Athersys, Inc. (Nasdaq:ATHX) today announced its financial results

for the three months ended September 30, 2017.

Highlights of the third quarter of 2017 and

recent events include:

- Our partner in Japan, HEALIOS K.K. (Healios), resumed

enrollment in the TREASURE stroke clinical trial, following a

temporary suspension related to placebo product;

- Entered into agreement with Nikon CeLL innovation Co., Ltd.

(Nikon) to prepare for manufacturing of MultiStem® cell therapy for

future commercialization in Japan by Healios;

- Awarded Regenerative Medicine Advanced Therapy designation

(RMAT) from U.S. Food and Drug Administration (FDA) for MultiStem

ischemic stroke program under the landmark 21st Century Cures

Legislation, which is intended to expedite the development and

regulatory review process and lead to accelerated U.S.

approval;

- Received Final Scientific Advice positive opinion for stroke

program from European Medicines Device Agency (EMA), establishing

alignment between European and U.S. regulators about potential for

product approval following a successful MASTERS-2 study;

- Progressed discussions with multiple parties regarding

collaboration and business opportunities associated with stroke

program;

- Included in Deloitte’s Technology Fast 500™, a ranking of the

500 fastest growing technology, media, telecommunications, life

sciences and energy tech companies in North America;

- Recognized revenues of $0.4 million for quarter ended September

30, 2017 and net loss of $7.2 million, or $0.06 net loss per share;

and

- Maintained a stable balance sheet with cash and cash

equivalents of $28.2 million at the end of the third quarter.

“Over the past year, we have submitted extensive data and

information to the FDA, EMA and other regulators who have conducted

a rigorous review of the results from the MASTERS-1 trial and the

other information we have provided for their consideration,”

commented Dr. Gil Van Bokkelen, Chairman & CEO at Athersys.

“In response, we have received multiple important regulatory

designations, including the Fast Track designation from the FDA

earlier this year and, more recently, the RMAT designation, as well

as the positive opinion from EMA. These actions provide

tangible evidence of the support we have received from regulators

following their careful review of the clinical data and

information, and the potential this program has for redefining

clinical care for patients that have suffered a debilitating

ischemic stroke.

“We are pleased that Healios’ stroke study has

resumed, following the resupply of placebo. In addition to

our support for the ongoing TREASURE study and continued

preparations for the MASTERS-2 study, we are laying the groundwork

for commercialization in anticipation of clinical success. An

important recent step was the establishment of a collaboration with

Nikon to prepare for commercial manufacturing to support initial

commercialization of MultiStem therapy for stroke in Japan.

We are also engaged in related activities to support manufacturing

scale-up and commercial supply.”

Dr. Van Bokkelen continued, “We have also

advanced our discussions with potential business partners to

support development and commercialization activities, particularly

related to our lead stroke program, and we are currently engaged in

active negotiations, discussions and other activities regarding

specific proposals with certain companies. As we have

conveyed previously, we are intent on establishing one or more

partnerships that balance our partner’s contribution of

capabilities and resources, commitment to the program, and

appropriate recognition of the value of the commercial

opportunity. Though we are currently focused on several

possible options, we cannot provide guidance about the precise

nature, scope and size of any potential partnership while this

process is ongoing. Needless to say, this remains an

important priority and objective for the company and our

shareholders.”

Third Quarter

Results

Revenues increased to $0.4 million for the three

months ended September 30, 2017, compared to $0.3 million for the

three months ended September 30, 2016, due to an increase of $0.1

million in grant revenues. Our grant revenues fluctuate from period

to period based on the timing of grant-related activities and the

award and expiration of new grants. Research and development

expenses increased to $5.4 million for the three months ended

September 30, 2017 from $5.3 million in the comparable period in

2016. The $0.1 million increase is primarily comprised of an

increase in preclinical and clinical development costs of $0.8

million partially offset by decreases in internal research supplies

of $0.4 million, sponsored research costs of $0.2 million and

travel costs of $0.1 million.

General and administrative expenses increased to

$2.1 million for the three months ended September 30, 2017 from

$1.8 million in the comparable period in 2016. The $0.3

million increase was due primarily to increases in personnel costs

of $0.1 million, stock-based compensation of $0.1 million and other

administrative costs of $0.1 million.

