Third Quarter 2017 Highlights

- Net income of $26.1 million

- Net income attributable to the

common unitholders and general partner of $18.4 million

- Adjusted EBITDA of $58.1 million

(1)

- Basic and diluted net income per

common unit of $1.48 and $1.07, respectively

Natural Resource Partners L.P. (NYSE:NRP) today reported

third quarter 2017 net income of $26.1 million and net income

attributable to the common unitholders and general partner of $18.4

million, which equated to $1.48 and $1.07 basic and diluted net

income per common unit, respectively. NRP also generated Adjusted

EBITDA of $58.1 million.

Craig Nunez, President and Chief Operating Officer, commented:

"I am pleased with our recent performance. We continue to generate

substantial amounts of cash from operations and our third quarter

results have considerably improved compared to prior year levels.

In addition, we continue to strengthen our balance sheet and have

reduced debt $294.4 million during 2017. Compared to the prior

quarter, our results were reflective of the steady performances

from our Coal Royalty, Soda Ash and Construction Aggregates

segments."

At the end of the third quarter, NRP had $121.2 million in cash

and $111.0 million of borrowing capacity available under its credit

facility. Subsequent to the end of the quarter, NRP redeemed the

remaining $94.4 million of its outstanding 9.125% Senior Notes due

2018 at par and repaid $17.0 million on its credit facility. NRP's

consolidated Debt-to-Adjusted EBITDA ratio now stands at 3.8x, down

from 4.5x at year-end 2016 and 5.3x at year-end 2015.

NRP continues to focus on reducing its debt while maintaining

sufficient liquidity to operate its businesses. NRP's goal is to

achieve a leverage ratio, defined as Debt-to-EBITDA, of less than

3.0x, while maintaining minimum liquidity of $100 million, which

may consist of a combination of cash and/or available borrowing

capacity.

With respect to the third quarter of 2017, NRP’s Board of

Directors declared a cash distribution of $0.45 per common unit and

declared a distribution on NRP’s 12.0% Class A Convertible

Preferred Units, one-half of which will be paid-in-kind through the

issuance of additional preferred units.

____________________

(1) See "Non-GAAP Financial Measures" and

reconciliation tables at the end of this release.

Segment Information

Coal Royalty and Other

Operating income for the quarter was $38.0 million and Adjusted

EBITDA was $43.3 million. For the quarter, net cash provided by

operating, investing and financing activities were $44.1 million,

$0.7 million and $0.5 million, respectively, and DCF was $44.8

million. NRP's Q3 2017 results represent a substantial improvement

from Q3 of 2016 and are essentially flat compared to Q2 of 2017.

Adjusted Coal Royalty and Other Operating Income compared to Q3 of

2016 increased 26% and excluding the impact of asset sales, DCF

increased 26% and Adjusted EBITDA increased 6%. Further discussion

of the key drivers for each major producing region follows:

- Appalachia: Coal royalty revenue

increased $6.6 million in this region primarily as a result of

increased metallurgical coal prices and production in the third

quarter of 2017 as compared to the third quarter of 2016.

- Illinois Basin: Lower production in

this region led to a $5.3 million decrease in coal royalty revenue,

despite the increase in thermal coal prices and our royalty revenue

per ton in the region. The decreased production in this region was

primarily a result of the temporary relocation of certain

production off of NRP's coal reserves. However, this decrease in

coal royalty revenue was partially offset by a $2.4 million

increase in overriding royalty revenue in this region.

- Northern Powder River Basin: Lower

production in this region led to the $1.4 million decrease in coal

royalty revenue, despite the modest increase in prices. The lower

production was a result of decreased mining on our acreage in this

region, which has a checkerboard coal reserve ownership

pattern.

Soda Ash

During the third quarter of 2017, international prices for soda

ash, particularly in Asia, continued to be strong, and domestic

prices have improved slightly over last year. NRP received $12.3

million of cash distributions from its 49% investment in Ciner

Wyoming during the period, which was unchanged from the previous

quarter and from Q3 of 2016. NRP's equity in earnings from Ciner

Wyoming of $9.0 million declined 16% in Q3 2017, compared to the

prior year period due to temporary production issues. However,

NRP's earnings from Ciner Wyoming increased 7% compared to the

previous quarter as a result of the progress made to improve

production efficiency at the facility.

Construction Aggregates

Operating income for the quarter was $3.3 million and Adjusted

EBITDA was $6.4 million. For the quarter, net cash provided by

(used in) operating and investing activities were $2.2 million and

$(1.2) million, respectively, and DCF was $1.3 million. While

operating performance was in line with the previous quarter,

performance improved compared to Q3 2016 as a result of increased

production and sales volumes, higher margins on road construction

and asphalt paving projects and increased marine terminal activity.

DCF was lower in Q3 2017 due to temporary timing differences in

cash receipts and payments that we expect to reverse during the

remainder of the year.

Corporate and Finance

Total costs in Q3 2017 were $23.8 million, which includes $20.0

million of interest expense. While these amounts were in line with

the previous quarter, total corporate and financing costs decreased

14% compared to the same period last year due to lower interest

expense and lower legal and consulting fees compared to amounts

incurred in Q3 of 2016 in connection with NRP's recapitalization

transactions.

Conference Call

A conference call will be held today at 10:00 a.m. ET. To join

the conference call, dial (844) 379-6938 and provide the conference

code 55454886. Investors may also listen to the call via the

Investor Relations section of the NRP website at www.nrplp.com.

Audio replays of the conference call will be available for

approximately one week. To access the replay, dial (855) 859-2056

and provide the conference code 55454886 or visit the Investor

Relations section of NRP’s website.

