Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Although actual results could differ from those estimates, management does not believe that such differences would be material.

Fair Value Measurements

The Company had no assets or liabilities that were measured using quoted prices for similar assets and liabilities or significant unobservable inputs (Level 2 and Level 3 assets and liabilities, respectively) as of September 30, 2017 and December 31, 2016. The carrying value of cash held in money market funds of approximately $110.9 million and $38.0 million as of September 30, 2017 and December 31, 2016, respectively, is included in cash and cash equivalents and approximates market values based on quoted market prices (Level 1 inputs).

Concentration of Credit Risk

Credit risk represents the risk that the Company would incur a loss if counterparties failed to perform pursuant to the terms of their agreements. Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash and cash equivalents. Cash and cash equivalents consist of money market funds with major financial institutions in the United States. These funds may be redeemed upon demand and, therefore, bear minimal risk. The Company does not anticipate any losses on such balances.

Revenue Recognition

From time to time, the Company is awarded reimbursement contracts for services and development grant contracts with government and non-government entities and philanthropic organizations. Under these contracts, the Company typically is reimbursed for the costs in connection with specific development activities. The Company recognizes revenue to the extent of costs incurred in connection with performance under such grant arrangements.

The Company has entered into a collaborative research and development agreement with Pfizer Inc. (Pfizer). The agreement is in the form of a license agreement (the Pfizer Agreement). The Pfizer Agreement calls for a nonrefundable up-front payment and milestone payments upon achieving significant milestone events. The Pfizer Agreement also contemplates royalty payments on future sales of an approved product. There are no performance, cancellation, termination, or refund provisions in the Pfizer Agreement that contain material financial consequences to the Company.

The primary deliverable under this arrangement is an exclusive worldwide license to the Company’s rivipansel compound, but the arrangement also includes deliverables related to research and preclinical development activities to be performed by the Company on Pfizer’s behalf.

Collaborative research and development agreements can provide for one or more of up-front license fees, research payments, and milestone payments. Agreements with multiple components (deliverables or items) are evaluated according to the provisions of Accounting Standards Codification (ASC) 605-25,

Revenue Recognition—Multiple-Element Arrangements

, to determine whether the deliverables can be separated into more than one unit of accounting. An item can generally be considered a separate unit of accounting if all of the following criteria are met: (1) the delivered item(s) has value to the customer on a stand-alone basis and (2) if the arrangement includes a general right of return relative to the delivered item(s) then delivery or performance of the undelivered item(s) is considered probable and substantially in control of the Company. Items that cannot be divided into separate units are combined with other units of accounting, as appropriate. Consideration received is allocated among the separate units based on selling price hierarchy. The selling price hierarchy for each deliverable is based on (i) vendor-specific objective evidence (VSOE), if available; (ii) third-party evidence (TPE) of selling price if VSOE is not available; or (iii) an estimated selling price, if neither VSOE nor TPE is available. Management was not able to establish VSOE or TPE for separate unit deliverables, as the Company does not have a history of entering into such arrangements or selling the individual deliverables within such arrangements separately. In addition, there may be significant differentiation in these arrangements, which indicates that comparable third-party pricing may not be available. Management determined that the selling price for the

deliverables within the Pfizer Agreement should be determined using its best estimate of selling price. The process of determining the best estimate of selling price involved significant judgment on the Company’s part and included consideration of multiple factors such as estimated direct expenses, other costs, and available clinical development data.

Pursuant to ASC 605-25, each required deliverable under the Pfizer Agreement is evaluated to determine whether it qualifies as a separate unit of accounting. Factors considered in this determination include the research capabilities of Pfizer, the proprietary nature of the license and know-how, and the availability of the Company’s glycomimetics technology research expertise in the general marketplace. Based on all relevant facts and circumstances and, most significantly, on the proprietary nature of the Company’s technology and the related proprietary nature of the Company’s research services, management concluded that stand-alone value does not exist for the license, and therefore, the license is not a separate unit of accounting under the Pfizer Agreement and will be combined with the research and development services (including participation on a joint steering committee). The Company has satisfied the deliverables under the Pfizer Agreement.

Pursuant to ASC 605-28,

Revenue Recognition—Milestone Method

, at the inception of agreements that include milestone payments, the Company evaluates whether each milestone is substantive and at risk to both parties on the basis of the contingent nature of the milestone. This evaluation includes an assessment of whether (a) the consideration is commensurate with either (1) the entity’s performance to achieve the milestone, or (2) the enhancement of the value of the delivered item(s) as a result of a specific outcome resulting from the entity’s performance to achieve the milestone, (b) the consideration relates solely to past performance and (c) the consideration is reasonable relative to all of the deliverables and payment terms within the arrangement. In making this assessment, the Company evaluates factors such as scientific, regulatory, commercial and other risks that must be overcome to achieve the respective milestone, the level of effort and investment required to achieve the respective milestone and whether the milestone consideration is reasonable relative to all deliverables and payment terms in the agreement.

Non-refundable development and regulatory milestones that are expected to be achieved as a result of the Company’s efforts during the period of substantial involvement are recognized as revenue upon the achievement of the milestone, assuming all other revenue recognition criteria are met. Milestones that are not considered substantive because the Company does not contribute effort to the achievement of such milestones are generally achieved after the period of substantial involvement and are recognized as revenue upon achievement of the milestone, as there are no undelivered elements remaining and no continuing performance obligation, assuming all other revenue recognition criteria are met. In May 2014, the Company recognized $15.0 million in revenue as a result of the first non-refundable milestone payment received from Pfizer. In June 2015, the Company recognized $20.0 million in revenue as a result of Pfizer dosing the first patient in the Phase 3 clinical trial of rivipansel, which triggered the second non-refundable milestone payment.

Accrued Liabilities

The Company is required to estimate accrued liabilities as part of the process of preparing its financial statements. The estimation of accrued liabilities involves identifying services that have been performed on the Company’s behalf, and then estimating the level of service performed and the associated cost incurred for such services as of each balance sheet date. Accrued liabilities include professional service fees, such as for lawyers and accountants, contract service fees, such as those under contracts with clinical monitors, data management organizations and investigators in conjunction with clinical trials, and fees to contract manufacturers in conjunction with the production of clinical materials. Pursuant to the Company’s assessment of the services that have been performed, the Company recognizes these expenses as the services are provided. Such assessments include: (i) an evaluation by the project manager of the work that has been completed during the period; (ii) measurement of progress prepared internally and/or provided by the third-party service provider; (iii) analyses of data that justify the progress; and (iv) the Company’s judgment.