Net loss was $7.2 million in the 2017 third

quarter, compared to net loss of $6.0 million in the comparable

period in 2016. The difference of $1.2 million reflects the

above variances, as well as a non-recurring $0.2 million gain on

the fair value of warrant liabilities and a non-recurring $0.7

million net gain from insurance proceeds related to flood damage,

both of which were recognized in the third quarter of 2016.

Cash used in operating activities was $6.8

million during the 2017 third quarter, compared to cash used of

$5.5 million in the 2016 third quarter. As of September 30, 2017,

we had $28.2 million in cash and cash equivalents, compared to

$14.8 million at December 31, 2016, which includes, among other

things, the impact of the common stock offering in February 2017,

the exercise of warrants to purchase common stock and proceeds from

the issuance of common stock under our equity purchase

facility.

Conference Call

Gil Van Bokkelen, Chairman and Chief Executive

Officer, and William (BJ) Lehmann, President and Chief Operating

Officer, will host a conference call today to review the results as

follows:

|

Date |

Wednesday, November 8, 2017 |

|

Time |

4:30 p.m. (Eastern Time) |

|

Telephone access: U.S. and Canada |

800-273-1254 |

|

Telephone access: International |

973-638-3440 |

|

Access code |

96178367 |

|

Live webcast |

www.athersys.com, under the Investors section |

A replay will be available for on-demand

listening shortly after the completion of the call until 11:59 PM

Eastern Time on November 22, 2017 at the aforementioned URL, or by

dialing (800) 585-8367 or (855) 859-2056 in the U.S. and Canada, or

from abroad (404) 537-3406, and entering access code 96178367.

About Athersys

Athersys is an international biotechnology

company engaged in the discovery and development of therapeutic

product candidates designed to extend and enhance the quality of

human life. The Company is developing its MultiStem® cell therapy

product, a patented, adult-derived "off-the-shelf" stem cell

product, initially for disease indications in the neurological,

cardiovascular, and inflammatory and immune disease areas, and has

several ongoing clinical trials evaluating this potential

regenerative medicine product. Athersys has forged strategic

partnerships and a broad network of collaborations to further

advance the MultiStem cell therapy toward commercialization.

More information is available at www.athersys.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainties. These

forward-looking statements relate to, among other things, the

expected timetable for development of our product candidates, our

growth strategy, and our future financial performance, including

our operations, economic performance, financial condition,

prospects, and other future events. We have attempted to identify

forward-looking statements by using such words as "anticipates,"

"believes," "can," "continue," "could," "estimates," "expects,"

"intends," "may," "plans," "potential," "should," “suggest,”

"will," or other similar expressions. These forward-looking

statements are only predictions and are largely based on our

current expectations. A number of known and unknown risks,

uncertainties, and other factors could affect the accuracy of these

statements. Some of the more significant known risks that we face

that could cause actual results to differ materially from those

implied by forward-looking statements are the risks and

uncertainties inherent in the process of discovering, developing,

and commercializing products that are safe and effective for use as

human therapeutics, such as the uncertainty regarding regulatory

approval and market acceptance of our product candidates and our

ability to generate revenues, including MultiStem for the treatment

of ischemic stroke, acute myocardial infarction, spinal cord injury

and acute respiratory distress syndrome and other disease

indications, including graft-versus-host disease. These risks may

cause our actual results, levels of activity, performance, or

achievements to differ materially from any future results, levels

of activity, performance, or achievements expressed or implied by

these forward-looking statements. Other important factors to

consider in evaluating our forward-looking statements include: the

success of our collaboration with Healios and others, including our

ability to reach milestones and receive milestone payments, and

whether any products are successfully developed and sold so that we

earn royalty payments; our possible inability to realize

commercially valuable discoveries in our collaborations with

pharmaceutical and other biotechnology companies; our

collaborators' ability to continue to fulfill their obligations

under the terms of our collaboration agreements; the success of our

efforts to enter into new strategic partnerships or collaborations

and advance our programs; our ability to raise additional capital;

results from our MultiStem ongoing and planned clinical trials,

including the MASTERS-2 Phase 3 clinical trial and the Healios

TREASURE clinical trial in Japan; the possibility of delays in,

adverse results of, and excessive costs of the development process;

our ability to successfully initiate and complete clinical trials

within the expected time frame or at all; changes in external

market factors; changes in our industry's overall performance;

changes in our business strategy; our ability to protect our

intellectual property portfolio; our possible inability to execute

our strategy due to changes in our industry or the economy

generally; changes in productivity and reliability of suppliers;

and the success of our competitors and the emergence of new

competitors. You should not place undue reliance on forward-looking

statements contained in this press release, and we undertake no

obligation to publicly update forward-looking statements, whether

as a result of new information, future events or otherwise.