Company Profile

Natural Resource Partners L.P., a master limited

partnership headquartered in Houston, TX, is a

diversified natural resource company that owns interests in coal,

aggregates and industrial minerals across the United States. A

large percentage of NRP's revenues are generated from royalties and

other passive income. In addition, NRP owns a construction

aggregates company and an equity investment in Ciner Wyoming, a

trona/soda ash operation.

For additional information, please contact Kathy H. Roberts at

713-751-7555 or kroberts@nrplp.com. Further information about NRP

is available on the partnership’s website at

http://www.nrplp.com.

Forward-Looking Statements

This press release includes “forward-looking statements” as

defined by the Securities and Exchange Commission. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that the

partnership expects, believes or anticipates will or may occur in

the future are forward-looking statements, including statements

regarding future cash distributions to our common unitholders.

These statements are based on certain assumptions made by the

partnership based on its experience and perception of historical

trends, current conditions, expected future developments and other

factors it believes are appropriate in the circumstances. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the

partnership. These risks include, but are not limited to, commodity

prices; decreases in demand for coal, aggregates and industrial

minerals, including trona/soda ash; changes in operating conditions

and costs; production cuts by our lessees; unanticipated geologic

problems; our liquidity, leverage and access to capital and

financing sources; changes in the legislative or regulatory

environment, and other factors detailed in Natural Resource

Partners’ Securities and Exchange Commission filings. Natural

Resource Partners L.P. has no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

Non-GAAP Financial Measures

"Adjusted EBITDA" is a non-GAAP financial measure that we

define as net income (loss) from continuing operations less equity

earnings from unconsolidated investment and income to

non-controlling interest; plus distributions from unconsolidated

investment, interest expense, debt modification expense, loss on

extinguishment of debt, depreciation, depletion and amortization

and asset impairments. Adjusted EBITDA should not be considered an

alternative to, or more meaningful than, net income or loss, net

income or loss attributable to partners, operating income, cash

flows from operating activities or any other measure of financial

performance presented in accordance with GAAP as measures of

operating performance, liquidity or ability to service debt

obligations. There are significant limitations to using Adjusted

EBITDA as a measure of performance, including the inability to

analyze the effect of certain recurring items that materially

affect our net income (loss), the lack of comparability of results

of operations of different companies and the different methods of

calculating Adjusted EBITDA reported by different companies. In

addition, Adjusted EBITDA presented below is not calculated or

presented on the same basis as Consolidated EBITDA as defined in

our partnership agreement. Adjusted EBITDA is a supplemental

performance measure used by our management and by external users of

our financial statements, such as investors, commercial banks,

research analysts and others to assess the financial performance of

our assets without regard to financing methods, capital structure

or historical cost basis.

“Distributable Cash Flow” is a non-GAAP financial measure

that we define as net cash provided by (used in) operating

activities of continuing operations, plus returns of equity from

unconsolidated investment, proceeds from sales of assets, including

those included in discontinued operations, and return on long-term

contract receivables (including affiliate); less maintenance

capital expenditures and distributions to non-controlling interest.

DCF is not a measure of financial performance under GAAP and should

not be considered as an alternative to cash flows from operating,

investing or financing activities. DCF may not be calculated the

same for us as for other companies. DCF is a supplemental liquidity

measure used by our management and by external users of our

financial statements, such as investors, commercial banks, research

analysts and others to assess the Partnership's ability to

make cash distributions to our common and preferred unitholders and

our general partner and repay debt.

“Adjusted Net Income” is a non-GAAP financial measure

that we define as Net income attributable to common unitholders and

general partner, plus asset impairments, loss from discontinued

operations and write-off of bad debt expense; less gain on sale of

assets and non-cash revenue from lease modifications. Adjusted net

income should not be considered in isolation or as a substitute for

operating income (loss), net income (loss), cash flows provided by

operating, investing and financial activities, or other income or

cash flow statement data prepared in accordance with GAAP. Our

management team believes Adjusted net income is useful in

evaluating our financial performance because restructuring

transaction expenses are one time charges, gains on asset sales are

not related to the operations of our business and asset impairments

and fair value adjustments for warrant liabilities are non-cash

charges and excluding these from net income allows us to better

compare results period-over-period. Reconciliations of Net income

attributable to common unitholders and general partner to Adjusted

net income are included in the table on the first page of this

release.

“Adjusted Coal Royalty and Other Operating Income” is a

non-GAAP financial measure that we define as Coal royalty and other

operating income plus asset impairments and write-off of bad debt

expense; less gains on asset sales and non-cash revenue associated

with lease modifications and terminations. Adjusted coal royalty

and other operating income should not be considered in isolation or

as a substitute for operating income (loss), net income (loss),

cash flows provided by operating, investing and financial

activities, or other income or cash flow statement data prepared in

accordance with GAAP. Our management team believes Adjusted coal

royalty and other operating income is useful in evaluating our

financial performance because gains on asset sales are not related

to the operations of our business and asset impairments and

non-cash revenue associated with lease modifications and

forfeitures are non-cash charges and excluding these from Coal

royalty and other operating income allows us to better compare

results period-over-period. Reconciliations of Coal royalty and

other operating income to Adjusted coal royalty and other operating

income are included in the tables attached to this release.