Research and Development Costs

Except for payments made in advance of services, research and development costs are expensed as incurred. For payments made in advance, the Company recognizes research and development expense as the services are rendered. Research and development costs primarily consist of salaries and related expenses for personnel, laboratory supplies and raw materials, sponsored research, depreciation of laboratory facilities and leasehold improvements, and utilities costs

related to research space. Other research and development expenses include fees paid to consultants and outside service providers including clinical research organizations and clinical manufacturing organizations.

Stock-Based Compensation

Stock-based payments are accounted for in accordance with the provisions of ASC 718,

Compensation—Stock Compensation

. The fair value of stock-based payments is estimated, on the date of grant, using the Black-Scholes-Merton model. The resulting fair value is recognized ratably over the requisite service period, which is generally the vesting period of the option.

The Company has elected to use the Black-Scholes-Merton option pricing model to value any options granted. The Company will reconsider use of the Black-Scholes-Merton model if additional information becomes available in the future that indicates another model would be more appropriate or if grants issued in future periods have characteristics that prevent their value from being reasonably estimated using this model.

A discussion of management’s methodology for developing some of the assumptions used in the valuation model follows:

Expected Dividend Yield

—The Company has never declared or paid dividends and has no plans to do so in the foreseeable future.

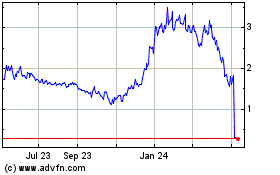

Expected Volatility

—Volatility is a measure of the amount by which a financial variable such as share price has fluctuated (historical volatility) or is expected to fluctuate (expected volatility) during a period. Prior to the Company’s initial public offering, there was not a market for the Company’s shares. The Company utilizes the historical volatilities of a peer group (e.g., several public entities of similar size, complexity, and stage of development), along with the Company’s historical volatility since its initial public offering, to determine its expected volatility.

Risk-Free Interest Rate

—This is the U.S. Treasury rate for the week of each option grant during the year, having a term that most closely resembles the expected life of the option.

Expected Term

—This is a period of time that the options granted are expected to remain unexercised. Options granted have a maximum term of 10 years. The Company estimates the expected life of the option term to be 6.25 years. The Company uses a simplified method to calculate the average expected term.

Expected Forfeiture Rate

—Effective on January 1, 2017 with the adoption of ASU 2016-09,

Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting

, the Company elected to account for forfeitures as they occur.

Net Loss Per Common Share

Basic net loss per common share is determined by dividing net loss by the weighted-average number of common shares outstanding during the period, without consideration of common stock equivalents. Diluted net loss per share is computed by dividing net loss by the weighted-average number of common stock equivalents outstanding for the period. The treasury stock method is used to determine the dilutive effect of the Company’s stock options, restricted stock units and warrants.

6. Operating Leases

The Company leases office and research space in Rockville, Maryland under an operating lease with a term through October 31, 2023 (as amended to date, the Lease) that is subject to annual rent increases. The Company has the right to sublease or assign all or a portion of the premises, subject to the conditions set forth in the Lease. The Lease may be terminated early by either the landlord or the Company in certain circumstances. In connection with the Lease, the Company received rent abatement as a lease incentive. The annual rent increases and rent abatement have been recognized as deferred rent that is being adjusted on a straight-line basis over the term of the Lease.

In March 2016, the Company amended the Lease (the Lease Amendment) to lease additional space as of June 1, 2016. In addition to the other terms of the Lease, the Lease Amendment provided for a tenant improvement allowance

reflected in the Company’s financial statements as an increase in capitalized leasehold improvements as incurred and an increase in deferred rent. In May 2016,

the Company also paid a security deposit of $52,320 to be held until the expiration or termination of the Company’s obligations under the Lease. The term of the Lease Amendment for the additional space continues through October 31, 2023, the same date as for the premises originally leased under the Lease, subject to the Company’s renewal option set forth in the Lease. The Company’s one-time option to terminate the Lease effective as of October 31, 2020 also applies to the additional space.

Deferred rent related to the Lease was $801,058 and $822,130 at September 30, 2017 and December 31, 2016, respectively. Total rent expense under the Company’s operating leases was $223,337 and $219,983 for the three months ended September 30, 2017 and 2016, respectively, and $667,507 and $557,262 for the nine months ended September 30, 2017 and 2016, respectively.

7. Stockholders’ Equity

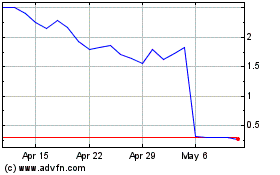

At-The-Market Equity Offering

On March 1, 2016, the Company entered into an at-the-market sales agreement with Cowen and Company, LLC to sell the Company’s securities under a shelf registration statement filed in March 2015. The at-the market sales agreement was terminated on May 23, 2017. During the nine months ended September 30, 2017, the Company issued and sold 1,388,647 shares of common stock under the at-the-market sales agreement. The shares were sold at a weighted average price per share of $5.55, for aggregate net proceeds of $7.4 million, after deducting commissions and offering expenses.

On September 28, 2017, the Company entered into a new at-the-market sales agreement with Cowen and Company, LLC to sell the Company’s securities under a shelf registration statement filed in September 2017. Subsequent to September 30, 2017, the Company issued and sold 1,600,000 shares of common stock under the at-the-market sales agreement. The shares were sold at a weighted average price per share of $12.50, for aggregate net proceeds of $19.2 million, after deducting commissions and offering expenses.

Equity Offering

In May 2017, the Company completed a public offering in which the Company sold 8,050,000 shares of its common stock at a price to the public of $11.50 per share. The Company received net proceeds of $86.8 million from this offering, after deducting underwriting discounts, commissions and other offering expenses.

2003 Stock Incentive Plan

The 2003 Stock Incentive Plan (the 2003 Plan) provided for the grant of incentives and nonqualified stock options and restricted stock awards. The exercise price for incentive stock options must be at least equal to the fair value of the common stock on the grant date. Unless otherwise stated in a stock option agreement, 25% of the shares subject to an option grant will vest upon the first anniversary of the vesting start date and thereafter at the rate of one forty-eighth of the option shares per month as of the first day of each month after the first anniversary. Upon termination of employment by reasons other than death, cause, or disability, any vested options shall terminate 60 days after the termination date. Stock options terminate 10 years from the date of grant. The 2003 Plan expired on May 21, 2013.

