Current Report Filing (8-k)

November 08 2017 - 8:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2017

|

LEXINGTON

REALTY TRUST

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Maryland

|

1-12386

|

13-3717318

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

One Penn Plaza, Suite 4015, New York, New York

|

10119-4015

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(212) 692-7200

(Registrant's telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2.):

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On November 7, 2017, we issued a press

release announcing our financial results for the quarter ended September 30, 2017. A copy of the press release is furnished herewith

as part of Exhibit 99.1.

The information furnished pursuant to this

“Item 2.02 - Results of Operations and Financial Condition”, including Exhibit 99.1, shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, or otherwise

subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by us

under the Exchange Act or Securities Act of 1933, as amended, which we refer to as the Securities Act, regardless of any general

incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

Effective November 8, 2017, our Board of

Trustees appointed Howard Roth as a member of the Board of Trustees, to fill the vacancy that was created when Richard J. Rouse

was not nominated for reelection at the 2017 Annual Meeting of Shareholders. Mr. Roth was also appointed to the Audit Committee

of the Board of Trustees.

Mr. Roth is a principal of HSR Advisors,

a consulting firm providing strategic and financial advice. Mr. Roth recently retired from Ernst & Young LLP as the leader

of the firm’s global Real Estate, Hospitality & Construction (RHC) practice. Mr. Roth was a partner at Ernst & Young

LLP (including its predecessor firm, Kenneth Leventhal & Co.) since 1991. Mr. Roth is also an Advisory Board Member of Hodes

Weill & Associates.

The Board of Trustees has determined that

Mr. Roth (1) has no material relationship with the Trust or its affiliates or any member of the management of the Trust or his

or her affiliates, (2) is “independent” under the Trust’s Corporate Governance Guidelines and the New York Stock

Exchange listing standards, and (3) qualifies as an “Audit Committee Financial Expert” in accordance with Item 407(d)(5)

of Regulation S-K.

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On November 7, 2017, we made available

supplemental information, which we refer to as the “Quarterly Supplemental Information, Third Quarter 2017,” a copy

of which is furnished herewith as Exhibit 99.1.

Also on November 7, 2017, our management

discussed our financial results and certain aspects of our business plan on a conference call with analysts and investors. A transcript

of the conference call is furnished herewith as Exhibit 99.2.

The information furnished pursuant to this

“Item 7.01 - Regulation FD Disclosure”, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed”

for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed

to be incorporated by reference into any filing made by us under the Exchange Act or the Securities Act, regardless of any general

incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing. Information

contained on our web site is not incorporated by reference into this Current Report on Form 8-K.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Lexington Realty Trust

|

|

|

|

|

|

|

|

|

|

Date: November 8, 2017

|

By:

|

/s/ Patrick Carroll

|

|

|

|

Patrick Carroll

|

|

|

|

Chief Financial Officer

|

Exhibit Index

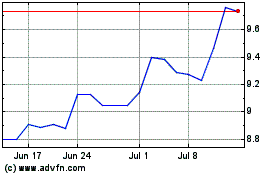

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

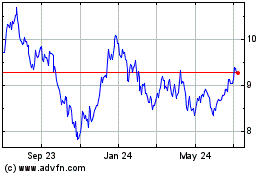

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024