-Financial Tables, Reconciliation of

Non-GAAP Measures and Recap of Metrics Follow-

Natural Resource Partners L.P. Financial

Tables Consolidated Statements of Comprehensive

Income (Unaudited) Three Months

Ended Nine Months Ended September

30, June 30, September 30,

(In thousands,

except per unit data)

2017 2016 2017 2017

2016 Revenues and other income: Coal royalty

and other $ 49,078 $ 27,504 $ 36,914 $ 120,986 $ 116,336 Coal

royalty and other—affiliates 335 21,434 12,712 29,191 49,508

Construction aggregates 34,710 31,757 33,555 95,486 88,081 Equity

in earnings of Ciner Wyoming 8,993 10,753 8,389 27,676 30,742 Gain

(loss) on asset sales, net 171 6,426 3,361

3,576 27,280 Total revenues and other income $ 93,287

$ 97,874 $ 94,931 $ 276,915 $ 311,947 Operating expenses:

Operating and maintenance expenses $ 32,441 $ 31,242 $ 31,020 $

93,089 $ 87,824 Operating and maintenance expenses—affiliates, net

2,154 4,062 2,219 6,928 9,948 Depreciation, depletion and

amortization 8,306 11,929 8,165 26,195 32,181 Amortization

expense—affiliate — 902 240 1,008 2,328 General and administrative

2,648 4,268 2,031 10,757 10,676 General and

administrative—affiliates 1,207 867 852 3,183 2,670 Asset

impairments — 5,697 — 1,778 7,681

Total operating expenses $ 46,756 $ 58,967 $ 44,527 $

142,938 $ 153,308 Income from operations $ 46,531 $ 38,907 $

50,404 $ 133,977 $ 158,639 Other income (expense) Interest

expense $ (20,080 ) $ (22,491 ) $ (20,377 ) $ (63,598 ) $ (66,742 )

Interest expense—affiliate — — — — (523 ) Debt modification expense

— — (132 ) (7,939 ) — Loss on extinguishment of debt — — (4,107 )

(4,107 ) — Interest income 48 3 69 134

29 Other expense, net $ (20,032 ) $ (22,488 ) $ (24,547 ) $

(75,510 ) $ (67,236 ) Net income from continuing operations

$ 26,499 $ 16,419 $ 25,857 $ 58,467 $ 91,403 Income (loss) from

discontinued operations (433 ) 7,112 133 (507 ) 2,001

Net income $ 26,066 $ 23,531 $ 25,990 $ 57,960 $ 93,404

Less: income attributable to preferred unitholders (7,650 ) —

(7,538 ) (17,688 ) — Net income attributable to

common unitholders and general partner $ 18,416 $ 23,531 $ 18,452 $

40,272 $ 93,404 Income from continuing operations per common

unit Basic $ 1.51 $ 1.32 $ 1.46 $ 3.27 $ 7.34 Diluted $ 1.08 $ 1.32

$ 1.13 $ 2.67 $ 7.34 Net income per common unit Basic $ 1.48

$ 1.89 $ 1.47 $ 3.23 $ 7.50 Diluted $ 1.07 $ 1.89 $ 1.13 $ 2.65 $

7.50 Net income $ 26,066 $ 23,531 $ 25,990 $ 57,960 $ 93,404

Add: comprehensive loss from unconsolidated investment and other

(268 ) (609 ) (13 ) (1,413 ) (692 ) Comprehensive income $ 25,798

$ 22,922 $ 25,977 $ 56,547 $ 92,712

Natural Resource Partners L.P.

Financial Tables Consolidated Statements of Cash

Flows (Unaudited) Three Months

Ended Nine Months Ended September

30, June 30, September 30,

(In

thousands)

2017 2016 2017 2017

2016 Cash flows from operating activities: Net

income $ 26,066 $ 23,531 $ 25,990 $ 57,960 $ 93,404 Adjustments to

reconcile net income to net cash provided by operating activities

of continuing operations: Depreciation, depletion and amortization

8,306 11,929 8,165 26,195 32,181 Amortization expense—affiliates —

902 240 1,008 2,328 Return on earnings from unconsolidated

investment 8,993 12,250 9,862 31,104 34,300 Equity earnings from

unconsolidated investment (8,993 ) (10,753 ) (8,389 ) (27,676 )

(30,742 ) (Gain) loss on asset sales, net (171 ) (6,426 ) (3,361 )

(3,576 ) (27,280 ) Debt modification expense — — 132 7,939 — Loss

on extinguishment of debt — — 4,107 4,107 — (Income) loss from

discontinued operations 433 (7,112 ) (133 ) 507 (2,001 ) Asset

impairments — 5,697 — 1,778 7,681 Amortization of debt issuance

costs and other 3,037 2,600 1,332 5,459 6,694 Other, net—affiliates

200 636 (999 ) 88 848 Change in operating assets and liabilities:

Accounts receivable 5,210 (4,263 ) (2,336 ) 1,607 (341 ) Accounts

receivable—affiliates 49 1,559 121 (777 ) (712 ) Accounts payable

684 485 (940 ) 730 635 Accounts payable—affiliates (272 ) 54 (254 )

(270 ) 29 Accrued liabilities (8,554 ) 10,418 4,182 (12,452 ) 7,287

Accrued liabilities—affiliates — — — — (456 ) Deferred revenue

(4,494 ) (2,558 ) 3,412 (5 ) (40,762 ) Deferred revenue—affiliates

— (4,130 ) (7,269 ) (10,166 ) (8,190 ) Other items, net (4,694 )

1,689 1,243 (2,166 ) (356 ) Other items, net—affiliates —

(607 ) — — — Net cash provided by operating

activities of continuing operations $ 25,800 $ 35,901 $ 35,105 $

81,394 $ 74,547 Net cash provided by (used in) operating activities

of discontinued operations (76 ) 2,358 (247 ) (607 ) 8,173

Net cash provided by operating activities $ 25,724 $ 38,259

$ 34,858 $ 80,787 $ 82,720 Cash flows from investing

activities: Return of equity from unconsolidated investment $ 3,258

$ — $ 2,388 $ 5,646 $ —

Proceeds from sale of assets

151 10,372 1,655 1,419 55,364 Return of long-term contract

receivables 600 — 1,207 1,807 — Return of long-term contract

receivables—affiliate — 397 390 804 2,577 Acquisition of plant and

equipment and other (1,238 ) (512 ) (2,903 ) (6,236 ) (4,431 ) Net

cash provided by investing activities of continuing operations $

2,771 $ 10,257 $ 2,737 $ 3,440 $ 53,510 Net cash provided by

investing activities of discontinued operations 4 110,635

173 206 106,821 Net cash provided by

investing activities $ 2,775 $ 120,892 $ 2,910 $ 3,646 $ 160,331

Cash flows from financing activities: Proceeds from issuance

of Convertible Preferred Units and Warrants, net $ — $ — $ — $

242,100 $ — Proceeds from issuance of 2022 Senior Notes, net — — —

103,688 — Proceeds from loans 69,000 — — 69,000 20,000 Repayments

of loans (8,000 ) (7,692 ) (97,282 ) (356,292 ) (106,174 )