A summary of the Company’s stock option activity under the 2003 Plan for the nine months ended September 30, 2017 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-Average

|

|

|

|

|

|

|

|

|

|

|

|

Remaining

|

|

Aggregate

|

|

|

|

|

Outstanding

|

|

Weighted-Average

|

|

Contractual Term

|

|

Intrinsic Value

|

|

|

|

|

Options

|

|

Exercise Price

|

|

(Years)

|

|

(In thousands)

|

|

|

Outstanding as of December 31, 2016

|

|

729,819

|

|

$

|

1.26

|

|

3.2

|

|

|

|

|

|

Options exercised

|

|

(16,608)

|

|

|

1.65

|

|

|

|

|

|

|

|

Options forfeited

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

Outstanding as of September 30, 2017

|

|

713,211

|

|

|

1.25

|

|

2.4

|

|

$

|

9,089

|

|

|

Vested as of September 30, 2017

|

|

713,211

|

|

|

1.25

|

|

2.4

|

|

$

|

9,089

|

|

|

Exercisable as of September 30, 2017

|

|

713,211

|

|

|

1.25

|

|

2.4

|

|

$

|

9,089

|

|

As of September 30, 2017, the options under the 2003 Plan were fully expensed. Total intrinsic value of the options exercised during the nine months ended September 30, 2017 and 2016 was $103,638 and $95,221, respectively, and total cash received for options exercised was $27,358 and $40,668 during the nine months ended September 30, 2017 and 2016, respectively. The total fair value of shares underlying options which vested in the nine months ended September 30, 2017 and 2016 was $1,573 and $14,450, respectively.

2013 Equity Incentive Plan

The Company’s board of directors adopted, and its stockholders approved, its 2013 Equity Incentive Plan (the 2013 Plan) effective on January 9, 2014. The 2013 Plan provides for the grant of incentive stock options within the meaning of Section 422 of the Internal Revenue Code to the Company’s employees and its parent and subsidiary corporations’ employees, and for the grant of nonstatutory stock options, restricted stock awards, restricted stock unit awards, stock appreciation rights, performance stock awards and other forms of stock compensation to its employees, including officers, consultants and directors. The 2013 Plan also provides for the grant of performance cash awards to the Company’s employees, consultants and directors. Unless otherwise stated in a stock option agreement, 25% of the shares subject to an option grant will typically vest upon the first anniversary of the vesting start date and thereafter at the rate of one forty-eighth of the option shares per month as of the first day of each month after the first anniversary. Upon termination of employment by reasons other than death, cause, or disability, any vested options will terminate 90 days after the termination date, unless otherwise set forth in a stock option agreement. Stock options generally terminate 10 years from the date of grant.

Authorized Shares

The maximum number of shares of common stock that initially could be issued under the 2013 Plan was 1,000,000 shares, plus any shares subject to stock options or similar awards granted under the 2003 Plan that expire or terminate without having been exercised in full or are forfeited to or repurchased by the Company. The number of shares of common stock reserved for issuance under the 2013 Plan automatically increases on January 1 of each year until January 1, 2023, by 3% of the total number of shares of common stock outstanding on December 31 of the preceding calendar year, or a lesser number of shares as may be determined by the Company’s board of directors. The maximum number of shares that may be issued pursuant to exercise of incentive stock options under the 2013 Plan is 20,000,000 shares. As of January 1, 2017, the number of shares of common stock that may be issued under the 2013 Plan was automatically increased by 697,500 shares, representing 3% of the total number of shares of common stock outstanding on December 31, 2016, increasing the number of shares of common stock available for issuance under the 2013 Plan to 2,837,201 shares.

Shares issued under the 2013 Plan may be authorized but unissued or reacquired shares of common stock. Shares subject to stock awards granted under the 2013 Plan that expire or terminate without being exercised in full, or that are paid out in cash rather than in shares, will not reduce the number of shares available for issuance under the 2013 Plan. Additionally, shares issued pursuant to stock awards under the 2013 Plan that the Company repurchases or that are forfeited, as well as shares reacquired by the Company as consideration for the exercise or purchase price of a stock

ITEM 2.

MANAGEMENT’S DISCUSSION AND ANALYSI

S OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements contained in this Quarterly Report on Form 10-Q may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words or phrases “would be,” “will allow,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar expressions, or the negative of such words or phrases, are intended to identify “forward-looking statements.” We have based these forward-looking statements on our current expectations and projections about future events. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to these differences include those below and elsewhere in this Quarterly Report on Form 10-Q, our Annual Report on Form 10-K, particularly in Part I – Item 1A, “Risk Factors,” and our other filings with the Securities and Exchange Commission. Statements made herein are as of the date of the filing of this Form 10-Q with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim, any obligation to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited financial statements and related notes that appear in Item 1 of this Quarterly Report on Form 10-Q and with our audited financial statements and related notes for the year ended December 31, 2016, which are included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 1, 2017.

Overview

We are a clinical-stage biotechnology company focused on the discovery and development of novel glycomimetic drugs to address unmet medical needs resulting from diseases in which carbohydrate biology plays a key role. Glycomimetics are molecules that mimic the structure of carbohydrates involved in important biological processes. Our proprietary glycomimetics platform is based on our expertise in carbohydrate chemistry and our understanding of the role carbohydrates play in key biological processes. Using this expertise and understanding, we are developing a pipeline of proprietary glycomimetics designed to inhibit disease-related functions of carbohydrates, such as the roles they play in inflammation, cancer and infection. We believe this represents an innovative approach to drug discovery to treat a wide range of diseases.

Most human proteins are modified by the addition of complex carbohydrates to the surface of the proteins. The addition of these carbohydrate structures affects the functions of these proteins and their interactions with other molecules. Our initial research and development efforts have focused on drug candidates targeting selectins, which are proteins that serve as adhesion molecules and bind to carbohydrates that are involved in the inflammatory component and progression of a wide range of diseases, including hematologic disorders, cancer and cardiovascular disease. Inhibiting specific carbohydrates from binding to selectins has long been viewed as a potentially attractive approach for therapeutic intervention. The ability to successfully develop drug-like compounds that inhibit binding with selectins, known as selectin antagonists, has been limited by the complexities of carbohydrate chemistry. We believe our expertise in carbohydrate chemistry enables us to design selectin antagonists and other glycomimetics that inhibit the disease-related functions of certain carbohydrates.