ATHX-G

Contact:

William (B.J.) Lehmann,

J.D.

President and Chief Operating

Officer

Tel: (216)

431-9900bjlehmann@athersys.com

Karen Hunady Corporate CommunicationsTel: (216)

431-9900khunady@athersys.com

David Schull Russo Partners, LLCTel: (212)

845-4271 or (858)

717-2310David.schull@russopartnersllc.com

| |

| (Tables Follow) |

| |

| Athersys, Inc. |

| Condensed Consolidated Balance

Sheets |

| (In thousands) |

|

|

|

|

|

|

September 30, |

December 31, |

|

|

2017 |

2016 |

|

|

(Unaudited) |

(Note) |

|

Assets |

|

|

| Cash and cash

equivalents |

$ |

28,234 |

$ |

14,753 |

| Other current

assets |

|

1,738 |

|

1,527 |

| Equipment, net |

|

2,265 |

|

2,605 |

| Deferred tax

assets |

|

198 |

|

175 |

| Total

assets |

$ |

32,435 |

$ |

19,060 |

| |

|

|

| Liabilities and

stockholders’ equity |

|

|

| Accounts payable and

accrued expenses |

$ |

5,860 |

$ |

6,875 |

| Deferred revenue |

|

503 |

|

-- |

| Warrant

liabilities |

|

-- |

|

1,004 |

| Total stockholders’

equity |

|

26,072 |

|

11,181 |

| Total

liabilities and stockholders’ equity

|

$ |

32,435 |

$ |

19,060 |

|

Note: The Condensed

Consolidated Balance Sheet Data has been derived from the audited

financial statements as of that date. |

| Athersys, Inc. |

| Condensed Consolidated Statements of Operations

and Comprehensive Loss |

| (In Thousands, Except Per Share Amounts) |

|

|

Three months

endedSeptember 30, |

|

|

2017 |

|

2016 |

|

|

Revenues |

|

|

| Contract revenue |

$ |

179 |

|

$ |

150 |

|

| Grant revenue |

|

220 |

|

|

161 |

|

| Total revenues |

|

399 |

|

|

311 |

|

| |

|

|

| Costs and

expenses |

|

|

| Research and

development |

|

5,441 |

|

|

5,263 |

|

| General and

administrative |

|

2,113 |

|

|

1,830 |

|

| Depreciation |

|

177 |

|

|

114 |

|

|

Total costs and expenses |

|

7,731 |

|

|

7,207 |

|

| Gain from insurance

proceeds, net |

|

-- |

|

|

682 |

|

| Loss from

operations |

|

(7,332 |

) |

|

(6,214 |

) |

| Income from change in

fair value of warrants |

|

-- |

|

|

191 |

|

| Other income, net |

|

71 |

|

|

7 |

|

| Loss before

income taxes |

|

(7,261 |

) |

|

(6,016 |

) |

| Income tax

benefit |

|

18 |

|

|

12 |

|

| Net loss and

comprehensive loss |

$ |

(7,243 |

) |

$ |

(6,004 |

) |

| Net loss per share –

Basic and Diluted |

$ |

(0.06 |

) |

$ |

(0.07 |

) |

| Weighted average shares

outstanding – Basic

|

|

114,515,405 |

|

|

84,928,198 |

|

| Weighted average shares

outstanding – Diluted

|

|

114,515,405 |

|

|

85,896,993 |

|

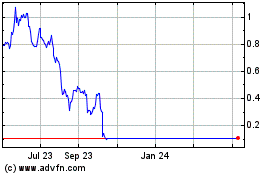

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Apr 2023 to Apr 2024