Distributions to common unitholders and general partner (5,616 )

(5,617 ) (5,619 ) (16,850 ) (16,849 ) Distributions to preferred

unitholders (3,769 ) — (1,250 ) (5,019 ) — Proceeds from

(contributions to) discontinued operations (72 ) 40,226 (74 ) (401

) 40,226 Debt issue costs and other 347 (2,074 )

(5,779 ) (40,187 ) (14,072 ) Net cash provided by (used in)

financing activities of continuing operations

$

51,890

$

24,843

$

(110,004

)

$

(3,961

)

$

(76,869

) Net cash provided by (used in) financing activities of

discontinued operations 72 (114,994 ) 74 401

(125,564 ) Net cash provided by (used in) financing

activities $ 51,962 $ (90,151 ) $ (109,930 ) $ (3,560 ) $ (202,433

) Net increase (decrease) in cash and cash equivalents $

80,461 $ 69,000 $ (72,162 ) $ 80,873 $ 40,618 Cash and cash

equivalents of continuing operations at beginning of period $

40,783 $ 21,391 $ 112,945 $ 40,371 $ 41,204 Cash and cash

equivalents of discontinued operations at beginning of period —

2,000 — — 10,569 Cash and cash

equivalents at beginning of period $ 40,783 $ 23,391 $ 112,945 $

40,371 $ 51,773 Cash and cash equivalents at end of period $

121,244 $ 92,391 $ 40,783 $ 121,244 $ 92,391 Less: cash and cash

equivalents of discontinued operations at end of period — —

— — — Cash and cash equivalents of

continuing operations at end of period $ 121,244 $ 92,391 $ 40,783

$ 121,244 $ 92,391 Supplemental cash flow information: Cash

paid during the period for interest from continuing operations $

26,977 $ 12,078 $ 15,029 $ 61,857 $ 54,749 Cash paid during the

period for interest from discontinued operations $ — $ — $ — $ — $

1,906 Non-cash financing activities: Issuance of 2022 Senior Notes

in exchange for 2018 Senior Notes $ — $ — $ — $ 240,638 $ —

Natural Resource Partners L.P.

Financial Tables

Consolidated Balance Sheets (Unaudited)

September 30, December 31,

(In thousands,

except unit data)

2017 2016 ASSETS Current assets: Cash and cash

equivalents $ 121,244 $ 40,371 Accounts receivable, net 48,788

43,202 Accounts receivable—affiliates, net 243 6,658 Inventory

7,671 6,893 Prepaid expenses and other 7,525 7,271 Current assets

of discontinued operations 991 991 Total current

assets $ 186,462 $ 105,386 Land 25,261 25,252 Plant and equipment,

net 47,584 49,443 Mineral rights, net 890,610 908,192 Intangible

assets, net 50,370 3,236 Intangible assets, net—affiliate — 49,811

Equity in unconsolidated investment 245,382 255,901 Long-term

contracts receivable 41,211 — Long-term contracts

receivable—affiliate — 43,785 Other assets 7,741 6,625 Other

assets—affiliate 892 1,018 Total assets $ 1,495,513

$ 1,448,649 LIABILITIES AND CAPITAL Current

liabilities: Accounts payable $ 5,812 $ 6,234 Accounts

payable—affiliates 670 940 Accrued liabilities 28,659 41,587

Current portion of long-term debt, net 174,138 140,037 Current

liabilities of discontinued operations 458 353 Total

current liabilities $ 209,737 $ 189,151 Deferred revenue 106,391

44,931 Deferred revenue

—affiliates — 71,632 Long-term debt,

net 762,441 990,234 Other non-current liabilities 2,727

4,565 Total liabilities $ 1,081,296 $ 1,300,513 Commitments

and contingencies Convertible Preferred Units (255,019 units issued

and outstanding at $1,000 par value per unit; liquidation

preference of $1,500 per unit) $ 169,606 $ — Partners’ capital:

Common unitholders’ interest (12,232,006 units issued and

outstanding) $ 182,760 $ 152,309 General partner’s interest 1,508

887 Warrant holders interest 66,816 — Accumulated other

comprehensive loss (3,079 ) (1,666 ) Total partners’ capital $

248,005 $ 151,530 Non-controlling interest (3,394 ) (3,394 ) Total

capital 244,611 148,136 Total liabilities and capital

$ 1,495,513 $ 1,448,649

Natural Resource Partners L.P.