We are focusing our initial efforts on drug candidates for rare diseases that we believe will qualify for orphan drug designation. Our first drug candidate, rivipansel, is a pan-selectin antagonist being developed for the treatment of vaso-occlusive crisis, or VOC, a debilitating and painful condition that occurs periodically throughout the life of a person with sickle cell disease. We have entered into an agreement with Pfizer Inc., or Pfizer, for the further development and potential commercialization of rivipansel worldwide. Rivipansel has received fast track designation from the U.S. Food and Drug Administration, or FDA, as well as orphan drug designation from the FDA in the United States and from the European Medicines Agency, or EMA, in the European Union. We believe the clinical progress of rivipansel provides evidence of the significant potential of our lead program and our proprietary glycomimetics platform.

Building on our experience with rivipansel, we are developing a pipeline of other glycomimetic drug candidates. Our second glycomimetic drug candidate, GMI-1271, is a specific E-selectin inhibitor, which we are developing to be used in combination with chemotherapy to treat patients with either acute myeloid leukemia, or AML, or multiple myeloma, or MM, both of which are life-threatening hematologic cancers, and potentially other hematologic cancers as well. We have completed enrollment in a Phase 1/2 clinical trial of GMI-1271 as an adjunct to standard chemotherapy in patients with AML and are currently conducting a Phase 1 clinical trial of GMI-1271 combined with chemotherapy for the treatment of MM. In the Phase 2 portion of our AML clinical trial, AML patients treated with GMI-1271, combined with chemotherapy, have experienced higher-than-expected remission rates and lower-than-expected induction-related mortality rates. We believe the data generated in this Phase 1/2 clinical trial support conducting one or more additional clinical trials of GMI-1271 in AML, with the ultimate goal of obtaining marketing approval from the FDA.

GMI-1271 received orphan drug designation from the FDA in May 2015 for the treatment of AML. In June 2016, GMI-1271 received fast track designation from the FDA for the treatment of adult patients with relapsed or refractory AML and elderly patients aged 60 years or older with AML. In May 2017, GMI-1271 received Breakthrough Therapy designation from the FDA for the treatment of adult patients with relapsed or refractory AML. In May 2017, the European Commission, based on a favorable recommendation from the EMA Committee for Orphan Medicinal Products, granted orphan designation for GMI-1271 for the treatment of AML.

In May 2015, we commenced our multinational, Phase 1/2, open-label trial of GMI-1271 as an adjunct to standard chemotherapy in patients with AML. This trial in males and females with AML enrolled patients at a number of academic institutions in the United States, Ireland and Australia. The trial consists of two parts. In the Phase 1 portion, escalation testing was performed to determine a recommended GMI-1271 dose in combination with standard chemotherapy to be used in the Phase 2 portion. In the Phase 2 portion of the trial, dose expansion was performed at the recommended dose of 10 mg/kg GMI-1271 in combination with standard chemotherapy. The primary objective of the trial was to evaluate the safety of GMI-1271 in combination with chemotherapy. Secondary objectives were to characterize pharmacokinetics, or PK, pharmacodynamics, or PD, and to observe anti-leukemic activity. There were a total of 19 patients with relapsed or refractory AML enrolled and dosed with a single cycle of treatment with GMI-1271 and chemotherapy in the Phase 1 portion of the trial.

In the Phase 2 portion, one cohort of 25 patients over 60 years of age with newly diagnosed AML and a second cohort comprised of 47 patients with relapsed or refractory AML were enrolled. Unlike in the Phase 1 portion, some of the patients in the Phase 2 portion were treated with multiple cycles of GMI-1271. In May 2017, we completed enrollment of 91 patients in the Phase 1/2 trial. We plan to provide additional updates from this clinical trial in the fourth quarter of 2017 and in 2018. We are consulting with the FDA regarding the design of a potential Phase 3 pivotal trial that could support an application for marketing approval for GMI-1271 for the treatment of AML. Based on the feedback from the FDA, we plan to initiate this pivotal trial in mid-2018.

In June 2017, we presented new data from the Phase 2 portion of the trial at the June 2017 annual meetings of the American Society of Clinical Oncology, or ASCO, and the European Hematology Association, or EHA. In the relapsed or refractory disease arm of the trial, 66 patients had been enrolled. Of the 54 relapsed/refractory patients with AML for whom data is available, the CR/CRi rate was 41%. The CR/CRi rate is the percentage of patients who achieved remission, with either full or incomplete blood count recovery. The mortality rate among this group at 60 days was 7%. Median overall survival of the 19 patients enrolled in the Phase 1 portion of the trial was 7.6 months. We believe these results compare favorably to what would be expected in this population, based on published historical controls in similar patients. In the newly-diagnosed, treatment-naïve elderly arm of the trial, 25 patients had been enrolled. Among these 25 patients, the CR/CRi rate was 68%, with a 73% rate for patients with de novo disease and 64% for patients with secondary AML.

Our data from the GMI-1271 program has been selected for two oral presentations at the upcoming annual meeting of the American Society of Hematology, or ASH, to be held in December 2017. One of these presentations will be an update on the current data set from the Phase 1/2 open-label trial of GMI-1271 as an adjunct to standard chemotherapy in patients with AML. The second oral presentation will present data from preclinical studies in which E-selectin was upregulated in a model of AML and increased resistance to chemotherapy, which we believe can be reversed by treatment with GMI-1271.

In December 2015, at the ASH annual meeting, we presented preclinical data suggesting that GMI-1271 could reverse resistance of certain chemotherapies seen in MM. In September 2016, we dosed the first patient in a Phase 1 multiple dose-escalation clinical trial in defined populations of patients with MM who have not responded optimally to standard chemotherapy. In this trial, we are evaluating the efficacy, safety and PK of GMI-1271, combined with bortezomib- or carfilzomib-based chemotherapy, for the treatment of MM. We are currently enrolling patients at clinical trial sites in Ireland and have initiated the enrollment process at additional sites in Europe.

In addition to GMI-1271, we have designed a family of small molecule drug candidates that simultaneously inhibit both E-selectin and CXCR4. We have selected one of these compounds, GMI-1359, for development as a potential treatment for certain malignancies. Since E-selectin and CXCR4 are both adhesion molecules that keep cancer cells in the bone marrow, we believe that targeting both E-selectin and CXCR4 with a single compound could improve efficacy in the treatment of cancers that affect the bone marrow such as AML and MM, as compared to targeting CXCR4 alone. In December 2016 at the ASH annual meeting, we presented preclinical data suggesting that GMI-1359 has a unique tumor cell mobilization kinetic profile and enhanced the ability of chemotherapy to target and improve survival from a high-risk form of mutated AML.

