual results and

developments will conform with REGENXBIO’s expectations and

predictions is subject to a number of risks and uncertainties,

including the timing of enrollment, commencement and completion of

REGENXBIO’s clinical trials; the timing and success of preclinical

studies and clinical trials conducted by REGENXBIO and its

development partners, the timely development and launch of new

products, the ability to obtain and maintain regulatory approval of

product candidates, the ability to obtain and maintain intellectual

property protection for product candidates and technology, trends

and challenges in the business and markets in which REGENXBIO

operates, the size and growth of potential markets for product

candidates and the ability to serve those markets, the rate and

degree of acceptance of product candidates, and other factors, many

of which are beyond the control of REGENXBIO. Refer to the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of

REGENXBIO’s Annual Report on Form 10-K for the year ended December

31, 2016 and comparable “risk factors” sections of REGENXBIO’s

Quarterly Reports on Form 10-Q and other filings, which have been

filed with the U.S. Securities and Exchange Commission (SEC) and

are available on the SEC’s website at www.sec.gov. All of the

forward-looking statements made in this press release are expressly

qualified by the cautionary statements contained or referred to

herein. The actual results or developments anticipated may not be

realized or, even if substantially realized, they may not have the

expected consequences to or effects on REGENXBIO or its businesses

or operations. Such statements are not guarantees of future

performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

Readers are cautioned not to rely too heavily on the

forward-looking statements contained in this press release.

These forward-looking statements speak only as of the date of this

press release. REGENXBIO does not undertake any obligation,

and specifically declines any obligation, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

| |

| REGENXBIO INC.CONSOLIDATED

BALANCE SHEETS(unaudited)(in

thousands, except per share data) |

| |

|

|

|

September 30, 2017 |

|

|

December 31, 2016 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

59,884 |

|

|

$ |

24,840 |

|

|

Marketable securities |

|

|

106,778 |

|

|

|

64,714 |

|

| Accounts

receivable |

|

|

884 |

|

|

|

1,032 |

|

| Prepaid

expenses |

|

|

3,225 |

|

|

|

1,775 |

|

| Other

current assets |

|

|

1,390 |

|

|

|

1,010 |

|

| Total

current assets |

|

|

172,161 |

|

|

|

93,371 |

|

| Marketable

securities |

|

|

24,485 |

|

|

|

69,412 |

|

| Property and equipment,

net |

|

|

11,548 |

|

|

|

9,324 |

|

| Restricted cash |

|

|

225 |

|

|

|

225 |

|

| Other assets |

|

|

836 |

|

|

|

400 |

|

| Total

assets |

|

$ |

209,255 |

|

|

$ |

172,732 |

|

| Liabilities and

Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

2,594 |

|

|

$ |

1,543 |

|

| Accrued

expenses and other current liabilities |

|

|

10,805 |

|

|

|

8,126 |

|

| Total

current liabilities |

|

|

13,399 |

|

|

|

9,669 |

|

| Deferred rent, net of

current portion |

|

|

1,205 |

|

|

|

1,326 |

|

| Total

liabilities |

|

|

14,604 |

|

|

|

10,995 |

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

| Preferred

stock; $0.0001 par value; 10,000 shares authorized, and no

shares issued and outstanding at September 30, 2017 and

December 31, 2016 |

|

|

— |

|

|

|

— |

|

| Common

stock; $0.0001 par value; 100,000 shares authorized at

September 30, 2017 and December 31, 2016; 31,109 and 26,477

shares issued and outstanding at September 30, 2017 and

December 31, 2016, respectively |

|

|

3 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

|

366,960 |

|

|

|

276,354 |

|

|

Accumulated other comprehensive loss |

|

|

(553 |

) |

|

|

(33 |

) |

|

Accumulated deficit |

|

|

(171,759 |

) |

|

|

(114,587 |

) |

| Total

stockholders’ equity |

|

|

194,651 |

|

|

|

161,737 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

209,255 |

|

|

$ |

172,732 |

|

| |

| |

| REGENXBIO INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(unaudited)(in thousands,

except per share data) |

| |

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| License

revenue |

|

$ |

1,335 |

|

|

$ |

65 |

|

|

$ |

8,345 |

|

|

$ |

2,638 |

|

| Reagent

sales |

|

|

— |

|

|

|

47 |

|

|

|

— |

|

|

|

213 |

|

| Grant

revenue |

|

|

1 |

|

|

|

13 |

|

|

|

8 |

|

|

|

42 |

|

| Total

revenues |

|

|

1,336 |

|

|

|

125 |

|

|

|

8,353 |

|

|

|

2,893 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of

revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing

costs |

|

|

683 |

|

|

|

13 |

|

|

|

2,085 |

|

|

|

528 |

|

| Costs of

reagent sales |

|

|

— |

|

|

|

22 |

|

|

|

6 |

|

|

|

101 |

|

| Research

and development |

|

|

12,518 |

|

|

|

12,560 |

|

|

|

43,054 |

|

|

|

29,423 |

|

| General

and administrative |

|

|

9,444 |

|

|

|

6,200 |

|

|

|

22,421 |

|

|

|

17,848 |

|

| Other

operating expenses (income) |

|

|

— |

|

|

|

(2 |

) |

|

|

74 |

|

|

|

(136 |

) |

| Total

operating expenses |

|

|

22,645 |

|

|

|

18,793 |

|

|

|

67,640 |

|

|

|

47,764 |

|

| Loss from

operations |

|

|

(21,309 |

) |

|

|

(18,668 |

) |

|

|

(59,287 |

) |

|

|

(44,871 |

) |

| Other

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

|

603 |

|

|

|

514 |

|

|

|

2,115 |

|

|

|

1,512 |

|

| Total

other income |

|

|

603 |

|

|

|

514 |

|

|

|

2,115 |

|

|

|

1,512 |

|

| Net

loss |

|

$ |

(20,706 |

) |

|

$ |

(18,154 |

) |

|

$ |

(57,172 |

) |

|

$ |

(43,359 |

) |

| Other

Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on available-for-sale securities, net

of reclassifications of $479 and $20 for the nine months ended

September 30, 2017 and 2016, respectively |

|

|

93 |

|

|

|

332 |

|

|

|

(521 |

) |

|

|

1,572 |

|

| Total

other comprehensive income (loss) |

|

|

93 |

|

|

|

332 |

|

|

|

(521 |

) |

|

|

1,572 |

|

|

Comprehensive loss |

|

$ |

(20,613 |

) |

|

$ |

(17,822 |

) |

|

$ |

(57,693 |

) |

|

$ |

(41,787 |

) |

| Basic and diluted net

loss per common share |

|

$ |

(0.67 |

) |

|

$ |

(0.69 |

) |

|

$ |

(1.94 |

) |

|

$ |

(1.64 |

) |

| Weighted-average basic

and diluted common shares |

|

|

30,940 |

|

|

|

26,469 |

|

|

|

29,440 |

|

|

|

26,386 |

|

|

|

|

CONTACT:

Investors Natalie Wildenradt, 646-681-8192

natalie@argotpartners.com

Media Adam Pawluk, 202-591-4063

apawluk@jpa.com

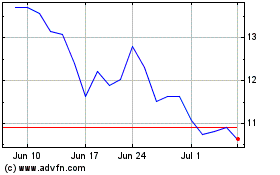

REGENXBIO (NASDAQ:RGNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

REGENXBIO (NASDAQ:RGNX)

Historical Stock Chart

From Apr 2023 to Apr 2024