Financial Tables

The table below presents NRP's unaudited

business results by segment for the three months ended

September 30, 2017 and 2016 and June 30, 2017,

respectively:

Operating Business Segments

CoalRoyaltyand

Other

ConstructionAggregates

CorporateandFinancing

($ In thousands)

Soda Ash Total Three Months Ended September 30, 2017

Revenues and other income $ 49,413 $ 8,993 $ 34,710 $ — $ 93,116

Gains on asset sales 154 — 17 — 171

Total revenues and other income $ 49,567 $ 8,993 $ 34,727 $

— $ 93,287 Net income (loss) from continuing operations $

37,992 $ 8,993 $ 3,342 $ (23,828 ) $ 26,499 Adjusted EBITDA (1) $

43,297 $ 12,250 $ 6,402 $ (3,807 ) $ 58,142 Net cash provided by

(used in) operating activities of continuing operations $ 44,119 $

8,992 $ 2,155 $ (29,466 ) $ 25,800 Net cash provided by (used in)

investing activities of continuing operations $ 676 $ 3,258 $

(1,163 ) $ — $ 2,771

Net cash provided by financing activities

of continuing operations

$ 484 $ — $ — $ 51,406 $ 51,890 Distributable Cash Flow (1) $

44,795 $ 12,250 $ 1,304 $ (29,466 ) $ 28,883 Three Months

Ended September 30, 2016 Revenues and other income $ 48,938 $

10,753 $ 31,757 $ — $ 91,448

Gain on asset sales

6,425 — 1 — 6,426 Total revenues

and other income $ 55,363 $ 10,753 $ 31,758 $ — $ 97,874

Asset impairments $ 5,697 $ — $ — $ — $ 5,697 Net income (loss)

from continuing operations $ 32,250 $ 10,753 $ 1,039 $ (27,623 ) $

16,419 Adjusted EBITDA (1) $ 47,017 $ 12,250 $ 4,800 $ (5,132 ) $

58,935 Net cash provided by (used in) operating activities of

continuing operations $ 34,997 $ 12,250 $ 4,357 $ (15,703 ) $

35,901 Net cash provided by (used in) investing activities of

continuing operations $ 10,691 $ — $ (434 ) $ — $ 10,257

Net cash provided by financing activities

of continuing operations

$ — $ — $ — $ 24,843 $ 24,843 Distributable Cash Flow (1) $ 45,683

$ 12,250 $ 4,093 $ (15,703 ) $ 156,212 Three Months Ended

June 30, 2017 Revenues and other income $ 49,626 $ 8,389 $ 33,555 $

— $ 91,570 Gains on asset sales 3,184 — 177 —

3,361 Total revenues and other income $ 52,810 $

8,389 $ 33,732 $ — $ 94,931 Net income (loss) from

continuing operations $ 42,084 $ 8,389 $ 2,636 $ (27,252 ) $ 25,857

Adjusted EBITDA (1) $ 47,459 $ 12,250 $ 5,844 $ (2,814 ) $ 62,739

Net cash provided by (used in) operating activities of continuing

operations $ 38,537 $ 9,862 $ 5,476 $ (18,770 ) $ 35,105 Net cash

provided by (used in) investing activities of continuing operations

$ 2,888 $ 2,388 $ (2,539 ) $ — $ 2,737 Net cash provided by (used

in) financing activities of continuing operations $ 17 $ — $ (1,000

) $ (109,021 ) $ (110,004 ) Distributable Cash Flow (1) $ 41,426 $

12,250 $ 3,424 $ (18,770 ) $ 38,330

Natural Resource Partners L.P.

Financial Tables

The table below presents NRP's unaudited

business results by segment for the nine months ended

September 30, 2017 and 2016:

Operating Business Segments

CoalRoyaltyand

Other

ConstructionAggregates

CorporateandFinancing

(In thousands)

Soda Ash Total Nine Months Ended September 30, 2017

Revenues and other income $ 150,177 $ 27,676 $ 95,486 $ — $ 273,339

Gains on asset sales 3,367 — 209 —

3,576 Total revenues and other income $ 153,544 $ 27,676 $

95,695 $ — $ 276,915 Asset impairments $ 1,778 $ — $ — $ — $

1,778 Net income (loss) from continuing operations $ 115,170 $

27,676 $ 4,439 $ (88,818 ) $ 58,467 Adjusted EBITDA (1) $ 134,601 $

36,750 $ 14,621 $ (13,806 ) $ 172,166 Net cash provided by (used

in) operating activities of continuing operations $ 120,588 $

31,104 $ 11,677 $ (81,975 ) $ 81,394 Net cash provided by (used in)

investing activities of continuing operations $ 3,570 $ 5,646 $

(5,776 ) $ — $ 3,440 Net cash provided by (used in) financing

activities of continuing operations $ 517 $ — $ (1,096 ) $ (3,382 )

$ (3,961 ) Distributable Cash Flow (1) $ 124,158 $ 36,750 $ 6,827 $

(81,975 ) $ 85,760 Nine Months Ended September 30, 2016

Revenues and other income $ 165,844 $ 30,742 $ 88,081 $ — $ 284,667

Gains on asset sales 27,270 — 10 —

27,280 Total revenues and other income $ 193,114 $ 30,742 $

88,091 $ — $ 311,947 Asset impairments $ 7,681 $ — $ — $ — $

7,681 Net income (loss) from continuing operations $ 137,802 $

30,742 $ 3,441 $ (80,582 ) $ 91,403 Adjusted EBITDA (1) $ 168,979 $

34,300 $ 14,454 $ (13,317 ) $ 204,416 Net cash provided by (used

in) operating activities of continuing operations $ 91,372 $ 34,300

$ 16,680 $ (67,805 ) $ 74,547 Net cash provided by (used in)

investing activities of continuing operations $ 57,834 $ — $ (4,324

) $ — $ 53,510 Net cash used in financing activities of continuing

operations $ — $ (7,229 ) $ (1,593 ) $ (68,047 ) $ (76,869 )

Distributable Cash Flow (1) $ 149,206 $ 34,300 $ 13,111 $ (67,805 )

$ 238,701

____________________

(1) See "Non-GAAP Financial Measures" and reconciliation tables at

the end of this release.