In 2016, we completed enrollment in a Phase 1 single-dose escalation trial of GMI-1359 in healthy volunteers. In this trial, volunteer participants received a single injection of GMI-1359, after which they were evaluated for safety, tolerability, PK and PD. The randomized, double-blind, placebo-controlled, escalating dose study was conducted at a single site in the United States. We are currently expanding enrollment in this trial with two additional cohorts and anticipate selecting an initial cancer indication for this drug candidate and determining an optimal dose for further clinical evaluation in 2018.

Using our glycomimetics platform, we have also designed inhibitors that specifically block the binding of galectin-3 to carbohydrate structures. Galectin-3 is a protein that is known to play critical roles in many pathological processes, including fibrosis, inflammation, cancer and cardiovascular disease. We plan to optimize these compounds and conduct preclinical experiments in the fourth quarter of 2017 and in 2018 to further characterize the effects of galectin-3 inhibitors on immune processes and anti-fibrotic activity. We are also designing other galectin inhibitors that we believe could be used to treat various diseases.

We commenced operations in 2003, and our operations to date have been limited to organizing and staffing our company, business planning, raising capital, developing our glycomimetics platform, identifying potential drug candidates, undertaking preclinical studies and conducting clinical trials of rivipansel, GMI-1271 and GMI-1359. To date, we have financed our operations primarily through private placements of our securities, upfront and milestone payments under our collaboration with Pfizer and the net proceeds from our IPO in January 2014, at-the-market sales facilities with Cowen and Company LLC, or Cowen, and our public offerings of common stock in June 2016 and May 2017. We have no approved drugs currently available for sale, and substantially all of our revenue to date has been revenue from the upfront and milestone payments from Pfizer, although we have received nominal amounts of revenue under research grants.

Prior to our IPO, we raised an aggregate of $86.6 million to fund our operations, of which $22.5 million was an upfront payment under our collaboration with Pfizer and $64.1 million was from the sale of our convertible promissory notes and convertible preferred stock. The IPO provided us with net proceeds of $57.2 million, and we received a non-refundable milestone payment from Pfizer in May 2014 of $15.0 million. In August 2015, we received another non-refundable milestone payment from Pfizer of $20.0 million following the dosing of the first patient in the Phase 3 clinical trial of rivipansel. We received an additional $19.7 million in net proceeds from our public offering in June 2016 and $86.8 million in net proceeds from our public offering in May 2017. In 2016 and to date in 2017 we have received an aggregate of $30.5 million of net proceeds under the at-the-market facilities with Cowen.

Since inception, we have incurred significant operating losses. We have generated cumulative revenue of $58.6 million since our inception through September 30, 2017, primarily consisting of the $22.5 million upfront payment from Pfizer in 2011, the $15.0 million non-refundable milestone payment in May 2014 and the $20.0 million non-refundable milestone payment in August 2015. We had an accumulated deficit of $135.1 million as of September 30, 2017, and we expect to continue to incur significant expenses and operating losses over at least the next several years. Our net losses may fluctuate significantly from quarter to quarter and year to year, depending on the timing of our clinical trials, the

receipt of milestone payments, if any, under our collaboration with Pfizer, and our expenditures on other research and development activities. We anticipate that our expenses will increase substantially as we:

|

|

·

|

|

initiate and conduct our planned clinical trials of GMI-1271 and GMI-1359;

|

|

|

·

|

|

continue the research and development of our other drug candidates;

|

|

|

·

|

|

seek to discover and develop additional drug candidates;

|

|

|

·

|

|

seek regulatory approvals for any drug candidates other than rivipansel that successfully complete clinical trials;

|

|

|

·

|

|

ultimately establish a sales, marketing and distribution infrastructure and scale up external manufacturing capabilities to commercialize any drug candidates other than rivipansel for which we may obtain regulatory approval;

|

|

|

·

|

|

maintain, expand and protect our intellectual property portfolio;

|

|

|

·

|

|

hire additional clinical, quality control and scientific personnel; and

|

|

|

·

|

|

add operational, financial and management information systems and personnel, including personnel to support our drug development and potential future commercialization efforts.

|

To fund further operations, we will need to raise capital. We may obtain additional financing in the future through the issuance of our common stock, through other equity or debt financings or through collaborations or partnerships with other companies. We may not be able to raise additional capital on terms acceptable to us, or at all, and any failure to raise capital as and when needed could compromise our ability to execute on our business plan. Although it is difficult to predict future liquidity requirements, we believe that our existing cash and cash equivalents, together with interest thereon, will be sufficient to fund our operations at least through the second half of 2019. However, our ability to successfully transition to profitability will be dependent upon achieving a level of revenues adequate to support our cost structure. We cannot assure you that we will ever be profitable or generate positive cash flow from operating activities.

Our Collaboration with Pfizer

In October 2011, we entered into the license agreement with Pfizer under which we granted Pfizer an exclusive worldwide license to develop and commercialize products containing rivipansel for all fields and uses. The license also covers specified back-up compounds along with modifications of and improvements to rivipansel that meet defined chemical properties. Pfizer is required to use commercially reasonable efforts, at its expense, to develop, obtain regulatory approval for and commercialize rivipansel for sickle cell disease in the United States. Under the terms of the agreement, we received a $22.5 million upfront payment. We are also eligible to earn potential milestone payments of up to $115.0 million upon the achievement of specified development milestones, including the dosing of the first patients in Phase 3 clinical trials for up to two indications and the first commercial sale of a licensed product in the United States and selected European countries for up to two indications, up to $70.0 million upon the achievement of specified regulatory milestones, including the acceptance of our filings for regulatory approval by regulatory authorities in the United States and Europe for up to two indications, and up to $135.0 million upon the achievement of specified levels of annual net sales of licensed products. We are also eligible to receive tiered royalties for each licensed product, with percentages ranging from the low double digits to the low teens, based on net sales worldwide, subject to reductions in specified circumstances.

The first potential milestone payment under the Pfizer agreement was $35.0 million upon the initiation of dosing of the first patient in a Phase 3 clinical trial of rivipansel by Pfizer. Under the collaboration, Pfizer made a $15.0 million non-refundable milestone payment to us in May 2014, which we recognized as revenue in May 2014, when earned, and the dosing of the first patient in the Phase 3 clinical trial in June 2015 triggered the remaining $20.0 million milestone payment to us. We recorded the $20.0 million milestone payment as revenue in June 2015. There were no milestone payments received from Pfizer for the three or nine months ended September 30, 2017.

We entered into a research services agreement with the University of Basel, or the University, for biological evaluation of selectin antagonists. Certain patents covering the rivipansel compound are subject to provisions of the Research Agreement. Under the terms of the Research Agreement, we will owe to the University 10% of all future milestone and royalty payments received from Pfizer with respect to rivipansel. In February 2016, we paid $2.0 million to the University based upon the non-refundable milestone payments from Pfizer. We recorded these payments during the year ended December 31, 2015, at the time the payments became due to the University. There were no additional payments due to the University for the three months or nine months ended September 30, 2017.

