Current Report Filing (8-k)

November 07 2017 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 3, 2017

NanoVibronix, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36445

|

|

01-0801232

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

9 Derech

Hashalom Street

Nesher, Israel

|

|

36651

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (914) 233-3004

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

[ ]

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4

(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 3.03.

Material Modification to Rights of Security Holders.

The information set forth in Item 5.03

of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.03.

Item 5.03. Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On November 3, 2017, NanoVibronix, Inc.

(the “Company”) filed with the office of the Secretary of State of the State of Delaware a Certificate of Designation

of Preferences, Rights and Limitations of Series D Convertible Preferred Stock (the “Certificate of Designation”) designating

506 shares of the Company’s authorized preferred stock as Series D Convertible Preferred Stock, par value $0.001 per share

(the “Preferred Stock”).

The Preferred Stock is convertible into

1,000 shares of the Company’s common stock (subject to the beneficial ownership limitations as provided in the Certificate

of Designation), at an initial conversion price equal to $4.90 per share of common stock, subject to adjustment as provided in

the Certificate of Designation, at any time at the option of the holder, provided that the holder will be prohibited from converting

Preferred Stock into shares of the Company’s common stock if, as a result of such conversion, the holder, together with its

affiliates, would own more than 4.99% of the total number of shares of the Company’s common stock then issued and outstanding.

However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided that any

increase in such percentage shall not be effective until 61 days after such notice to the Company.

In the event of liquidation, dissolution,

or winding up of the Company, holders of the Preferred Stock will be entitled to receive the amount of cash, securities or other

property to which such holder would be entitled to receive with respect to such shares of Preferred Stock if such shares had been

converted to common stock immediately prior to such event (without giving effect for such purposes to the 4.99% or 9.99% beneficial

ownership limitation, as applicable) subject to the preferential rights of holders of any class or series of the Company’s

capital stock specifically ranking by its terms senior to the Preferred Stock as to distributions of assets upon such event, whether

voluntarily or involuntarily.

Shares of Preferred Stock are not entitled

to receive any dividends, unless and until specifically declared by the board of directors. However, holders of the Preferred Stock

are entitled to receive dividends on shares of Preferred Stock equal (on an as-if-converted-to-common-stock basis, and without

giving effect for such purposes to the 4.99% or 9.99% beneficial ownership limitation, as applicable) to and in the same form as

dividends actually paid on shares of the common stock when such dividends are specifically declared by the board of directors of

the Company. The Company is not obligated to redeem or repurchase any shares of Preferred Stock. Shares of Preferred Stock are

not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous fund provision.

The holders of the Preferred Stock have

no voting rights, except as required by law. Any amendment to the certificate of incorporation, bylaws or Certificate of Designation

that adversely affects the powers, preferences and rights of the Preferred Stock requires the approval of the holders of a majority

of the shares of Preferred Stock then outstanding.

The foregoing description of the terms

and provisions of the Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the Certificate

of Designation, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 8.01

Other Events.

On November 7, 2017, the Company announced the closing of an

underwritten offering of 1,224,488 shares of its common stock (or common stock equivalents) and warrants to purchase up to 918,366

shares of common stock. The Company received proceeds from the offering of approximately $5.1 million, after deducting the applicable

underwriting discount and estimated offering expenses payable by the Company. As a result of the offering, the Company’s

common stock is listed on the NASDAQ Capital Market and trades under the ticker symbol “NAOV”.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

NanoVibronix, Inc.

|

|

|

|

|

Date: November 7, 2017

|

By:

|

/s/

Stephen Brown

|

|

|

|

Name: Stephen Brown

Title:

Chief Financial Officer

|

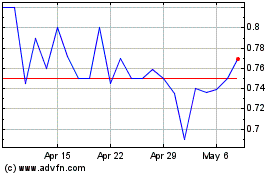

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

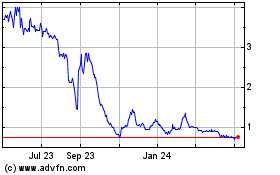

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Apr 2023 to Apr 2024