Natural Resource Partners

L.P. Financial Tables Operating Statistics -

Coal Royalty and Other (Unaudited)

Three Months Ended Nine Months Ended

September 30, June 30, September

30,

($ in thousands,

except tons and per tons amounts)

2017 2016 2017 2017

2016 Coal production (tons) Appalachia

Northern (1) 226 (356 ) 247 1,672 479 Central 3,596 3,348 3,897

11,193 10,046 Southern 468 683 690 1,721

2,201 Total Appalachia 4,290 3,675 4,834 14,586 12,726

Illinois Basin 794 2,411 734 3,545 6,056 Northern Powder River

Basin 849 1,318 910 2,708 2,734 Total

coal production 5,933 7,404 6,478 20,839

21,516 Coal royalty revenue per ton Appalachia

Northern (1) $ 3.26 $ 1.98 $ 3.78 $ 1.36 $ 4.19 Central $ 4.77 $

3.28 $ 5.05 $ 5.09 $ 3.22 Southern $ 5.73 $ 3.83 $ 5.69 $ 5.95 $

3.37 Illinois Basin $ 4.32 $ 3.63 $ 4.06 $ 3.68 $ 3.57 Northern

Powder River Basin $ 3.47 $ 3.27 $ 2.62 $ 2.89 $ 3.04 Coal

royalty revenues Appalachia Northern (1) $ 737 $ 370 $ 933 $ 2,279

$ 2,005 Central 17,154 10,994 19,691 57,027 32,331 Southern 2,683

2,618 3,927 10,242 7,419 Total

Appalachia $ 20,574 $ 13,982 $ 24,551 $ 69,548 $ 41,755 Illinois

Basin 3,431 8,745 2,978 13,055 21,611 Northern Powder River Basin

2,945 4,314 2,384 7,827 8,314 Total

coal royalty revenue $ 26,950 $ 27,041 $ 29,913

$ 90,430 $ 71,680 Other revenues Minimums recognized

as revenue $ 9,812 $ 9,755 $ 7,547 $ 22,556 $ 60,455 Transportation

and processing fees 5,570 6,127 5,520 15,729 15,663 Property tax

revenue 513 2,567 1,100 4,311 8,899 Wheelage 1,219 919 1,025 3,510

1,797 Coal override revenue 3,059 615 1,885 5,769 1,482 Lease

assignment fee 1,000 — — 1,000 Hard mineral royalty revenues 817

700 1,452 3,513 2,194 Oil and gas royalty revenues 117 1,283 924

2,532 2,538 Other 356 (69 ) 260 827 1,136

Total other revenues $ 22,463 $ 21,897 $ 19,713

$ 59,747 $ 94,164 Coal royalty and other income

49,413 48,938 49,626 150,177 165,844 Gain on coal royalty and other

segment asset sales 154 6,425 3,184 3,367

27,270 Total coal royalty and other segment revenues and

other income $ 49,567 $ 55,363 $ 52,810 $

153,544 $ 193,114

____________________

(1) During the three months ended September 30, 2016,

Northern Appalachia was impacted by a prior period adjustment of

0.5 million tons and less than $0.1 million in royalty revenue

related to the Hibbs Run mine that temporarily ceased production

during 2016. Absent this adjustment, production in the Northern

Appalachia region was 0.2 million tons with revenue of $0.4

million. Coal royalty revenue per ton removes the impact of the

Hibbs Run prior period adjustment.

Natural Resource

Partners L.P. Reconciliation of Non-GAAP Measures

Distributable Cash Flow (Unaudited)

CoalRoyalty

andOther

ConstructionAggregates

CorporateandFinancing

(In

thousands)

Soda Ash Total Three Months Ended September 30,

2017 Net cash provided by (used in) operating activities of

continuing operations $ 44,119 $ 8,992 $ 2,155 $ (29,466 ) $ 25,800

Add: return of equity from unconsolidated investment — 3,258 — —

3,258 Add: proceeds from sale of assets 76 — 75 — 151 Add: return

on long-term contract receivable 600 — — — 600 Less: maintenance

capital expenditures — — (926 ) — (926 )

Distributable cash flow $ 44,795 $ 12,250 $ 1,304 $ (29,466 ) $

28,883 Proceeds from sale of assets 76 — 75 —

151 Distributable cash flow adjusted for proceeds

from sale of assets $ 44,719 $ 12,250 $ 1,229

$ (29,466 ) $ 28,732

Three Months Ended September

30, 2016 Net cash provided by (used in) operating activities of

continuing operations $ 34,997 $ 12,250 $ 4,357 $ (15,703 ) $

35,901 Add: proceeds from sale of assets 10,294 — 78 — 10,372 Add:

proceeds from sale of assets from discontinued operations — — — —

109,889 Add: return on long-term contract receivables—affiliate 397

— — — 397 Less: maintenance capital expenditures (5 ) — (342

) — (347 ) Distributable cash flow $ 45,683 $ 12,250 $ 4,093

$ (15,703 ) $ 156,212 Proceeds from sale of assets, including

discontinued operations 10,294 — 78 —

120,261 Distributable cash flow adjusted for proceeds from

sale of assets $ 35,389 $ 12,250 $ 4,015 $

(15,703 ) $ 35,951

Three Months Ended June 30,

2017 Net cash provided by (used in) operating activities of

continuing operations $ 38,537 $ 9,862 $ 5,476 $ (18,770 ) $ 35,105

Add: return of equity from unconsolidated investment — 2,388 — —

2,388 Add: proceeds from sale of assets 1,292 — 363 — 1,655 Add:

return on long-term contract receivables (including affiliate)

1,597 — — — 1,597 Less: maintenance capital expenditures — —

(2,415 ) — (2,415 )

Distributable cash flow

$ 41,426 $ 12,250 $ 3,424 $ (18,770 ) $ 38,330 Proceeds from sale

of assets 1,292 — 363 — 1,655

Distributable cash flow adjusted for proceeds from sale of assets $

40,134 $ 12,250 $ 3,061 $ (18,770 ) $ 36,675

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

Distributable Cash Flow (Unaudited)