Critical Accounting Policies and Significant Judgments and Estimates

There have been no material changes in our critical accounting policies, estimates and judgments during the nine months ended September 30, 2017 compared to the disclosures in Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 31, 2016.

Components of Operating Results

Revenue

To date, we have not generated any revenue from the sale of our drug candidates and do not expect to generate any revenue from the sale of drugs in the near future. Substantially all of our revenue recognized to date has consisted of the upfront and milestone payments under our agreement with Pfizer.

Since our inception, we have also recognized a nominal amount of revenue under research grant contracts, generally to the extent of our costs incurred in connection with specific research or development activities.

Research and Development

Research and development expenses consist of expenses incurred in performing research and development activities, including compensation and benefits for full-time research and development employees, facilities expenses, overhead expenses, cost of laboratory supplies, clinical trial and related clinical manufacturing expenses, fees paid to contract research organizations and other consultants and other outside expenses. Other preclinical research and platform programs include activities related to exploratory efforts, target validation, lead optimization for our earlier programs and our proprietary glycomimetics platform.

To date, our research and development expenses have related primarily to the development of rivipansel and our other drug candidates. In April 2013, when we completed our Phase 2 clinical trial of rivipansel, all further clinical development obligations associated with rivipansel shifted to Pfizer.

We do not currently utilize a formal time allocation system to capture expenses on a project-by-project basis because we are organized and record expense by functional department and our employees may allocate time to more than one development project. Accordingly, we only allocate a portion of our research and development expenses by functional area and by drug candidate.

Research and development costs are expensed as incurred. Non-refundable advance payments for goods or services to be received in the future for use in research and development activities are deferred and capitalized. The capitalized amounts are expensed as the related goods are delivered or the services are performed.

Research and development activities are central to our business model. Drug candidates in later stages of clinical development generally have higher development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later stage clinical trials. We expect our research and development expenses to increase over the next several years as we seek to progress GMI-1271, GMI-1359 and our other drug candidates through clinical development. For example, as we prepare to potentially submit an application for marketing approval for GMI-1271, we will incur substantial expenses in scaling up the production and manufacturing of GMI-1271. However, it is difficult to determine with certainty the duration and completion costs of our current or future preclinical studies and clinical trials of our drug candidates, or if, when or to what extent we will generate revenues from the commercialization

and sale of any of our drug candidates that obtain regulatory approval. We may never succeed in achieving regulatory approval for any of our drug candidates.

The duration, costs and timing of clinical trials and development of our drug candidates will depend on a variety of factors that include:

|

|

·

|

|

per patient trial costs;

|

|

|

·

|

|

the number of patients that participate in the trials;

|

|

|

·

|

|

the number of sites included in the trials;

|

|

|

·

|

|

the countries in which the trial is conducted;

|

|

|

·

|

|

the length of time required to enroll eligible patients;

|

|

|

·

|

|

the number of doses that patients receive;

|

|

|

·

|

|

the drop-out or discontinuation rates of patients;

|

|

|

·

|

|

potential additional safety monitoring or other studies requested by regulatory agencies;

|

|

|

·

|

|

the duration of patient follow-up; and

|

|

|

·

|

|

the safety and efficacy profile of the drug candidate.

|

In addition, the probability of success for each drug candidate will depend on numerous factors, including competition, manufacturing capability and commercial viability. We will determine which programs to pursue and how much to fund each program in response to the scientific and clinical success of each drug candidate, as well as an assessment of each drug candidate’s commercial potential.

General and Administrative

General and administrative expenses consist primarily of salaries and other related costs, including stock-based compensation, for personnel in executive, finance, accounting, business development and human resources functions. Other significant costs include facility costs not otherwise included in research and development expenses, legal fees relating to patent and corporate matters and fees for accounting and consulting services. We anticipate that our general and administrative expenses will increase in the future to support our continued research and development activities.

Other Income

Other income consists of interest income earned on our cash and cash equivalents.

Results of Operations for the Three and Nine Months Ended September 30, 2017 and 2016

The following tables set forth our results of operations for the three and nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

Revenue

|

|

$

|

—

|

|

$

|

18

|

|

$

|

(18)

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expense

|

|

|

5,780

|

|

|

5,921

|

|

|

(141)

|

|

|

General and administrative expense

|

|

|

2,402

|

|

|

1,984

|

|

|

418

|

|

|

Total costs and expenses

|

|

|

8,182

|

|

|

7,905

|

|

|

277

|

|

|

Loss from operations

|

|

|

(8,182)

|

|

|

(7,887)

|

|

|

(295)

|

|

|

Other income

|

|

|

232

|

|

|

32

|

|

|

200

|

|

|

Net loss and comprehensive loss

|

|

$

|

(7,950)

|

|

$

|

(7,855)

|

|

$

|

(95)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

Revenue

|

|

$

|

—

|

|

$

|

18

|

|

$

|

(18)

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expense

|

|

|

17,380

|

|

|

17,221

|

|

|

159

|

|

|

General and administrative expense

|

|

|

7,016

|

|

|

6,352

|

|

|

664

|

|

|

Total costs and expenses

|

|

|

24,396

|

|

|

23,573

|

|

|

823

|

|

|

Loss from operations

|

|

|

(24,396)

|

|

|

(23,555)

|

|

|

(841)

|

|

|

Other income

|

|

|

373

|

|

|

74

|

|

|

299

|

|

|

Net loss and comprehensive loss

|

|

$

|

(24,023)

|

|

$

|

(23,481)

|

|

$

|

(542)

|

|

Research and Development Expense

The following tables summarize our research and development expense by functional area for the three and nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