Coal Royalty

andOther

ConstructionAggregates

CorporateandFinancing

(In

thousands)

Soda Ash Total Nine Months Ended September 30,

2017 Net cash provided by (used in) operating activities of

continuing operations $ 120,588 $ 31,104 $ 11,677 $ (81,975 ) $

81,394 Add: return of equity from unconsolidated investment — 5,646

— — 5,646 Add: proceeds from the sale of assets 959 — 460 — 1,419

Add: return on long-term contract receivables (including affiliate)

2,611 — — — 2,611 Less: maintenance capital expenditures — —

(5,310 ) — (5,310 ) Distributable cash flow $ 124,158

$ 36,750 $ 6,827 $ (81,975 ) $ 85,760 Proceeds from sale of assets

959 — 460 — 1,419 Distributable

cash flow adjusted for proceeds from sale of assets $ 123,199

$ 36,750 $ 6,367 $ (81,975 ) $ 84,341

Nine Months Ended September 30, 2016 Net cash

provided by (used in) operating activities of continuing operations

$ 91,372 $ 34,300 $ 16,680 $ (67,805 ) $ 74,547 Add: Proceeds from

the sale of assets 55,262 — 102 — 55,364 Add: proceeds from sale of

assets included in discontinued operations — — 109,889 Add: return

on long-term contract receivables—affiliate 2,577 — — — 2,577 Less:

maintenance capital expenditures (5 ) — (3,671 ) —

(3,676 ) Distributable cash flow $ 149,206 $ 34,300 $ 13,111 $

(67,805 ) $ 238,701 Proceeds from sale of assets, including

discontinued operations 55,262 — 102 —

165,253 Distributable cash flow adjusted for proceeds from

sale of assets $ 93,944 $ 34,300 $ 13,009 $

(67,805 ) $ 73,448

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

Adjusted EBITDA

(Unaudited)

CoalRoyalty

andOther

ConstructionAggregates

CorporateandFinancing

(In

thousands)

Soda Ash Total Three Months Ended September 30, 2017

Net income (loss) from continuing operations $ 37,992 $ 8,993 $

3,342 $ (23,828 ) $ 26,499 Less: equity earnings from

unconsolidated investment — (8,993 ) — — (8,993 ) Add:

distributions from unconsolidated investment — 12,250 — — 12,250

Add: interest expense — — 59 20,021 20,080 Add: depreciation,

depletion and amortization 5,305 — 3,001 — 8,306 Add: asset

impairments — — — — — Adjusted

EBITDA $ 43,297 $ 12,250 $ 6,402 $ (3,807 ) $ 58,142 Gains on sale

of assets 154 — 17 — 171

Adjusted EBITDA excluding gains on sale of assets $ 43,143 $

12,250 $ 6,385 $ (3,807 ) $ 57,971

Three Months Ended September 30, 2016 Net income (loss) from

continuing operations $ 32,250 $ 10,753 $ 1,039 $ (27,623 ) $

16,419 Less: equity earnings from unconsolidated investment —

(10,753 ) — — (10,753 ) Add: distributions from unconsolidated

investment — 12,250 — — 12,250 Add: interest expense — — — 22,491

22,491 Add: depreciation, depletion and amortization 9,070 — 3,761

— 12,831 Add: asset impairments 5,697 — — —

5,697 Adjusted EBITDA $ 47,017 $ 12,250 $ 4,800 $

(5,132 ) $ 58,935 Gains on sale of assets 6,425 — 1

— 6,426 Adjusted EBITDA excluding gains on

sale of assets $ 40,592 $ 12,250 $ 4,799 $

(5,132 ) $ 52,509 Three Months Ended June 30, 2017

Net income (loss) from continuing operations $ 42,084 $ 8,389 $

2,636 $ (27,252 ) $ 25,857 Less: equity earnings from

unconsolidated investment — (8,389 ) — — (8,389 ) Add:

distributions from unconsolidated investment — 12,250 — — 12,250

Add: interest expense — — 178 20,199 20,377 Add: debt modification

expense — — — 132 132 Add: loss on extinguishment of debt — — —

4,107 4,107 Add: depreciation, depletion and amortization 5,375

— 3,030 — 8,405 Adjusted EBITDA

$ 47,459 $ 12,250 $ 5,844 $ (2,814 ) $ 62,739 Gains on sale of

assets 3,184 — 177 — 3,361

Adjusted EBITDA excluding gains on sale of assets $ 44,275 $

12,250 $ 5,667 $ (2,814 ) $ 59,378

Natural Resource Partners L.P. Reconciliation of Non-GAAP

Measures Adjusted EBITDA (Unaudited)

CoalRoyalty

andOther

ConstructionAggregates

CorporateandFinancing

(In

thousands)

Soda Ash Total Nine Months Ended September 30, 2017

Net income (loss) from continuing operations $ 115,170 $ 27,676 $

4,439 $ (88,818 ) $ 58,467 Less: equity earnings from

unconsolidated investment — (27,676 ) — — (27,676 ) Add:

distributions from unconsolidated investment — 36,750 — — 36,750

Add: interest expense — — 632 62,966 63,598 Add: debt modification

expense — — — 7,939 7,939 Add: loss on extinguishment of debt — — —

4,107 4,107 Add: depreciation, depletion and amortization 17,653 —

9,550 — 27,203 Add: asset impairments 1,778 — —

— 1,778 Adjusted EBITDA $ 134,601 $ 36,750 $

14,621 $ (13,806 ) $ 172,166 Gains on sale of assets 3,367 —

209 — 3,576 Adjusted EBITDA excluding

gains on sale of assets $ 131,234 $ 36,750 $ 14,412

$ (13,806 ) $ 168,590 Nine Months Ended

September 30, 2016 Net income (loss) from continuing operations $

137,802 $ 30,742 $ 3,441 $ (80,582 ) $ 91,403 Less: equity earnings

from unconsolidated investment — (30,742 ) — — (30,742 ) Add:

distributions from unconsolidated investment — 34,300 — — 34,300

Add: interest expense — — — 67,265 67,265 Add: depreciation,

depletion and amortization 23,496 — 11,013 — 34,509 Add: asset

impairments 7,681 — — — 7,681

Adjusted EBITDA $ 168,979 $ 34,300 $ 14,454 $ (13,317 ) $ 204,416

Gains on sale of assets 27,270 — 10 —

27,280 Adjusted EBITDA excluding gains on sale of assets $

141,709 $ 34,300 $ 14,444 $ (13,317 ) $

177,136

Natural Resource Partners L.P.