Clinical development

|

|

$

|

1,109

|

|

$

|

2,389

|

|

$

|

(1,280)

|

|

|

Manufacturing and formulation

|

|

|

1,893

|

|

|

893

|

|

|

1,000

|

|

|

Contract research services, consulting and other costs

|

|

|

308

|

|

|

332

|

|

|

(24)

|

|

|

Laboratory costs

|

|

|

499

|

|

|

466

|

|

|

33

|

|

|

Personnel-related

|

|

|

1,644

|

|

|

1,580

|

|

|

64

|

|

|

Stock-based compensation

|

|

|

327

|

|

|

261

|

|

|

66

|

|

|

Research and development expense

|

|

$

|

5,780

|

|

$

|

5,921

|

|

$

|

(141)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

Clinical development

|

|

$

|

4,392

|

|

$

|

5,403

|

|

$

|

(1,011)

|

|

|

Manufacturing and formulation

|

|

|

4,165

|

|

|

3,780

|

|

|

385

|

|

|

Contract research services, consulting and other costs

|

|

|

1,196

|

|

|

1,354

|

|

|

(158)

|

|

|

Laboratory costs

|

|

|

1,456

|

|

|

1,237

|

|

|

219

|

|

|

Personnel-related

|

|

|

5,217

|

|

|

4,675

|

|

|

542

|

|

|

Stock-based compensation

|

|

|

954

|

|

|

772

|

|

|

182

|

|

|

Research and development expense

|

|

$

|

17,380

|

|

$

|

17,221

|

|

$

|

159

|

|

During the three months ended September 30, 2017, our research and development expense decreased by $141,000, or 2%, compared to the same period in 2016. The decrease was primarily caused by lower clinical trial expenses related to the Phase 2 clinical trial of GMI-1271 for the treatment of AML due to patient enrollment completion in May 2017 and a decrease in costs for non-clinical toxicology studies and clinical studies for GMI-1359. These decreases were offset in part by additional costs related to the manufacturing of Phase 3 clinical supplies of GMI-1271. Personnel-related and stock-based compensation expenses increased due to annual salary adjustments for research and development personnel and annual stock option awards granted in the first quarter of 2017. During the nine months ended September 30, 2017, our research and development expense increased by $159,000, or 1%, compared to the same period in 2016. The increase was caused by the ongoing costs associated with the clinical trials for GMI-1271 in AML and MM, partially offset by a decrease in expenses related to non-clinical toxicology and clinical studies and manufacturing and process development for GMI-1359. Personnel-related and stock-based compensation expenses increased due to annual salary adjustments for research and development personnel and annual stock option awards granted in the first quarter of 2017.

The following tables summarize our research and development expense by drug candidate for the three and nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

GMI-1271

|

|

$

|

2,921

|

|

$

|

2,799

|

|

$

|

122

|

|

|

GMI-1359

|

|

|

253

|

|

|

715

|

|

|

(462)

|

|

|

Other research and development

|

|

|

635

|

|

|

565

|

|

|

70

|

|

|

Personnel-related and stock-based compensation

|

|

|

1,971

|

|

|

1,842

|

|

|

129

|

|

|

Research and development expense

|

|

$

|

5,780

|

|

$

|

5,921

|

|

$

|

(141)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

GMI-1271

|

|

$

|

8,760

|

|

$

|

7,619

|

|

$

|

1,141

|

|

|

GMI-1359

|

|

|

562

|

|

|

2,316

|

|

|

(1,754)

|

|

|

Other research and development

|

|

|

1,887

|

|

|

1,838

|

|

|

49

|

|

|

Personnel-related and stock-based compensation

|

|

|

6,171

|

|

|

5,448

|

|

|

723

|

|

|

Research and development expense

|

|

$

|

17,380

|

|

$

|

17,221

|

|

$

|

159

|

|

General and Administrative Expense

The following tables summarize the components of our general and administrative expense for the three and nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

Personnel-related

|

|

$

|

729

|

|

$

|

640

|

|

$

|

89

|

|

|

Stock-based compensation

|

|

|

635

|

|

|

479

|

|

|

156

|

|

|

Legal, consulting and other professional expenses

|

|

|

863

|

|

|

719

|

|

|

144

|

|

|

Other

|

|

|

175

|

|

|

146

|

|

|

29

|

|

|

General and administrative expense

|

|

$

|

2,402

|

|

$

|

1,984

|

|

$

|

418

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30,

|

|

Period-to-Period

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

Change

|

|

|

Personnel-related

|

|

$

|

2,282

|

|

$

|

2,019

|

|

$

|

263

|

|

|

Stock-based compensation

|

|

|

1,842

|

|

|

1,467

|

|

|

375

|

|

|

Legal, consulting and other professional expenses

|

|

|

2,385

|

|

|

2,412

|

|

|

(27)

|

|

|

Other

|

|

|

507

|

|

|

454

|

|

|

53

|

|

|

General and administrative expense

|

|

$

|

7,016

|

|

$

|

6,352

|

|

$

|

664

|

|

During the three months ended September 30, 2017, our general and administrative expense increased by $418,000 compared to the same period in 2016, reflecting an increase of 21%. During the nine months ended September 30, 2017, our general and administrative expense increased by $664,000 compared to the same period in 2016, reflecting an increase of 10%. These increases in general and administrative expense were primarily attributable to annual salary adjustments awarded to general and administrative personnel and an increase in stock-based compensation expense caused by the 2017 awards to employees and directors.

Liquidity and Capital Resources

Sources of Liquidity

We have financed our operations primarily through private placements of our capital stock, our IPO, our at-the-market sales facilities with Cowen, our public offerings in June 2016 and May 2017 and upfront and milestone payments from Pfizer. As of September 30, 2017, we had $112.9 million in cash and cash equivalents.

We are potentially eligible to earn a significant amount of milestone payments and royalties under our agreement with Pfizer. Our ability to earn these payments and their timing is dependent upon the outcome of Pfizer’s activities and is uncertain at this time.

On March 1, 2016, we entered into an at-the-market sales agreement with Cowen to sell shares of our common stock having an aggregate offering price of up to $40.0 million through Cowen acting as our sales agent. For the nine months ended September 30, 2017, we sold an aggregate of 1,388,647 shares of our common stock under the at-the-market facility, for net proceeds of $7.4 million. We and Cowen terminated the agreement in May 2017. As of its termination , we had sold an aggregate of 2,057,438 shares for net proceeds of $11.3 million under the at-the-market facility.

In May 2017, we completed a public offering in which we sold 8,050,000 shares of our common stock at a price to the public of $11.50 per share. We received net proceeds of $86.8 million from this offering, after deducting underwriting discounts, commissions and other offering expenses.

On September 28, 2017, we entered into a new at-the-market sales agreement with Cowen, under which we may offer and sell, from time to time at our sole discretion, shares of our common stock having an aggregate offering price of up to $100.0 million through Cowen acting as our sales agent. As of the date of this report, we have sold an aggregate of 1,600,000 shares of our common stock under the new at-the-market facility, for net proceeds of $19.2 million.

Funding Requirements

Our primary uses of capital are, and we expect will continue to be, compensation and related expenses, third-party clinical research and development services, laboratory and related supplies, clinical costs, legal and other regulatory expenses and general overhead costs.