Reconciliation of Non-GAAP Measures Last Twelve

Months Distributable Cash Flow (Unaudited)

Three Months Ended December

March 31, June 30,

September Last 12

(In thousands,

except ratios)

31, 2016 2017 2017 30, 2017

Months

Net cash provided by operating activities

of continuing operations

$ 26,096 $ 20,489 $ 35,105 $ 25,800 $ 107,490 Add: return of equity

from unconsolidated investment — — 2,388 3,258 5,646 Add: proceeds

from the sale of assets 7,019 (387 ) 1,655 151 8,438 Add: proceeds

from the sale of assets included in discontinued operations (17 ) —

— — (17 ) Add: return on long-term contract receivables (including

affiliate) 391 414 1,597 600 3,002 Less: maintenance capital

expenditures (775 ) (1,969 ) (2,415 ) (926 ) (6,085 ) Distributable

cash flow $ 32,714 $ 18,547 $ 38,330 $ 28,883 $ 118,474 Proceeds

from sale of assets, including discontinued operations 7,002

(387 ) 1,655 151 8,421 Distributable cash flow

adjusted for proceeds from sale of assets $ 25,712 $ 18,934

$ 36,675 $ 28,732 $ 110,053 Unit

Distribution Coverage Ratio (1) 5.3 x

____________________

(1) Common unit distribution coverage ratio is

calculated by dividing distributable cash flow by total

distributions on the common units and to the general partner.

Last Twelve Months Adjusted EBITDA (Unaudited)

Three Months Ended

December March 31,

June 30, September Last 12

(In thousands,

except ratios)

31, 2016 2017 2017 30, 2017

Months

Net income from continuing operations

$ 3,811 $ 6,111 $ 25,857 $ 26,499 $ 62,278 Less: equity earnings

from unconsolidated investment (9,319 ) (10,294 ) (8,389 ) (8,993 )

(36,995 ) Add: distributions from unconsolidated investment 12,250

12,250 12,250 12,250 49,000 Add: interest expense 23,305 23,141

20,377 20,080 86,903 Add: debt modification expense — 7,807 132 —

7,939 Add: loss on extinguishment of debt — — 4,107 — 4,107 Add:

depreciation, depletion and amortization 11,763 10,492 8,405 8,306

38,966 Add: asset impairments 9,245 1,778 — —

11,023 Adjusted EBITDA $ 51,055 $ 51,285

$ 62,739 $ 58,142 $ 223,221

Debt-to-Adjusted EBITDA, September 30, 2017 4.3 x Redemption of

9.125% senior notes, October 2017 $ 94,362 Payment on credit

facility, October 2017 $ 17,000 Debt at November 7, 2017, face

value (after redemption and payment noted above) $ 844,507

Debt-to-Adjusted EBITDA, November 7, 2017 3.8 x

Natural Resource Partners L.P. Reconciliation of Non-GAAP

Measures Adjusted Net Income (Unaudited)

Three Months Ended September 30,

(In

thousands)

2017 2016 Net income $ 26,066 $ 23,531

Less: income attributable to preferred unitholders (7,650 ) —

Net income attributable to common unitholders and general

partner $ 18,416 $ 23,531 Add: asset impairments — 5,697 Add: loss

from discontinued operations 433 (7,112 ) Add: write-off of bad

debt expense 1,534 1,679 Less: gain on asset sales (171 ) (6,426 )

Less: non-cash revenue associated with lease modifications and

forfeitures (2,142 ) (3,627 ) Adjusted net income $ 18,070 $

13,742

Adjusted Coal Royalty and Other

Operating Income (Unaudited)

Three Months Ended September 30,

(In

thousands)

2017 2016 Coal royalty and other

operating income $ 37,992 $ 32,250 Add: asset impairments — 5,697

Add: write-off of bad debt expense 1,534 1,679 Less: gain on asset

sales (154 ) (6,425 ) Less: non-cash revenue associated with lease

modifications and forfeitures (2,142 ) (3,627 ) Adjusted coal

royalty and other operating income $ 37,230 $ 29,574

Natural Resource Partners L.P. Recap of

Metrics (Unaudited)

(In thousands,

except units, prices, ratio and yields)

November 7, 2017 Common Unit price $ 24.95

Enterprise value Equity market cap $ 305,188 Debt 844,507

Preferred Units 250,000 Intrinsic Value of Warrants 3,745

Total enterprise value $ 1,403,440 DCF—last twelve

months $ 118,474 DCF/Equity market cap 39 % Adjusted

EBITDA—last twelve months $ 223,221 Adjusted EBITDA/Total

Enterprise value 16 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171108005652/en/

Natural Resource Partners L.P.Kathy H. Roberts,

713-751-7555kroberts@nrplp.com

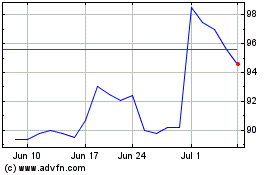

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Apr 2023 to Apr 2024