The successful development of any of our drug candidates is highly uncertain. As such, at this time, we cannot reasonably estimate or know the nature, timing and costs of the efforts that will be necessary to complete the remainder of the development of GMI-1271 or our other drug candidates. We are also unable to predict when, if ever, material net cash inflows will commence from rivipansel or GMI-1271. This is due to the numerous risks and uncertainties associated with developing drugs, including the uncertainty of:

|

|

·

|

|

successful enrollment in, and completion of, clinical trials;

|

|

|

·

|

|

receipt of marketing approvals from applicable regulatory authorities;

|

|

|

·

|

|

establishing commercial manufacturing capabilities or making arrangements with third-party manufacturers;

|

|

|

·

|

|

obtaining and maintaining patent and trade secret protection and regulatory exclusivity for drug candidates;

|

|

|

·

|

|

launching commercial sales of drugs, if and when approved, whether alone or in collaboration with others; and

|

|

|

·

|

|

obtaining and maintaining healthcare coverage and adequate reimbursement.

|

A change in the outcome of any of these variables with respect to the development of any of our drug candidates would significantly change the costs and timing associated with the development of that drug candidate. Because our drug candidates are in various stages of clinical and preclinical development and the outcome of these efforts is uncertain, we cannot estimate the actual amounts necessary to successfully complete the development and commercialization of our drug candidates or whether, or when, we may achieve profitability. Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity or debt financings and collaboration arrangements, including our existing collaboration with Pfizer. Except for Pfizer’s obligation to make milestone payments under our agreement with them, we do not have any committed external source of liquidity.

To the extent that we raise additional capital through the future sale of equity or debt, the ownership interest of our stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of our existing common stockholders. If we raise additional funds through the issuance of convertible debt securities, these securities could contain covenants that would restrict our operations.

We may require additional capital beyond our currently anticipated amounts. Additional capital may not be available on reasonable terms, or at all. If we raise additional funds through collaboration arrangements in the future, we may have to relinquish valuable rights to our drug candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our drug development or future commercialization efforts or grant rights to develop and market drug candidates that we would otherwise prefer to develop and market ourselves.

Outlook

Based on our research and development plans and our timing expectations related to the progress of our programs, we expect that our existing cash and cash equivalents as of September 30, 2017 will enable us to fund our operating expenses and capital expenditure requirements at least through the second half of 2019. We have based this estimate on assumptions that may prove to be wrong, and we could use our capital resources sooner than we expect. Additionally, the process of testing drug candidates in clinical trials is costly, and the timing of progress in these trials is uncertain.

Cash Flows

The following is a summary of our cash flows for the nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30,

|

|

|

(in thousands)

|

|

2017

|

|

2016

|

|

|

Net cash provided by (used in):

|

|

|

|

|

|

|

|

|

Operating activities

|

|

$

|

(21,399)

|

|

$

|

(23,777)

|

|

|

Investing activities

|

|

|

(260)

|

|

|

(266)

|

|

|

Financing activities

|

|

|

94,490

|

|

|

22,522

|

|

|

Net change in cash and cash equivalents

|

|

$

|

72,831

|

|

$

|

(1,521)

|

|

Operating Activities

Net cash used in operating activities for the nine months ended September 30, 2017 included the ongoing costs associated with the GMI-1271 clinical development programs. Net cash used in operating activities for the nine months ended September 30, 2016 included the costs associated with the advancement of the GMI-1271 and GMI-1359 development programs. In addition, the $2.0 million milestone license fee due to the University of Basel and accrued as a liability as of December 31, 2015 was paid during the nine months ended September 30, 2016.

Investing Activities

Net cash used in investing activities for the nine months ended September 30, 2017 included capital expenses relating to the additional leasehold improvements and the purchase of laboratory equipment. Net cash used in investing activities for the nine months ended September 30, 2016 included capital expenses relating to the additional leasehold improvements including architect and project management fees.

Financing Activities

Net cash provided by financing activities for the nine months ended September 30, 2017 consisted primarily of the net proceeds of $86.8 million from our public offering in May 2017 and $7.4 million from at-the-market sales under our sales agreement with Cowen. Net cash provided by financing activities during the nine months ended September 30, 2016 comprised primarily of the net proceeds of $19.8 million from our public offering in June 2016 and $2.7 million from at-the-market sales under our sales agreement with Cowen.

Off-Balance Sheet Arrangements

During the nine months ended September 30, 2017, we did not have, and we do not currently have, any off-balance sheet arrangements, as defined under SEC rules.

JOBS Act

In April 2012, the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, was enacted. Section 107(b) of the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period, and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

Item 3. Quantitative and Qualitative Disclosures about Market Ris

k

The market risk inherent in our financial instruments and in our financial position represents the potential loss arising from adverse changes in interest rates. As of September 30, 2017 and December 31, 2016, we had cash and cash equivalents of $112.9 million and $40.0 million, respectively. We generally hold our cash in interest-bearing money market accounts. Our primary exposure to market risk is interest rate sensitivity, which is affected by changes in the general level of U.S. interest rates. Due to the short-term maturities of our cash equivalents and the low risk profile of our investments, an immediate 100 basis point change in interest rates would not have a material effect on the fair market value of our cash equivalents.

Item 4. Controls and Procedure

s

(a)

Evaluation of Disclosure Controls and Procedures

The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended, or the Exchange Act, refers to controls and procedures that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Security and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that such information is accumulated and communicated to a company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

In designing and evaluating our disclosure controls and procedures, management recognizes that disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the disclosure controls and procedures are met. Additionally, in designing disclosure

controls and procedures, our management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible disclosure controls and procedures. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with policies or procedures may deteriorate. Because of the inherent limitations in a control system, misstatements due to error or fraud may occur and not be detected.

Our management, with the participation of our Chief Executive Officer and our Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures as of September 30, 2017, the end of the period covered by this Quarterly Report on Form 10-Q. Based upon such evaluation, our Chief Executive Officer and our Chief Financial Officer have concluded that our disclosure controls and procedures were effective as of such date at the reasonable assurance level.

(b)

Changes in Internal Controls Over Financial Reporting

There have not been any changes in our internal controls over financial reporting during our fiscal quarter ended September 30, 2017 that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATIO

N

Item 1. Legal Proceeding

s

From time to time, we are subject to litigation and claims arising in the ordinary course of business. We are not currently a party to any material legal proceedings and we are not aware of any pending or threatened legal proceeding against us that we believe could have a material adverse effect on our business, operating results, cash flows or financial condition.

Item 1A. Risk Factor

s